Americans have closed 3 central banks. One to go.

America has had a total of 4 central banks. 3 were shut down. 1 to go.

The last central bank we closed was Andrew Jackson shuttering the Second Bank of the United States in 1836.

And it gives us a road-map how to End the Fed.

The Second Bank was been set up in 1816. Like all central banks, its purpose was to counterfeit money in return for financing government debt.

Buying government debt is standard for central banks: it's the bribe they pay government for the counterfeiting license. They use the counterfeits to buy the national debt at low rates, which makes it cheap for governments to run deficits.

Governments usually mandate that regular people have to use the counterfeits using legal tender laws, since otherwise the whole thing falls apart: The government would be getting worthless confetti that it can't spend.

Aside from the profits to the central bankers’ sponsors, the flood of counterfeits is popular with politicians because it drives a temporary economic boom: The counterfeits massively fortify genuine savings, making it cheap to borrow.

The cheap loans spark an artificial boom, a frenzy of hiring, construction and investment. This is cocaine to politicians who take credit for the tissue-fire boom that burns bright but burns short.

But it inevitably ends in bust -- a recession or depression. At which point governments scapegoat markets -- those mysterious Keynesian "animal spirits" of mass hallucination. Or they blame external crises like wars or the very financial collapses caused by the bust itself as banks overextended.

So that's the central bank bundle: licensed counterfeiters to give governments cheap money, along with tissue-fire growth that ends in bust hopefully after the election.

Now back to 1816.

Money-printing during the war of 1812 had left regional banks refusing to redeem their paper dollars for gold, the bank version of default.

Keep in mind back then a dollar literally represented gold -- about 1/20 of an ounce. So refusing to redeem in specie (gold and silver) was akin to bankruptcy. Like a pawnshop refusing to give you back your guitar.

The banks wanted a bailout, and a central bank -- the Second Bank of the United States -- was their vehicle.

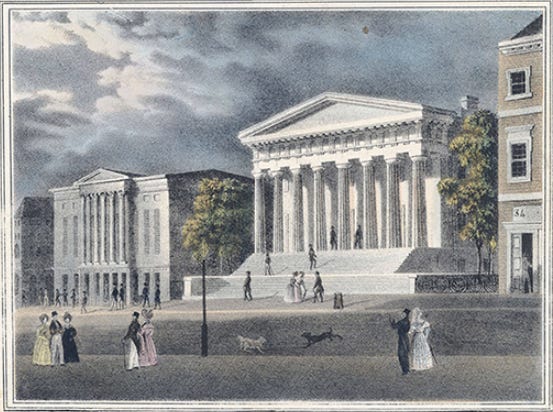

Set up by Congress, the Second Bank would hold Federal deposits and handle its payments -- so it would act like a normal bank for the federal government. More important, the Second Bank would help market government debt.

In return, the Second Bank was allowed to print banknotes and issue loans the same way fractional reserve banks do today: they pretend to have a million dollars and draw up an IOU to a borrower in return for a promise to pay a million plus interest. That IOU — bank notes — is spendable just like real money thanks to legal tender laws. It’s illegal to refuse.

Unlike today's Fed, the Second Bank did not set interest rates. But the counterfeiting drove down rates, leading to a tissue-fire boom that ended in the Panic of 1819, one of the deepest recessions in American history.

Murray Rothbard, by the way, wrote an entire book on this crash -- in fact, it was his dissertation.

1819 led to public outrage blaming the Second Bank for the crash. But money-printers can buy a lot of friends, so the Bank still had support in Congress.

So the Bank went on to cause panic after panic -- 1822, 1825. One every three years.

