The Bank of Japan raised interest rates during a recession, countering traditional economic practices, influenced by the yen's depreciation and political pressures.

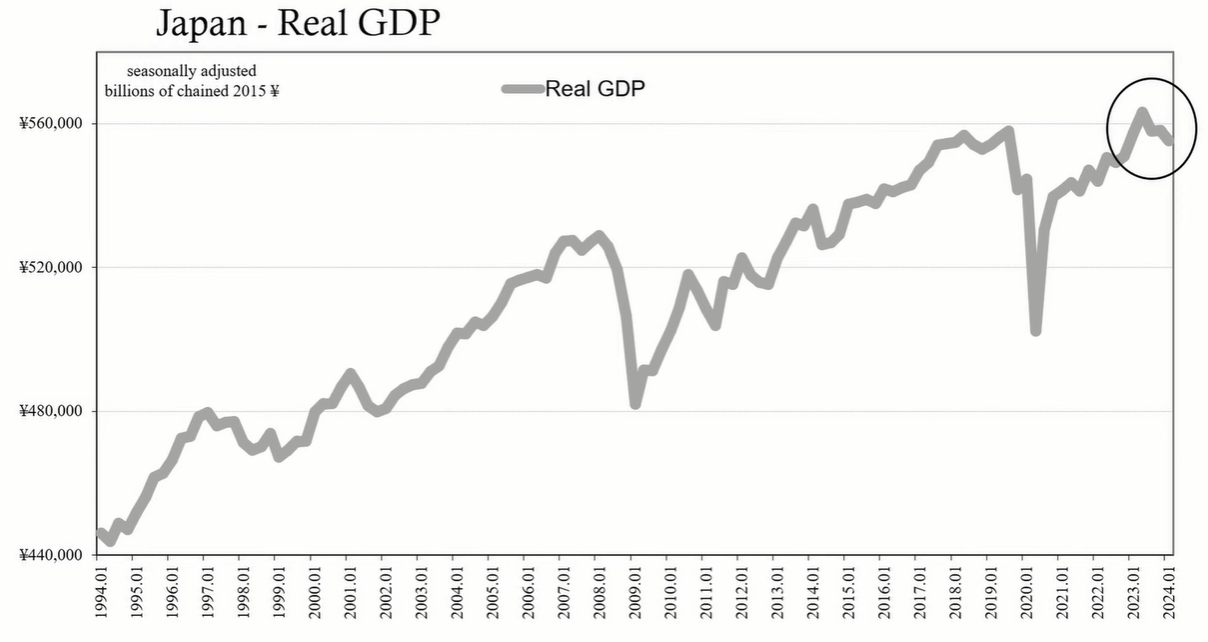

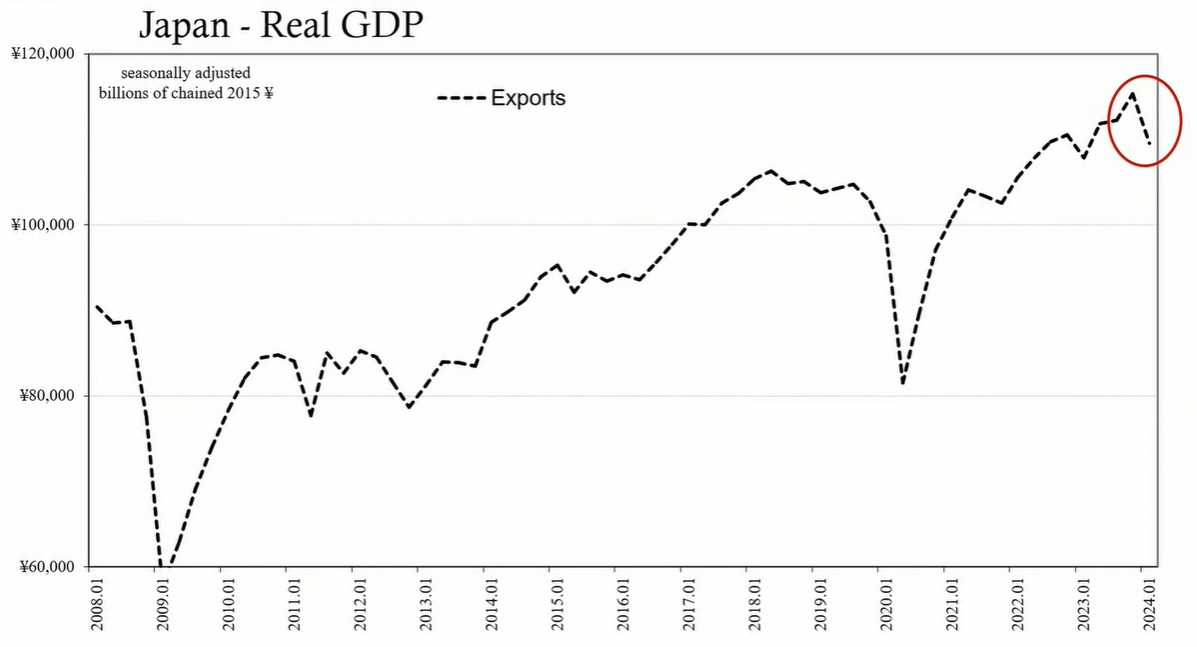

Conventional economic theories suggest that during a recession, central banks are likely to lower interest rates to stimulate growth. However, historical data and current events show that central banks sometimes do the opposite. The Bank of Japan (BoJ) recently raised its short-term rates in March, despite the country being in a recession since the second half of the previous year, as confirmed by the Japanese government.

According to Bloomberg, Japan's economy shrank in the first quarter as both consumers and companies reduced spending, marking a continuation of the country's economic decline. This contraction adds complexity to the central bank's upcoming decisions on interest rate policies.

The BoJ has provided justifications for its rate hikes, citing concerns such as the adverse effects of a weaker yen. Toru Suehiro, a chief economist at Security, suggested that the yen's weakness could be a reason for the BoJ to raise interest rates. However, this reasoning appears to be influenced by non-economic factors, including political pressure to address the yen's depreciation, rather than based on economic fundamentals.

The weak yen has led to significant political pressure on the BoJ to act. Recent interactions between Governor Ueda and the Japanese Prime Minister, who faces low popularity, have indicated a shift toward a more hawkish stance on the yen. Officials have blamed market speculation for the yen's weakness, yet they maintain that Japan's economic fundamentals remain strong, a perspective that is increasingly challenged by recent data.

The latest GDP figures for the first quarter of 2024 revealed a contraction greater than expected, with significant declines in household consumption and capital spending. The BoJ's expectations of wage gains leading to increased consumer spending have not materialized, as evidenced by the reported slowdown in average cash earnings and reductions in bonuses and overtime pay.

