Inflation is everywhere.

Inflation is everywhere. We will be updating the tracker daily with anecdotes and headlines highlighting the inflation people are experiencing in the real world.

The price of goods 📈 we ALL buy daily & monthly:

— Golden Coast (Cassandra) (@GregCrennan) December 12, 2023

•Breakfast cereal 4%

•Bread 4%

•Baked goods 4%

•Beef 8.7%

•Shelter 7%

•Transportation 10%

Yea seems like inflation is over and we can start cutting rates now

🤡🌎 pic.twitter.com/OtyCY5vfDg

The latest data on consumer inflation showed that prices in some areas — services such as restaurants, used cars and auto insurance — continued to rise uncomfortably fast. | Tap on the picture to learn more 🔽 https://t.co/zleDYgTSKA

— Hickory Daily Record (@Hickoryrecord) December 12, 2023

The median monthly mortgage payment has increased 100% since Jan '21. Has your income doubled over that same time? This is a cost-of-living crisis. pic.twitter.com/0df4BAnfU3

— E.J. Antoni, Ph.D. (@RealEJAntoni) December 12, 2023

Don't worry, the CPI says inflation is coming down.

What should a burrito bowl from Chipotle cost?

— Wall Street Silver (@WallStreetSilv) December 11, 2023

🔊 ... "my burrito bowl from Chipotle just cost me $19.82. Yes, I got guac, but that shouldn't make it $19.82. That is so much money for one bowl. What is happening?"

That is crazy. One person eating at a fast food place shouldn't… pic.twitter.com/I27HuznLG5

Even with the guac, this is a bit outrageous.

"New York city will be the first city in America to charge Americans just to go to work in the morning"

— Wall Street Silver (@WallStreetSilv) December 6, 2023

"Americans will have to pay $23 per day"

"Passenger vehicles will be charged $15 to enter the congestion zone"

"Trucks between $26 and $36"

"The tolls will be charged once… pic.twitter.com/kMiREg4pI6

If you thought sitting in traffic on your way to a job that barely enables you to live paycheck to paycheck was bad enough, I've got some news for you... it just got worse. People commuting into New York City will now be forced to pay materially higher toll costs.

