Treasury yields have stagnated despite Federal Reserve efforts, hinting at deeper economic concerns.

Despite aggressive actions by the Federal Reserve, including rate hikes and balance sheet roll-offs, treasury yields have not risen as much as expected. This article delves into the underlying reasons for this discrepancy and what it signals about the economy.

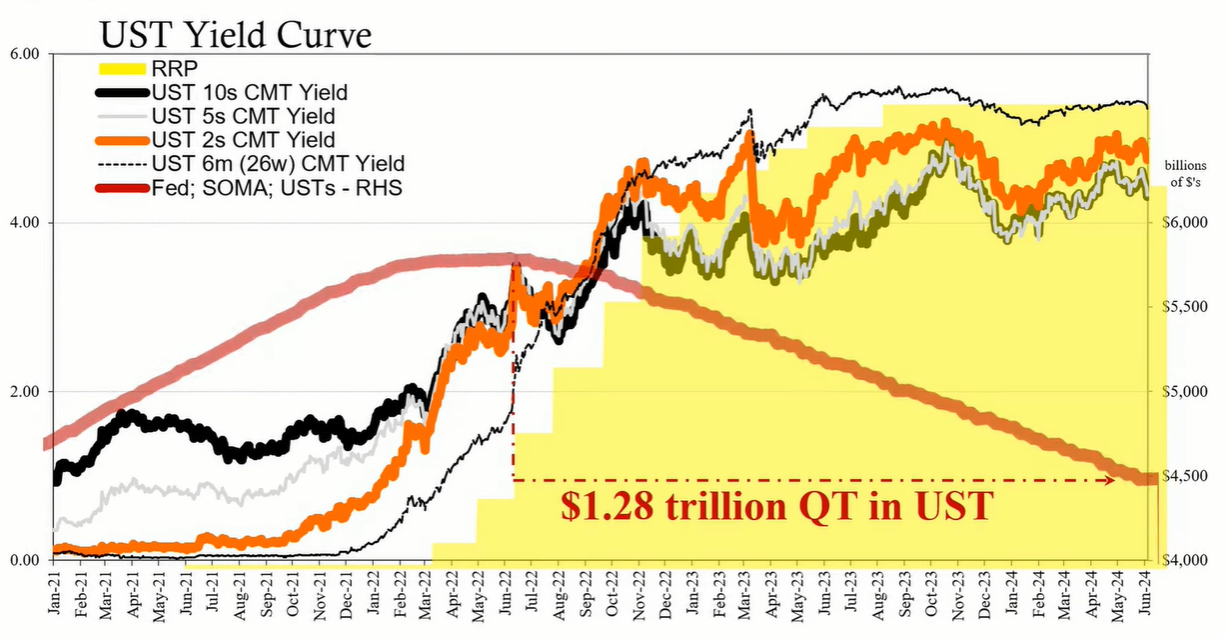

In 2021, the benchmark ten-year treasury hovered around 1.2% to 1.5%, even as the Consumer Price Index (CPI) surged. Typically, the Federal Reserve’s influence is cited as the primary driver for interest rates; however, this correlation seems to be faltering. Despite the cessation of bond purchases and the roll-off of $1.28 trillion in Treasuries, rates have not increased proportionately. Furthermore, the federal government added nearly $5 trillion in debt held by the public during the same period. Despite these factors, the ten-year treasury yield is only about three percentage points higher than in 2021, and there is pressure for it to go lower still.

Interest rates reflect the market's growth and inflation expectations, but economists often dispute this, claiming that rates are influenced by Fed actions and government bond supply. Historical data, however, suggests this is not the case. For example, during periods when the Fed was actively purchasing bonds, rates remained low, and they have continued to do so even after the Fed stopped its bond-buying program. This indicates that interest rates are fundamentally driven, a fact that confronts the conventional econometric perspective.

