The Bank of Japan is standing idly by while their currency depreciates past the limit set in September 2022. Is all hope lost for the Japanese Yen?

This week, the Japanese Yen slid past another crucial threshold, crossing 155 to the dollar and falling even lower during a crucial press conference. For months, I’ve been writing about what I believe is a burgeoning Asian Currency Crisis with Japan at the forefront. It appears that Governor Ueda has completely given up control.

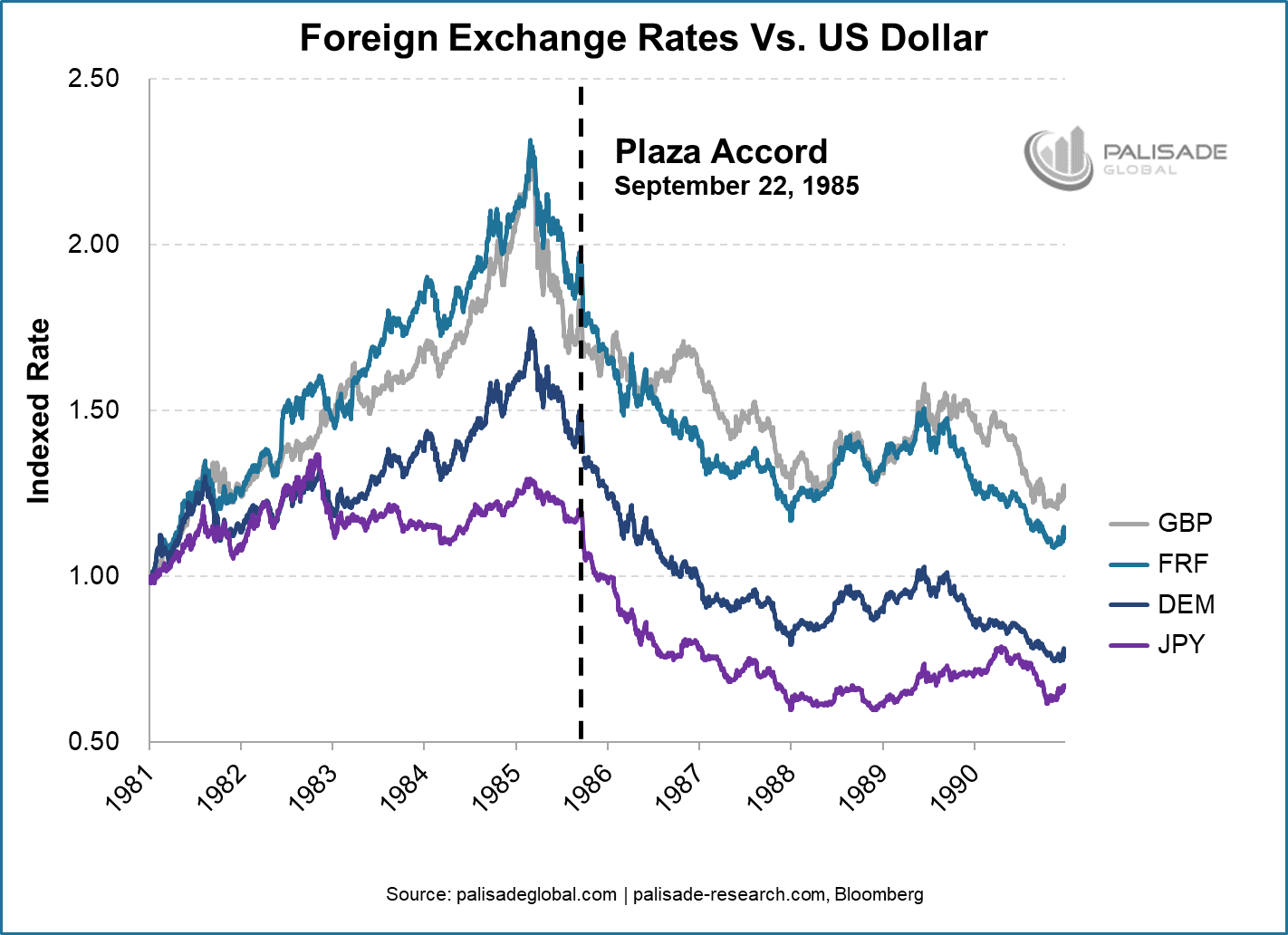

In 1985, at the Plaza Hotel, the United States and its four industrial-nation allies made an agreement to lower the high value of the dollar by collectively selling it on the currency market. A year and a half later, they again convened in Paris with the goal of stabilizing the dollar after successfully orchestrating its decrease. The dollar had ripped higher with the Volcker Shock, introduced by the eponymous Fed Chair who sought to defeat the runaway inflation in the United States by aggressively hiking the Fed Funds rate to the highest it has ever been.

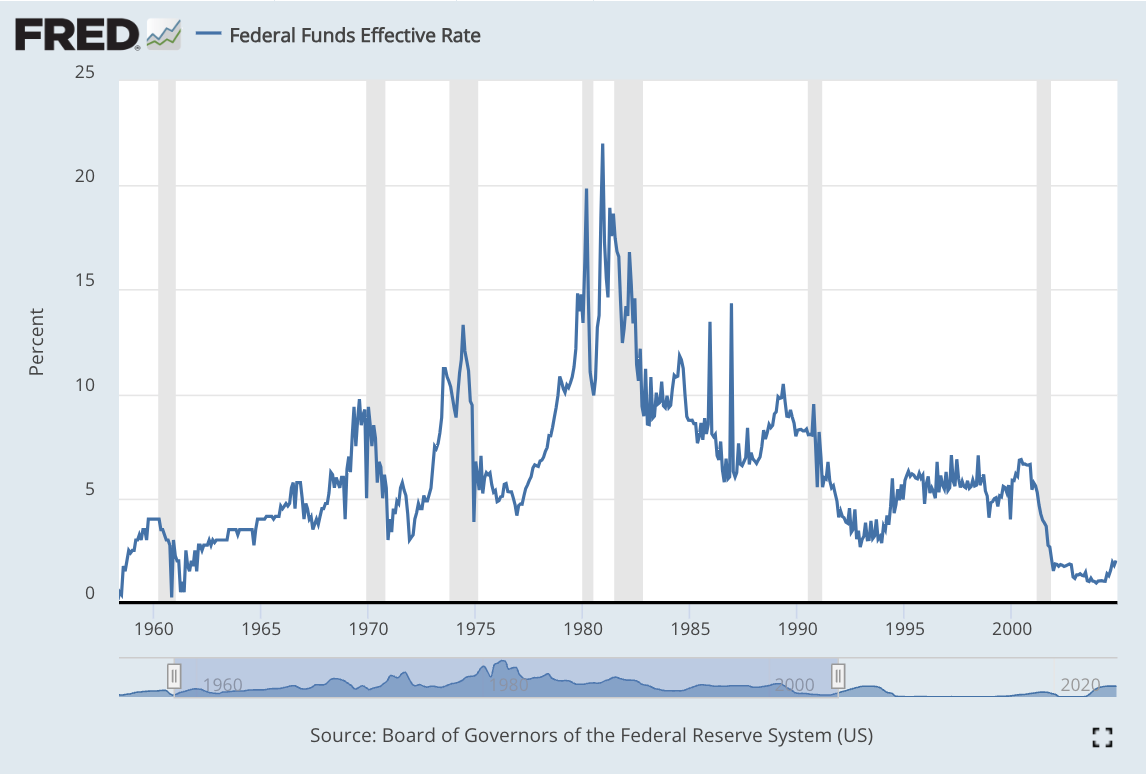

For a brief moment in December 1980, the rate had reached an eye-watering 22%, pushing all other interest rates well into the 20s and some even the low 30s. This was effective in finally breaking the back of the stubborn inflation which had been in place for the duration of the 1970s. With government debt to GDP at a historic low of 30.6% that year, the Fed was safe in hiking rates aggressively (temporarily) without causing a fiscal crisis. As Luke Gromen says, the Fed pushed us into a recession, effectively saying “your Treasuries will be money-good, even if it hurts us domestically”.

