Japan's yen keeps falling despite interventions, weighed down by energy dependence and eurodollar impacts.

Japan has recently undertaken a series of major interventions to bolster the value of its currency, the yen (JPY), yet despite significant effort, the yen continues to depreciate.

On April 29, Japanese authorities intervened in the currency market as the yen approached a fall below 160 against the dollar. Subsequent interventions occurred on May 1 and May 3 after the currency began to weaken again. Despite these efforts, which reportedly cost Japan approximately ¥3.66 trillion on May 1 alone, the yen has failed to sustain its gains, slipping towards 156 against the dollar.

The market's response to these interventions suggests a skepticism about their long-term efficacy. Traders appear to anticipate that despite immediate government action, the fundamental economic issues will prevail, leading to a resumption of the yen's decline. The pattern indicates that the market expects the yen to continue weakening, essentially waiting out government interventions.

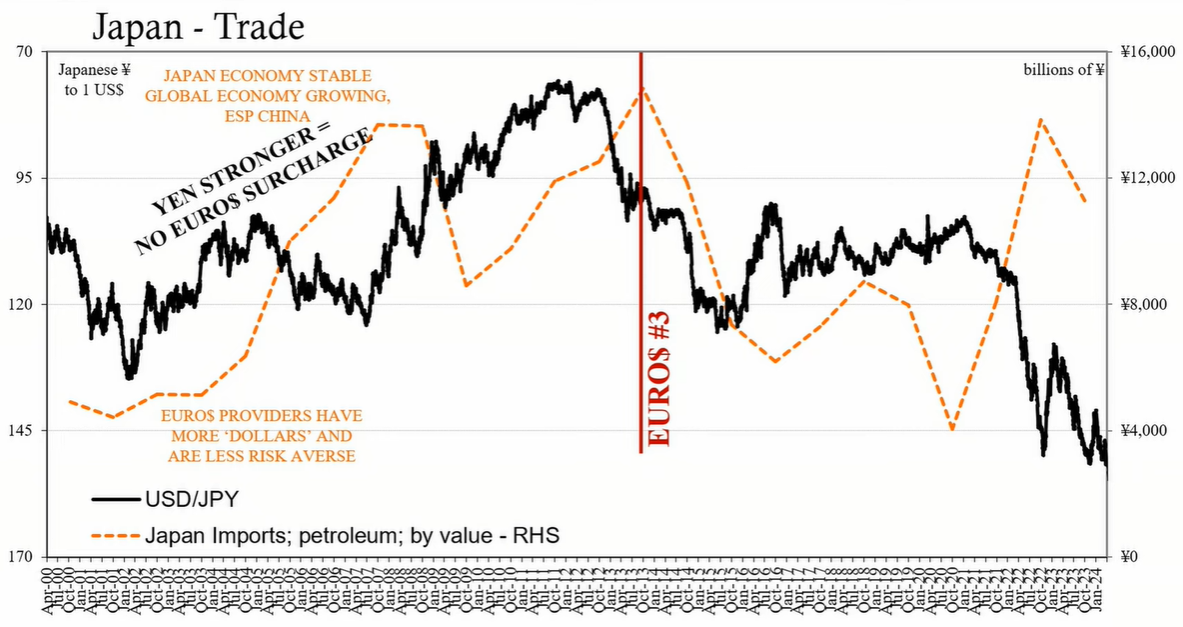

The primary issue at hand is not interest rates but economic fundamentals, particularly Japan's energy situation. Japan relies heavily on imported energy, requiring dollars to make these purchases. This dependency introduces a "eurodollar surcharge" – a premium paid due to the exchange rate when acquiring dollars. As the surcharge increases, it exacerbates Japan's financial challenges.

The Japanese economy exhibits an energy deficit, met primarily through imports. Examining the volume of Japan's oil imports reveals insights into its economic health. Following a stable period in the mid-2000s, Japan's oil imports by volume decreased significantly post-2008, indicating economic distress. Even as global oil prices fell during the 2014 period, Japan's oil imports continued to decline, marking a longer-term economic contraction.

Post-pandemic, Japan's oil imports have not fully rebounded, and the surge in global energy prices has forced Japan to pay substantially more for less oil, further straining the economy. This situation is reflected in the yen's depreciation, as the cost of importing energy in yen has dramatically increased.