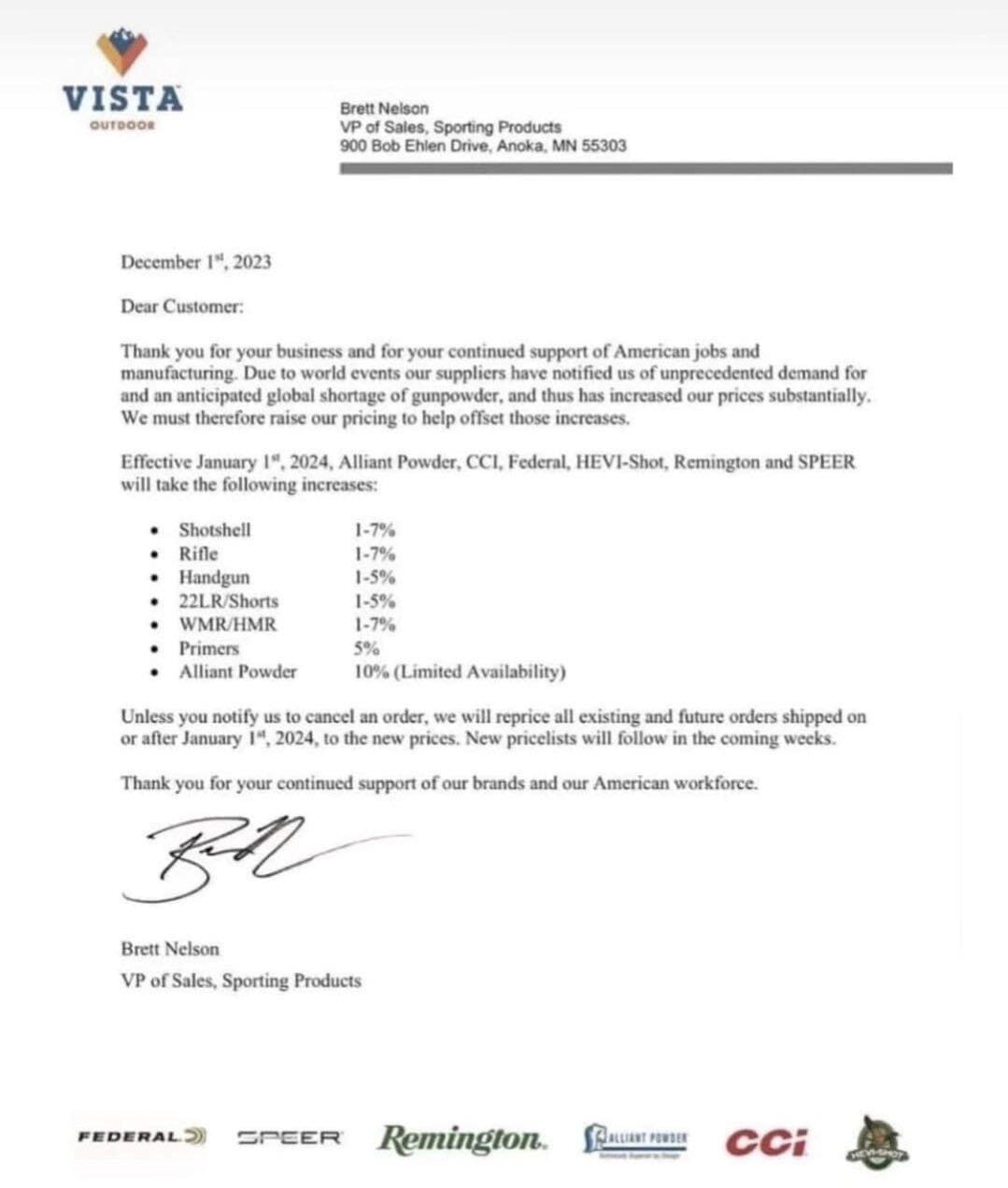

Supply can't keep up with demand in ammo markets, exacerbating the ammo shortage.

This guy is upset at the new smaller portion sizes for his chicken salad. And the price has increased from $8 to $14.

— Wall Street Silver (@WallStreetSilv) December 4, 2023

🔊 ... is he right for what he did?

Meanwhile, the government CPI claims that food outside the home is only up 5% year over year. Does anyone seriously believe… pic.twitter.com/fPmgkIgLjZ

Shrinkflation is becoming more noticeable and people are still misdiagnosing the inflation problem and pinning it on corporations who are reacting to increased input costs on their end driven by money printing.

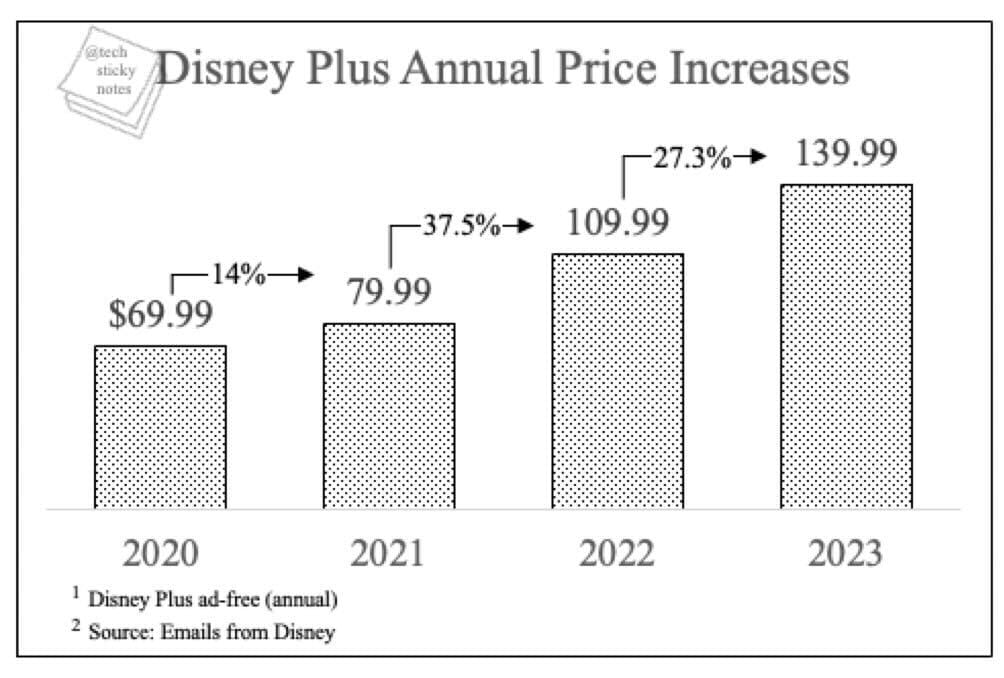

Yes. You read that correctly. The cost of Disney+ is up 100% since 2020.