This had another side effect other than the mild recession caused by the Volcker Shock. By hiking interest rates so high, the Fed was attracting massive amounts of capital into the U.S., which strengthened our currency significantly. This aided the inflation fight at home, as imports became cheaper comparatively, but this began to cause massive problems in the global financial system as other currencies began to fall sharply versus the dollar. But while the Federal Reserve was hiking, other key central banks went the opposite direction. Between 1980 and 1984, the Bank of Japan cut its policy rates from 9 percent to 5 percent, and the Deutsche Bundesbank reduced its rates from 9.5 percent to 5.5 percent. The Yen fell from 181 to the dollar in 1978 to 258 by March 1985; the Yuan from 1.58 in 1981 to 2.82, and the British Pound from 0.42 to 0.91, a massive devaluation of over 50%.

This burgeoning currency crisis was causing major issues, but especially for American auto exporters, who saw collapsing sales as the dollar continued to rip higher. These executives began pressuring the government to do something.

On September 22, 1985, at the Plaza Hotel in New York, officials from the US and the Group of Five major industrialized nations reached an agreement to reduce the value of the dollar. They supported their public declarations with actions in the foreign exchange market, where they sold dollars in exchange for other currencies.

Between 1985 and 1987, the dollar's value fell by 40 percent. Following this decline, the trade balance improved, though after a delay of several quarters. Ultimately, the U.S. Congress decided against implementing protectionist trade measures. This was seen as probably the most successful coordinated foreign exchange intervention ever.

Now, a similar dynamic has taken place. Japan, in the wake of the financial crisis, began piling on debt to new astronomical levels. They ran QE programs to attempt to revitalize the economy and create price rises to counteract consistent deflation, but these were unsuccessful. As I covered in previous posts, such as The BoJ is Trapped, they experimented with a new form of monetary policy, Yield Curve Control. I’ll include a quote from that piece:

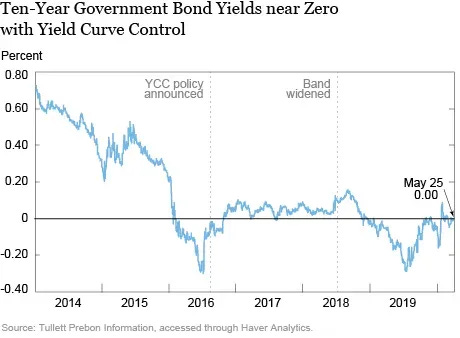

In 2016, the Bank of Japan had adopted Negative Interest Rate Policy (NIRP), aiming to “stimulate borrowing and lending” to revitalize the nation's sluggish economy. This approach of negative interest rates, also used by some central banks in Europe, basically means depositors will pay fees to banks for holding their money and enables borrowers to secure loans at very low costs, thereby encouraging spending.

The BOJ initiated YCC almost a decade ago in 2016- conducting four Fixed-Rate Purchase Operations to lower the 10-year yield, with the time intervals between operations ranging from three to seven months. The first two operations targeted short-term JGBs, while the latter two focused on 10-year JGBs. All four trials effectively lowered the yield curve, rapidly bringing down the 10-year JGB yield to the zero bound.”

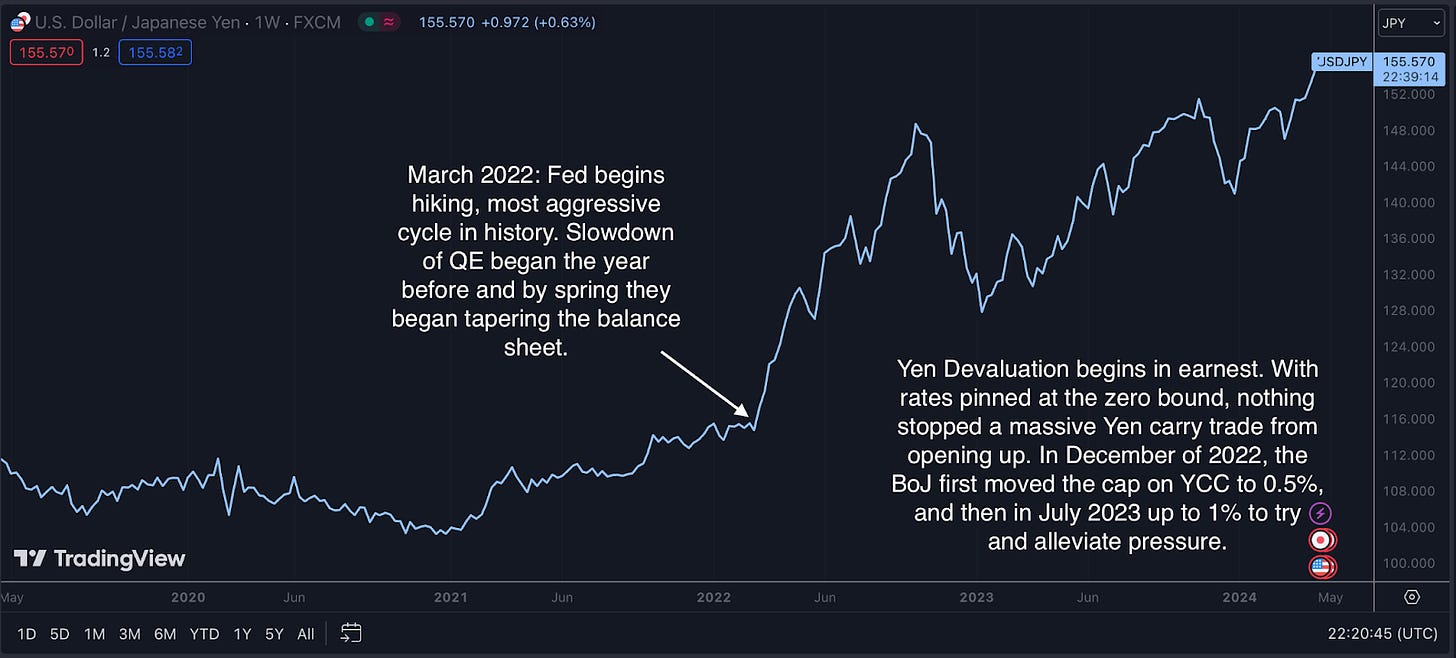

Keeping rates pinned so low worked for years, as the rest of the world had eased and even the modest interest rate hikes the Fed did in 2018 and 2019 were quickly undone by the record stimulative response to Coronavirus. As inflation ripped higher in the U.S., policy makers began to panic, to the point that they began the fastest hiking cycle in history by spring of 2022. As you can see below, the Yen had only slightly devalued against the dollar to this point, but once interest rates began to rise with their second largest trading partner, a massive carry trade began to open up. The larger the rate spread grew, the more pressure built up on their currency, and the Yen subsequently devalued.

