The United States, amidst a globally synchronized recession, faces significant economic challenges. With countries like the United Kingdom, Germany, and Japan in technical recessions, and China's economy slowing, the US is not immune to these global economic shifts.

The global economy is facing a synchronized recession, with widespread implications for the United States. While the US may seem removed from economic troubles in Europe and Asia, the interconnectedness of the global economy means that international struggles have direct consequences for the United States, affecting not only its economy but also triggering significant migratory movements.

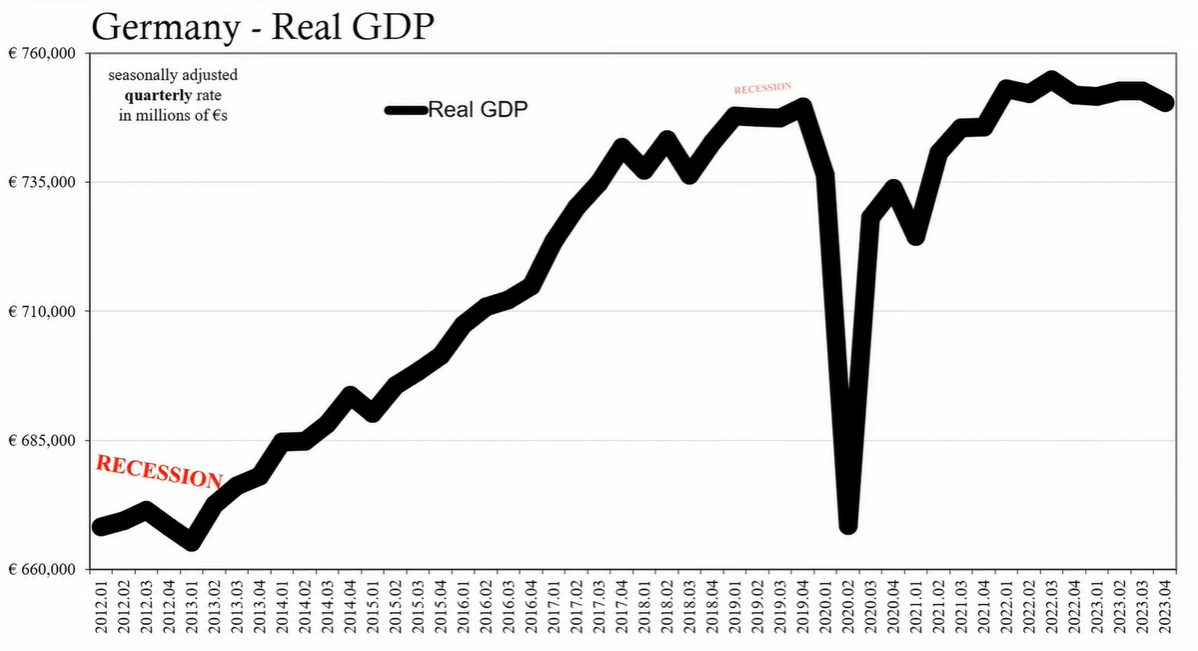

Recent data from various parts of the world point to a troubling economic trend. The United Kingdom, Germany, and Japan are among the nations that have entered technical recessions. This global economic weakness is not a transitory phenomenon but a persistent issue that has been exacerbated by factors such as the COVID-19 pandemic, geopolitical tensions, and internal structural problems within individual economies.

