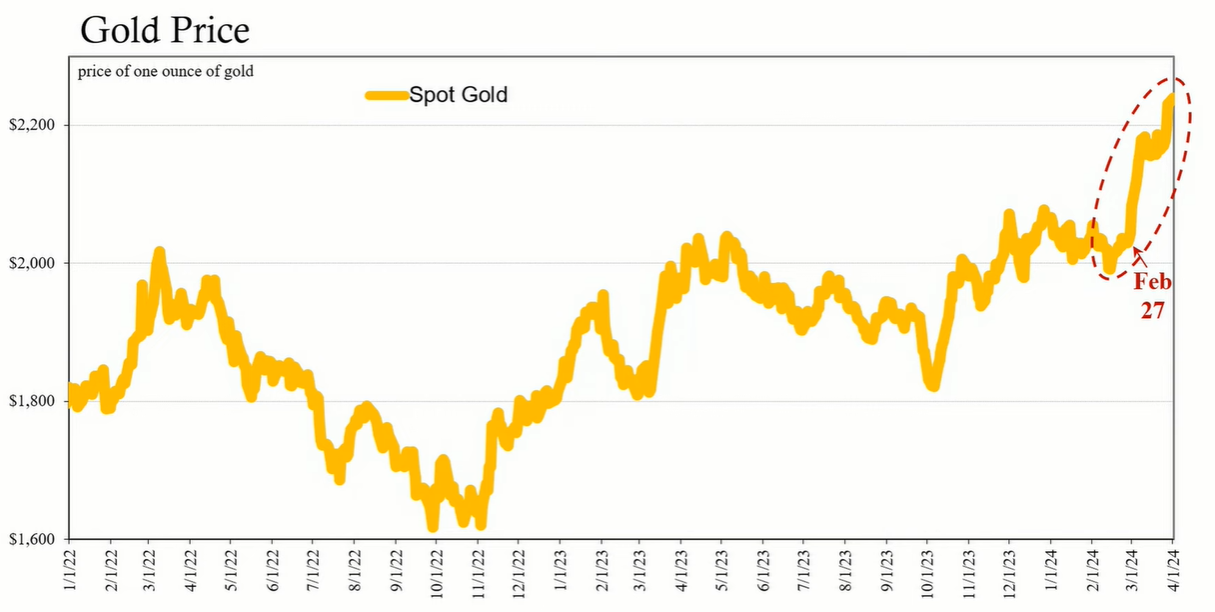

Gold's recent rally to all-time highs is a reflection of its perceived role as a financial safe haven amid various global economic uncertainties.

Gold has reached another all-time high, indicating its status as a financial hedge against major economic dangers. While other commodities like silver remain unaffected by this trend, gold's unique position warrants a detailed investigation into the causes behind its surge. The prevalent explanations center around China's economic conditions, global inflation concerns, and banking fragility.