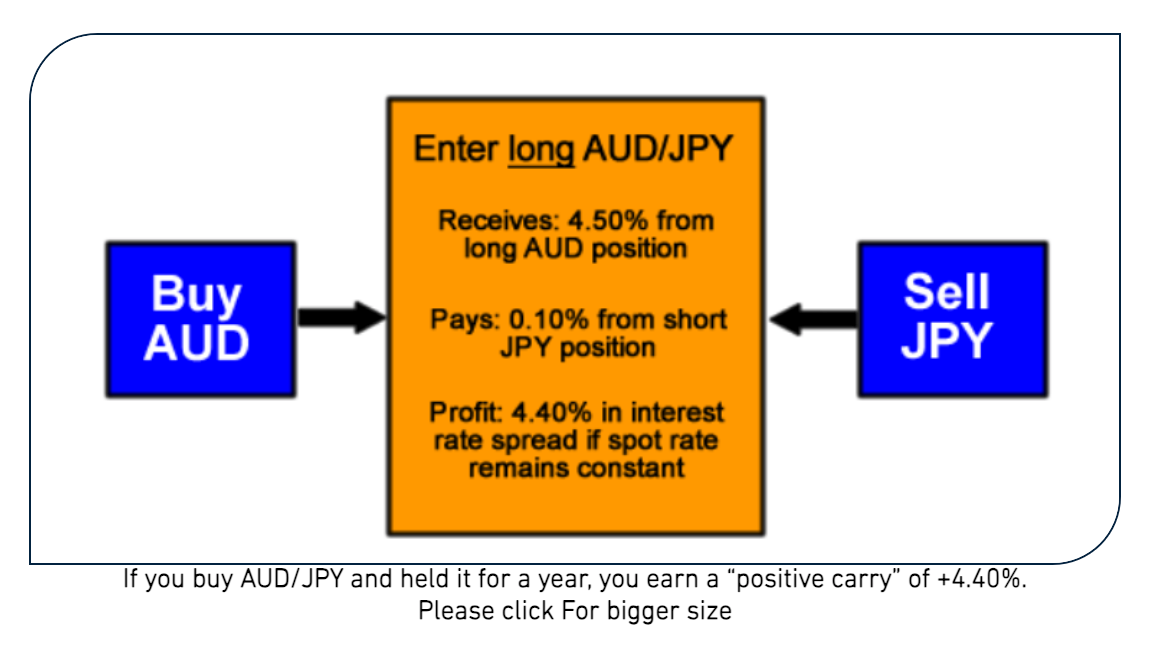

In simple terms, a carry trade occurs when an investor can borrow at a low rate in one currency, and lend or buy assets in another currency with a higher interest rate, providing a healthy spread that provides returns. This strategy can be levered up many times to provide a strong source of cash flow for institutions like hedge funds. Here’s a great example with Australian Dollars and Yen from CFI Financial. When you borrow Yen and buy AUD, you push down the relative value of JPY and bolster AUD. Since you are making a positive spread, you can keep this trade on as long as the currency moves either flat or in your favor.

As the Fed began their historic hiking cycle, it suddenly became profitable for traders to borrow Yen and buy USD, and as they continued raising rates, this trade grew more lucrative, to the point that the trade began to outperform even the SPY. With Japanese interest rates pinned to the zero bound, this trade was virtually free money.

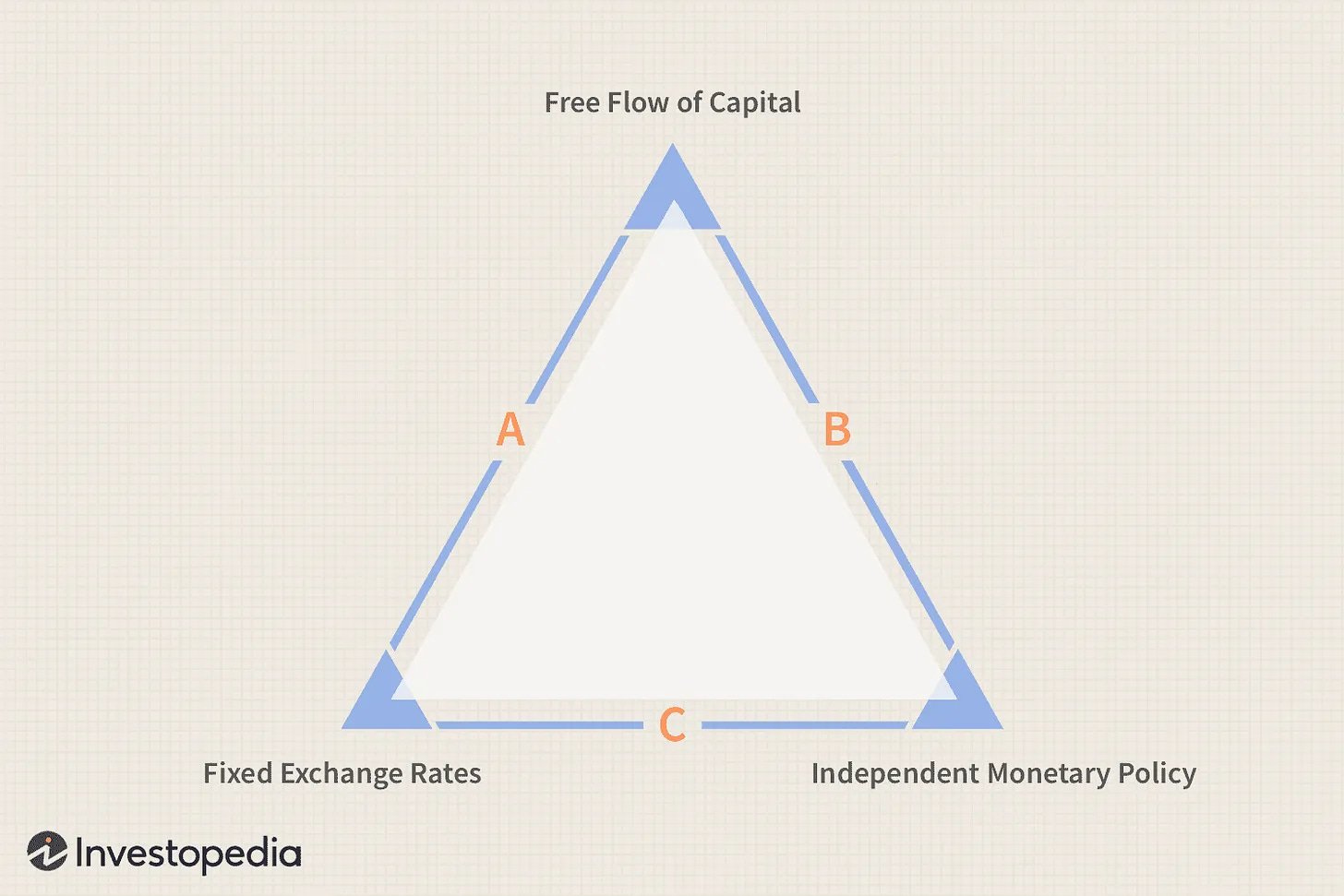

It is important to note here a key economic concept that I’ve already covered in-depth in my piece the Japanese Maginot Line- the policy trilemma:

Often referred to as the impossible or inconsistent trinity, the policy trilemma presents a scenario where a nation must make a choice among three key objectives: unrestricted movement of capital, effective management of exchange rates, and maintaining monetary autonomy. This trio forms the corners of a triangle in the graphical representation seen below.

However, it's possible to achieve only two out of these three objectives concurrently. By choosing two of the options, you by default exclude the third, at least in the medium to long run.