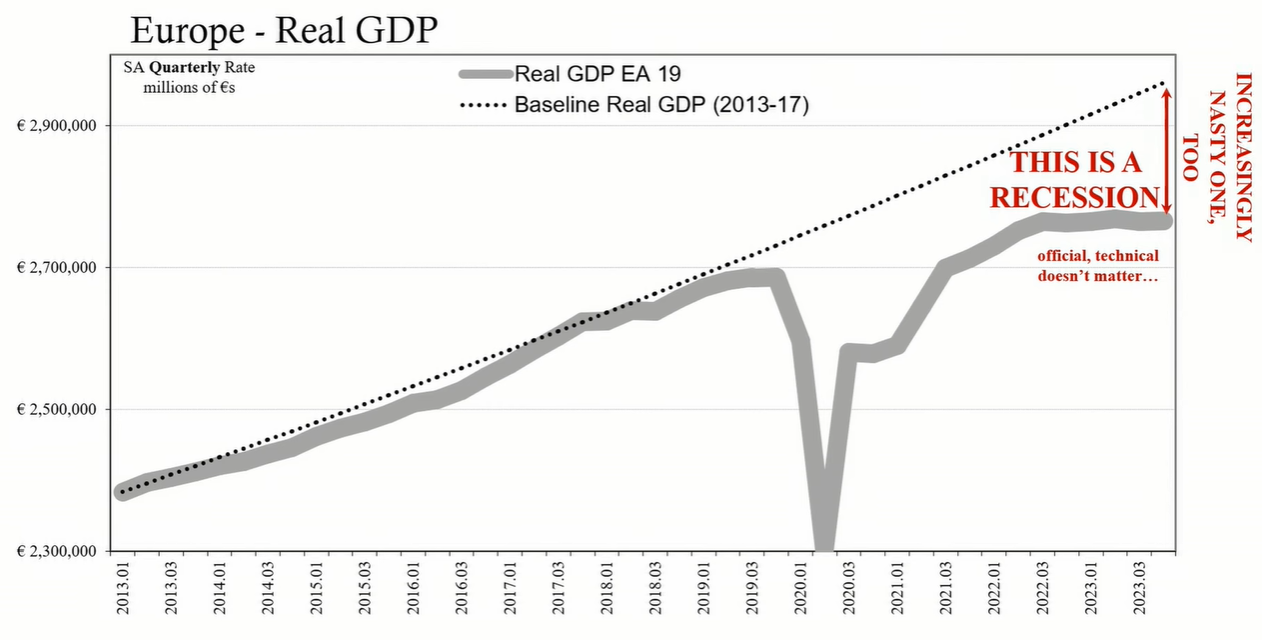

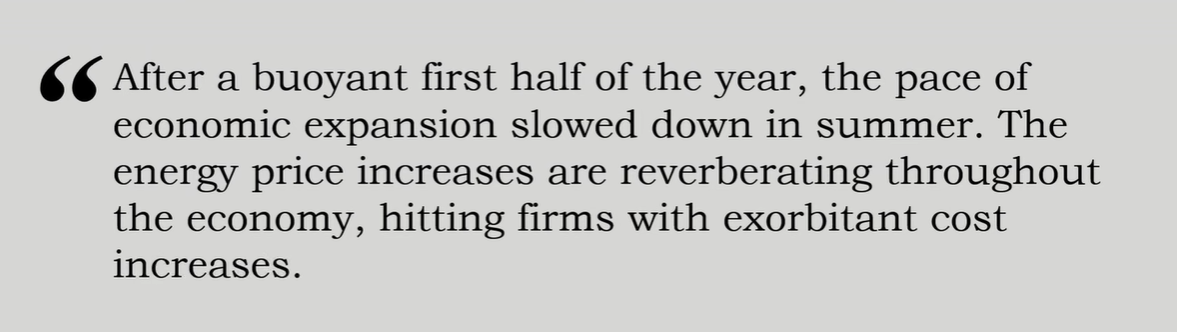

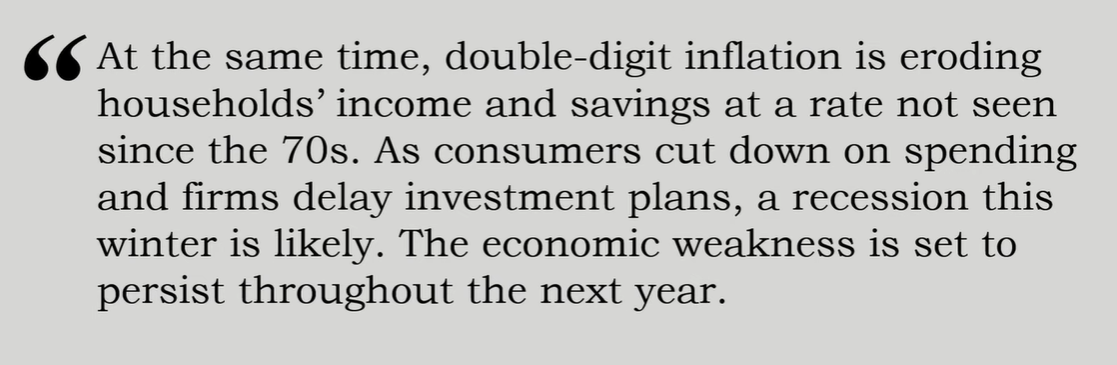

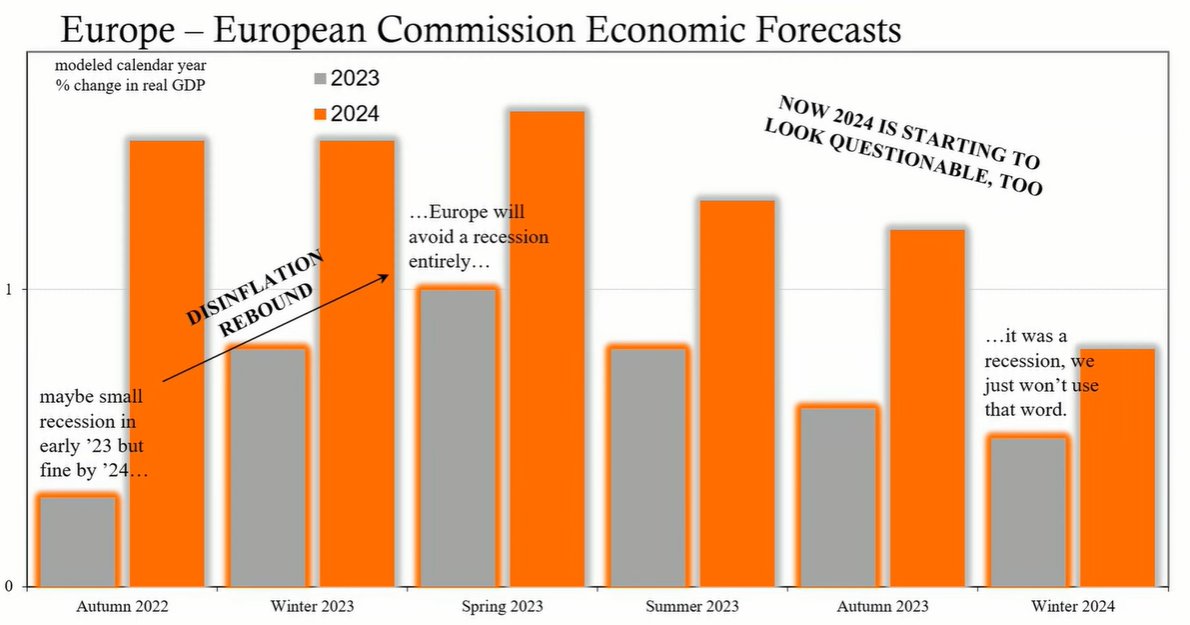

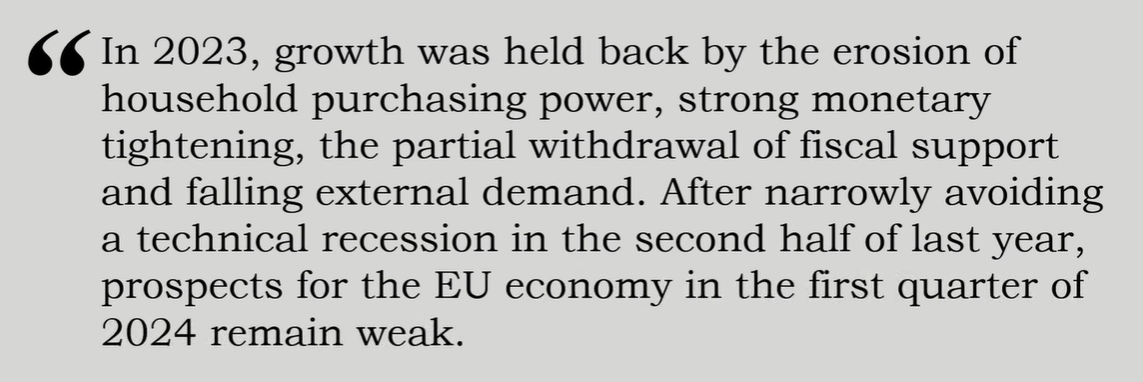

The European Commission has revised its economic outlook multiple times, with each iteration presenting a more delayed rebound. Initial hopes for a post-pandemic recovery have been dashed due to challenges such as energy price hikes, rampant inflation eroding household incomes, and a decrease in consumer spending and investment.

The pandemic's economic disruptions disproportionately affected emerging markets, which were already struggling prior to the crisis. The lack of a strong recovery in these regions has been evident, as the brief rebound observed in developed economies did not extend to less affluent nations.

