The Truth About Health Insurance Deductibles.

We hate deductibles. So should you. They are evil because they give people a false sense of security only to rip their savings away from them in the event of a medical event.

200,000 people last year went bankrupt due to a health event even though they had health insurance. How the heck can this be the case? Isn’t health insurance's purpose to keep people from going into financial distress when they have a big health event? Yes, but thanks to the Affordable Care Act, deductibles have skyrocketed.

Deductibles appear to be a straightforward concept: the amount you pay out-of-pocket before your insurance plan begins to cover medical expenses. However, the reality is far more complex and, frankly, daunting. The role of deductibles in health insurance is often misunderstood, leading many to a false sense of security. As Kevin McCaffrey once tweeted,

Health insurance is cool cuz you get to pay a bunch of money each month for nothing & then if something happens to you, you pay a bunch more

— Kevin McCaffrey (@KevinMcCaff) July 24, 2021

The mechanism of deductibles and their companions—coinsurance and out-of-pocket maximums—creates a terrible financial situation for many.

For example, facing an $8,000 deductible means that a hospital bill of $20,000 leaves you scrambling to cover the initial $8,000. It's a recipe for financial disaster. Do you have $8,000 in your bank account? If not, then you are headed for deep financial trouble.

The above scenario does not account for the additional burden of coinsurance, where you continue to pay a percentage of the expenses beyond the deductible until you reach your out-of-pocket maximum. You are probably responsible for coinsurance, meaning you’ll share the responsibility with the health plan above your deductible. If you have a 20% coinsurance, you’ll pay 20% above the deductible until you reach your out-of-pocket max. In this case, if your out-of-pocket max is $10,000, you’ll first pay the deductible of $8000 and then 20% of the remaining $12,000 on that bill until you pay a total of $10,000.

The Affordable Care Act (ACA) aimed to provide broader health insurance coverage but also led to an unintended consequence: the rise of high-deductible health plans. As deductibles soared, many found themselves with health insurance that offered little immediate financial relief in times of need. The ACA's noble intentions have been overshadowed by the stark reality that insurance coverage does not equate to affordable care for all.

The rationale behind high deductibles and coinsurance is encouraging individuals to be more intelligent healthcare consumers. Yet, this theory falls short in practice. The lack of transparency in healthcare pricing and the urgency of medical emergencies often leave no room for cost comparison. Also, the complex dynamics of network vs. out-of-network providers add another layer of confusion and financial burden, leaving patients vulnerable to unexpected and sometimes exorbitant charges.

