Goldman Sachs Group Inc’s rate cut in its consumer bank Marcus reflects a wider financial sector trend, driven by expectations of Federal Reserve policy changes and underlying economic fragility.

In the face of a changing economic landscape, financial institutions and central banks are adjusting their strategies. Notable among these is the recent decision by Goldman Sachs Group Inc's consumer bank Marcus to lower the rate on its high yield savings account, a move that signifies a broader trend in the financial sector.

Goldman Sachs reduced the annual percentage yield on its high yield savings account from 4.5% to 4.4%. This adjustment, the first since November 2020, reflects a broader anticipation of policy shifts by the Federal Reserve. The trend is not confined to Goldman Sachs alone; other banks are expected to follow suit, adjusting their rates in response to the broader economic climate and central bank policies.

The Federal Reserve's potential rate cuts are central to understanding these banking trends. The rationale behind a central bank's decision to cut rates often hinges on the state of the economy. Despite narratives of a resilient economy, there are underlying concerns about its fragility. A "very fragile recovery" is suggested by some in the financial industry, such as State Street's chief investment officer Laurie Heinel, indicating that surface-level economic indicators may not capture the full picture.

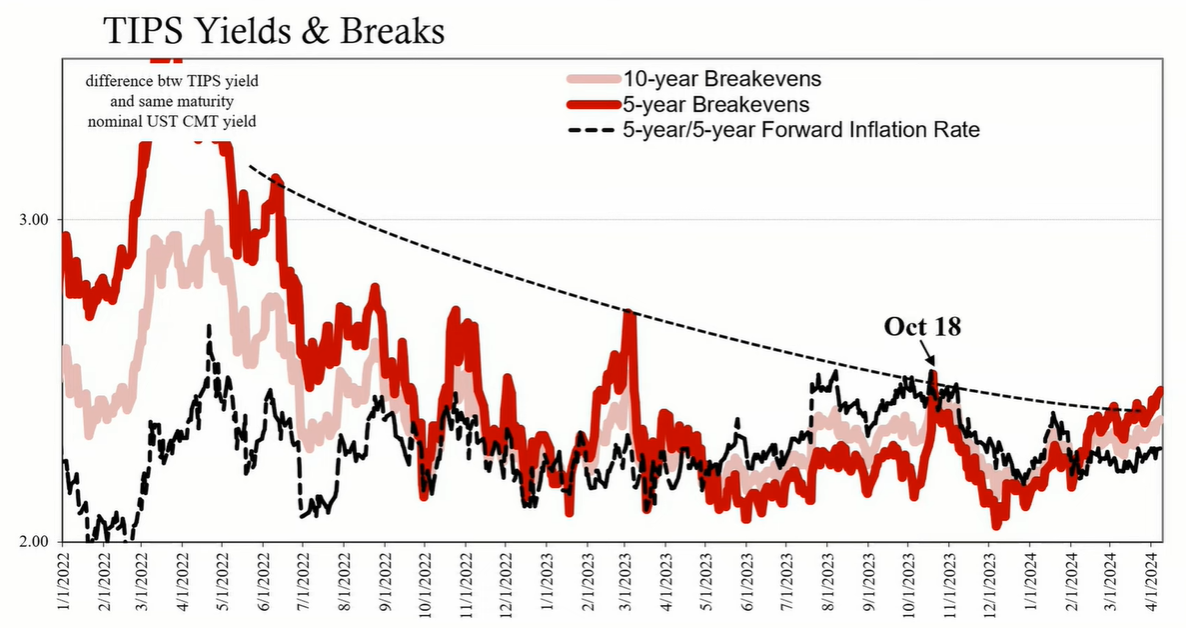

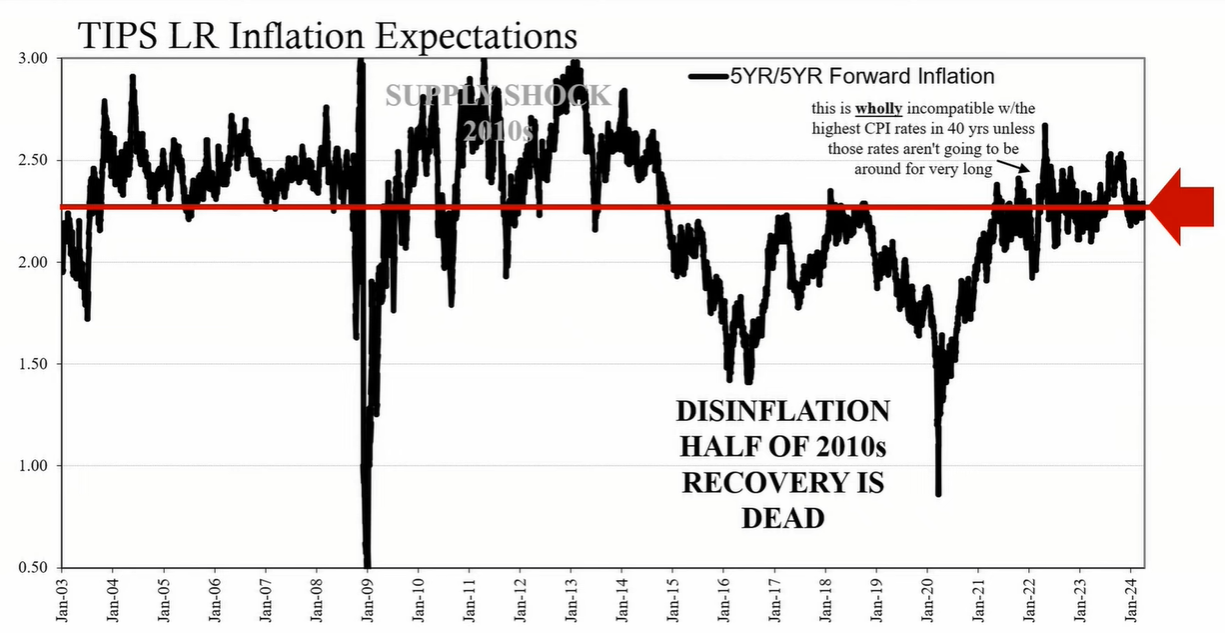

Historically, following a significant decrease in interest rates, a period of lateral to upward movement typically ensues. This pattern has often been misinterpreted as a market adjustment to inflation pressures or a shift towards hawkish central bank policies. However, the current stability in rates, despite external factors like rising oil prices, suggests that the market is maintaining its previous trajectory rather than indicating a shift towards higher rates.

The Treasury Inflation-Protected Securities (TIPS) market shows that short-term inflation expectations have risen, but long-term expectations remain anchored. This implies that while oil prices may impact consumer prices in the short term, the market does not anticipate a lasting inflationary effect. Instead, higher oil prices are expected to be disinflationary in the long term due to their negative impact on economic demand.