The European Commission's latest forecast from November 2023 projected a modest recovery following a challenging year. However, the anticipated rebound has yet to materialize, and the winter update of February 2024 suggests a continued period of weakness, despite a faster easing of inflation.

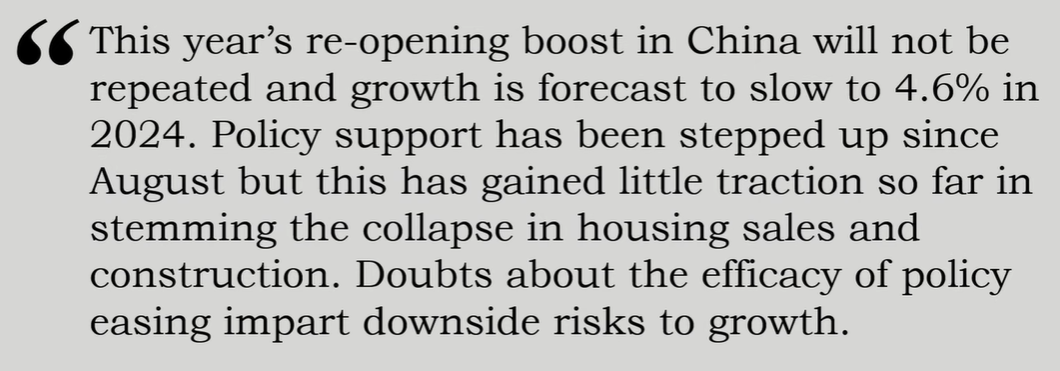

China's economic slowdown, particularly in the housing sector, has raised concerns about the global impact of its financial stresses. Despite policy support, Chinese banks are reluctant to lend, which has implications beyond its borders. A slowdown in China translates into reduced external demand, affecting global trade and the economies tied to it.

The stagnation and decline in global prosperity have prompted a significant migratory movement towards the United States. Individuals from Central and South America, and beyond, are seeking better opportunities as their home countries face worsening economic conditions.

Despite robust GDP and payroll reports, the US cannot remain impervious to global economic trends. Financial stresses in major economies, such as China, have the potential to strain the US economy through market disruptions, shifts in risk sentiment, and currency fluctuations.

The globally synchronized recession is not an isolated phenomenon—it has direct and indirect consequences for nations around the world, including the United States. As major economies grapple with recessions and economic stagnation, the effects ripple outwards, influencing trade, migration, and financial stability globally. The US may face direct economic risks, but even if its economy remains relatively strong, it cannot ignore the broader challenges that are increasingly knocking on its door.