The recent 15% month-over-month drop in housing construction, alongside a fluctuation in oil prices, underscores vulnerabilities in key sectors influenced by rising interest rates and shifting geopolitical sentiments.

Recent economic updates have provided sobering insights into key sectors of the economy, particularly housing and oil demand. These insights are critical in understanding the current state of the economy and forecasting future movements in the Consumer Price Index (CPI).

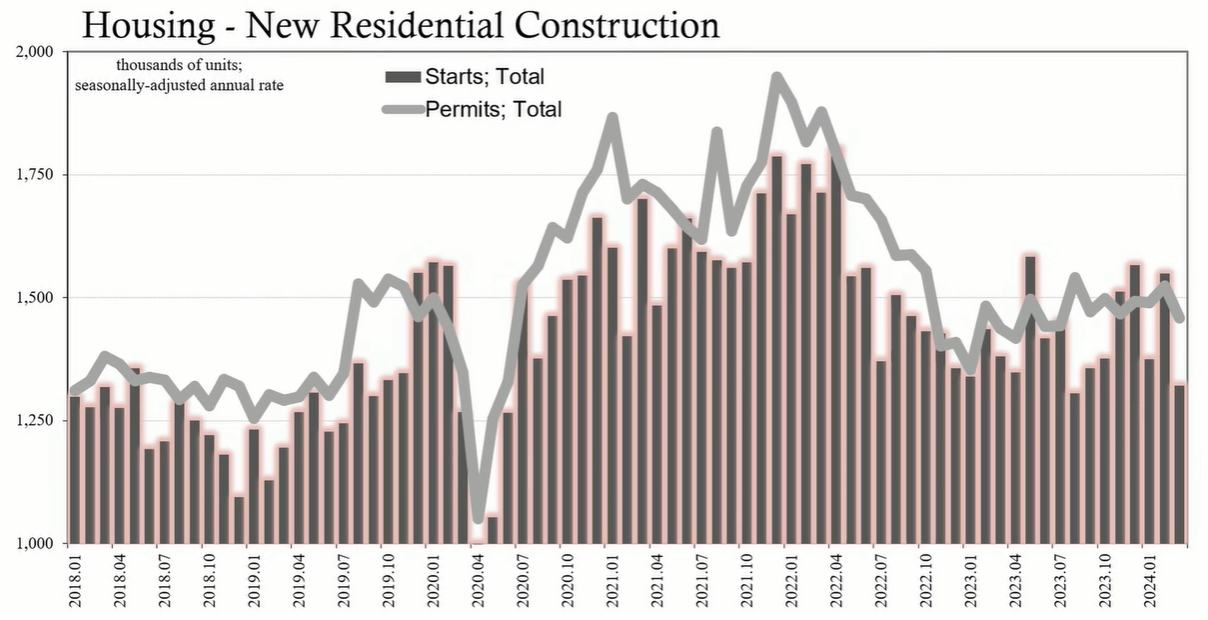

The U.S. Census Bureau reports a downturn in housing construction, with total permits in March down by 4% and a 22% decrease from the peak. This decline is attributed to factors such as interest rate hikes and mortgage costs. The month-over-month data shows significant volatility, with a 12% decrease in starts in January, a 12% increase in February, and a 15% drop in March of 2024.