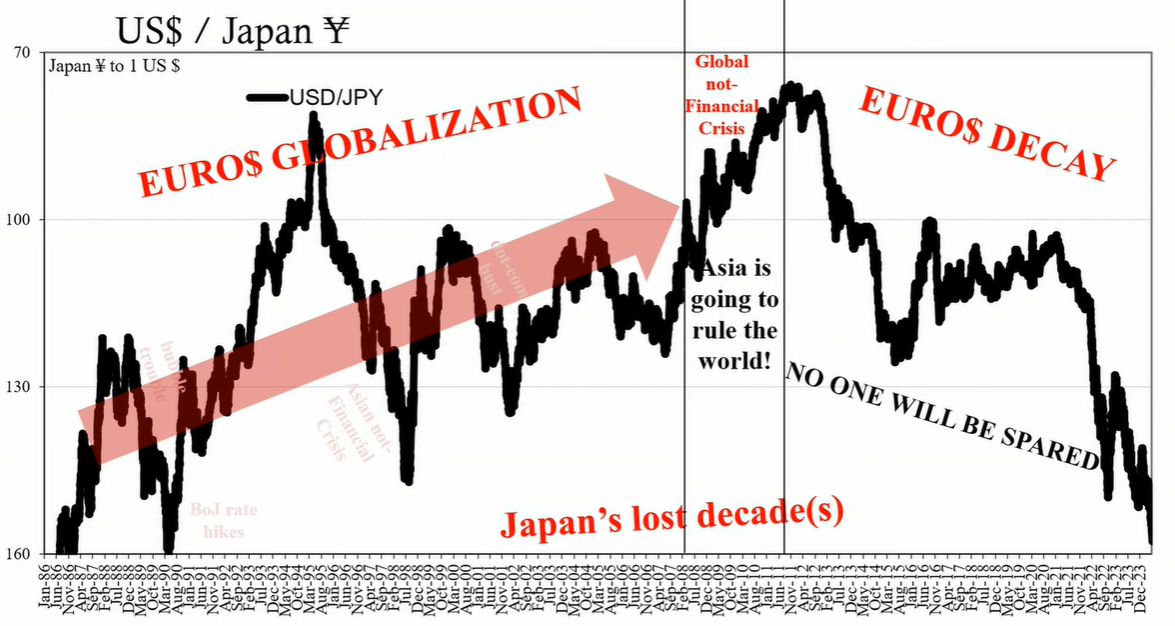

Japan's currency value in the international market is also influenced by the eurodollar system, which governs the global flow of dollars. During times of dollar abundance and economic stability, Japan benefited from a low eurodollar surcharge and a stronger yen. However, as global dollar liquidity tightened and Japan's economic outlook dimmed, the surcharge increased, contributing to the yen's decline.

The eurodollar providers' risk aversion has heightened due to Japan's growing need to borrow dollars for energy imports amid rising global prices. This has led to an increased eurodollar surcharge, further weakening the yen.

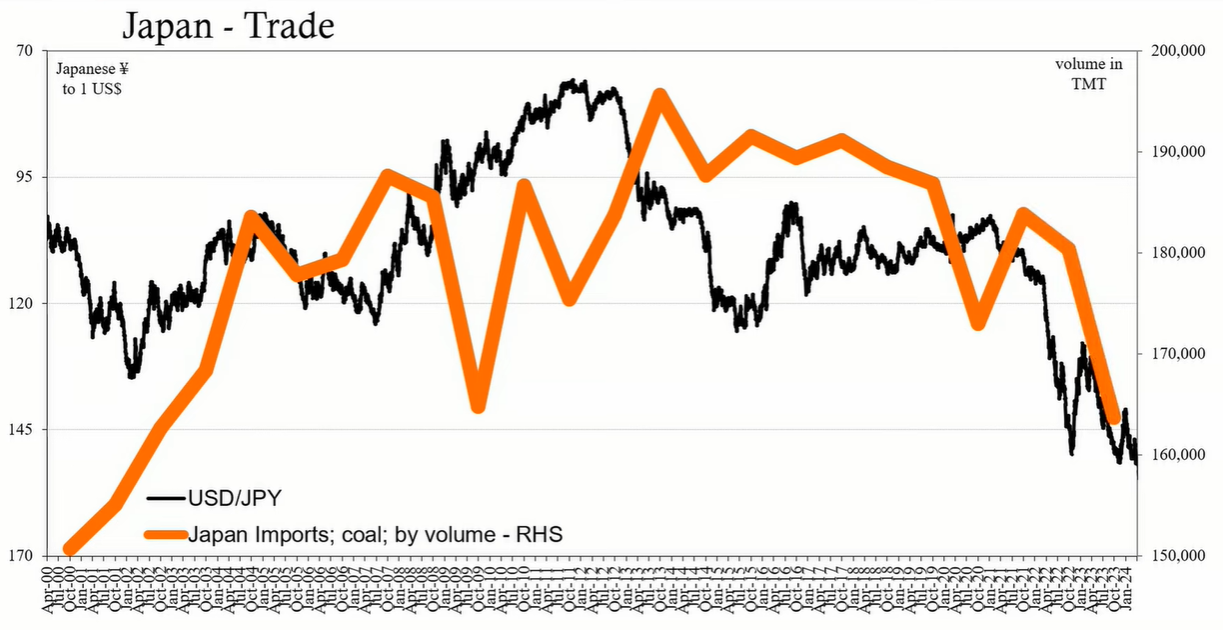

The statistics of Japan's coal imports align with the narrative of its oil imports. Both have seen a steady decline in volume since around 2013-2014, reinforcing the view of Japan's economic difficulties.

The market's reaction to Japan's currency interventions is grounded in a fundamental analysis of Japan's economic condition, which is heavily influenced by its energy dependency and the broader eurodollar system. The interventions have had limited impact in altering the trajectory dictated by these underlying economic challenges. As the yen continues to fall, it underscores the dominance of fundamental economic factors over temporary government measures.