The disparity between the payroll report's optimistic job additions and the household survey's indication of a weakened labor market.

The US economy is currently facing a conundrum as conflicting data from the payroll and household surveys present a divergent view of labor market health.

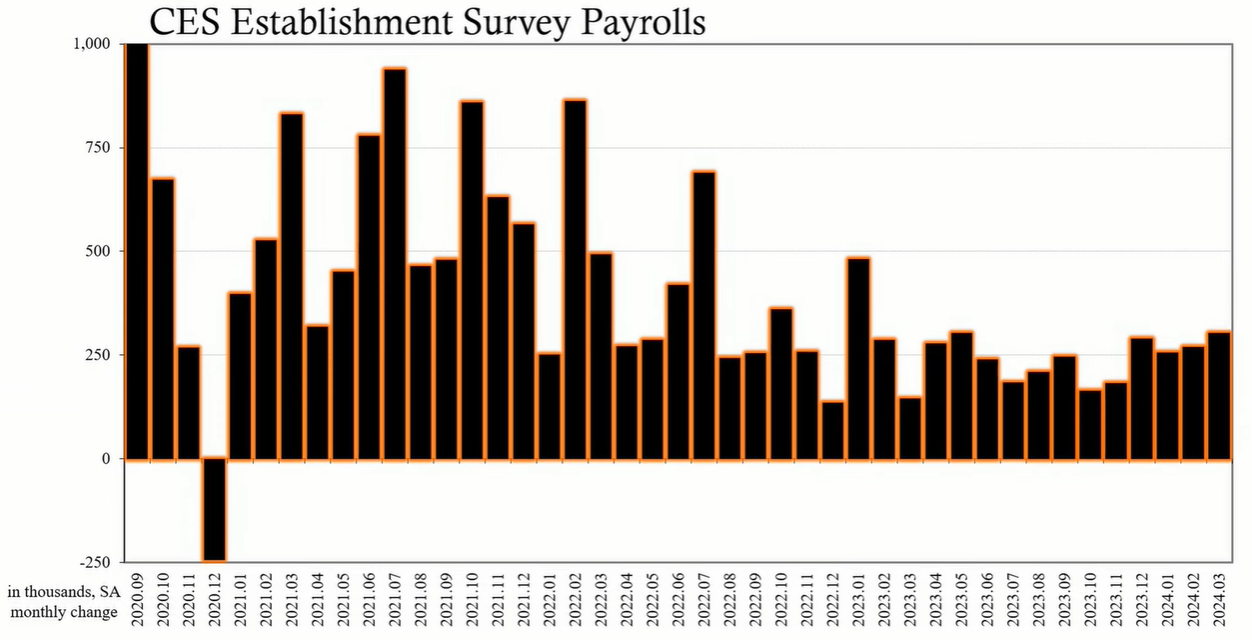

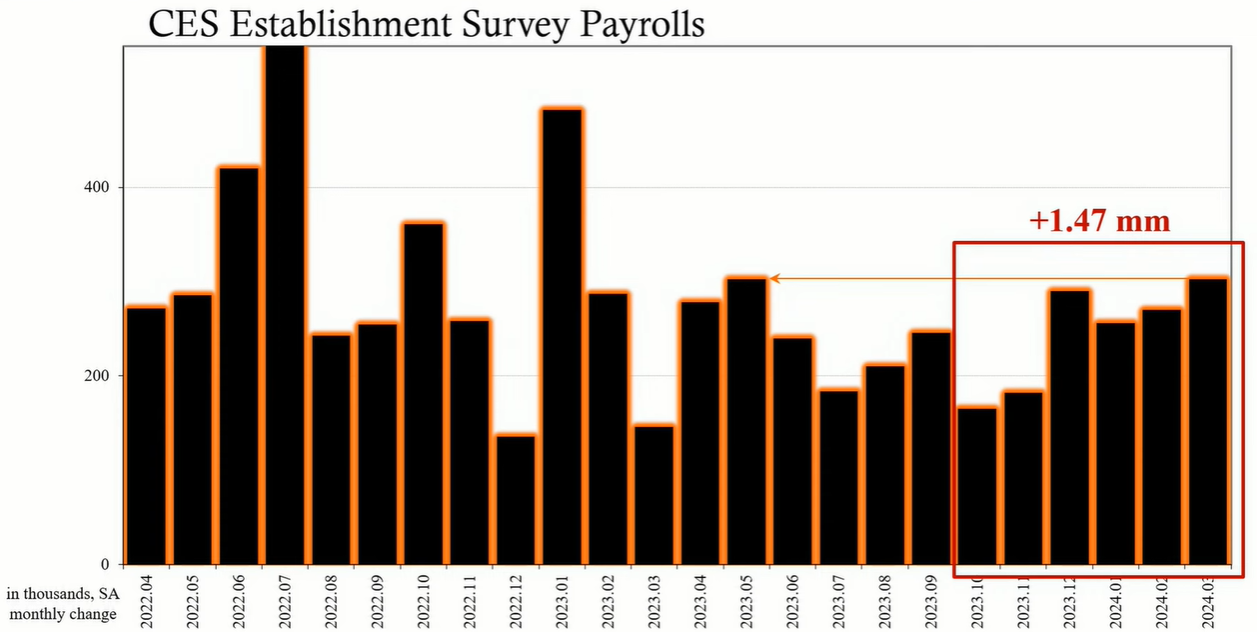