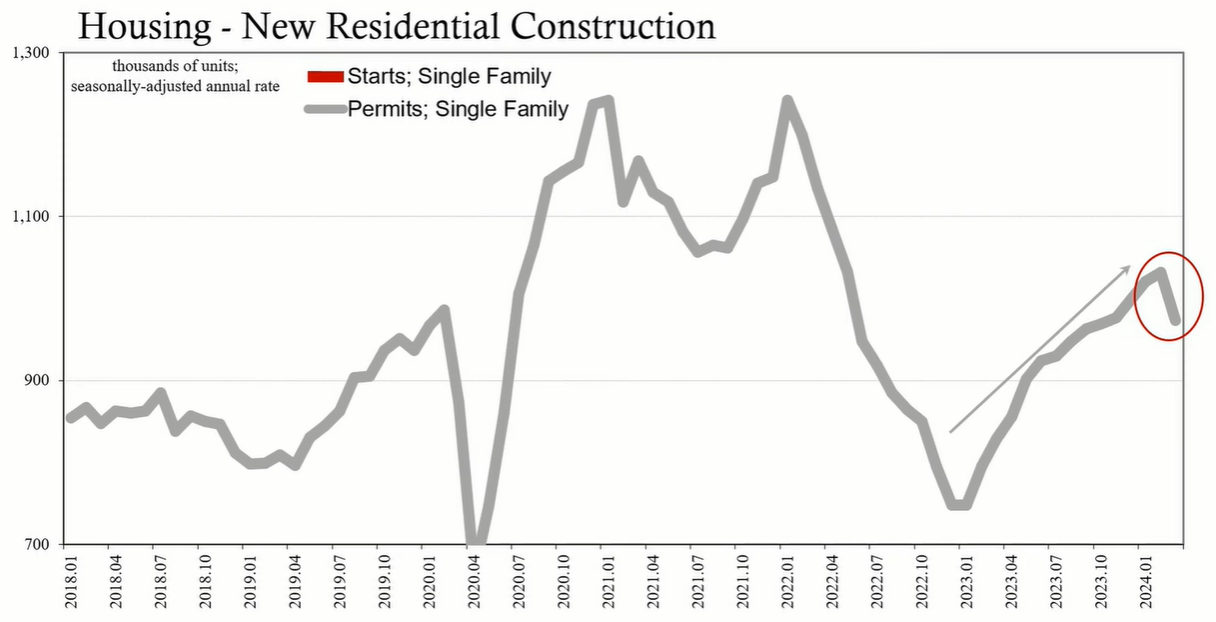

The single-family housing segment has shown particular volatility. In March 2024, permit filings decreased by nearly 6% from February, marking the first decline since December 2022. Despite a year-long upward trend due to builders' optimism, the recent decline suggests potential weakening in demand for new builds.

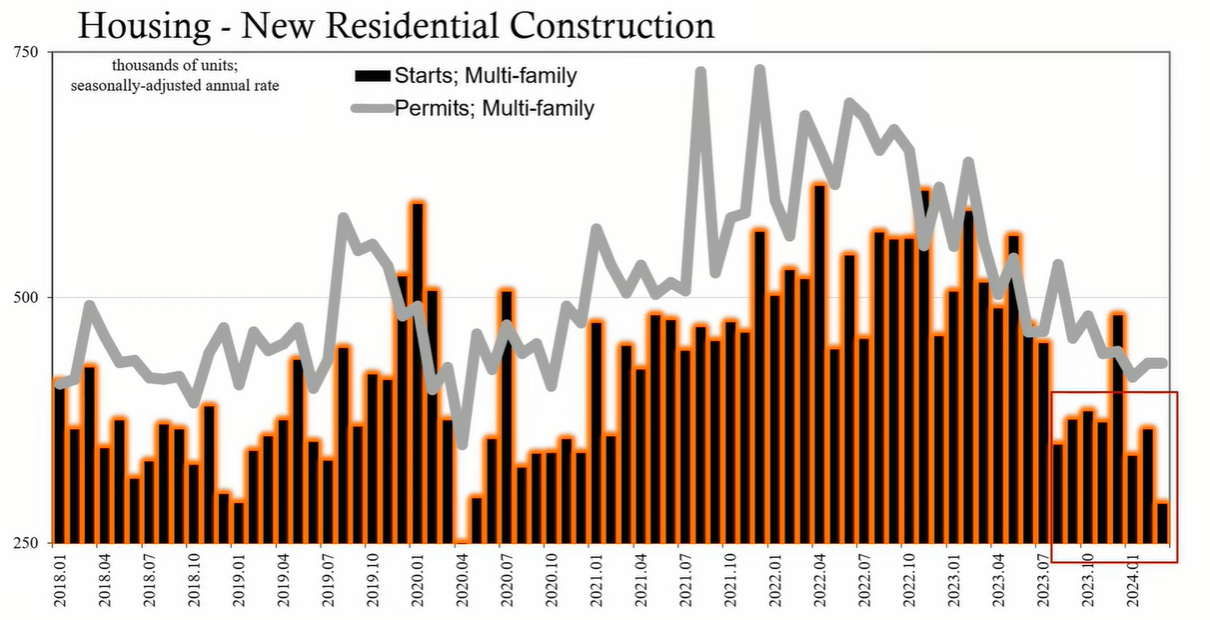

The multifamily apartment units segment is experiencing a stark downturn. With the number of permits filed stagnating and the seasonally adjusted annual rate of starts plummeting by over 20% in March from February, this level of construction activity is reminiscent of the period following the 2007-2009 housing bust.