For example, a country aiming to stabilize its currency value while independently setting interest rates (side C of the triangle) cannot permit unregulated cross-border capital flows. Alternatively, if a country opts for a fixed exchange rate but keeps its economy open to international capital movement, it gives up the ability to exercise an autonomous monetary policy (side A). Lastly, if a nation desires both free capital mobility and monetary independence, it must allow its currency to fluctuate freely in the foreign exchange market (side B).

Japan must keep an open capital account if it wants to remain a player in the global export space, so this corner is required. Thus, it must pick which of the two other options it wants to have- a fixed (or in a tight range) exchange rate, which means it must give up monetary autonomy, or monetary autonomy, which means rampant currency devaluation in the forex markets.

Whether they like it or not, the Japanese MUST choose which side of the triangle they will rest on. Either they maintain monetary autonomy, which means their currency blows out, or they hold the peg, which means they must follow rate synchronization with the Fed and ECB. A rapid hiking cycle would thus commence.

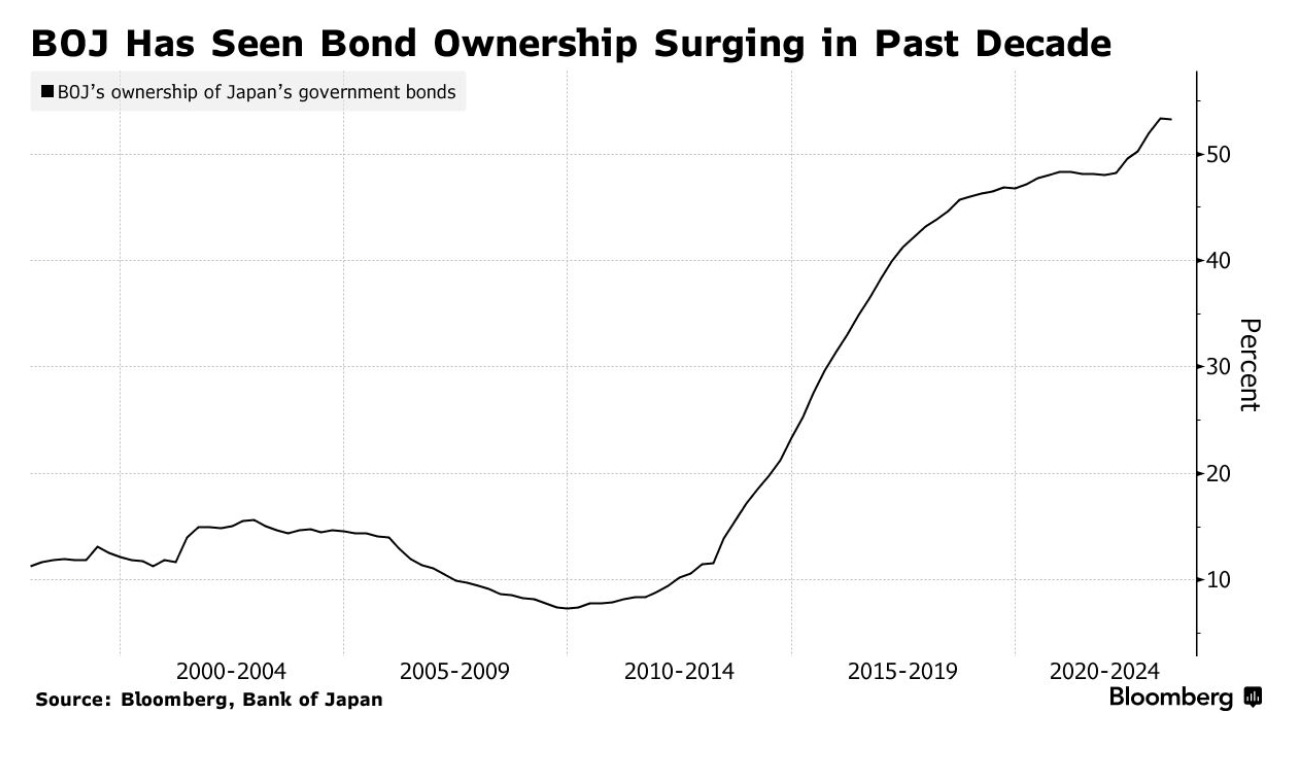

Worse yet, recall that the central bank already owns over half of the entire bond market, due to decades of Yield Curve Control creating an infinite bid for JGBs.

As some have pointed out on Twitter, this is recursive, as higher interest rates paid by the national government would mostly go to the central bank, who can use these profits to roll back into buying more JGBs. The Bank can essentially eat the entire bond market- at which point its liquidity hose will be injected directly into the veins of the Treasury. We would see both money supply and overall government debt rise in tandem.

The Japanese first saw this crisis begin in September 2022, only 6 months after the Fed’s hiking cycle, where the Yen crossed 153 and the BoJ dumped $20B in a single day to stem the decline. This wasn’t enough, and over the next two months they dumped $57B more. As Powell began to drain Reverse Repo, and Yellen the TGA, liquidity was added back into the system, buying the Japanese valuable time. The Yen remained mostly range bound below 150 for the duration of 2023.