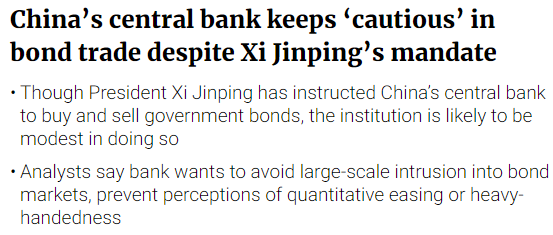

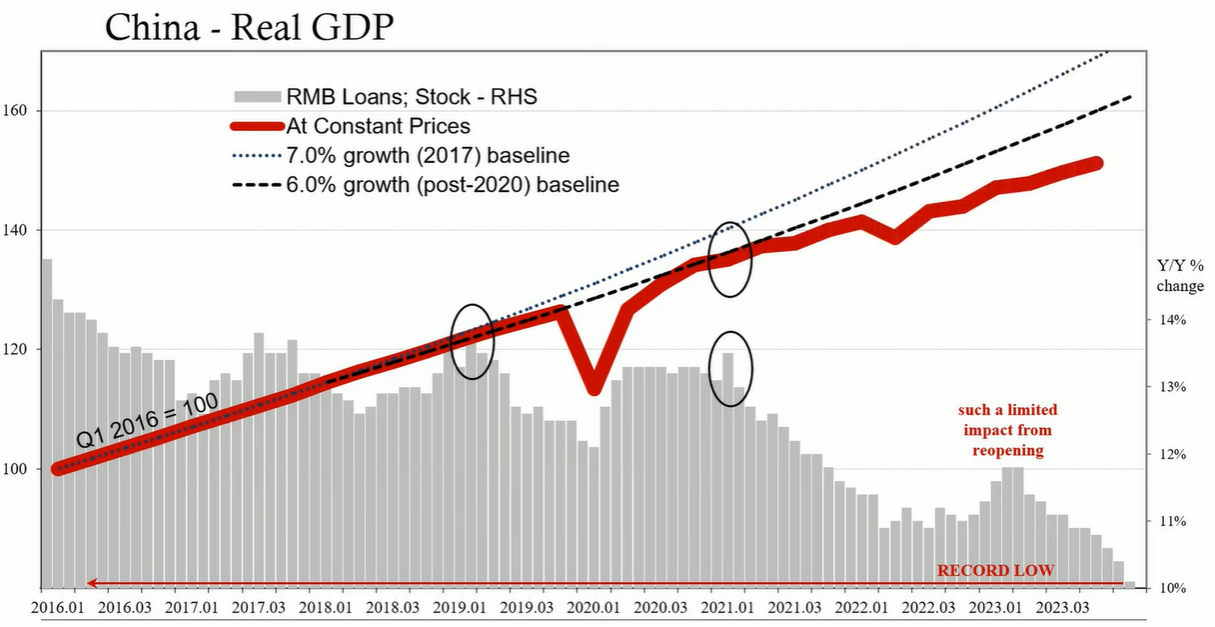

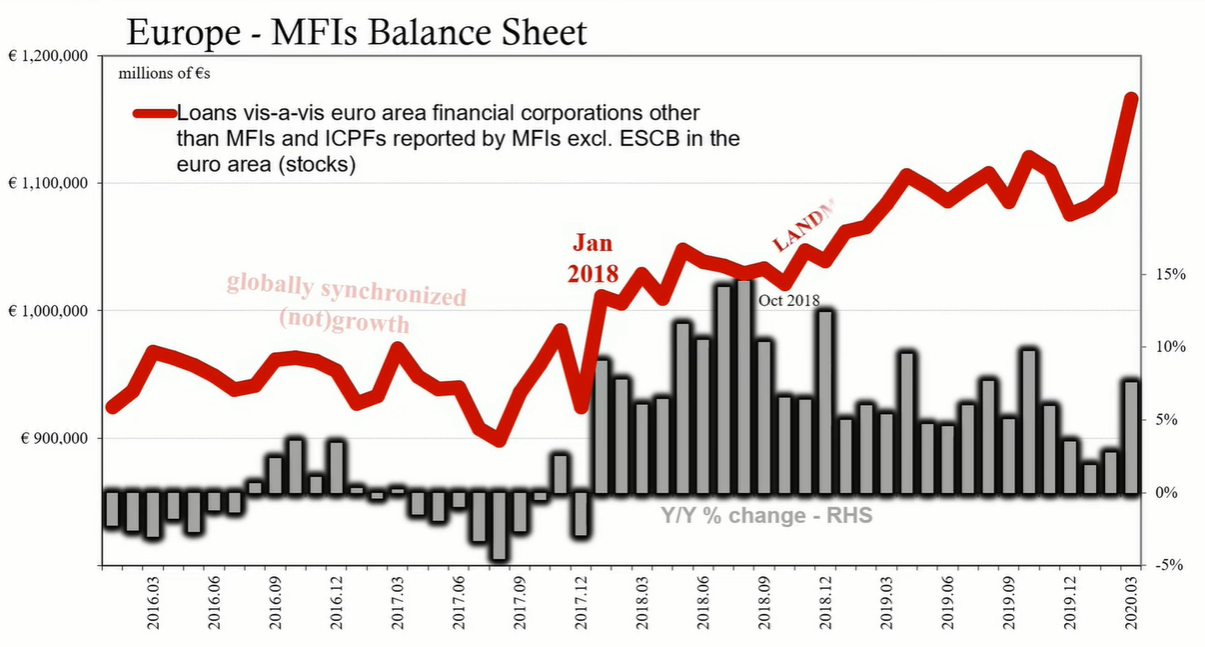

China's struggling economy, particularly its real estate sector, has prompted speculation about the People's Bank of China (PBoC) potentially implementing quantitative easing (QE) policies. Although QE is often perceived as inflationary, evidence suggests that this is not the case. The PBoC has already been infusing liquidity into the market since the previous fall. February's balance sheet data showed a mixed picture, indicating that while liquidity measures are in place, the banking system is exhibiting deflationary behavior.

