Shadow banks' rise threatens national bankruptcy with potential bailouts akin to 2008.

A recent investigation by Bloomberg has unearthed a concerning trend in the realm of high finance.

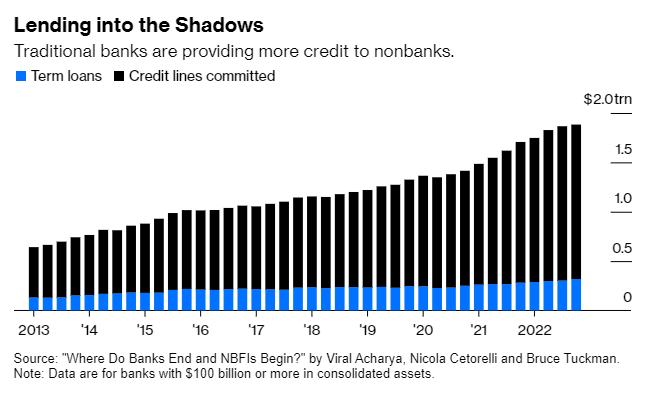

According to Bloomberg's findings, shadow banks have amassed nearly $1.8 trillion in loans from traditional banks.

The arrangement poses a stark risk: should these high-stakes gamblers of Wall Street default, the repercussions would ripple through to the traditional banks and ultimately burden the taxpayers,

The fundamental issue lies in the nature of risk and reward in finance; higher risks tend to attract greater rewards,

To avert disaster, some suggest a radical overhaul of the current system,