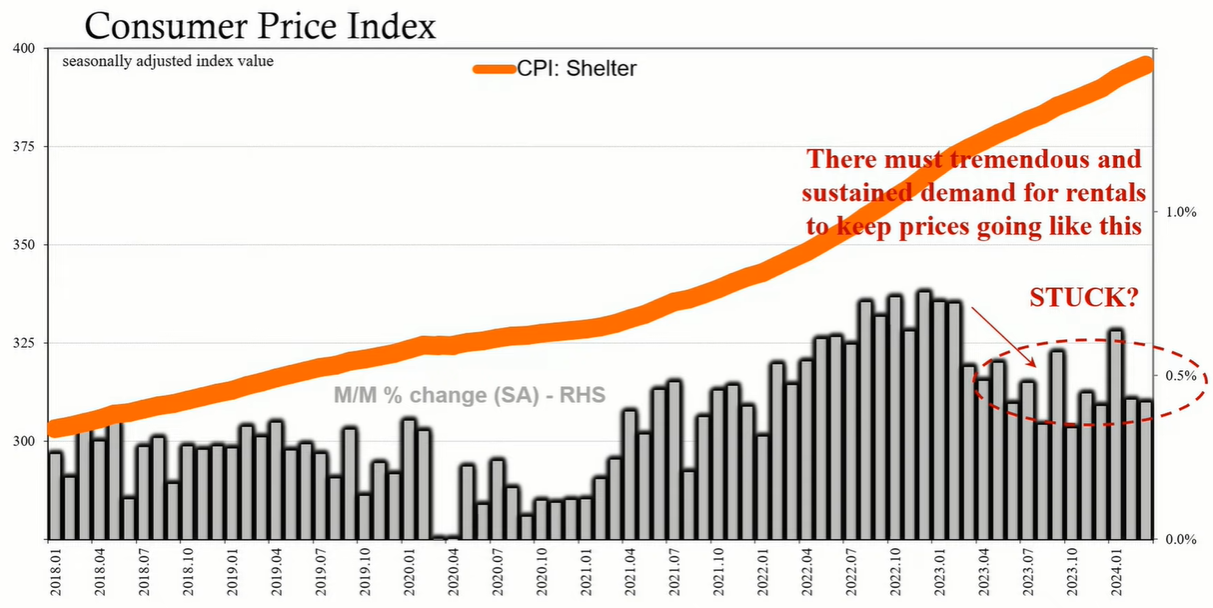

Over half of the recent CPI gains are attributed to shelter and energy costs. However, the data indicates a possible disconnect between reported CPI shelter costs and the actual housing demand. The CPI's consistent rise in shelter costs suggests robust demand, but the decline in construction activity tells a different story.