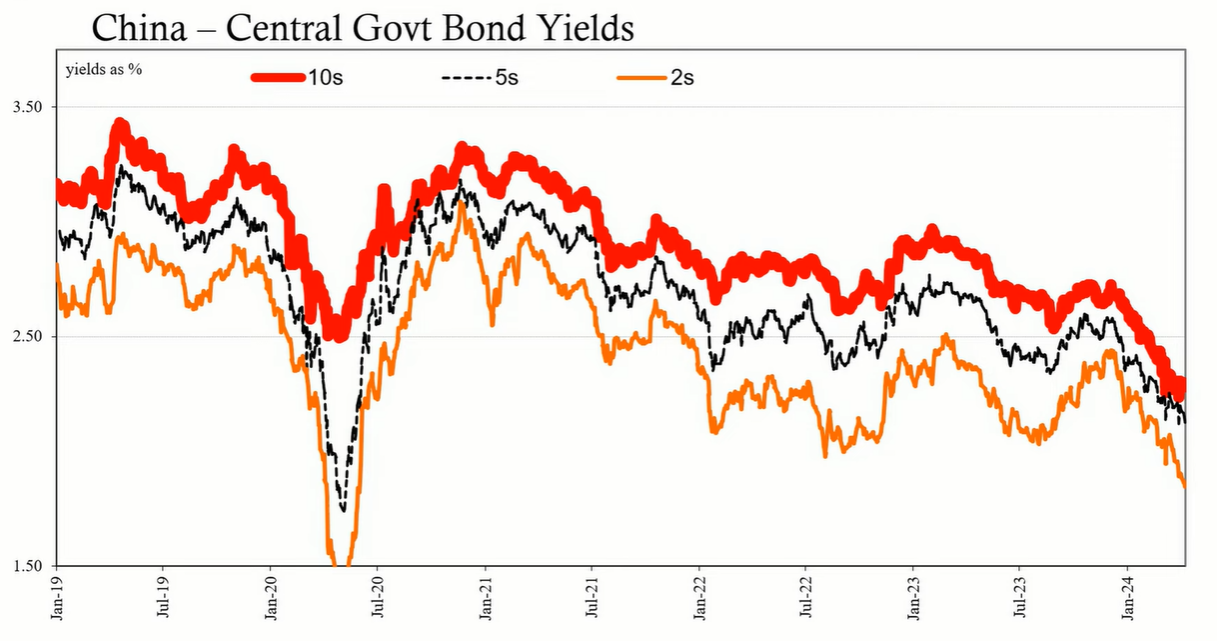

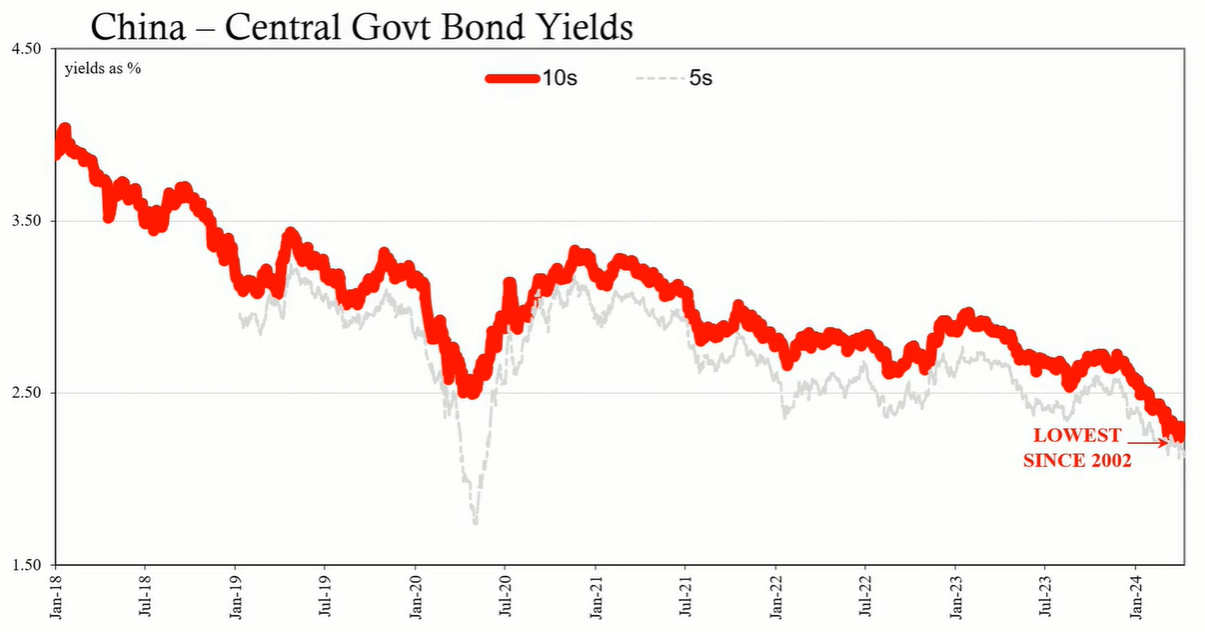

Internationally, interest rates are also on a downward trajectory. In China, for example, government bond yields have been declining, a trend consistent with global economic interconnectivity. Lower interest rates in China reflect broader concerns about financial risks and economic fragility.

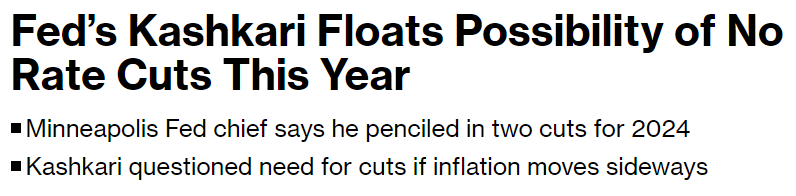

Central bankers, including Federal Reserve Bank of Minneapolis President Neel Kashkari, have expressed caution regarding rate cuts. The decision to adjust rates hinges on inflation trends and economic performance. If inflation aligns with targets and economic indicators remain positive, rate cuts may be unnecessary. However, the persistent inversion of the yield curve, a historical predictor of recession, underlines the potential for economic downturn despite some optimistic narratives.