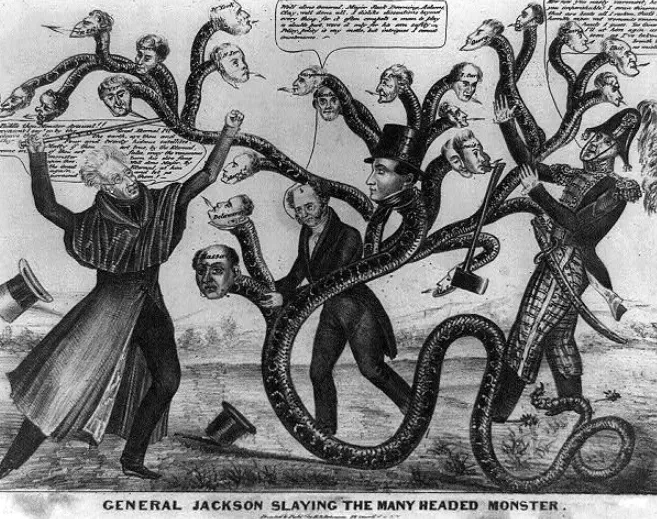

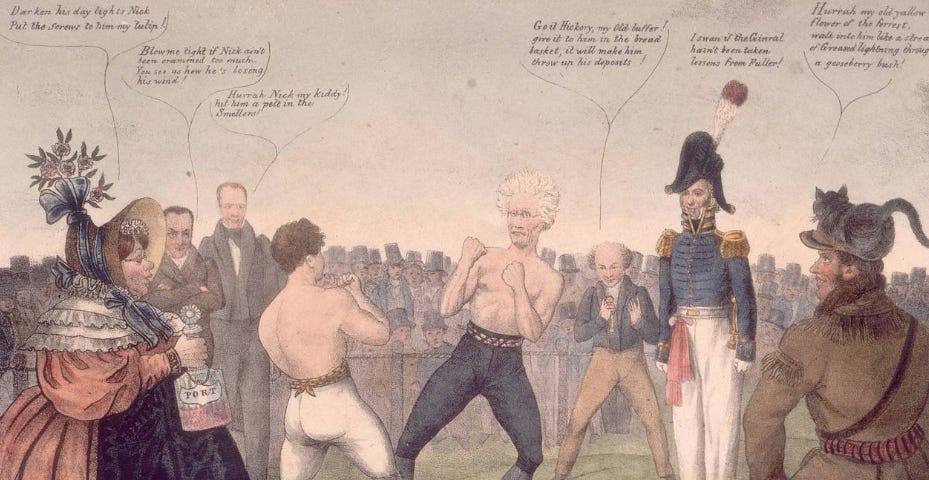

These built public anger and launched the firebrand populist Jackson to make repeal of the Bank the centerpiece of his campaign.

Jackson was the Donald Trump of his day -- despised by the establishment, which he hated in return. He'd been a war hero, and he despised the elite. In fact, Donald Trump had a bust of Jackson displayed prominently in the Oval Office.

Jackson himself hated paper money since he'd been nearly ruined by accepting paper notes that turned worthless. He felt only specie -- gold and silver -- were real money. Plus, Jackson was sympathetic to states' rights, and felt the Bank, being federal, was trampling on states.