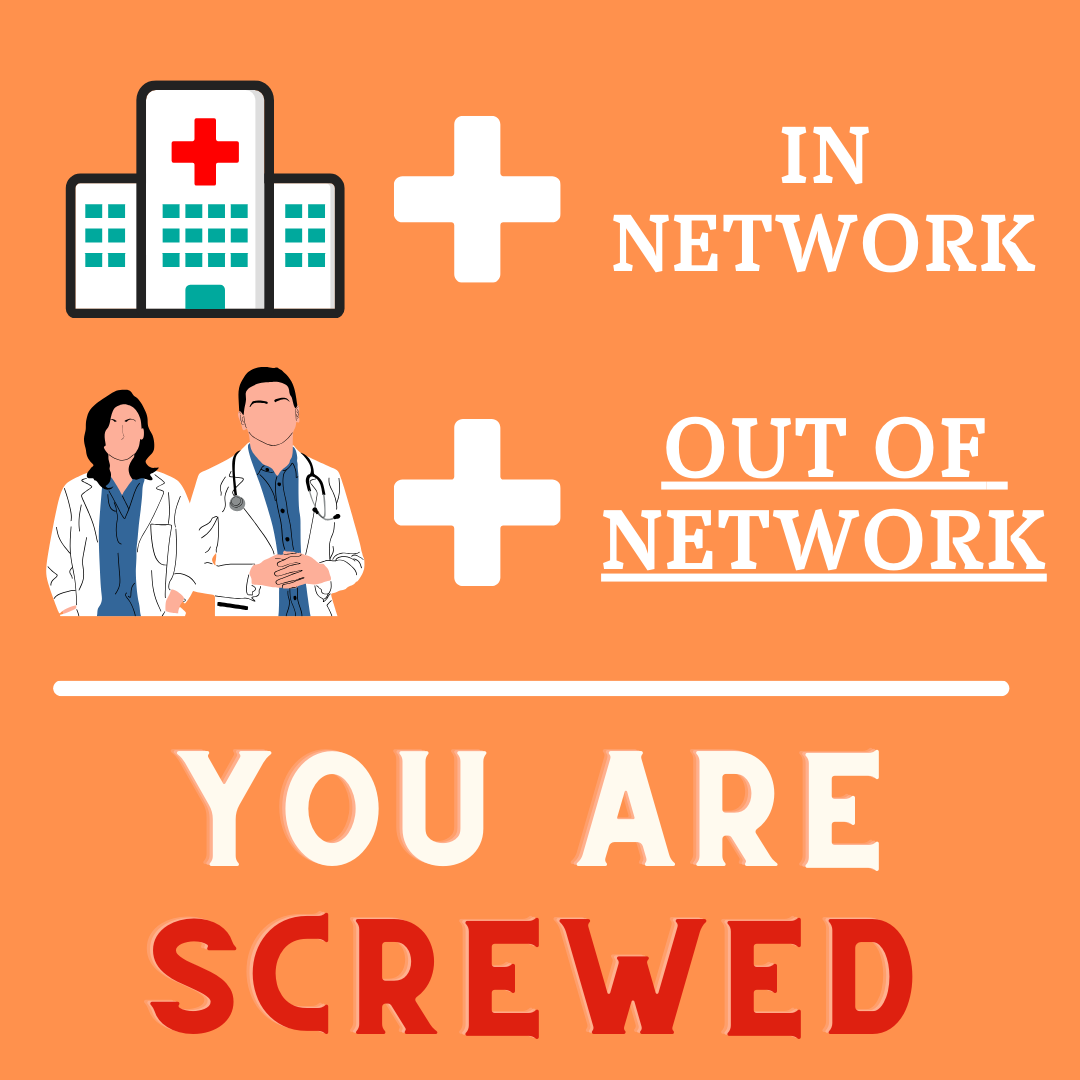

For example, Let's say you go to the emergency room. You may go to a hospital in network, but the doctors you see at that hospital may be out of network. People don’t understand that doctors who work in the hospital often don’t work for the hospital. They work for Service Providers contracted with the hospital for services but may not be in your insurance plan network. Therefore, you have a separate out-of-network deductible. This isn't very clear to consumers. Unfortunately, the system was built to confuse consumers. Let me sum it up for you in one image.

The healthcare system's complexity is by no means an accident. It's a labyrinth designed with enough twists and turns to confound the average consumer. From the ambiguity of in-network versus out-of-network providers to the perplexing structure of deductibles for different services, the system seems engineered more for obfuscation than clarity. This complexity hinders understanding and significantly increases the risk of financial jeopardy for the unwary.

As I said earlier, 200,000 Americans filed for bankruptcy last year alone due to medical expenses despite having health insurance. This is a glaring indictment of a system prioritizing paperwork and profits over patients and their well-being. The financial mechanisms designed to share costs and incentivize wise healthcare spending have become instruments of economic instability and distress.

The dark side of health insurance deductibles reveals a troubling landscape where financial security is undermined, not upheld, by the very mechanisms supposed to protect it. As we grapple with the complexities of healthcare financing, it becomes increasingly clear that we need a new plan.

At Crowdhealth we do not have Deductibles. You pay a monthly membership fee of $50 a month and then up to $135 a month for a single person between the ages of 18-54. If you have a "health event" you pay the first $500 then we negotiate the cost of said "health event" and the rest is submitted to the crowd for help. It's that simple.

We are done crowdfunding for the year.

— CrowdHealth (@JoinCrowdHealth) December 28, 2023

3,506 submitted to the community for crowdfunding

3,506 funded by the community

We had some doozies. Brain surgery, cancer cases, motor vehicle accidents, NICU babies, a whole bunch of MSK surgeries, and a host of other large events.… pic.twitter.com/isPNN9ue9O

Use Code "Healthy" for an exclusive offer—3 months for $89 dollars.