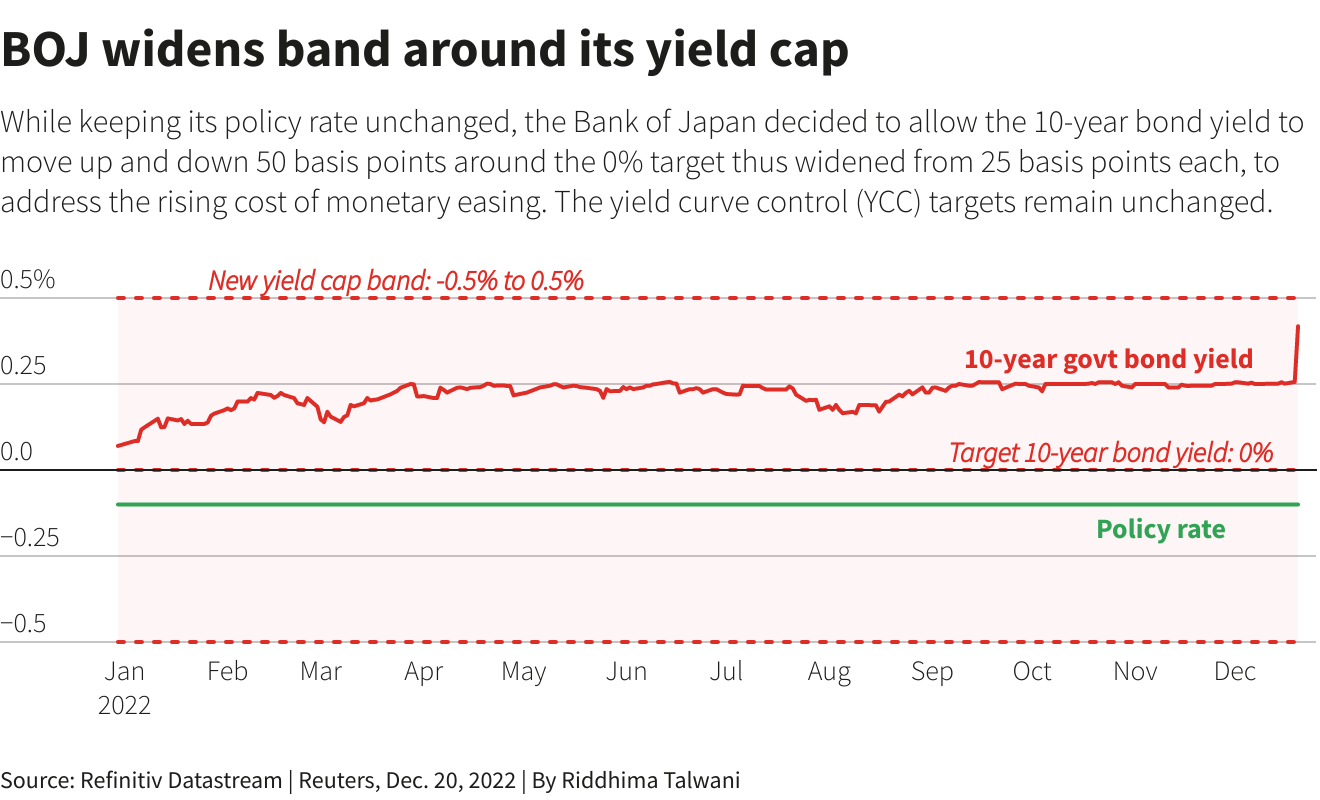

In late November of that year, the Yen again approached 150, and Kuroda responded by making the first big move other than forex intervention, raising the cap on Yield Curve Control of the benchmark 10 yr JGB to 0.5%. This triggered a flurry of activity in the bond market, and even led to an emergency margin call issued by the Japanese Securities Clearing Corporation.

Moving the bands on YCC was the first tentative step taken by authorities to hopefully ease the pressure on JPY and restore stability to the forex markets without warranting another intervention. Dumping dollar assets, mainly Treasuries, is a very short term panic solution, as it essentially is burning the candle at both ends. Moreover, it’s counterproductive. On one hand, the Bank was buying massive amounts of JGBs every month with freshly printed Yen to maintain the cap on YCC, and with the other, they were wading into the forex markets to bolster the currency. I relayed the absurdity in a meme that went quite viral (by Fintwit standards).

The Japanese had widened the band significantly, and now promised to intervene whenever the 10yr rose to 0.5%, or close to it. Within a few weeks, the unscheduled bond buying operations began as they had to machine gun fire the rate down every time it approached the cap. This continued throughout January and early February of 2023.

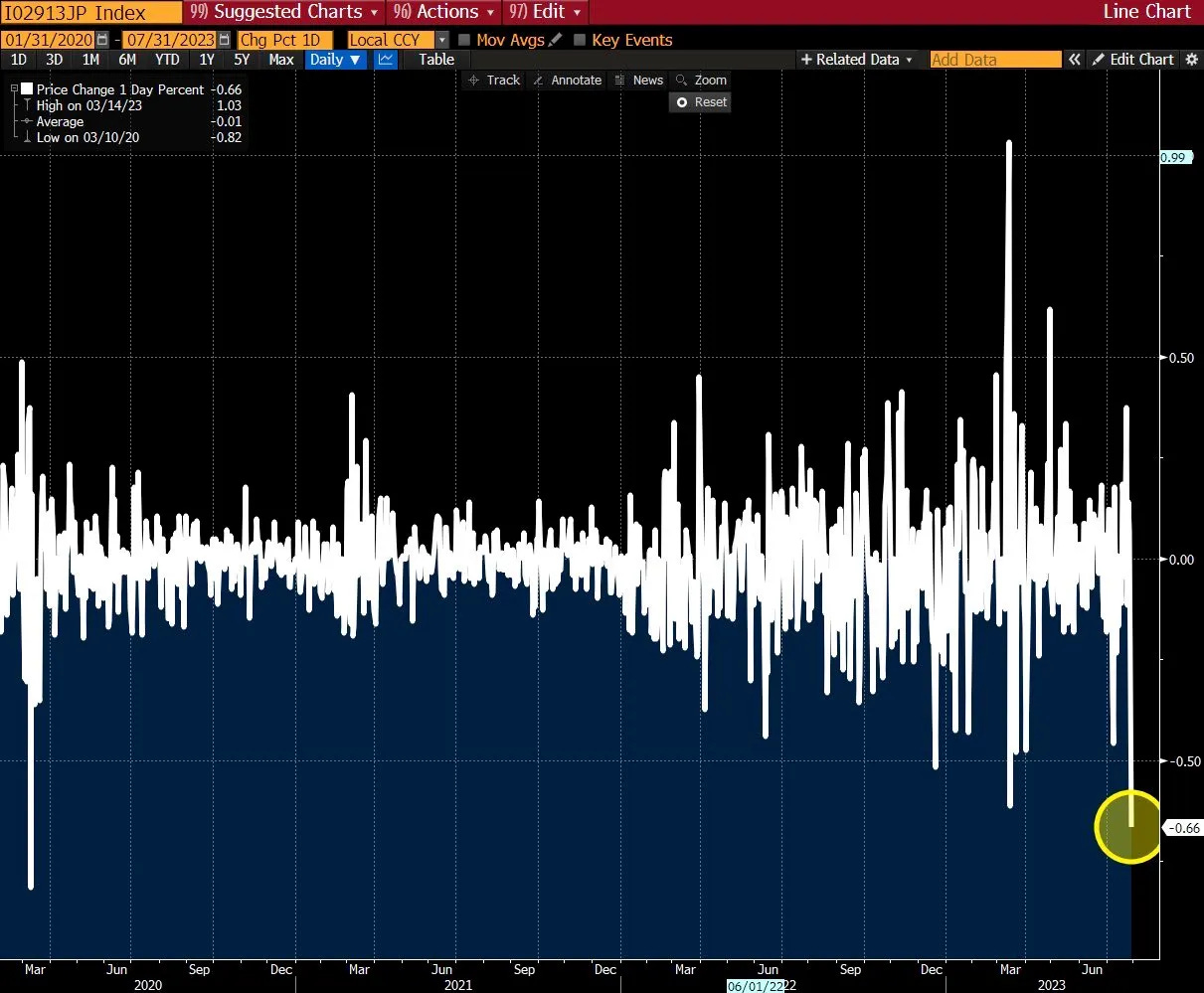

The Bank’s ostensible hard line defense bolstered the market temporarily, and the Yen ran to 131. Soon, however, it began depreciating once again. By summer, the currency was closing in on 145, and Kuroda decided to act again. On July 28th, they moved the cap on the 10yr all the way up to 1%, double what it had been before. Chaos quickly ensued in Japanese bond and stock markets, and the next Monday, Japanese bonds experienced their worst daily drawdown in years. I covered the action here.