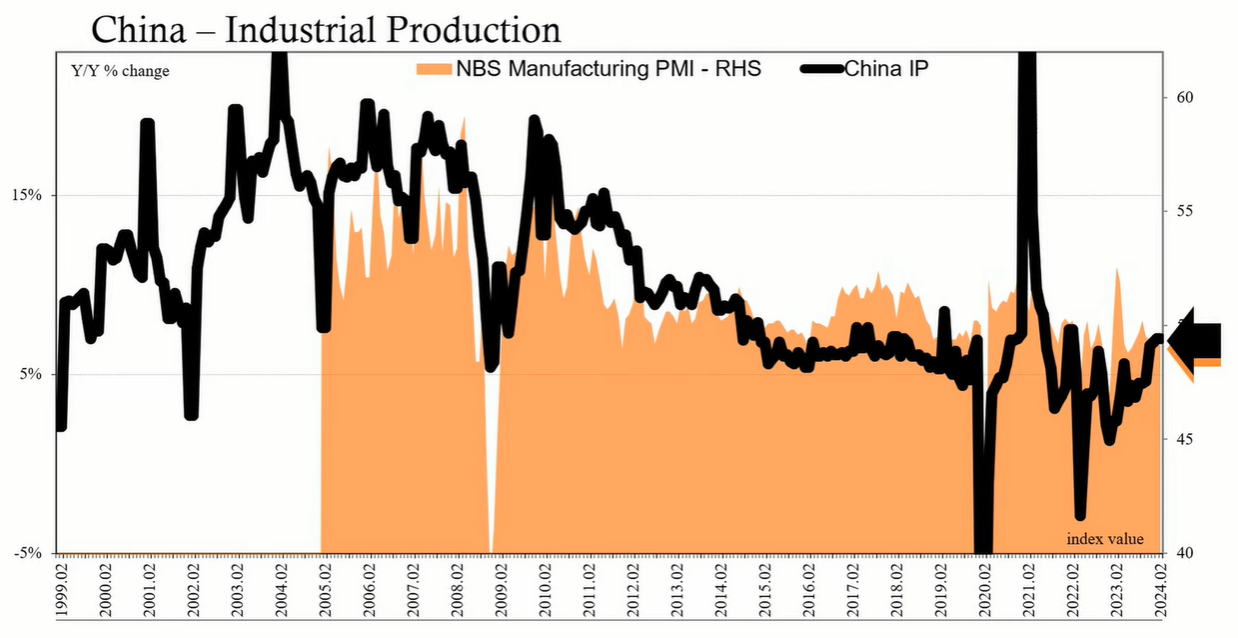

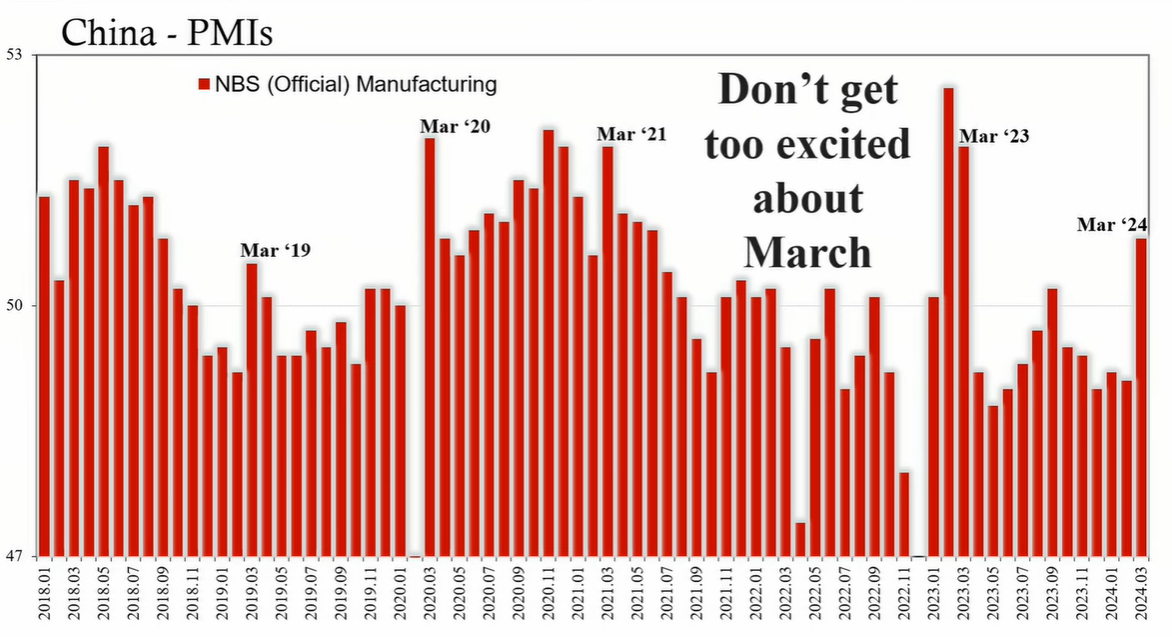

Recent economic data, including retail sales, industrial production, and fixed asset investment, have shown signs of improvement, albeit from low levels. Furthermore, the manufacturing Purchasing Managers' Index (PMI) has reached levels not seen since the post-reopening period the previous year. These indicators may lead to a more patient