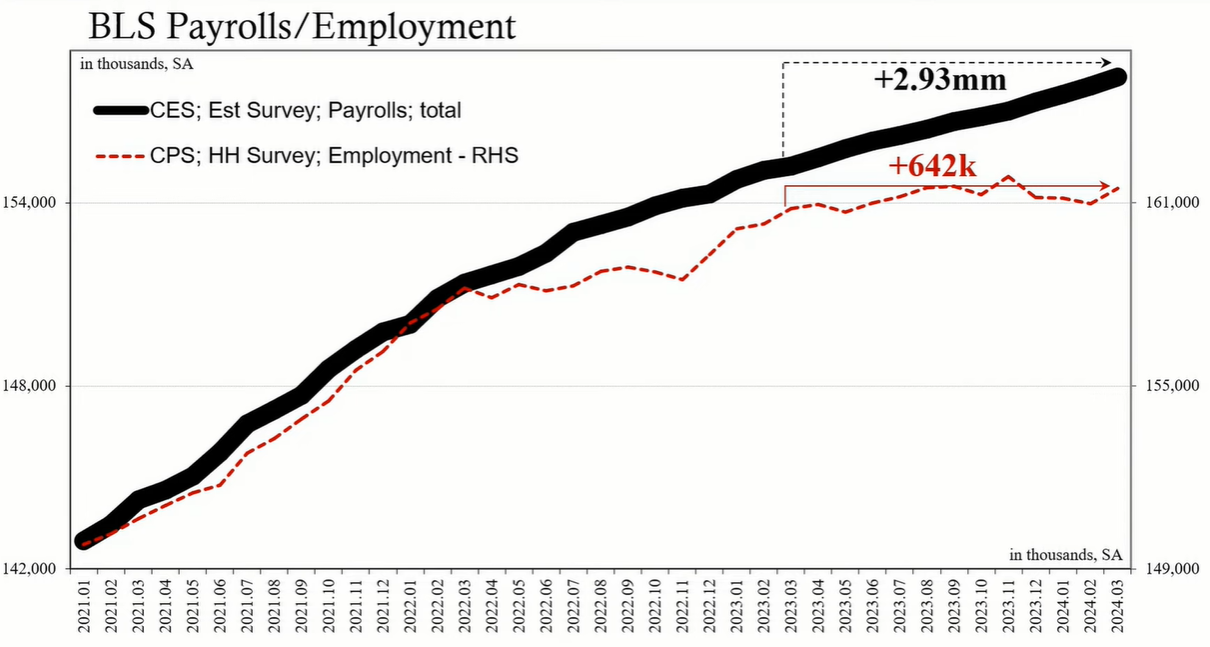

The Bureau of Labor Statistics (BLS) released a robust payroll report for March, with the Current Employment Statistics (CES) showing an addition of 303,000 jobs, surpassing expectations. Revisions to previous months' data were modest and largely positive. Over the last six months, the CES reflects an increase of 1.5 million jobs.

