The Federal Reserve's inconsistencies in communicating and managing U.S. monetary policy, highlight historical and current challenges in accurately predicting and controlling economic trends.

The Federal Reserve's approach to managing the United States' monetary policy, particularly regarding inflation control and interest rate adjustments, has been subject to considerable scrutiny. The central bank's communication, especially from its Chair, Jerome Powell, has shown varying degrees of confidence in their ability to manage inflation and the appropriate timing for rate adjustments.

In recent weeks, Jerome Powell's public statements have revealed a lack of certainty about the path of inflation and the timing of interest rate cuts. This is evidenced by his comments suggesting that it might take longer than expected to gain confidence in controlling inflation. Contrastingly, earlier statements in early March indicated a near confidence in achieving sustainable inflation rates around the 2% target, which would predicate an appropriate time to reduce restrictions.

Jerome Powell:

— TFTC (@TFTC21) April 16, 2024

"We'll need greater confidence that inflation is moving sustainably toward 2%... the recent data have clearly not given us greater confidence and instead indicate that it's likely to take longer than expected to achieve that confidence." pic.twitter.com/AQsaT0DCng

Such inconsistent messaging has contributed to public uncertainty, highlighting the difficulties the Federal Reserve faces in predicting and controlling inflationary trends. This is not a new phenomenon; historical accounts show that central bankers have grappled with understanding and managing the money supply effectively.

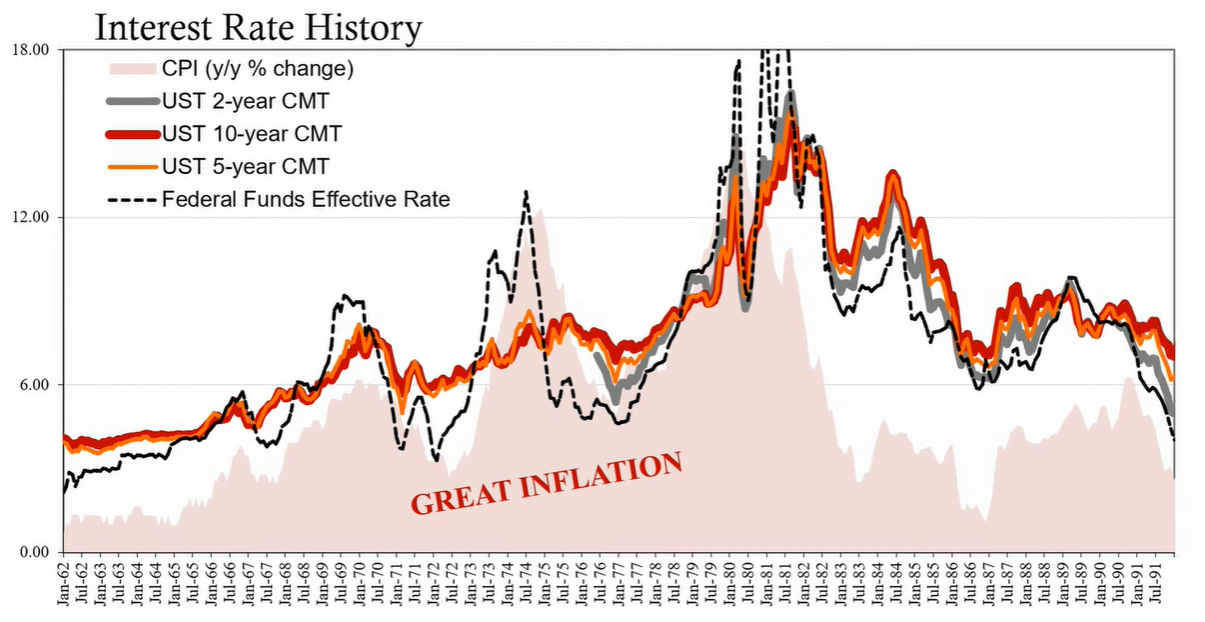

Senator William Proxmire, known for his focus on fiscal responsibility and economic matters, highlighted the challenges of central banking in the 1970s. His interactions with then Federal Reserve Chairman Arthur Burns during the period of great inflation brought attention to the potential disconnect between the money supply and inflation. Proxmire's inquiry into whether an excessive increase in the money supply contributed to inflation elicited a response from Burns that pointed to the need for better control and understanding of the money supply, especially regarding non-member banks.