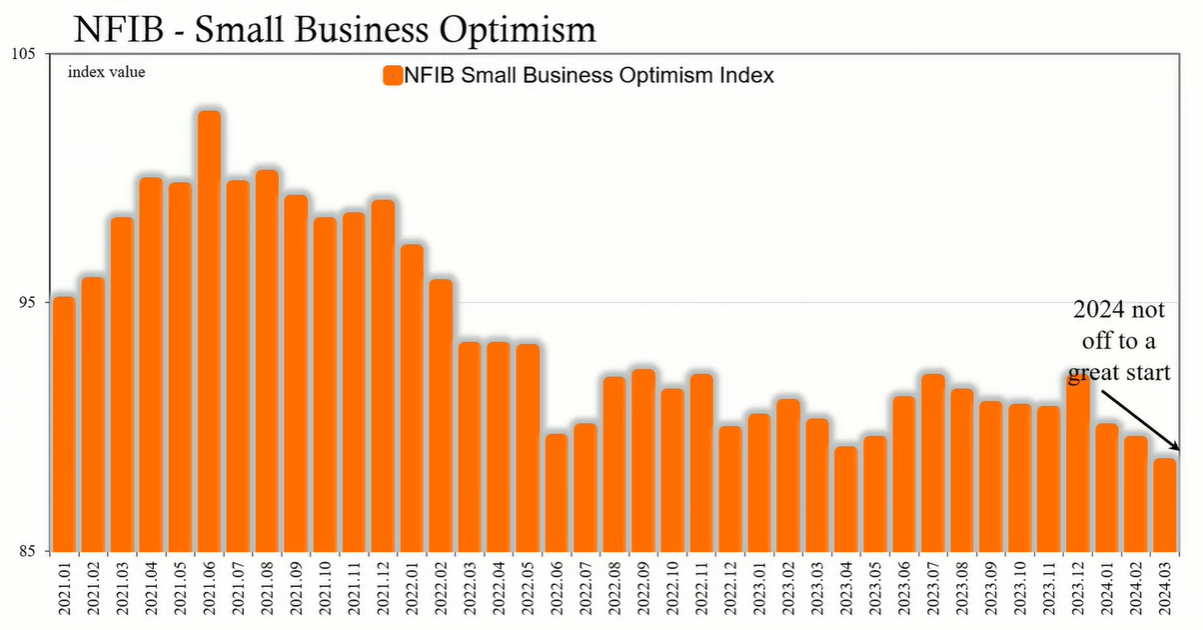

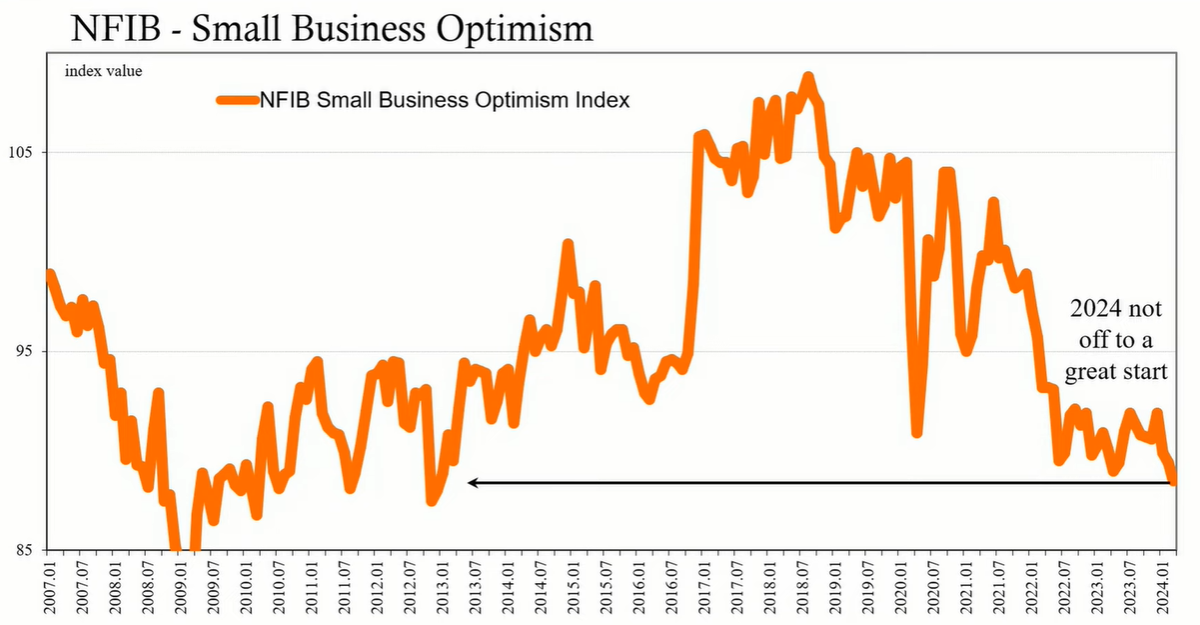

The sentiment among small business owners, as measured by the National Federation of Independent Business (NFIB), reveals a less optimistic outlook. The Small Business Optimism Index has dropped to its lowest level in a decade, reflecting challenges in sales, revenue expectations, and job creation.

The financial market's current stability in interest rates, despite external pressures, aligns with a narrative of economic fragility rather than robust growth. The yield curve's persistent inversion and the cautious approach of central bankers underscore the likelihood of future rate reductions. Small business sentiment corroborates this perspective, emphasizing the disconnect between surface-level economic indicators and the underlying economic reality.