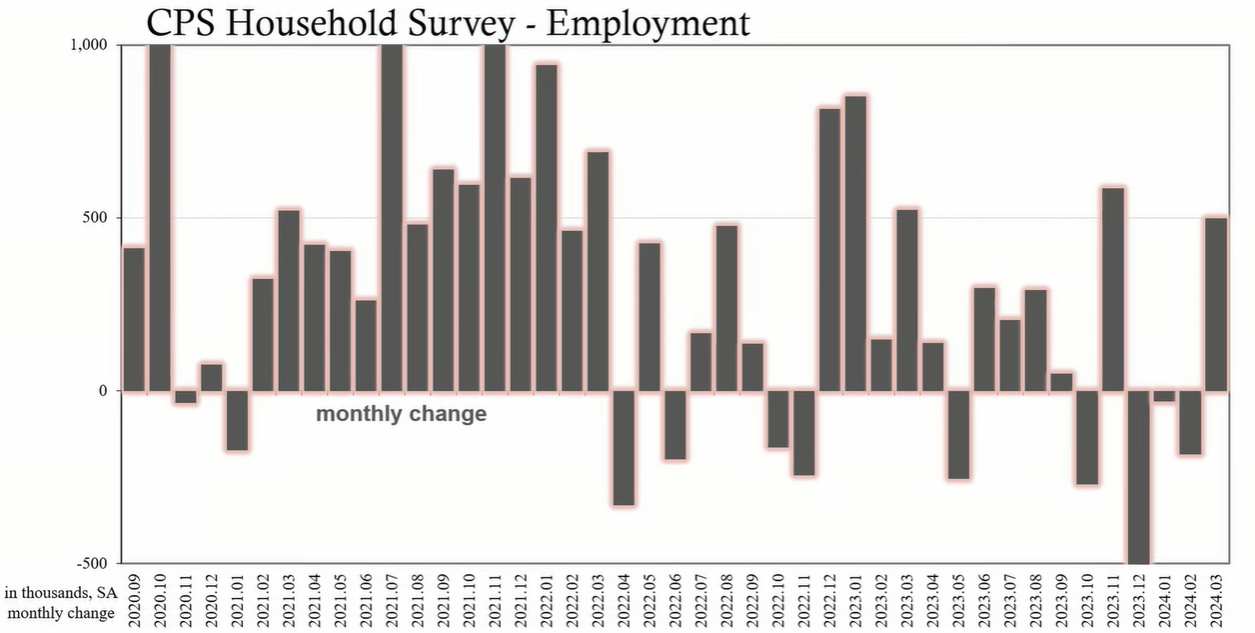

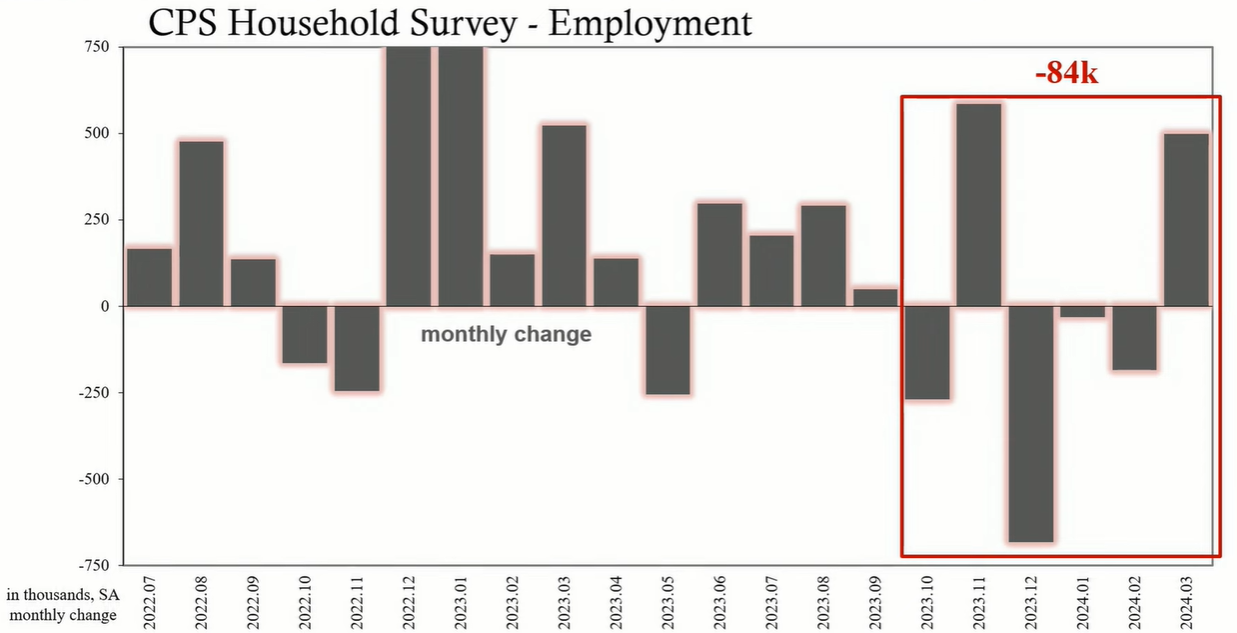

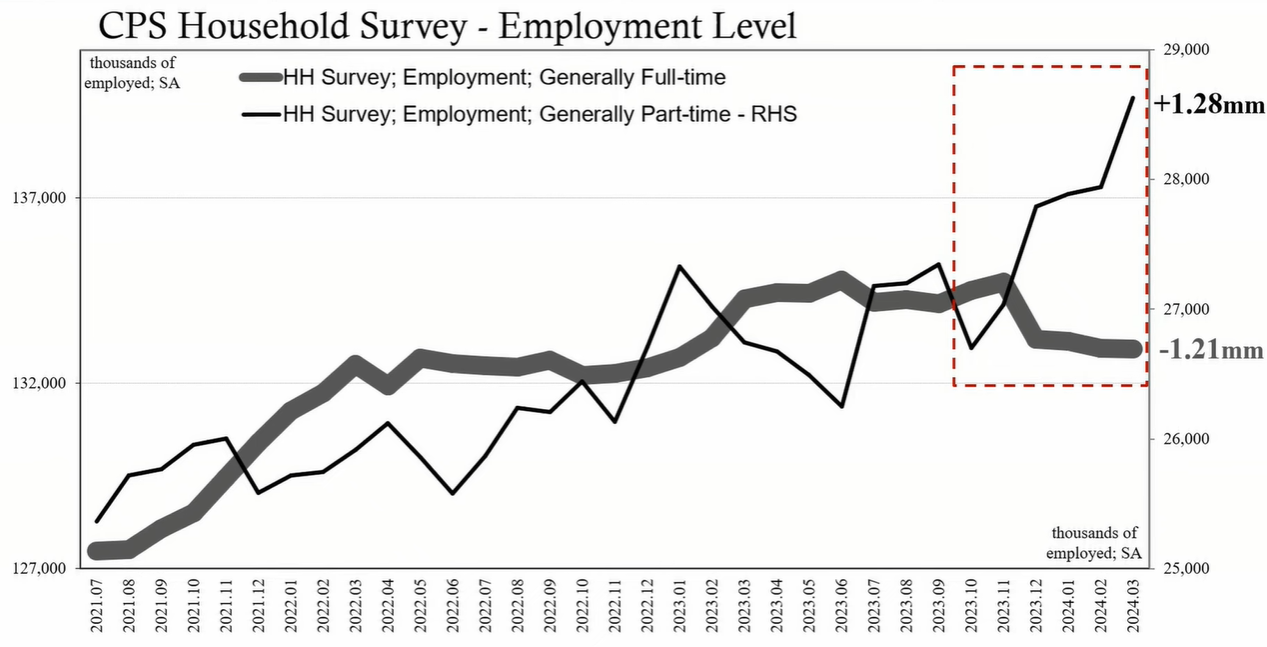

Conversely, the household survey indicated a less optimistic scenario. Although there was an uptick in March with nearly 500,000 jobs added, the last six months witnessed a net decline of 84,000 jobs. The increase in part-time employment, up by 1.28 million over the same period, contrasts with a loss of 1.21 million full-time jobs, suggesting a potential shift in employer hiring practices towards more part-time roles.

To resolve the disparity between these two surveys, it is crucial to evaluate other economic evidence. The CES figures show a strong labor market, with 3 million jobs added over the past twelve months. However, the household survey only reports a 642,000 increase during the same period, signaling potential recessionary trends.