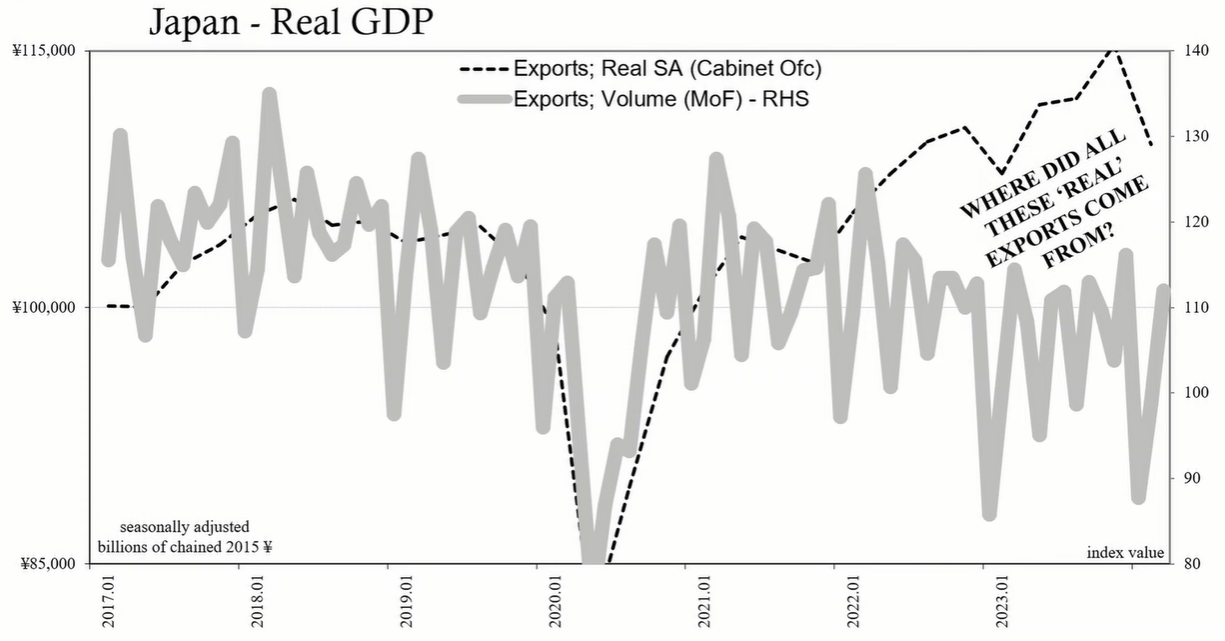

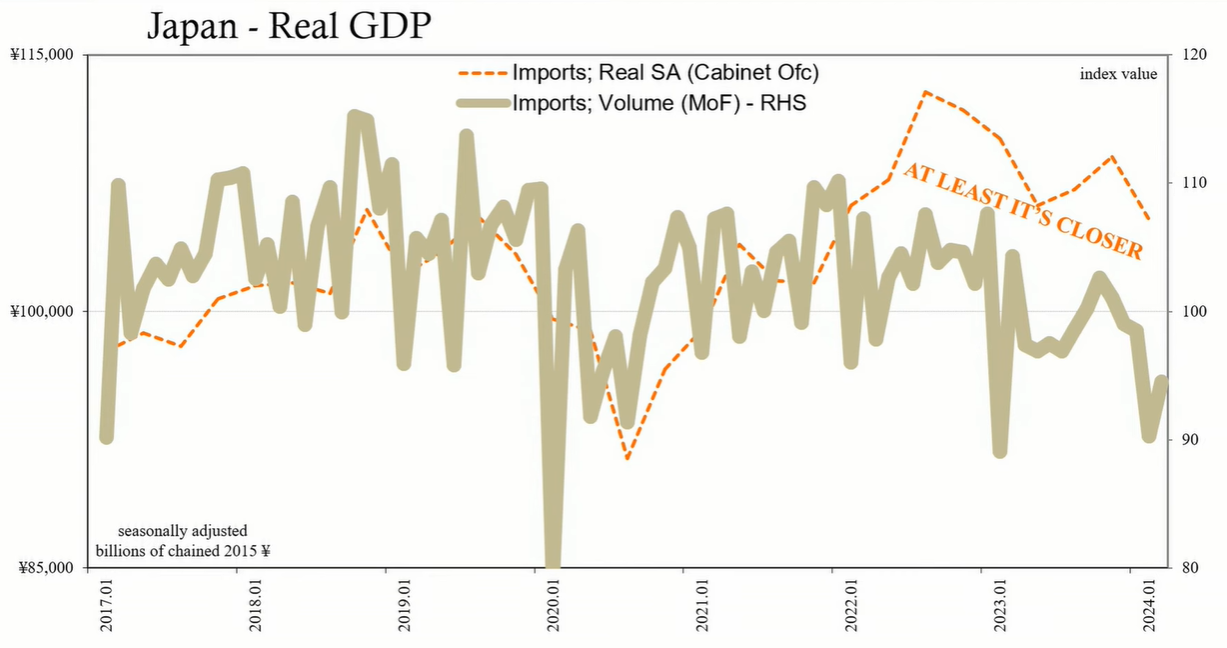

Japan's trade figures also point to a worsening situation, with exports falling and imports declining due to the country's economic weakness and the impact of a global supply shock. Business investment continues to be restrained, signaling that Japanese companies are not convinced by narratives of a strong economy or global reflation.

The low unemployment rate in Japan contradicts theories that suggest low unemployment should be inflationary, which is part of the rationale behind the BoJ's rate hike. However, the current recession in Japan persists despite low unemployment, challenging the validity of these economic theories.

The Bank of Japan's decision to hike rates during a recession highlights a disconnection between central bank policies and economic fundamentals. The weak yen, low consumer spending, and lackluster business investment indicate a globally synchronized downturn that is not yet abating. Central banks' interventions, such as rate hikes based on flawed economic reasoning or political pressures, may impede the natural adjustment of interest rates that would reflect true growth and inflation expectations. As global data continues to reflect ongoing economic challenges, the case of Japan serves as a cautionary example of central bank policy potentially exacerbating rather than alleviating economic difficulties.