Indeed's layoffs and the decline in consumer confidence signal deepening challenges in the U.S. labor market and broader economic instability.

Recent layoffs from a major staffing firm signal that the U.S. labor market is facing significant challenges. Indeed, a prominent job search company, has announced another round of layoffs, cutting approximately 8% of its workforce, which follows a previous reduction of around 2,200 employees last year. According to the CEO, Chris Hyams, the company's measures to stabilize profitability have not positioned it for sustainable growth, and further simplification of the business is necessary due to persistent organizational complexity and duplication of efforts.

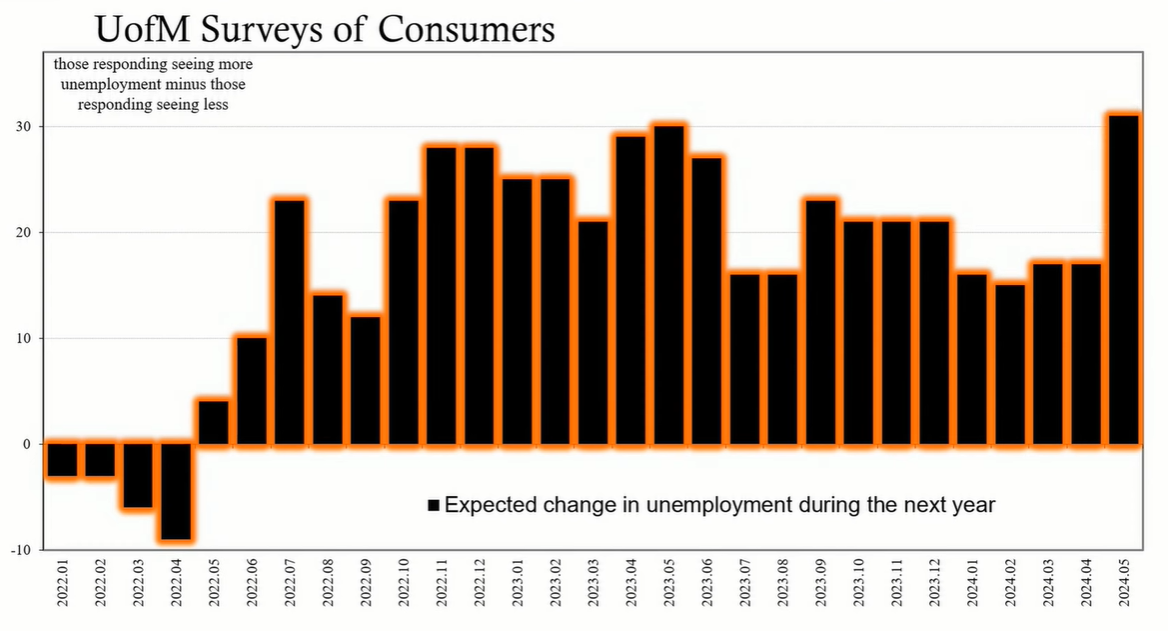

Consumer confidence has seen a dramatic decline, with the University of Michigan's consumer sentiment index experiencing its most significant single-month drop in its 46-year history. The primary concern among consumers is not escalating prices but the fear of unemployment. Similarly, the Conference Board's consumer confidence index has fallen to its lowest level in several years, with jobs and income growth failing to keep up with inflation, thereby exacerbating financial stress for consumers.