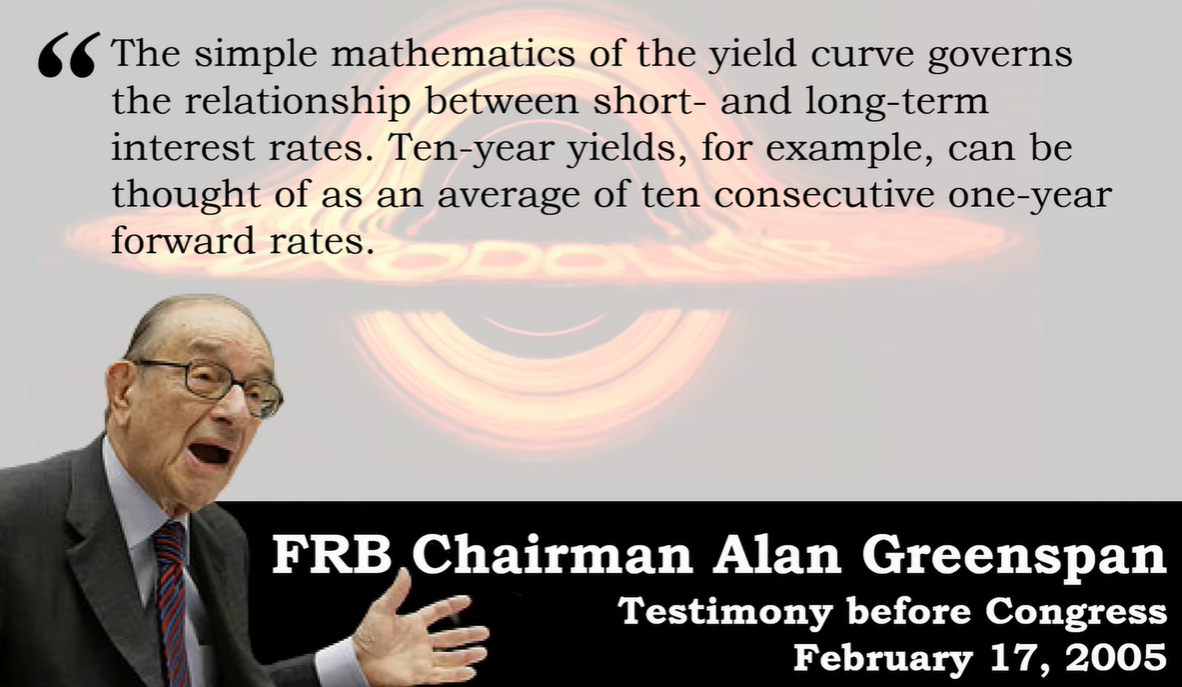

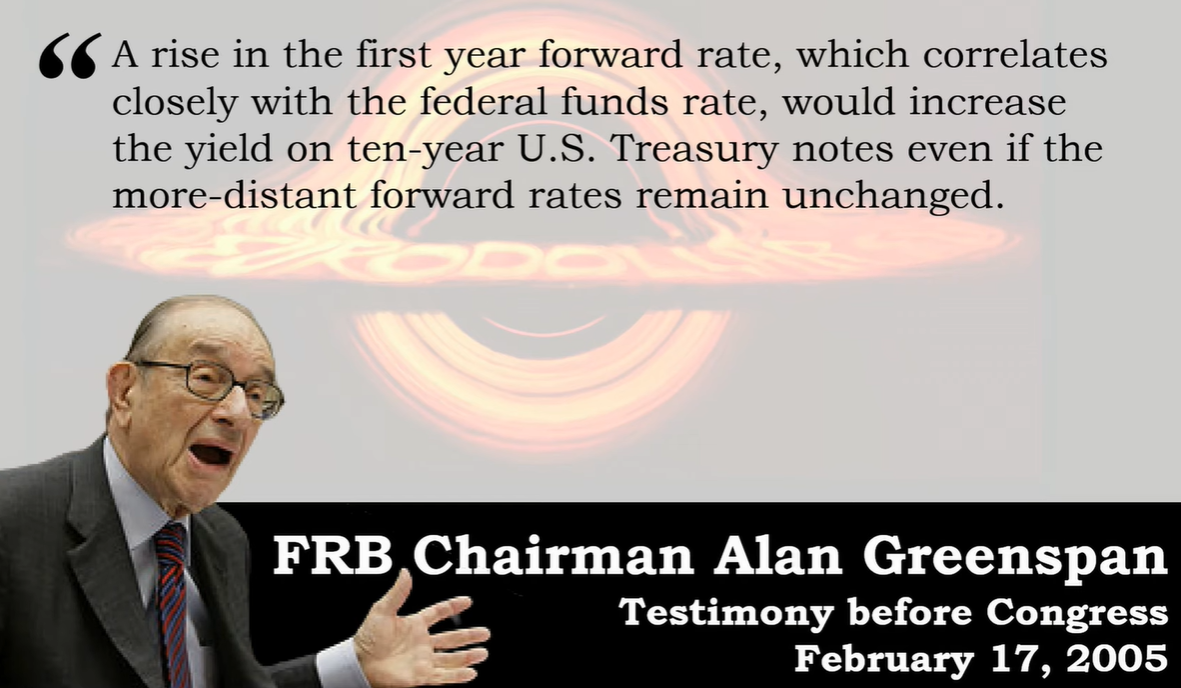

Former Federal Reserve Chairman Alan Greenspan's testimony before Congress in February 2005 highlighted the disconnect between expected and actual interest rates. He suggested that ten-year yields should be thought of as an average of consecutive one-year forward rates. While there is some truth to this, the bond market shows that rates are not entirely dependent on the Fed’s short-term rate adjustments. Long-term interest rates have displayed a degree of independence, dictated by the market's assessment of future growth and inflation.