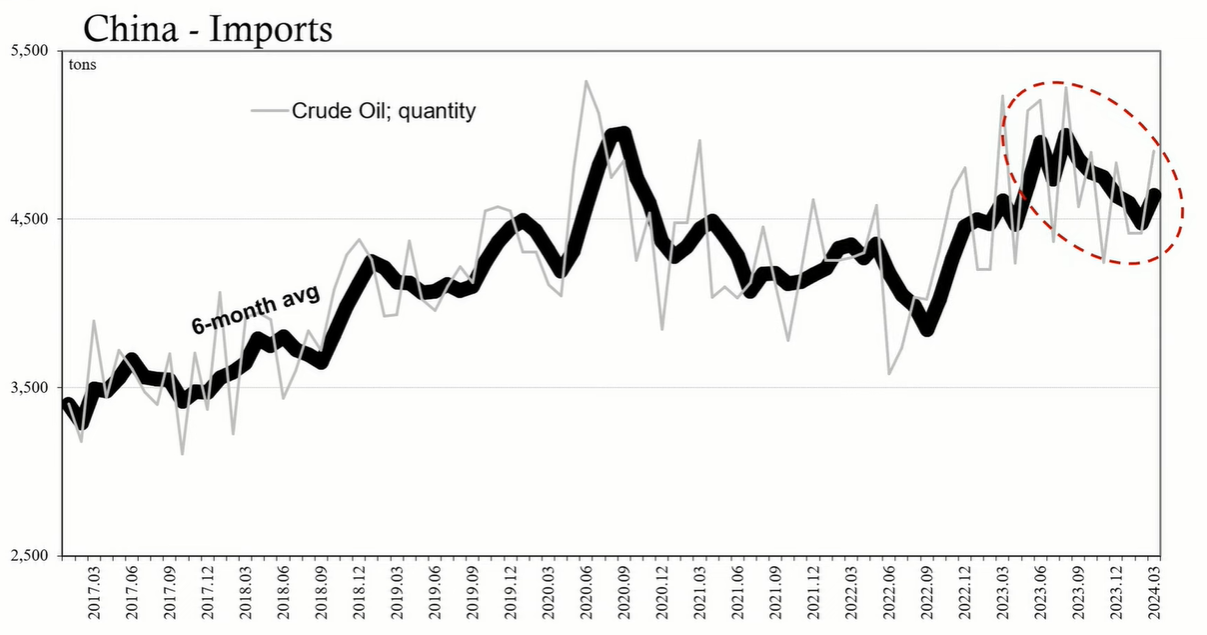

Oil prices have seen a decline as market fears regarding the Middle East conflict fade, prompting a re-evaluation based on actual economic demand rather than geopolitical factors. The current price of oil at around $83.20 reflects this shift in market sentiment.

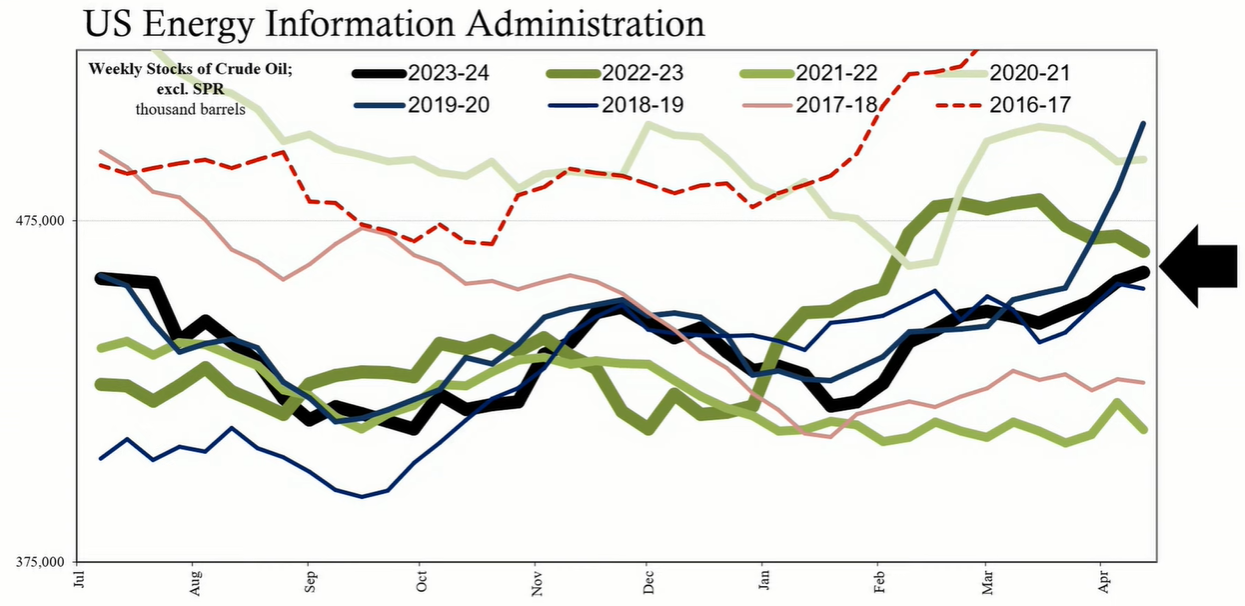

The Energy Information Administration (EIA) reports that crude oil inventories are at the higher end of their seasonal range despite flat domestic supply, indicating weak demand. With no resurgence in energy demand, the market faces potential demand destruction, contrary to reflationary expectations.

Data from sources like rents.com show that median rental asking prices have been flat since 2022, challenging the CPI's portrayal of steadily rising rents. Industry sources report that builders are scaling back construction and offering concessions to attract tenants, further evidence of a lack of demand.

The current economic indicators suggest a lack of reflationary pressure in both housing and energy sectors. Instead, signs point towards disinflation, as the fundamental demand that drives economic growth appears to be absent. With CPI's shelter costs potentially overestimated and oil prices influenced by non-economic factors, the true state of the economy may be weaker than some indicators suggest.