Bitcoin is a decentralized digital currency that operates without the need for a central authority, such as a government or a central bank. One of the fundamental aspects of Bitcoin is its fixed supply limit of 21 million coins.

Bitcoin is a decentralized digital currency that operates without the need for a central authority, such as a government or a central bank. One of the fundamental aspects of Bitcoin is its fixed supply limit of 21 million coins. This feature is critical to its value proposition as a form of digital gold and a hedge against the inflationary nature of fiat currencies.

The enforcement of Bitcoin's fixed supply is not managed by any single entity but is instead upheld by a combination of social consensus, technical protocols, and energy expenditure by miners.

The fixed supply of Bitcoin is enforced by the collective decision of the participants in the Bitcoin network. Unlike fiat currencies managed by central banks, Bitcoin operates on a consensus mechanism where every user agrees to maintain the supply limit. This consensus is not just about agreement in principle; it involves active participation in the network's protocols and practices.

Bitcoin's supply limit is hardcoded into its software, which spells out the number of Bitcoins that can ever exist (21,000,000) and how they will be issued. The software that users can run independently verifies all transactions and the entire ledger dating back to Bitcoin's creation in 2009. It ensures that only legitimate, rule-abiding transactions are confirmed and included in the blockchain. Any attempt to transact with invalid Bitcoin or alter the supply is automatically rejected by the network.

Miners play an essential role in enforcing Bitcoin's supply. They do not create new Bitcoin but instead validate transactions and add them to the blockchain. The reward miners receive for this service is predetermined and decreases over time through an event known as halving, which ensures that the rate of new Bitcoin entering the system slows down and the total supply cap is never exceeded.

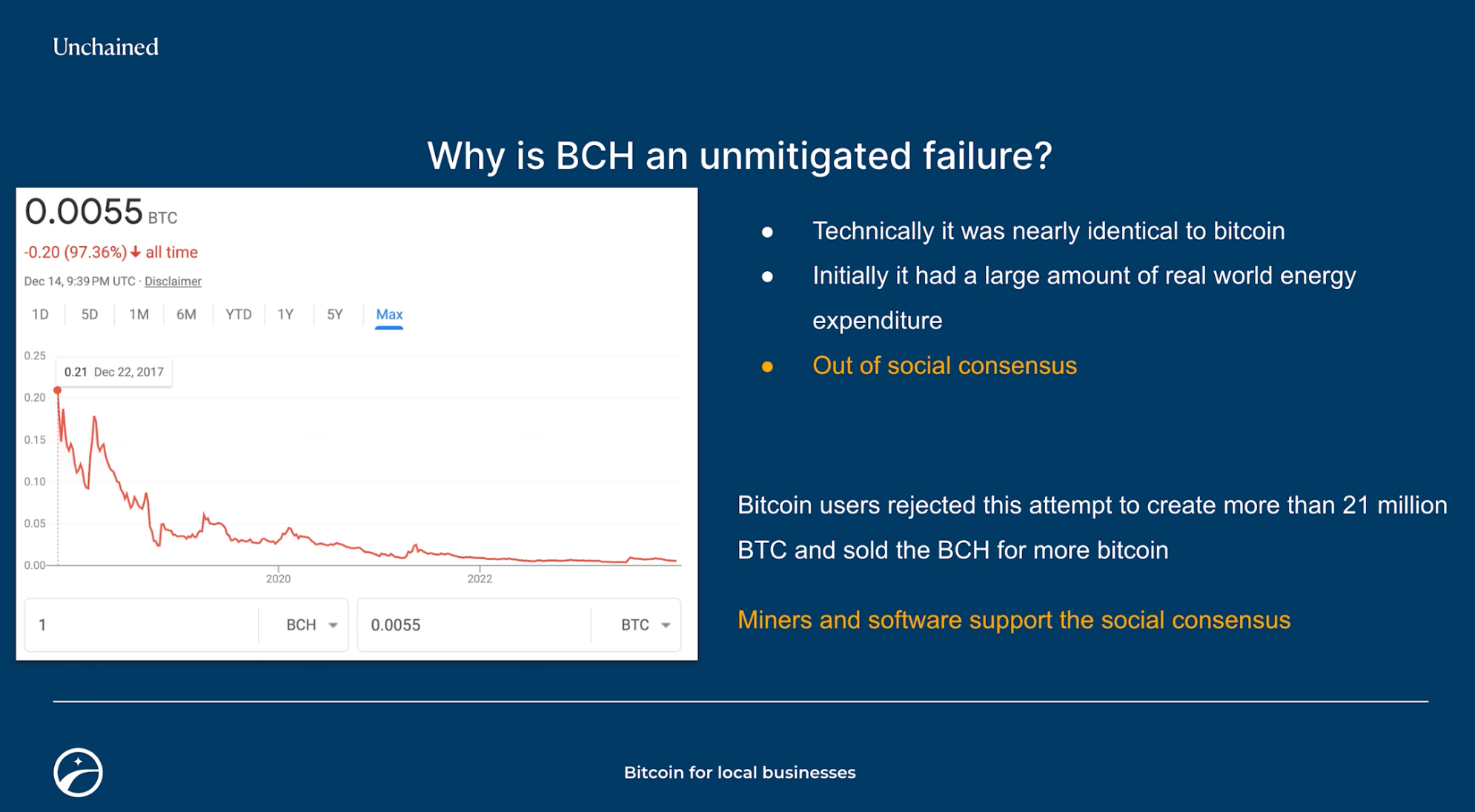

In 2017, a group of Bitcoin participants attempted to change the software in a way that was incompatible with the existing rules, creating a fork known as Bitcoin Cash. Despite having significant resources and backing, Bitcoin Cash failed to replace Bitcoin because it lacked the broad consensus of the user base. The market response was swift, as many opted to sell their Bitcoin Cash for more Bitcoin, reinforcing the value of the original network and its fixed supply.

By operating Bitcoin, every user is effectively casting a vote for a monetary system with a fixed supply. Miners, by securing the network through energy expenditure, reaffirm the commitment to a non-inflationary currency. The collective actions of participants ensure that Bitcoin's supply remains fixed and that any attempt to alter this policy will likely be rejected by the community.

In essence, Bitcoin's fixed supply is not just a feature of the software; it's a commitment by its users to uphold a specific monetary policy. This commitment is what gives Bitcoin its value and distinguishes it from traditional fiat currencies that are subject to inflation and devaluation through increased supply.