approach from Beijing, suggesting that there is no urgent pivot towards hyperinflationary policies.

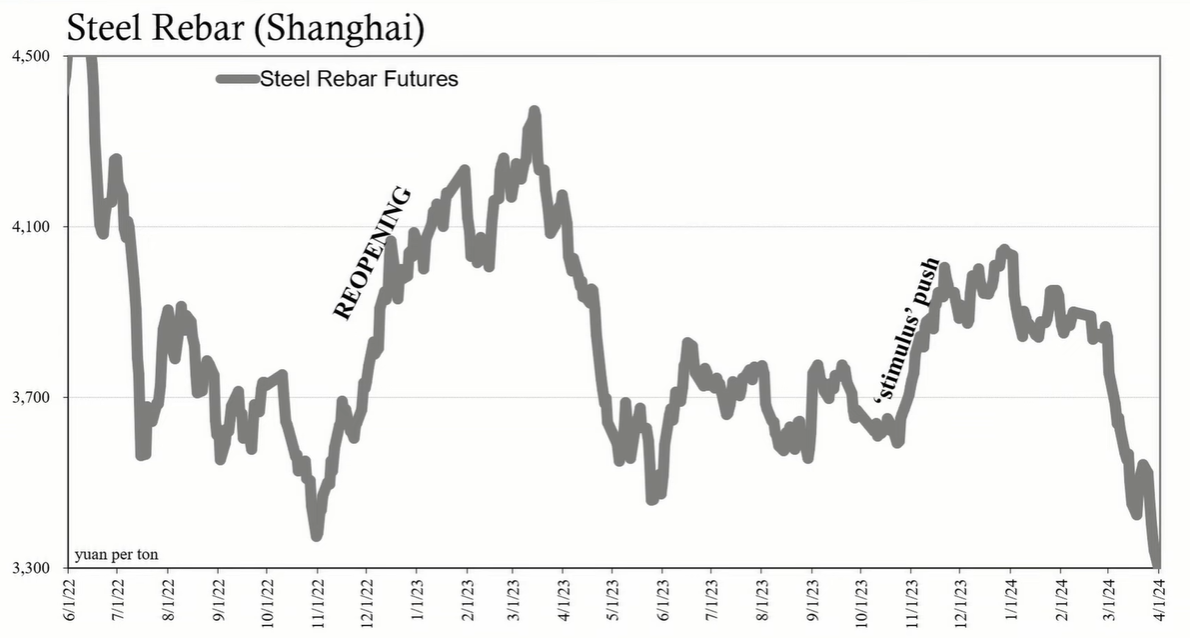

It is noteworthy that the prices of other commodities like steel and iron in China are declining despite these economic improvements. This divergence suggests that the factors driving gold are unique and potentially linked to concerns about the worsening real estate sector in China.