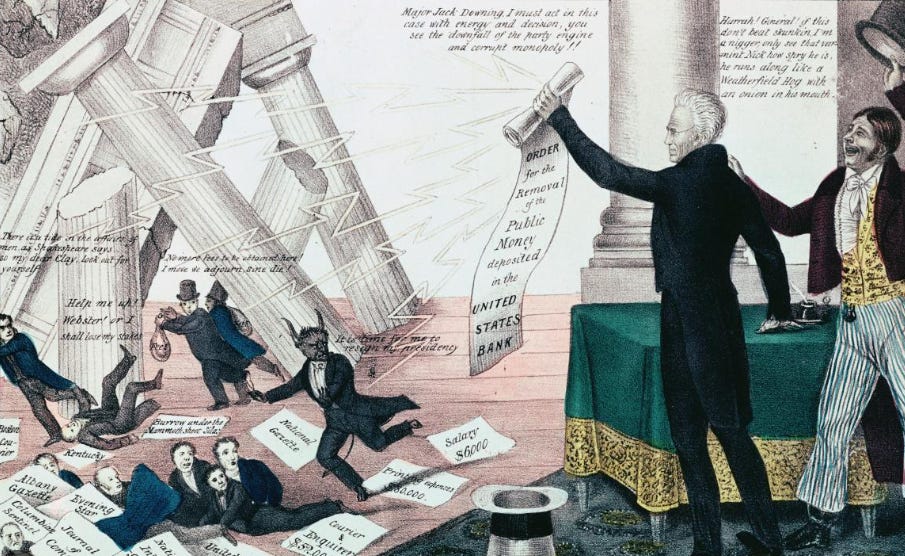

Jackson was elected in 1828, but the bank's charter wasn't set to expire until 1836. He began to prepare by moving federal deposits out of the Second Bank.

The Second Bank retaliated by calling in loans from state banks, hoping to set off a bank crash -- a "panic" -- that would be blamed on Jackson.

It backfired, and the public further turned on the Second Bank. Seeing it as a plutocratic manipulator, which it was.

Facing this anger, the House of Representatives failed to renew the Second Bank's charter in 1834, closing it.

What happened next? Jackson ramped up land sales, paid off the federal debt -- for the first and only time in US history.

These sales were initially done in paper money, which state banks kept cranking out, taking up the counterfeiting from the Second Bank. This set off land speculation, which Jackson countered with the 1836 Specie Circular that required land purchases be paid in gold or silver.

That finally broke the inflationary banks: the end of cheap money drove almost half of America's banks out of business -- about 400 in all.

The vast majority were new "wildcat" state banks that had been set up to profit from the land mania. But even the major New York banks suspended specie redemption, effectively declaring bankruptcy.

We now had all the pieces for a return to sound money in America. The Second Bank was dead, the gambler banks had been purged. The national debt was even paid off.

If, at that point, the government had done nothing, the surviving conservative bankers would have replaced the gamblers. We'd have a sound banking system, a sound dollar, and an end of the boom-bust cycles of inflation and depression.

Unfortunately, by that point Andrew Jackson was out of office. The cronies were back. President Van Buren allowed banks to operate despite specie suspension, the 1800's version of a bank bailout.

That continued for another 40 years, boom-bust cycle after cycle. With railroads typically playing the part of extravagent bubble, and punctuated by Lincoln's bout of literal hyperinflation.

Proponents of hard money did have one win along the way, putting the country back on a gold standard in 1879 and ushering in the greatest golden age in US history. Arguably in world history. By the way, my article on that golden age is here.

Alas, this golden age only lasted until 1907. When a conspiracy of banks attempted to corner copper, failed, and set off one of the nation's biggest banking collapses. This collapse was bailed out almost single-handed by the nations biggest oligarch, JP Morgan.

It cost JP a lot of money, so he and the other bankers immediately turned to institutionalizing the bailouts at public expense. Culminating in a revival of the Second Bank, now under the Orwellian name "Federal Reserve." The name was carefully chosen to evoke safety and security for a tawdry revival of the banker bailout machine.

And so was born the Federal Reserve, that Creature of Jekyll Island.

For me the biggest lesson of the Second Bank is that we can absolutely End the Fed. It's been done 3 times and counting.

But the key is educating regular people — voters — to understand exactly what the Fed does, what all central banks do.

Help them understand that the inflation, the recessions, even the bank crashes aren't "animal spirits." They aren’t greedy workers, or even failures of private market requiring the wise hand of government. They are the product of the Fed. They are what it does for a living, the reason it exists.

Sign up to my free email list to get weekly posts on what’s happening in economy and freedom. Choose the $5 option if you’d like to support the content — everything’s audience-supported.

I’ve also got a brand new website at Peterstonge.com with the daily videos, weekly podcast, and all the articles in one spot.

This was originally published on profstonge.com