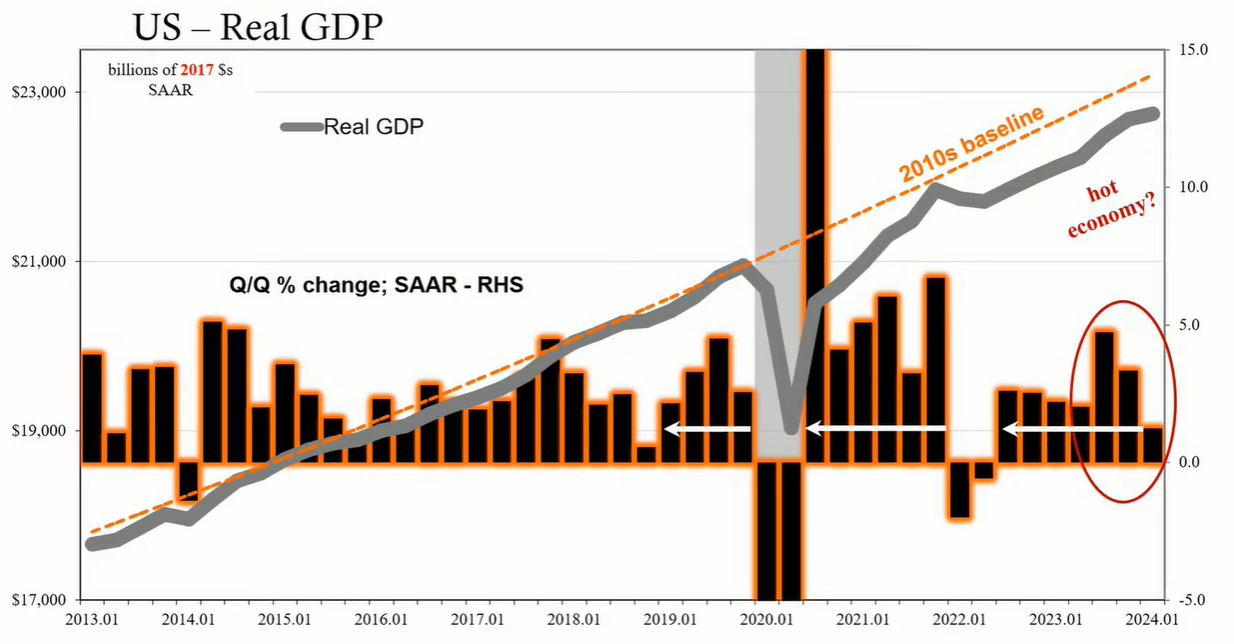

Low rates signal the market's anticipation of subdued growth and inflation. The bond market’s persistent low rates, even in the face of aggressive Fed policies and increased government debt issuance, suggest that the market is skeptical about long-term economic prospects. The recent nominal growth has not translated into sustainable recovery, as evidenced by low real growth and a skewed distribution of economic gains.

