Prices are sky high but nobody's buying

Home prices just hit a fresh all-time record, even as homes sold plunge.

So much for the housing bubble unwinding so prices could come back to earth. Pretty much on-brand for this miracle economy of ours: nothing's selling, but it's all really expensive.

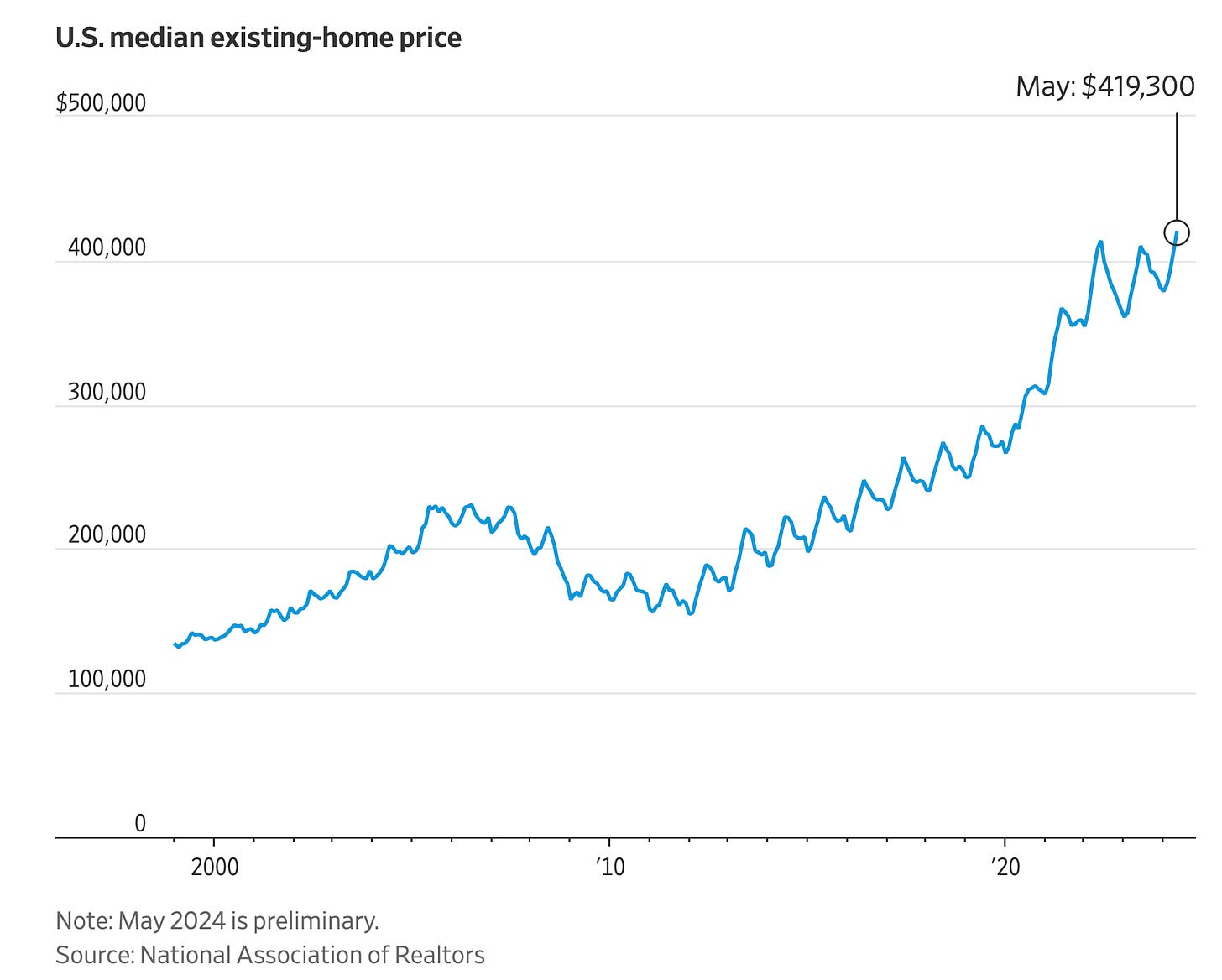

The numbers come from the National Association of Realtors, who report the the median existing home price in May was a record $419,300, up nearly 6% from last year.

Meanwhile, sales of existing homes plunged to just 4.1 million -- down 6% on the quarter and down 40% since Joe Biden took office.

What's crashing the number of sales is, of course interest rates, which at 7.5% are putting houses out of reach – you need to make six figures to qualify for a start home, and you're mortgage will be half your income.

What makes this interesting is that crashing sales was supposed to bring prices back to earth after the pandemic-era housing boom.

It hasn't.

For the simple reason that rates went up so fast that it's locked people in -- they can't afford a replacement house. After all, maybe your condo went up 40%, but that starter house also went up 40%.

Even with the gains you can't afford to upgrade at a 7.5% mortgage unless you're retired and moving to Costa Rica.

As I've mentioned in recent articles, this has all done a number on the young and the working class. Because it means pretty much the only buyers are people who need to -- maybe they got a job in a new city, or maybe they lost their job.

For everybody else -- young families, empty nesters -- they're locked in.

Meanwhile, of course, inflation keeps marching up, driving up house prices to meet the bubble highs — apparently to exceed them, going by today’s new record.

It's a roughly century-long trend that houses march in near lock-step with inflation — actually about a percent over inflation.

Meaning for all those people waiting for the pandemic housing bubble to burst -- it may never burst. Thanks to the Fed.

In fact, house prices could take another jump. Because Zerohedge reports that government-owned mortgage bundler Freddie Mac -- which already owns roughly $3 trillion worth of mortgages -- just applied to deal in second mortgages.

A second mortgage is when you take a fresh loan to take money out of your house. The problem is that this effectively turns a house into a credit card, but one that's government subsidized.

This does two things.

First, it drives house prices even higher -- a credit card is worth more than frozen equity.

Second — and worse — it encourages people to drain every last dime out of their house. Which leaves them right on the edge of default when a recession -- or a layoff -- hits.

We saw this in 2008, where millions of owners bailed on their houses because they owed more than it was worth.

With subsidized second mortgages, if you're smart you should owe more than its worth -- it's a cheap loan, and one doesn’t look a gift-horse in the mouth.

Take enough gift horses and we get to repeat 2008 all over again.

For 50 years Washington has done everything possible to pump up house prices, as a kind of upper middle class welfare scheme that pays the affluent and fleeces the have-nots.

Now we're got a world of rich Boomers stepping over the young who are not only giving up on starting a family, they're losing faith in the entire system. Doom-spending their way to financial oblivion.

In terms of what's next, if you own a house, here comes another jackpot. If not, it's time to start driving for Uber.

Originally Published on Profstonge Weekly