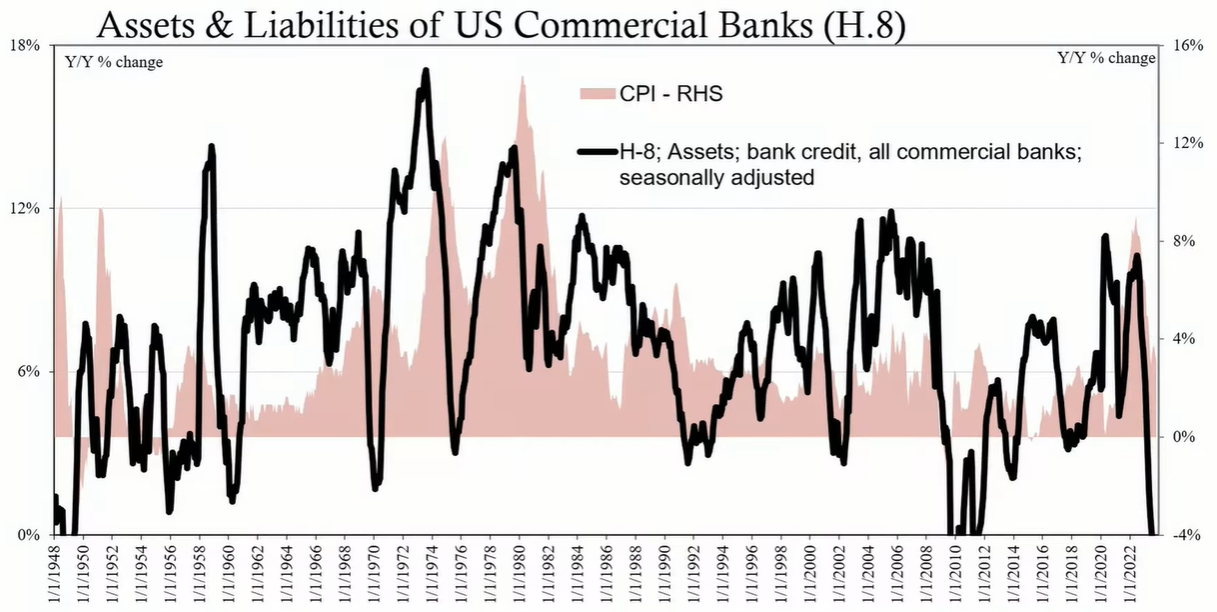

The banking landscape has undergone significant changes since the 1970s. The distinction between commercial and depository banks has blurred, particularly after the consolidation in the 1990s and subsequent regulatory changes. Burns's correspondence with Proxmire foreshadowed the challenges associated with a growing and evolving monetary system that was increasingly difficult to monitor and control.

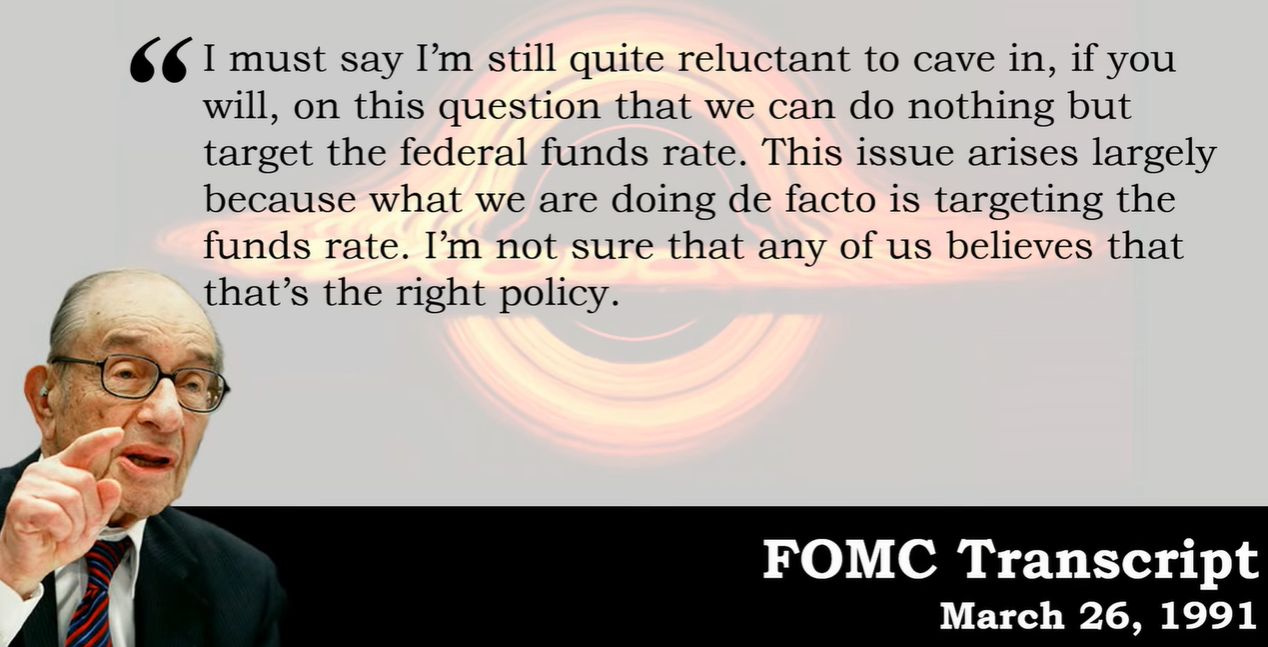

The shift toward the eurodollar system and the proliferation of financial products beyond the reach of traditional banking regulations meant that the Federal Reserve's role as a monetary authority became limited. By the 1990s, central banking had effectively transitioned from managing the money supply to influencing economic behavior through interest rates, as admitted by then Federal Reserve Chairman Alan Greenspan in 1991.

The Federal Reserve's current predicament is rooted in the complexities of a financial system that has grown beyond the scope of traditional monetary policy tools. The reliance on consumer price indices to guide policy decisions—indices that can be influenced by various factors unrelated to long-term monetary conditions—underscores the reactive nature of the central bank's approach.

The lack of a clear grasp on the monetary conditions and the delayed reaction to economic indicators result in a lack of confidence in the Federal Reserve's ability to manage inflation and economic stability. This is compounded by the potential for significant economic downside that the central bank may neither foresee nor acknowledge, as the 2008 financial crisis highlighted.

The Federal Reserve's shifting stance on inflation and interest rate policy reflects enduring challenges in central banking. Historical patterns and the evolution of the banking system illustrate the difficulties inherent in managing a complex and dynamic monetary environment. As the Federal Reserve continues to grapple with these issues, it becomes increasingly important to address foundational monetary questions raised decades ago to ensure economic stability and to regain public confidence in monetary policy.