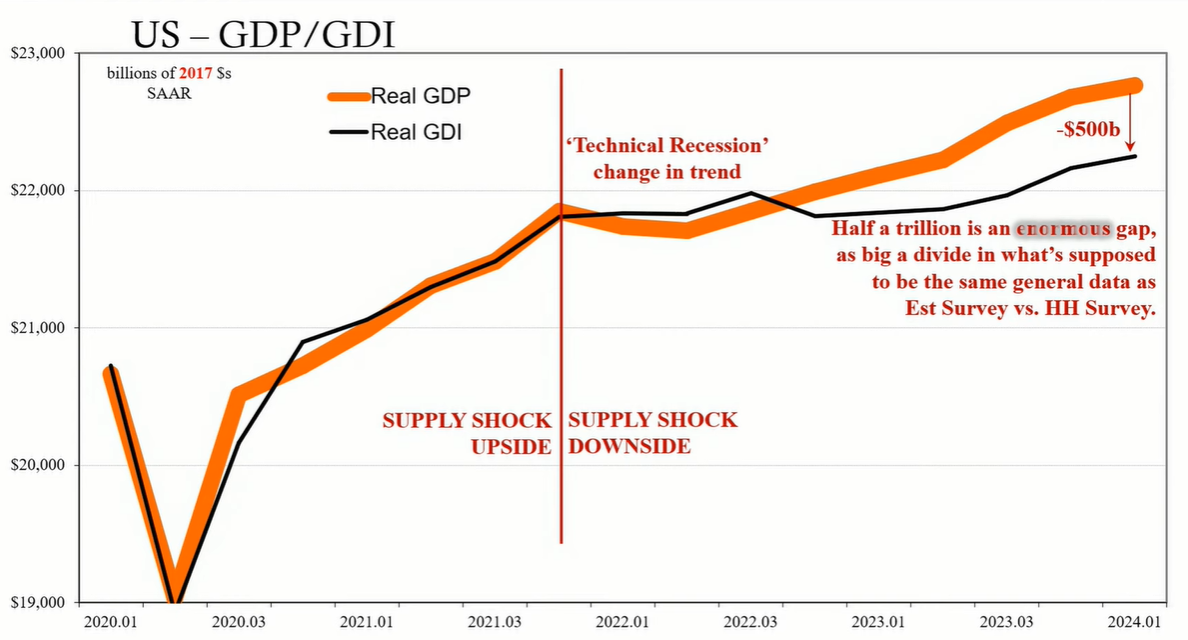

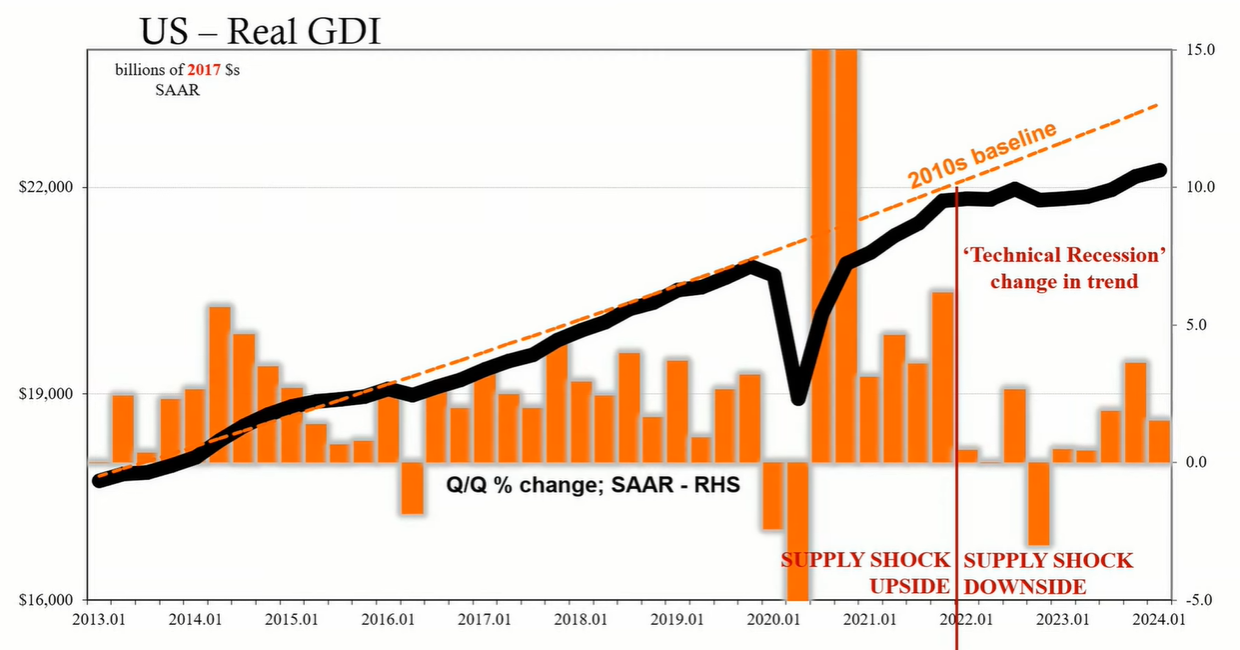

The bond market appears to be pricing in a transition from artificially inflated nominal growth to a period of lower growth and inflation. This is supported by real GDP and Gross Domestic Income (GDI) trends, which indicate a lag behind the 2010s. Factors such as labor market imbalances and financial bubbles further substantiate the bond market's cautious stance.

The disconnect between Federal Reserve actions and treasury yields points to a market-driven view that fundamentally differs from the mainstream economic narrative. The bond market, by anticipating lower future growth and inflation, suggests that the economy may not be as robust as some indicators imply. The evidence leans toward a gradual correction and transition to a more balanced economic state, one that aligns with the lower growth and inflation expectations that the bond market has been signaling.