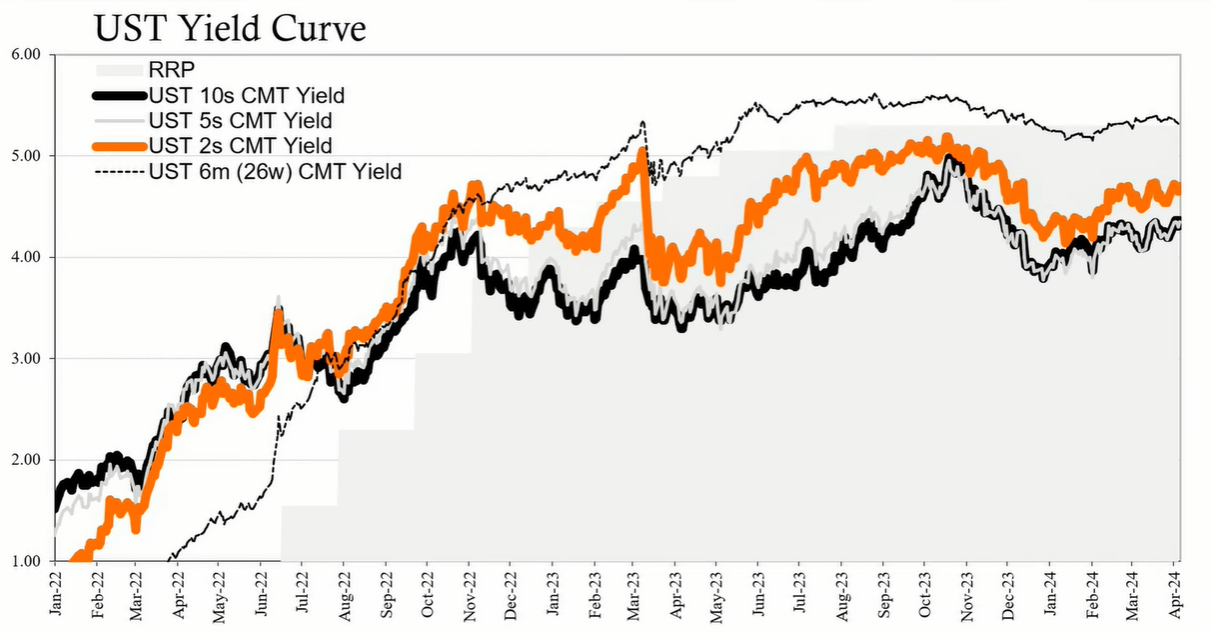

Despite the strong payroll numbers, the market reaction has been muted, with only a slight uptick in Treasury interest rates. This could indicate skepticism towards the CES data, with market participants potentially giving more weight to the household survey and other economic indicators.

