Hedge funds, corporations, and President Trump endorse Bitcoin, signaling a significant shift towards mainstream adoption.

With President Trump now endorsing Bitcoin the orange pill is going mainstream at honey badger speed.

Recently, Zerohedge reported that 52% of major hedge funds now own Bitcoin.

Meanwhile, thousands of companies hold Bitcoin as a corporate asset.

And -- most important, politically -- President Trump gave Bitcoin his full-throated endorsement in his recent speech to rambunctious libertarians.

Are we finally Ending the Fed, home-brew style?

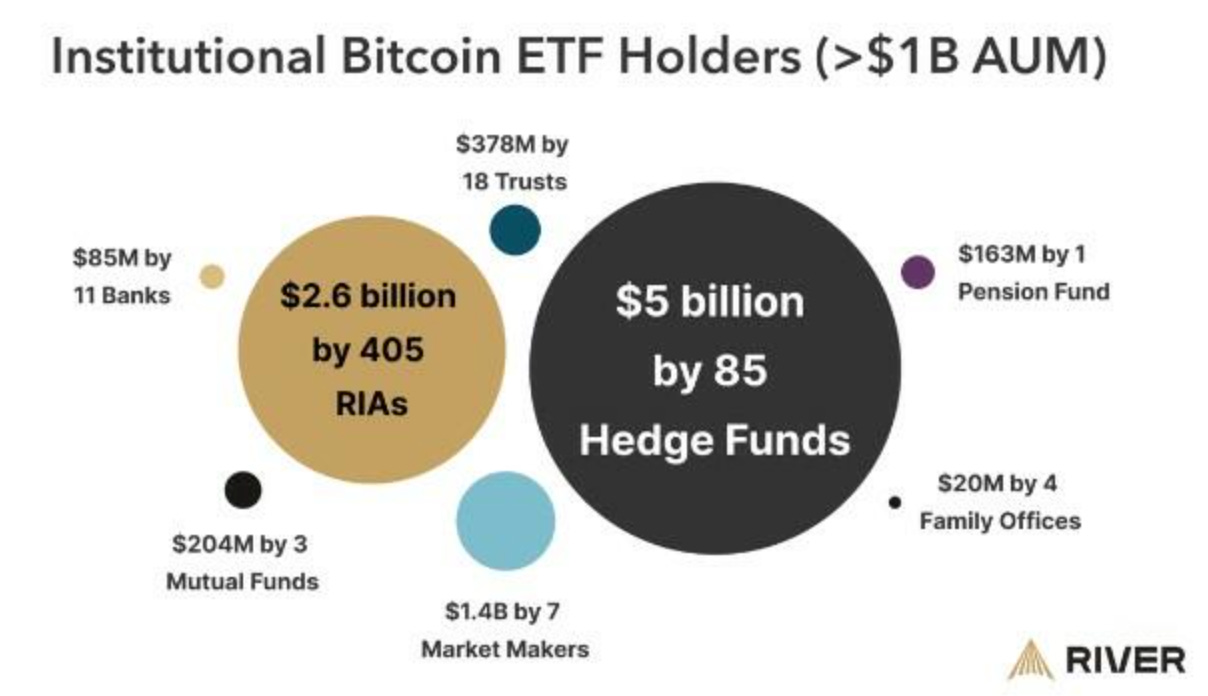

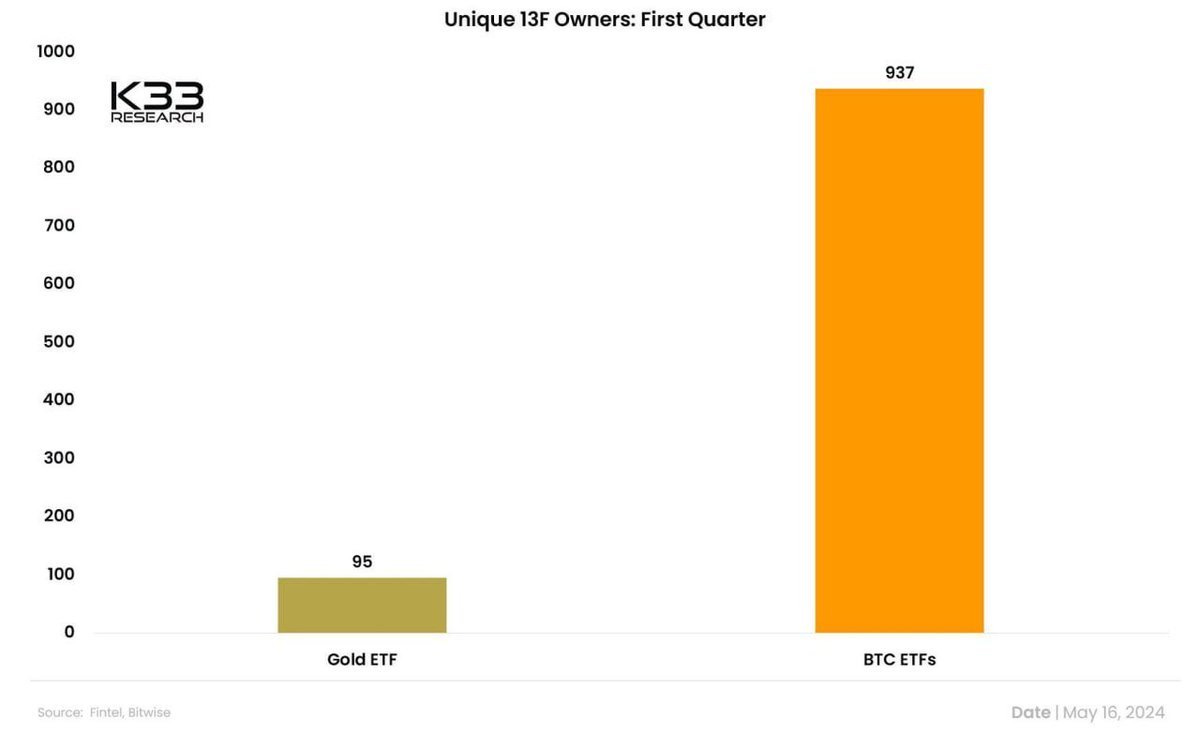

First the numbers. A recent study surveyed asset managers with over a billion in assets, finding that 534 of them – over half – have now incorporated Bitcoin into their portfolios.

That list includes hedge funds, pensions, and insurance companies. And the holdings total roughly $10 billion of Bitcoin -- so about 143,000 bitcoins out of the 20-million odd in existence.

Roughly half of that is hedge funds, a quarter is financial advisors, and the rest is pensions, mutual funds, and even a few banks, who hold close to $100 million in Bitcoin.

The other interesting tidbit was corporate holdings, where over a thousand companies now report holding Bitcoin as an asset, averaging 4 bitcoin -- worth nearly $300,000. That's almost four times the average holdings in last year's study, when companies reported 2.5 Bitcoin worth just 70 thousand -- Bitcoin tripled in price since then.

Keep in mind that's just a subset of respondents, so the actual number of companies holding Bitcoin would be many times bigger.