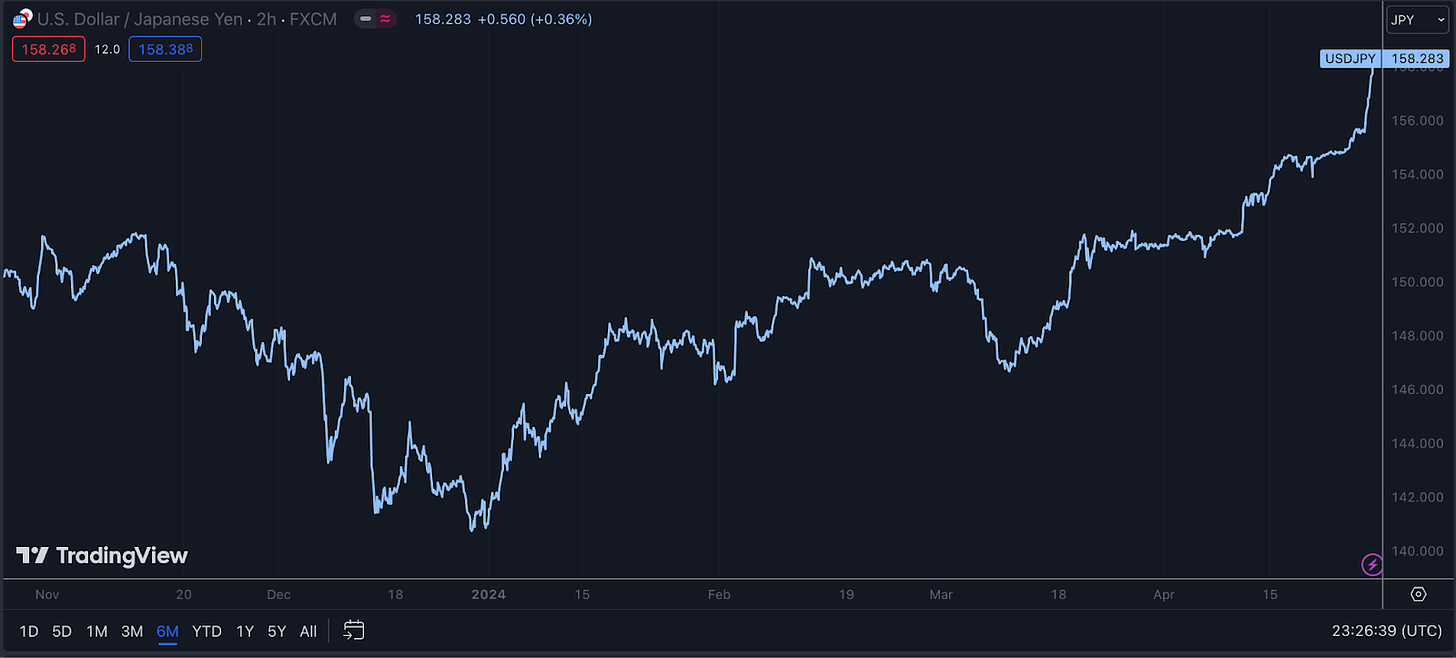

Again, this bought some time. As rates rose in Japan, the carry trade unwound slightly and USDJPY fell back to 138. But, the printing soon caught up with them, and by early 2024, we were back at 150. Staying rangebound below 152, we finally broke through on April 10th, and things have only gone from bad to worse.

The yen took an additional hit this Friday when Bank of Japan Governor Kazuo Ueda signaled that monetary policy would remain accommodative. During the conference, he maintained the current interest rates and offered minimal support for the struggling currency. The market had expected hawkish rate signaling from Ueda, at least in words, and this was hoped to stem the decline in the Yen.

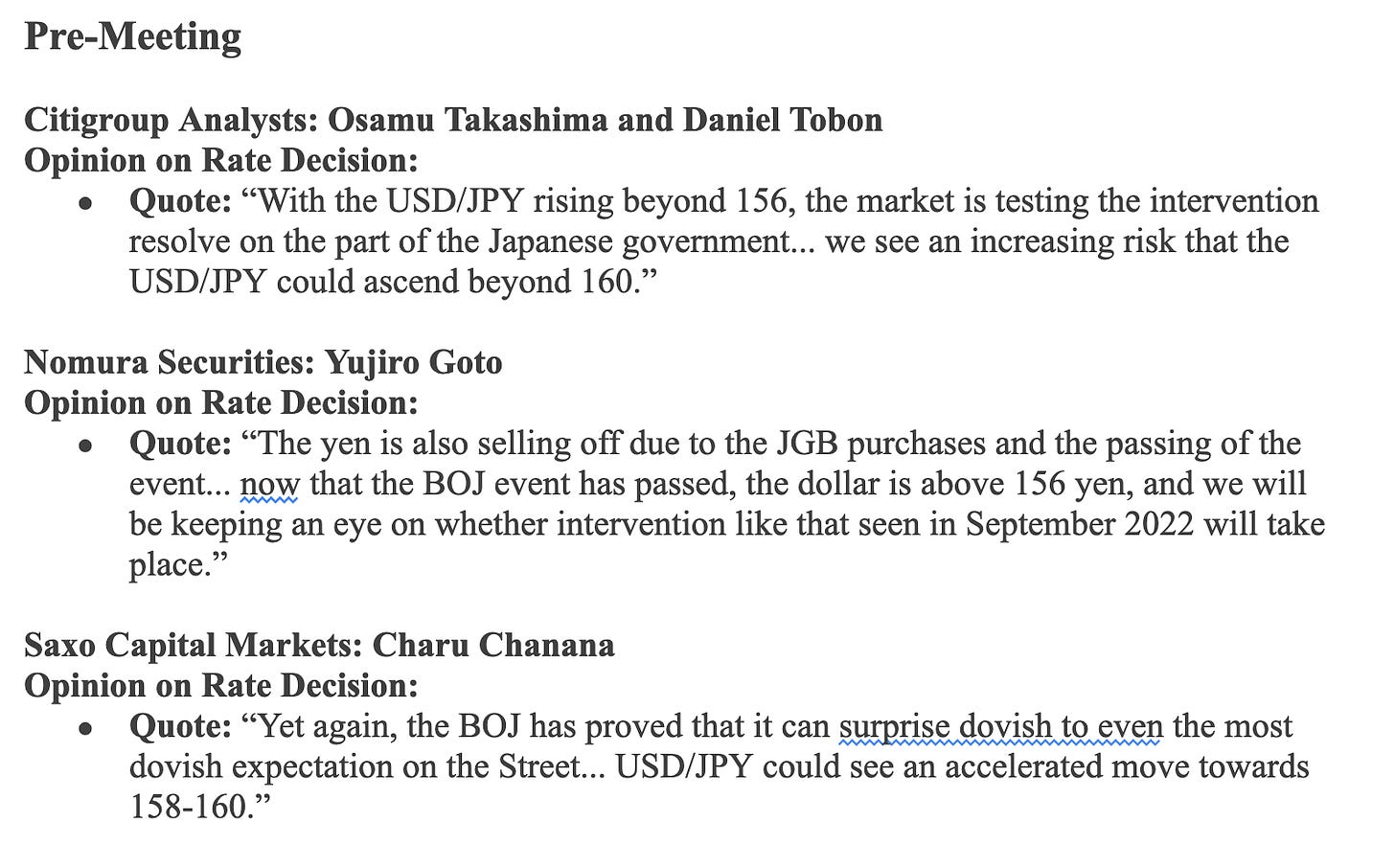

Before the meeting, several analysts had expressed concern over the yen and anticipated some kind of intervention. Citigroup pointed to the market testing new USD/JPY highs, Nomura predicted selling pressure and had some thoughts on possible future interventions. Saxo Capital noted the BoJ’s consistent dovish surprises and again predicted the further decline of the yen.