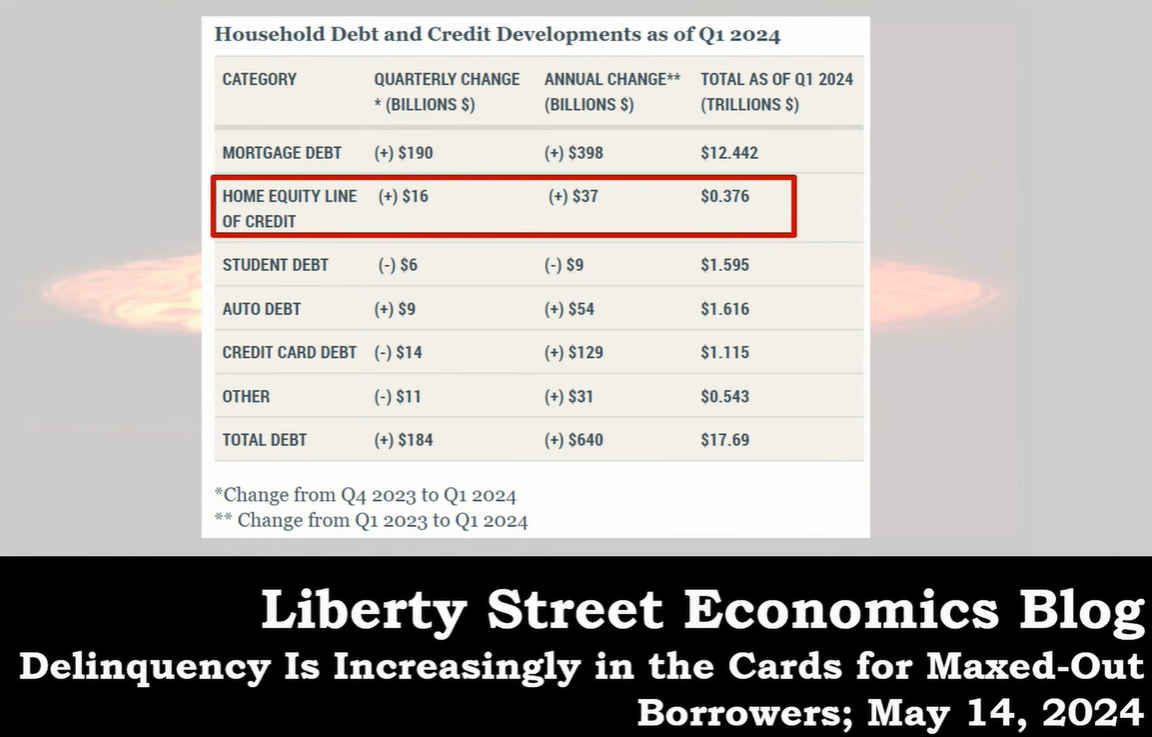

The Federal Reserve Bank of New York's household debt and credit report for the first quarter of 2024 reveals worrying trends. An increasing number of borrowers are missing credit card payments, suggesting deepening financial distress. The share of maxed-out borrowers is approaching pre-pandemic levels, and the delinquency transition rates for these individuals are now higher than before the pandemic. This is a concerning sign as it suggests consumers are exhausting their credit options and may soon face default.

