Knowing health insurance deductibles helps you use your coverage effectively and save money on healthcare expenses. This comprehensive guide illuminates the intricacies of health insurance deductibles, offering crucial insights to manage this essential component of healthcare planning effectively.

A health insurance deductible is the amount you must pay for medical services before your insurance covers the costs. It is an important part of health insurance, affecting how much you and your insurance company share the costs. Grasping the concept of deductibles is fundamental to understanding how health insurance works in practice.

Annual Reset marks the cyclical nature of deductibles, which reset at the start of each plan year. This reset is vital for budgeting healthcare expenses, especially with anticipated medical needs.

Types of Deductibles vary, including individual deductibles that apply per person and family deductibles that encompass all family members under a single aggregate deductible.

Impact on Premiums reveals an inverse relationship; higher deductibles typically mean lower monthly premiums, allowing policyholders to tailor plans to their financial and healthcare necessities.

Deductibles vs. Out-of-Pocket Maximums distinguish between the initial spend before insurance payments commence (deductibles) and the yearly cap on personal healthcare spending, including deductibles, copayments, and coinsurance.

Preventive Care is often exempt from deductibles in many health plans, encouraging regular health check-ups and screenings without additional cost.

Copayments and Coinsurance become relevant after deductibles are met, with policyholders paying a fixed amount (copayment) or a percentage of costs (coinsurance) for covered services.

High-Deductible Health Plans (HDHPs) and HSAs represent a synergy that offers lower premiums for higher deductibles while allowing the use of Health Savings Accounts (HSAs) to pay for qualified medical expenses with pre-tax dollars, optimizing healthcare cost management.

Choosing health insurance involves balancing deductibles, premiums, and out-of-pocket costs with personal healthcare needs and financial ability. Consider your usual healthcare expenses, preferred providers, and prescription requirements to make an informed decision.

Mastering the nuances of health insurance deductibles is indispensable for informed healthcare coverage decisions. Knowing deductibles well helps people manage healthcare costs and get the most out of their insurance. It's important to understand how premiums work in health insurance. However, it's essential to recognize innovative health solutions like CrowdHealth, which diverge from traditional health insurance models.

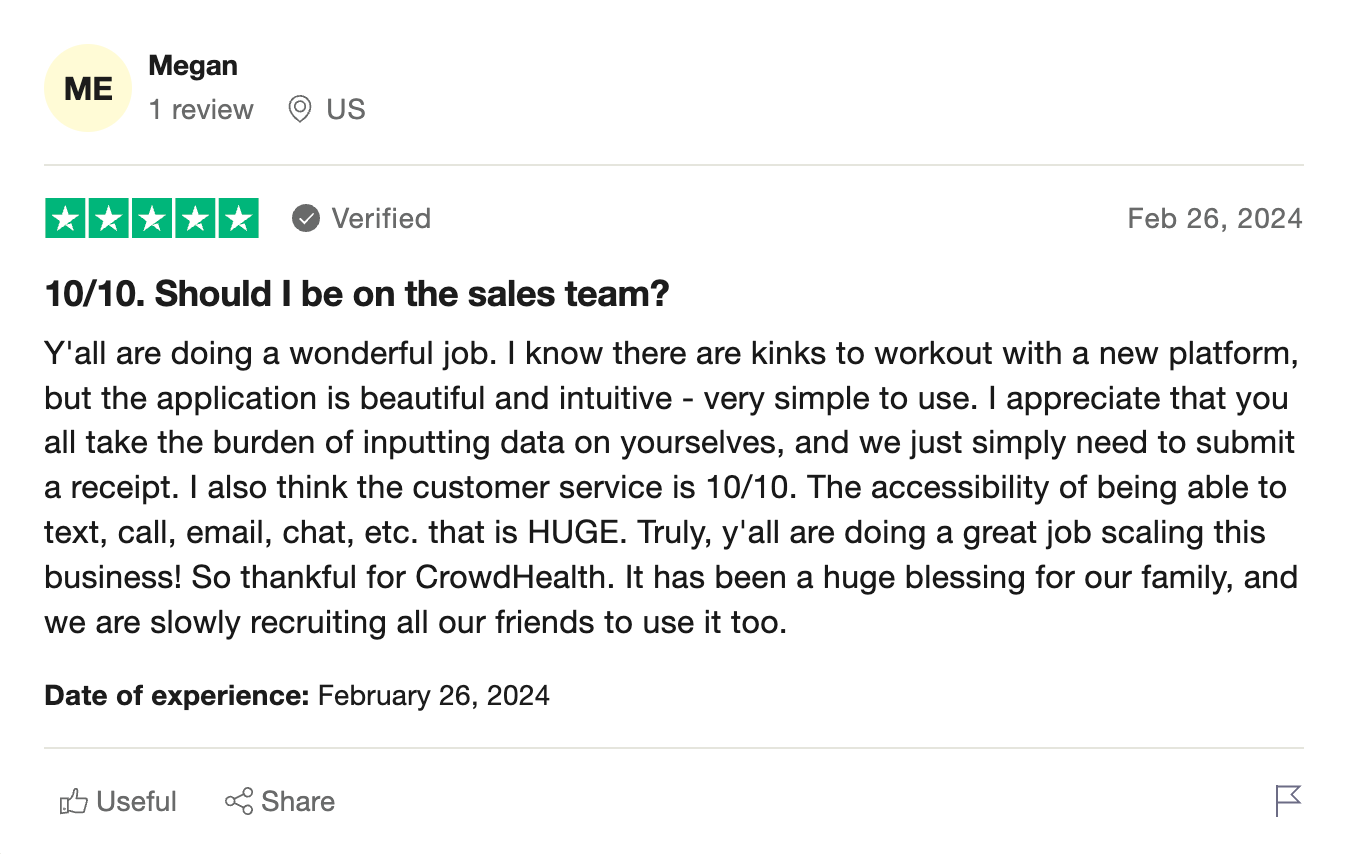

CrowdHealth uses a community-sharing system for healthcare costs instead of regular insurance. This paradigm shift allows individuals to directly share in the costs of health events, effectively bypassing the traditional insurance company intermediary.

This model saves money by cutting administrative costs and giving the savings to its members. This new health solution allows people to find cheaper ways to manage their healthcare. It's important to stay updated on new trends and options in the healthcare industry.

You can check out Crowdhealth today and get an exclusive offer from TFTC where they fund people, not insurance companies.