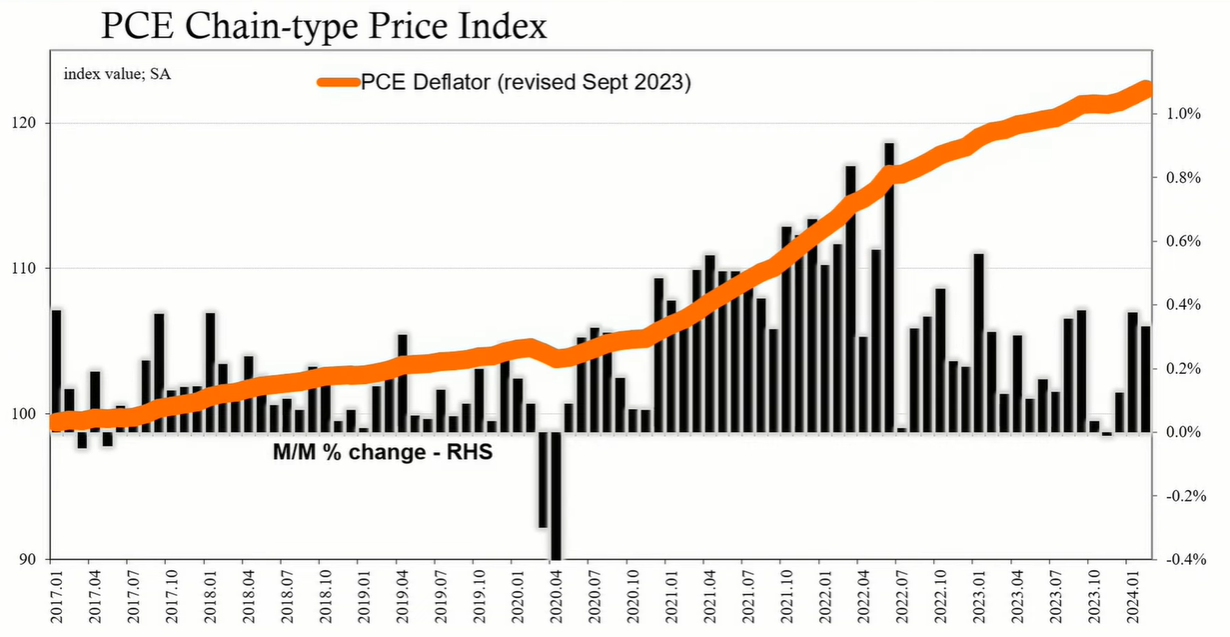

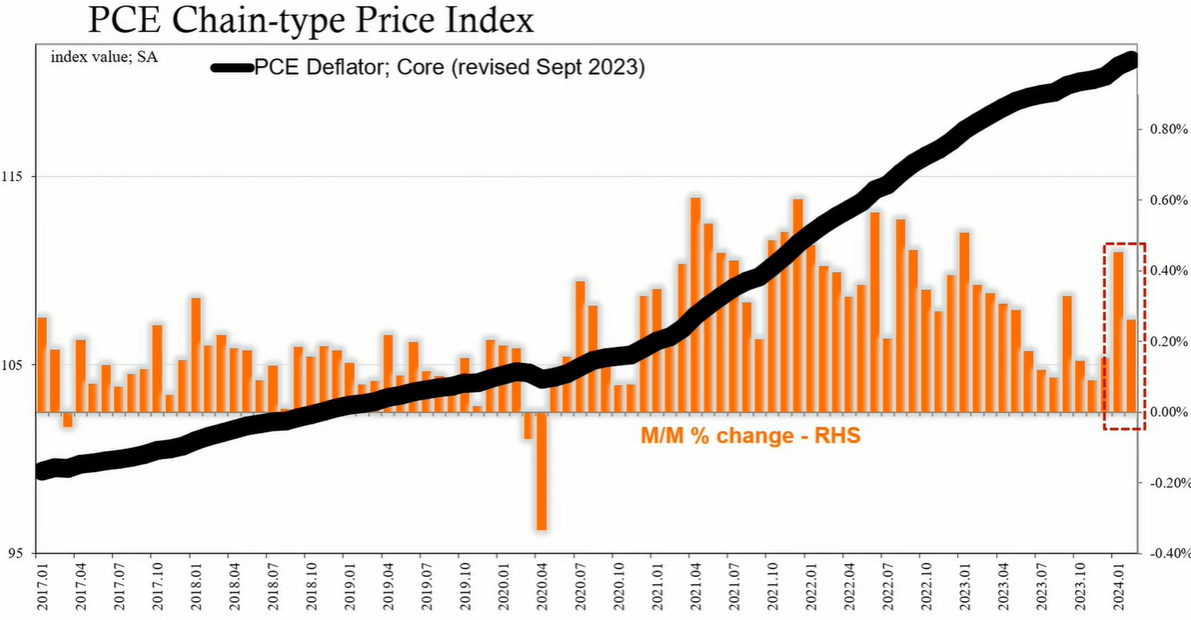

The resurgence of inflation is a common theory for gold's price increase. However, recent consumer price data, including the Personal Consumption Expenditures (PCE) deflator, indicate a continuation of disinflationary trends. With oil prices and labor market conditions fluctuating, the outlook on inflation remains uncertain. Income data, on the other hand, is weak, negating the theory of a tight labor market and robust economy.

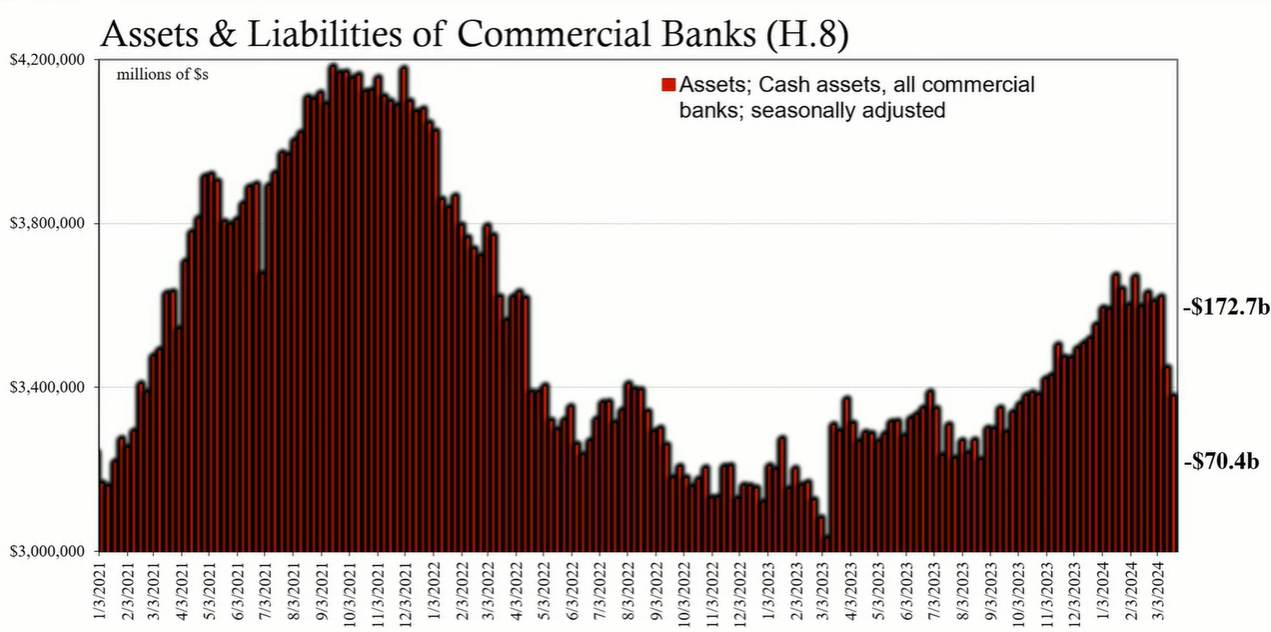

Unusual patterns in the banking sector, such as significant decreases in cash holdings, hint at underlying fragility. Federal Reserve Chairman Jerome Powell's acknowledgment of potential bank failures, particularly among smaller institutions, adds to the concern. Commercial real estate challenges, highlighted by increased vacancy rates and decreased listing rates, underscore the potential for liquidity crises and distressed asset sales.

The surge in gold prices can be attributed to a combination of factors. While the potential for inflationary pressures from China seems overstated, the real estate challenges within the country could be a driving force. The global inflation narrative does not hold up against the backdrop of weak income data and disinflationary evidence. Lastly, banking fragility, particularly related to commercial real estate, presents a significant risk that may justify the appeal of gold as a financial hedge. The complexities of these factors make the current situation worthy of close attention and careful analysis.