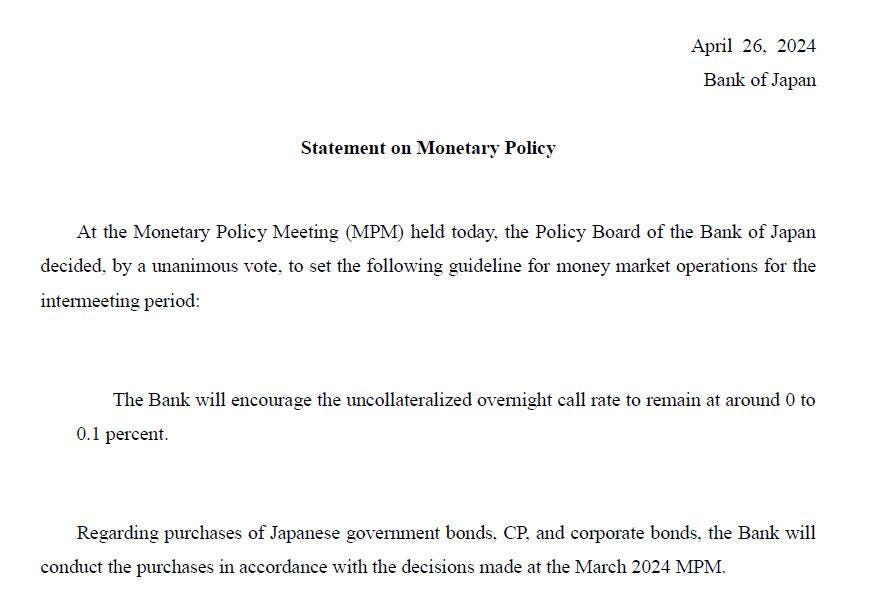

The statement they released had no indication of intervention. In a hilariously short memo, they essentially said that nothing would change from their March meeting, where they had abandoned explicit YCC but promised to maintain consistent scheduled purchases of JGBs so as to not allow interest rates to rise in a “disorderly” fashion.

During the conference, Governor Ueda played off all the questions about the Japanese Yen, even going so far as to dismiss any concerns that the recent weakness is even something to worry about. This goes against the stance of his predecessor Kuroda, who had intervened multiple times in the markets to defend the Yen between 150-155.

Weston Nakamura lays out in Across the Spread:

It's not just BOJ, its Governor Ueda’s behavior and conduct at the press conference- who is taking a very strange apathetic attitude about a +5% multi-decade breakout in USDJPY since the last BOJ meeting only a month earlier, despite the common narrative that the March BOJ itself had kicked off the relentless JPY decline - (inaccurate as that may be).

“Recent depreciation in the yen has not had significant impact”

-Governor Ueda Press Conference

That quote is everywhere right now in Japan. And it’s not a one-off comment- basically every question throughout the entire press conference was yen, yen, yen. Governor Ueda had maintained this “not a big deal/factor” stance. This is why USDJPY at the start of the press conference was at 155.90, and hit 156.72 during.

After hopping through a blurred sense of future inflation expectations Ueda moved onto the subsequent actions that the BoJ will undertake:

“... There was no opposition from the board today on continuing to buy at the current pace of roughly 6 trillion yen per month."

Although the JGB purchases stayed the same, Ueda gave the most informative view from the interest rate perspective. Governor Ueda started by announcing that the ideal level for interest rates had not yet been achieved, hinting towards some adjustments soon. He expressed concerns about the economic impact of rate hikes, alluding perhaps to the tightrope that would need to be walked along the catastrophic debt-to-GDP ratio and the historical context of Japan’s minimal experience with rate-hiking cycles.

Also in the conference, Ueda stated:

“Currency rates is not a target of monetary policy to directly control. But currency volatility could be an important factor in impacting the economy and prices. If the impact on underlying inflation becomes too big to ignore, it may be a reason to adjust monetary policy.”

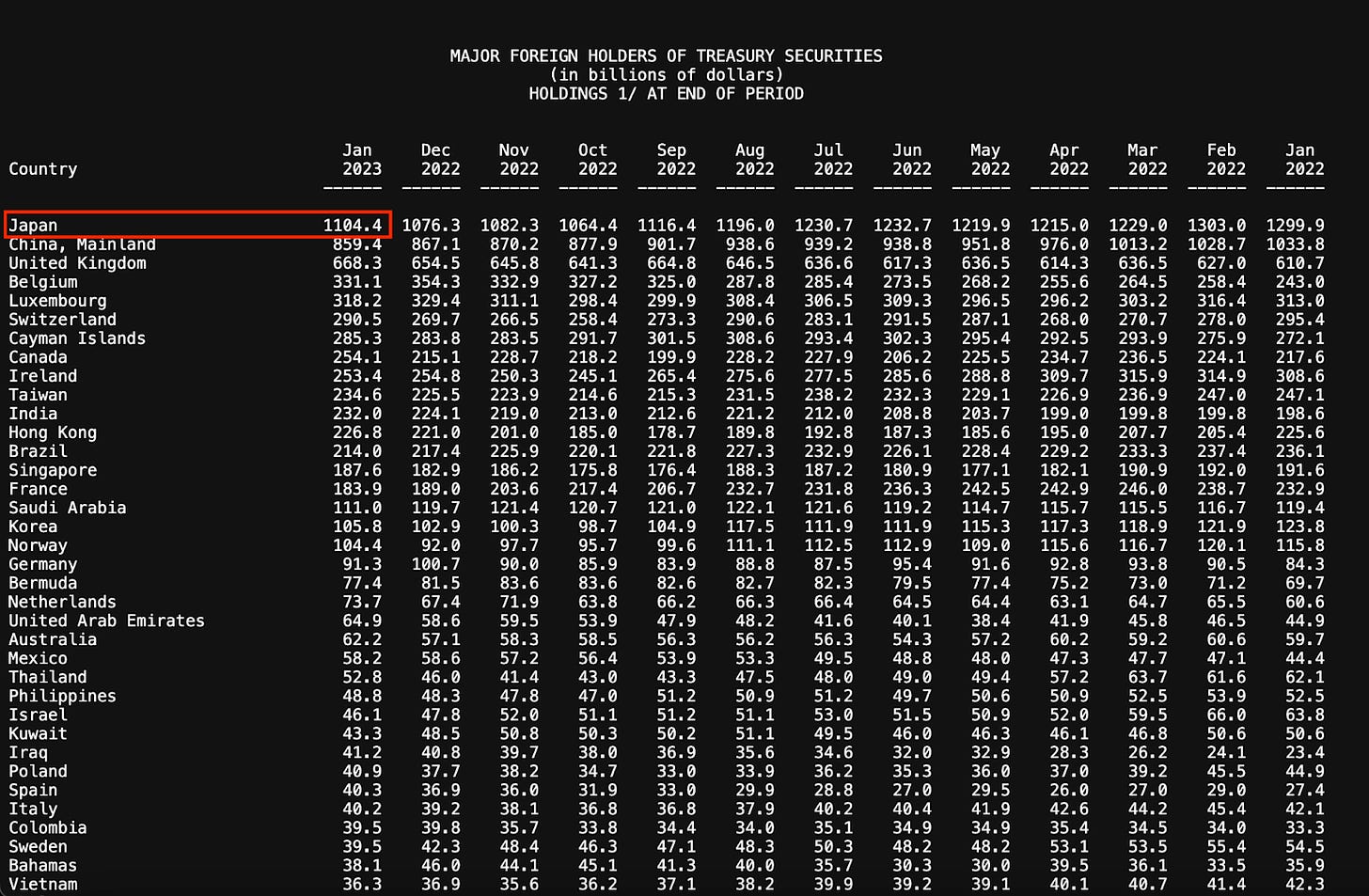

This finally revealed that it's likely the Bank of Japan is just going to sit on its hands and watch the Yen depreciate, at least in the short term, and markets reacted quickly. They understand a key point- that anything the Japanese do to combat the burgeoning crisis will make it worse. Thus, authorities would need to see rampant inflation for them to try anything to stop the depreciation. For example, if the Japanese do decide to intervene in the spot market by buying JPY, they will have to fund it by selling sections of their massive hoard of US Treasuries. With them being the largest single creditor to the U.S. by a substantial amount, this would have an outsized impact on bond markets. Their positions totaled around $1.1T in January of 2023, and grew to $1.167T by February of this year, per TIC data.

