A Redfin survey reveals that 38% of U.S. renters now believe homeownership is unattainable, driven by rising home prices, steep mortgage rates, and increasing financial hurdles.

A new report from real estate brokerage Redfin indicates a significant shift in American sentiment regarding homeownership. The study, conducted in February 2024, found that 38% of U.S. renters now believe they will never be able to own their own home, a sharp increase from the 27% who felt this way less than a year prior, according to a previous survey from May and June 2023.

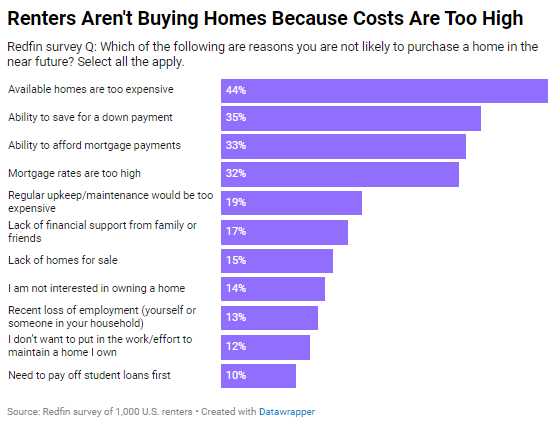

The survey, administered by Qualtrics, queried approximately 3,000 U.S. residents, focusing on the responses of 1,000 renters. Participants were asked about their future homeownership prospects and their reasons for potentially not purchasing a home. The main barrier cited by renters was lack of affordability, with 44% indicating that homes are too expensive as the reason they might not buy a home in the future. Other hurdles included the ability to save for a down payment (35%), the ability to afford mortgage payments (33%), and high mortgage rates (32%). Additionally, 14% of the surveyed renters expressed a lack of interest in owning a home.

This pessimistic outlook is underscored by the financial challenges facing prospective buyers. To afford a typical U.S. starter home, first-time buyers need to earn around $76,000—a figure that has risen by 8% from the previous year and nearly doubled since pre-pandemic times. A Redfin analysis highlights the more than 40% surge in home prices since 2019, driven by a combination of pandemic-induced buying and a shortage in housing supply. Meanwhile, average 30-year fixed mortgage rates stand at 6.82%, which, though lower than the 23-year peak of nearly 8% reached in October, remains significantly above the historical lows seen in 2020.

In the last year alone, home prices have increased by 7%, with monthly mortgage payments climbing even more steeply, by over 10%. Such figures contribute to the growing belief among renters that homeownership is slipping out of reach. The financial strain is evident, with nearly one-quarter of renters (24%) regularly struggling to afford their current housing payments and an additional 45% facing occasional difficulties.

The rental market, too, has been under pressure, with median U.S. asking rents hovering around $2,000, close to the record high set in 2022. However, rental prices have seen a slower rate of increase post-pandemic, attributed in part to a rise in available apartments.

Redfin Chief Economist Daryl Fairweather commented on the situation, stating, "Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now—especially those who have never owned a home and aren't able to tap into equity from a previous sale." Fairweather noted the significant barriers and upfront costs associated with buying a home, such as the substantial down payment and the necessity of mortgage approval, which many find challenging given the current economic climate.

On a generational note, the survey revealed that Gen Z renters are the most optimistic about future homeownership, with only 8% doubting they will ever own a home. This contrasts with higher skepticism among millennials (22%), Gen Xers (40%), and baby boomers (81%), reflecting the varying stages of life and financial circumstances across the age spectrum.