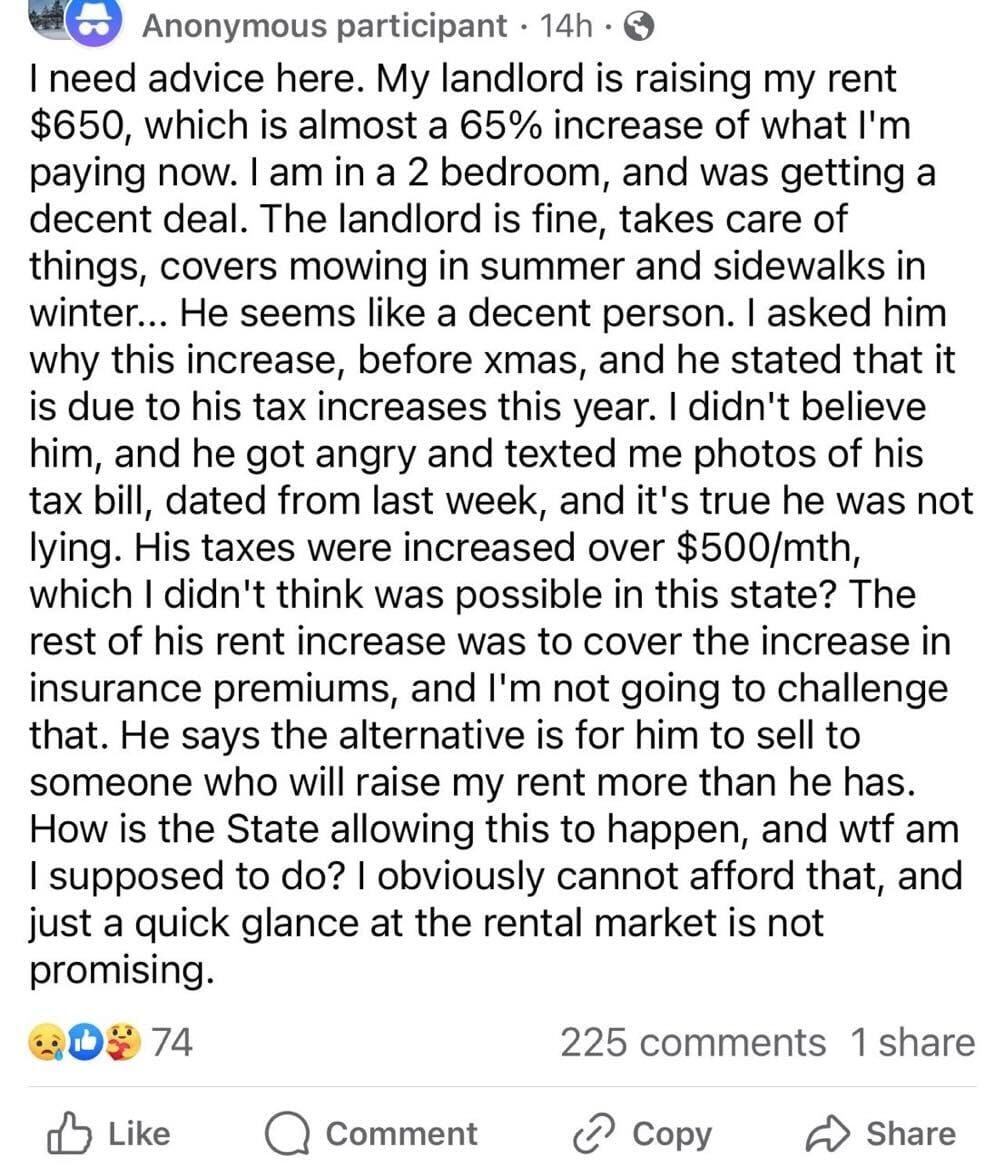

With national debt on the rise and tax receipts falling, the government is raising property taxes to collect, and further inflating rents.