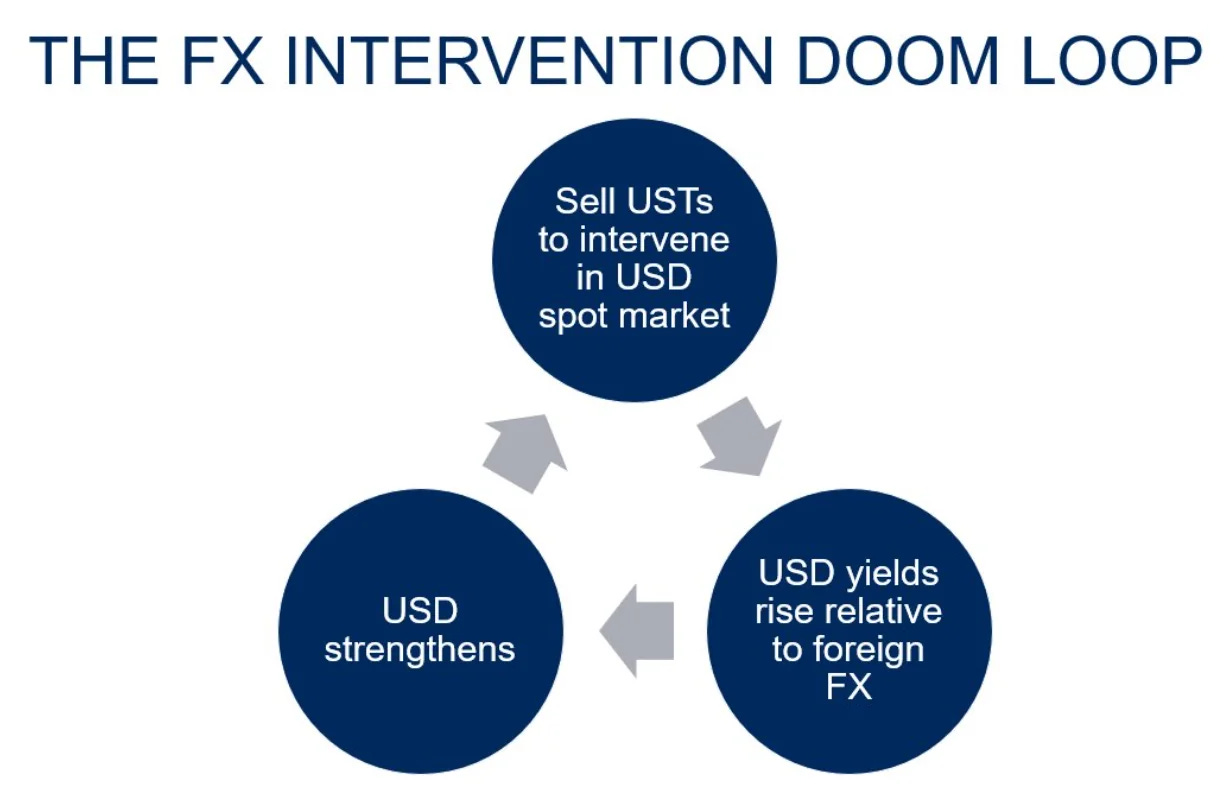

However, in doing so, they open up a positive feedback loop that works against them. As they sell USTs to get the dollars necessary to buy back their own currency, this pushes bond prices down which makes US yields rise. As the yields rise, the aforementioned carry trade becomes more and more profitable, which in the long run puts more downward pressure on the yen. This means the interventions in dollar terms have to get larger and larger, making yields rise even more, and the cycle repeats in a vicious feedback loop.

The yenterventions done in 2022 only bought them time- and through the dumping of USTs and the secret liquidity injections from the Fed the Yen’s depreciation was kept at bay.

Some on Twitter pointed out that these types of interventions have been done before for other currencies, and worked. The reason why this isn’t the case this time is simply the massive size of the carry trade- Deutsche Bank analysts put the figure at $20T (conservatively) as of November 2023. This means that this feedback loop exists more strongly for dollar/yen than any other currency. Previous currency crises, like the Asian Currency Crisis, were due more to structural economic weakness and deficit problems, which were taken as reasons for traders to short the market.

In the past few years, we’ve seen an increasing correlation between the US 10yr bond and the Yen, with each basis point higher on the bond met with more JPY weakness. This serves to further prove the point that dumping Treasuries is counterproductive here, as this adds more pressure on the short side for the Japanese currency.

Given the current levels of Yen volatility, and the overall price level, we should have already seen an intervention, or at least mention of one. The fact that Ueda has fallen silent is very telling. It looks like he’s just given up.

Yen volatility has reached the highest in well over a year, and currently sits at 25.8- the last interventions happened with vol between 28-30.

So, as we mentioned, per the policy trilemma, their hands are effectively tied. They cannot normalize rates with the U.S., as this would bring on a rapid deflationary cycle with debt to GDP so high; they can’t intervene without making the carry trade effect worse; and they can’t close their capital account as they need it to be open for free trade.

So what can happen from here? I see two major outcomes:

Option 1 is what they have been doing so far. USDJPY quickly broke through 156 early Friday morning (UTC time) as the comments from Ueda’s press conference got digested. It paused briefly before ripping through 157 and then through 158, exhibiting high volatility for a currency pair that is this liquid.

Here’s an inverted graph from Zerohedge. The level reached by the Yen in trading Friday was a fresh 34 year low, and past the level of the first intervention at 150.

The second option could be in the works, but the Fed itself may be reluctant to cut just for the Japanese's sakes, especially after a PCE inflation reading came in hot this week at 2.7%, above estimates. To keep the lid on inflation, the Fed would keep rates “higher for longer”- which means, by default, the carry trade would remain open, and the pressure on the Yen would continue. The hot inflation readings probably therefore contributed to Yen weakness.

Domestic monetary policy also doesn’t typically trend around what is happening in other countries, regardless of how closely tied they are. It’s unlikely the Fed would cut rates just to save Japan, so a more likely outcome is an intermediate move like funding a large dollar swap line to help with future yenterventions. This would be a good medium-term solution, but it has the side effect of increasing dollar liquidity by somewhere in the range of $50-$100B a month as long as they use the swap line to fund yen purchases. Such a move would be additive to global net liquidity, which as I’ve covered in other substack posts like this one, is highly correlated with equity index prices in general, and Bitcoin price in particular, which trades as a hyper-levered risk asset.

This may be necessary, as Treasury market dysfunction is already heightened, as we’ve seen per the recent secret moves to add cash to the banking system. Some examples include the Treasury buyback programs or the SLR exemption pushed forth by ISDA as covered in my piece Stealth QE. That piece also goes over some deeper changes to the monetary system, so I recommend you read it.

In any case, if the swap line is going to be the solution then it is strange that it hasn’t been activated already. As Nakamura lays out in his piece, it’s likely that the Ministry of Finance views the risk of a failed intervention (meaning they dump $50B on the market and it retraces back within a few hours or days) to be so great, that they have resigned themselves to their fate. It’s also likely that the geopolitical pressure is building from the U.S. not to intervene, as Treasury bond issuance is already reaching record levels and the aforementioned SLR exemption is being pushed as a potential solution to have domestic banks absorb the wave of debt.

Kishida, the Prime Minister of Japan, met with Biden and other American officials earlier this month, smiling on the surface but likely discussing the path of the Yen and potential solutions with policymakers.

What will happen, remains to be seen. Each day that goes by and a swap line isn’t opened increases the probability that Ueda and friends are just going to sit idly by and let the currency melt down. If that is the case, then watch out below for the Asian heavyweight!

Originally Published on The Dollar Endgame