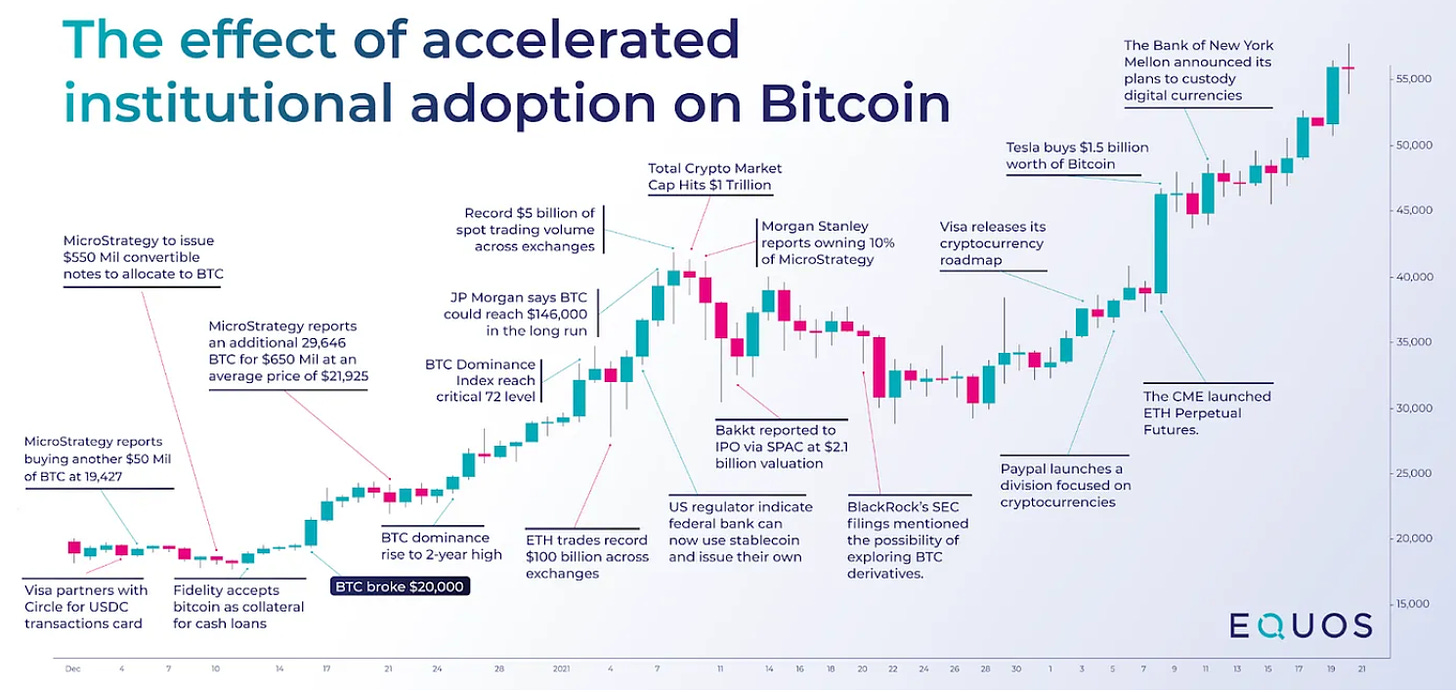

What's driving institutions, according to MicroStrategy CEO Michael Saylor, is that Bitcoin now has an infrastructure where institutions can hold it while following know-your-customer regulations that, for better or worse, exist.

This lets new companies enter and provide much wider distribution.

CashApp, for example, is selling $10 billion of Bitcoin every year. Compare this to 10 years ago, when people were still meeting in parking lots to swap bitcoin for cash, which is something your grandmother's not going to do with her retirement portfolio.

On the other hand, if she can buy bitcoin in her mutual fund — or her bank account — that opens the door to, first, a speculative 5% holding. And then, as the price soars, the percent goes up.

Perhaps the most important aspect here isn't just the wider distribution and the peace of mind, but the fact that with major players like Fidelity or Blackrock now selling Bitcoin, one of the biggest risks to Bitcoin -- that it might be banned -- is evaporating.

After all, for better or worse, Blackrock gets what it wants in Washington. So the institutions are essentially regulatory plot armor against a ban.

Finally, Donald Trump. In a rousing speech to a conference full of amped up libertarians, he announced that "the future of Bitcoin will be made here in the USA," adding "I will support the right to self-custody" -- meaning that you can own your own bitcoin -- your keys, your coins -- as my show sponsor Unchained.com helps you do.

Trump promised "I will keep Elizabeth Warren and her goons away from your bitcoin, and I will never allow the creation of a central bank digital currency.“

This was a crowd-pleaser, as you'd expect. And it's quite a shift since Trump's dismissals of Bitcoin back in 2021 because it competes with the dollar.

Of course, this has it backwards: like gold, the very fact that Bitcoin competes with the dollar protects the dollar. It stops them inflating since people will sell their dollars for a hard money.

Perhaps in the wake of Biden's inflation Trump has now realized this or, more likely, he now understands his base likes Bitcoin as much as they hate CBDC's.

Having the former president and current front-runner whole-heartedly endorse Bitcoin is a big step. Add in the regulatory plot armor and institutional adoption and it just got a lot easier to protect your life savings.

Moreover, if enough people do flee the confetti dollar for either gold or for Bitcoin, it topples the Federal Reserve from the bottom-up. They can still make policy, but it won’t matter.

Originally Published on Profstonge Weekly