Treasury borrowed another $15 billion yesterday - we're closing in on $33.9 trillion in federal debt. Next stop...

— E.J. Antoni, Ph.D. (@RealEJAntoni) November 29, 2023

...🚀 pic.twitter.com/ldcT7DTS5D

Do you think this trend will have a positive or negative effect on inflation?

Joe Scarborough complaining about the cost of delivery services

— Eric Abbenante (@EricAbbenante) November 27, 2023

Bidenomics in action. I thought you said we had a booming economy under Biden and inflation wasn't an issue? pic.twitter.com/0nGTmQPGJV

I wonder what is causing "the patterns" to change.

The cost of living is going through the roof. Just to get groceries is almost a second mortgage.

— Wall Street Silver (@WallStreetSilv) November 28, 2023

🔊... "am I the only one struggling? I have to pick and choose which bills to fall behind on. so that I have groceries in my house. I feel like everyone is silently struggling and… pic.twitter.com/oZK1D2pP5j

When they tell you #Inflation is no big deal and well under control... 🤣 pic.twitter.com/nE3X7EA1Vv

— Emergent Perspective (@_emergent_) November 28, 2023

This girl gets $100 worth of groceries and it's literally 9 items 🚨🚨🚨

— Wall Street Silver (@WallStreetSilv) November 28, 2023

🔊 … "How am I supposed to afford everything?"

"Just worked for four or five hours today and it's all gone"

"Why is everything so expensive?" pic.twitter.com/6x4eS7HB9P

🔊 … "The whole Black Friday gimmick no longer works"

— Wall Street Silver (@WallStreetSilv) November 28, 2023

"All the stores were empty"

"Not only are they putting stickers over the regular price and pretending like they are on sale"

"In 2010, there were people getting trampled trying to make it to these stores to get these… pic.twitter.com/iARLPN4POI

The current economic landscape has been marked by fluctuations in prices, creating waves of uncertainty among consumers and businesses alike. Inflation, an indicator of rising prices, has become a significant concern for individuals and industries globally. In this article, we delve into the concept of an inflation tracker, its significance, and how it aids in understanding economic trends.

The inflation tracker serves as a tool to monitor and measure changes in the general price level of goods and services over a specific period. It enables economists, policymakers, businesses, and the public to assess the rate at which prices are rising and the subsequent impact on purchasing power. TFTC's inflation tracker is currently gathering anecdotal evidence of individuals being affected by inflation in their everyday lives as well as headlines that highlight changes in inflation.

Tracking inflation is crucial as it provides valuable insights into the health of an economy. A steady, controlled rate of inflation is generally healthy for economic growth. However, rapid inflation can erode the value of money, decrease consumer spending power, and disrupt financial planning for individuals and businesses.

Several methods are employed to track inflation. The Consumer Price Index (CPI), Producer Price Index (PPI), and Gross Domestic Product (GDP) deflator are commonly used metrics. Each method focuses on different baskets of goods and services, enabling a comprehensive view of inflation across various sectors of the economy. These inflation trackers are easily manipulated by the government to push the narrative that things are better than they actually are. Chapwood Index and Shadow Stats are much more accurate inflation indices. TFTC will produce an inflation index in the future.

Inflation affects consumers in diverse ways. As prices rise, the cost of living escalates, impacting households’ budgets. Essential expenses like housing, food, and transportation become pricier, thereby reducing discretionary income and altering spending patterns.

For businesses, inflation can pose challenges in multiple facets. Rising costs of raw materials and production inputs can squeeze profit margins. Additionally, uncertainty in pricing makes long-term planning and investment decisions more complex, affecting growth strategies.

The TFTC inflation tracker serves as a compass for our audience to see what is actually happening throughout the economy as it pertains to the affects of inflation so that you can make informed decisions. By analyzing inflation trends, stakeholders can devise strategies to mitigate risks, adjust personal spending policies, and develop pricing models that align with actual economic conditions.

Inflation tracking is an indispensable tool in comprehending economic dynamics. Understanding the nuances of inflation and its impact on consumers and businesses is crucial in navigating through periods of economic uncertainty. By staying informed and proactive in response to inflation trends, individuals and organizations can better safeguard their financial interests and adapt to changing market conditions.