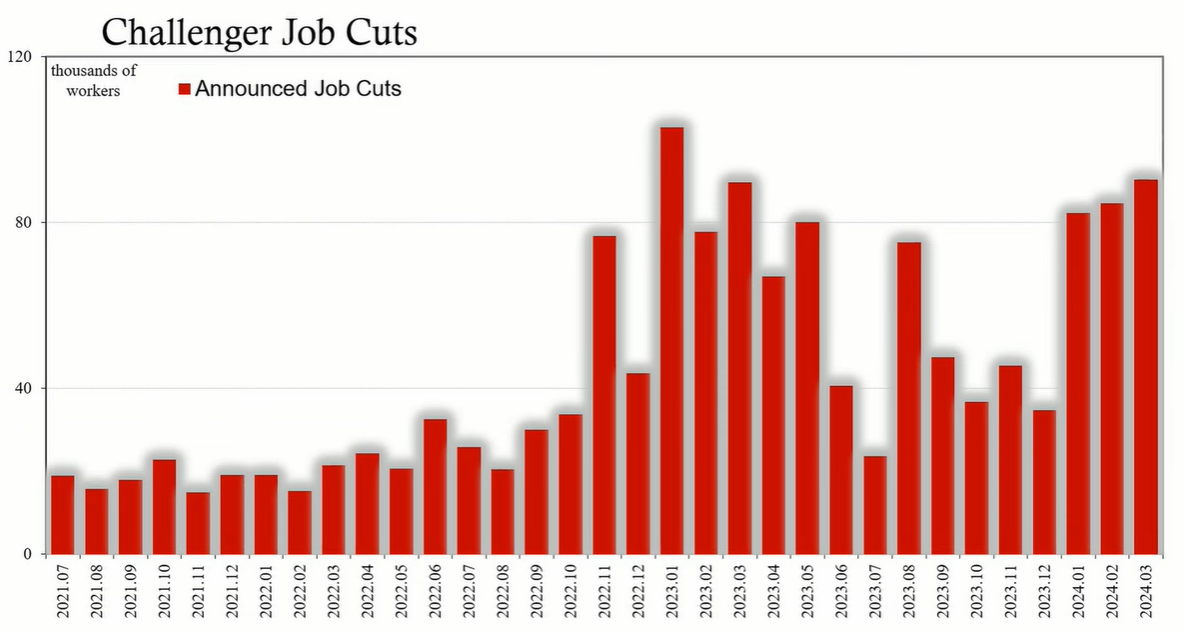

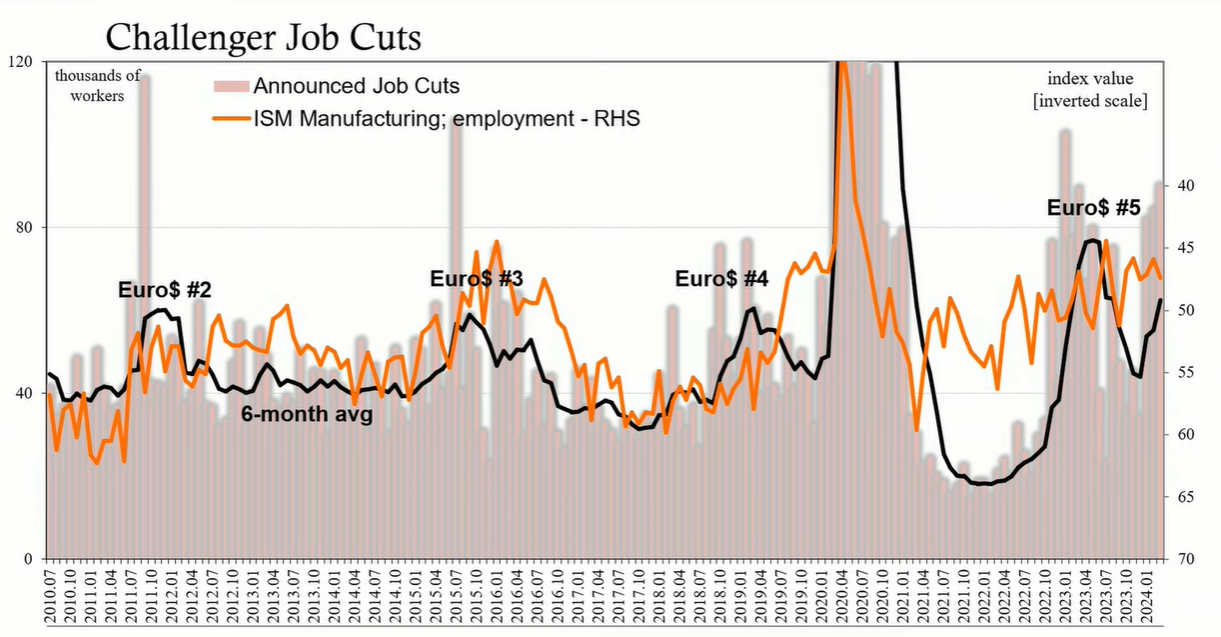

To further assess the labor market, we can look at alternative data such as job cut announcements from Challenger, Gray & Christmas and employment indexes from the Institute for Supply Management (ISM). Both sources have shown elevated job cut announcements and weaker employment trends, which seem to align more closely with the household survey than the CES data.

A comprehensive review of labor market data suggests that the CES may be overstating job market health due to methodological issues related to the pandemic and post-pandemic period. In contrast, the household survey, along with other data sources like the ISM employment indexes and job cut announcements, indicates a weaker labor market. This discrepancy is a recent development, with most data sources historically aligning closely until 2021.