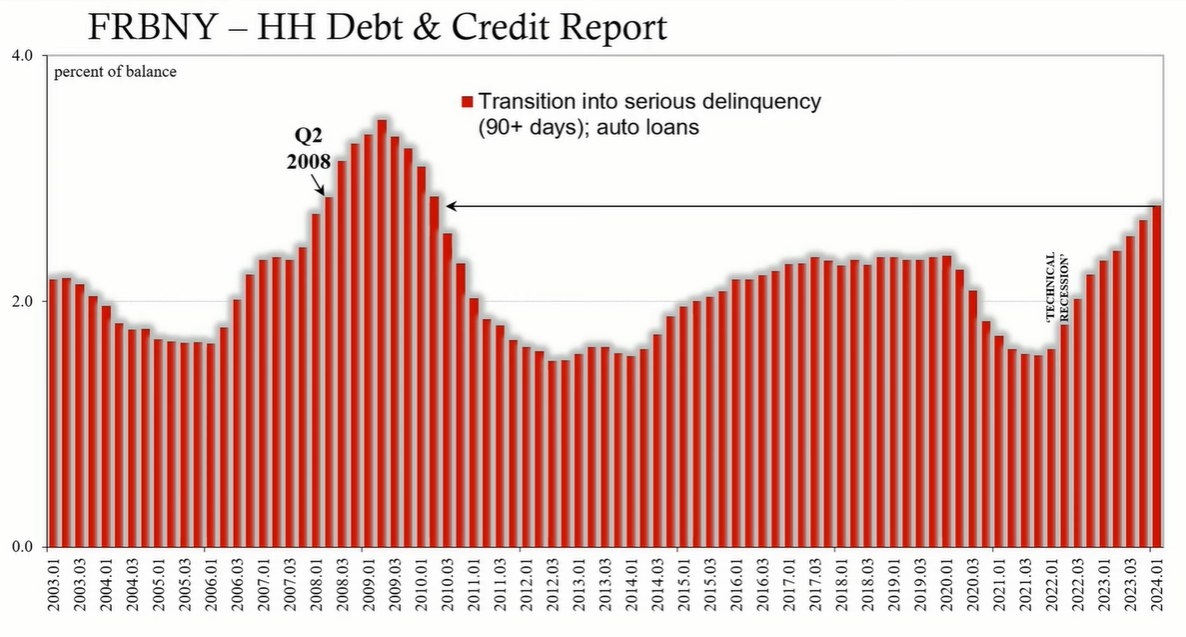

The auto loan sector also shows signs of distress, with total auto loans outstanding reaching $1.62 trillion. The proportion of loans that are 30+ days delinquent has climbed to the highest levels since 2010, paralleling patterns seen during the onset of the Great Recession.

Amidst rising interest rates, home equity lines of credit have increased as consumers tap into their home equity to maintain spending levels, further indicating that incomes are not keeping pace with living costs.

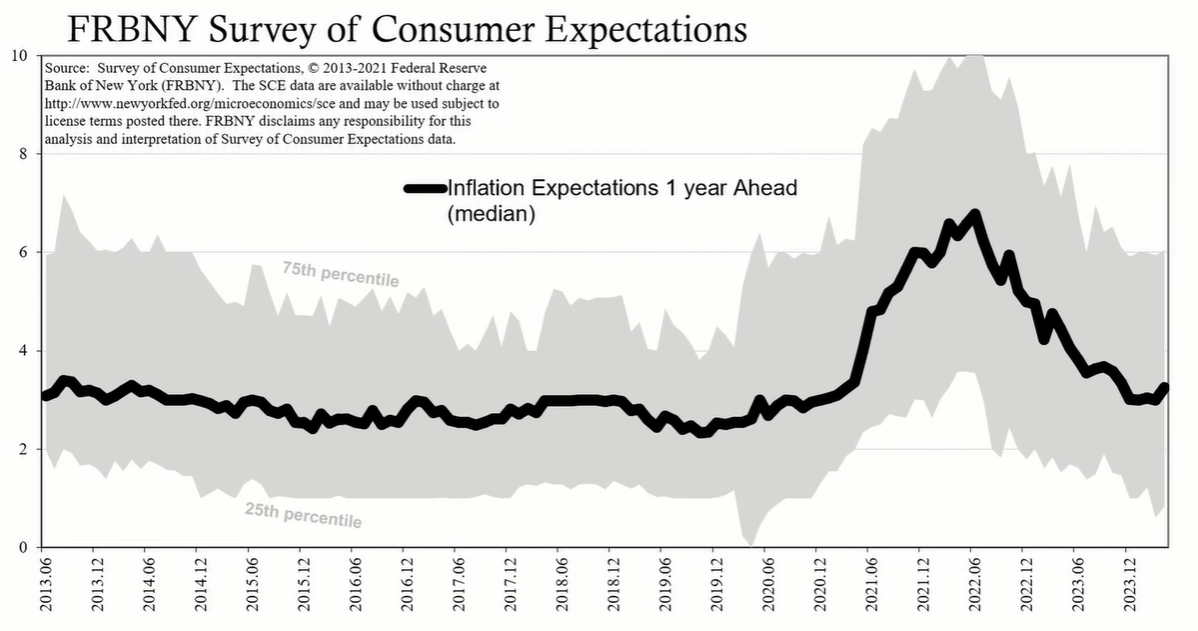

Despite media narratives about resurgent inflation, consumer price expectations are relatively contained. According to the Federal Reserve Bank of New York, the median one-year price expectation rose slightly in April but remains substantially lower than during periods of last year's price increases. Long-term expectations also remain subdued, suggesting consumers do not anticipate a persistent inflationary environment.

Overall, the data paints a picture of a U.S. economy facing late-stage cycle behavior, with a labor market that is not as robust as some narratives suggest. Consumers are increasingly burdened by debt, and the rise in credit card and auto loan delinquencies may foreshadow broader economic difficulties. Despite the challenges, consumer price expectations remain relatively moderate, reflecting a complex economic landscape where inflation is not the foremost concern for many households. As the labor market and consumer credit data continue to suggest weakness, it is clear that the U.S. economy is in a precarious state that may not support a strong recovery in the near term.