Recent U.S. GDP growth figures obscure deeper economic challenges, as rising costs and declining consumer spending hint at underlying vulnerabilities.

The latest GDP report from the Bureau of Economic Analysis (BEA) has prompted a reevaluation of the US economic condition, especially in the context of global economic performance. After a surprising third-quarter surge in GDP last year, the question arises whether the US economy is truly booming or if this was an anomaly.

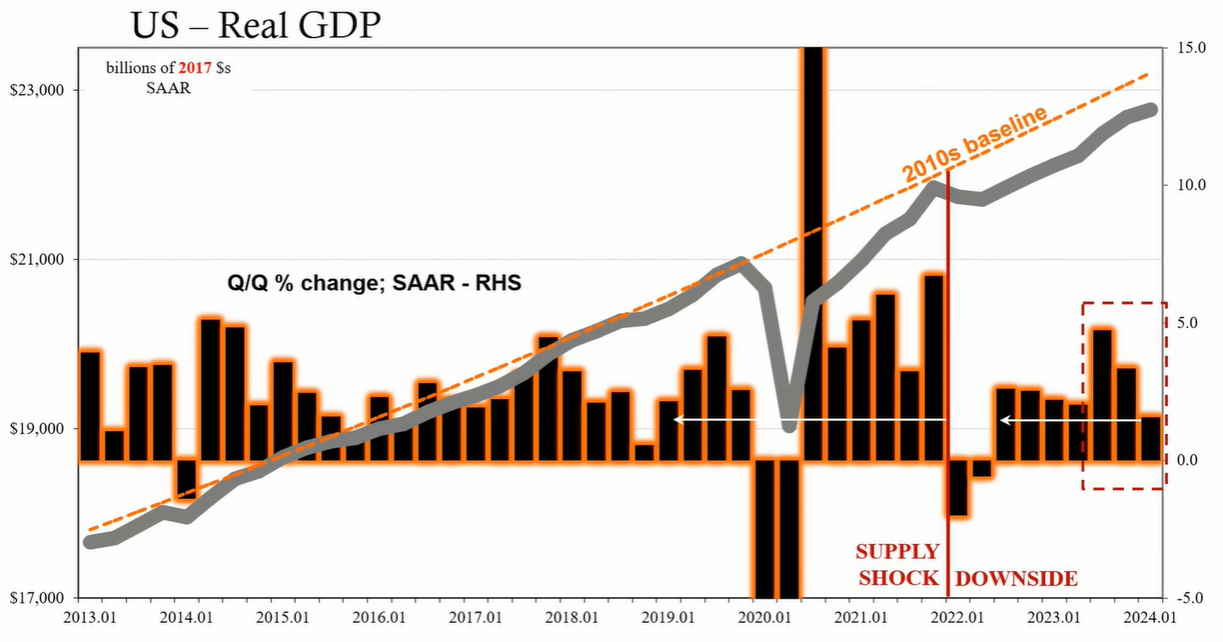

In the third quarter of the previous year, the US GDP surged to almost 5%, a figure that stood out compared to the performance of other global economies, many of which were either in recession or on the brink of one. This surge suggested a booming US economy, even though other economic data hinted at struggles.

However, the subsequent fourth-quarter report showed a slight decrease in GDP, maintaining the narrative of a strong economy, albeit with a softer growth rate. This juxtaposition between GDP figures and the experiences of businesses and consumers raised doubts about the accuracy of these economic indicators.

The first quarter estimate for the current year showed a 1.6% growth in GDP, the lowest in two years, falling short of the 2.5% expectations. This drop has raised concerns over the reliability of GDP as an accurate reflection of the economy's health.

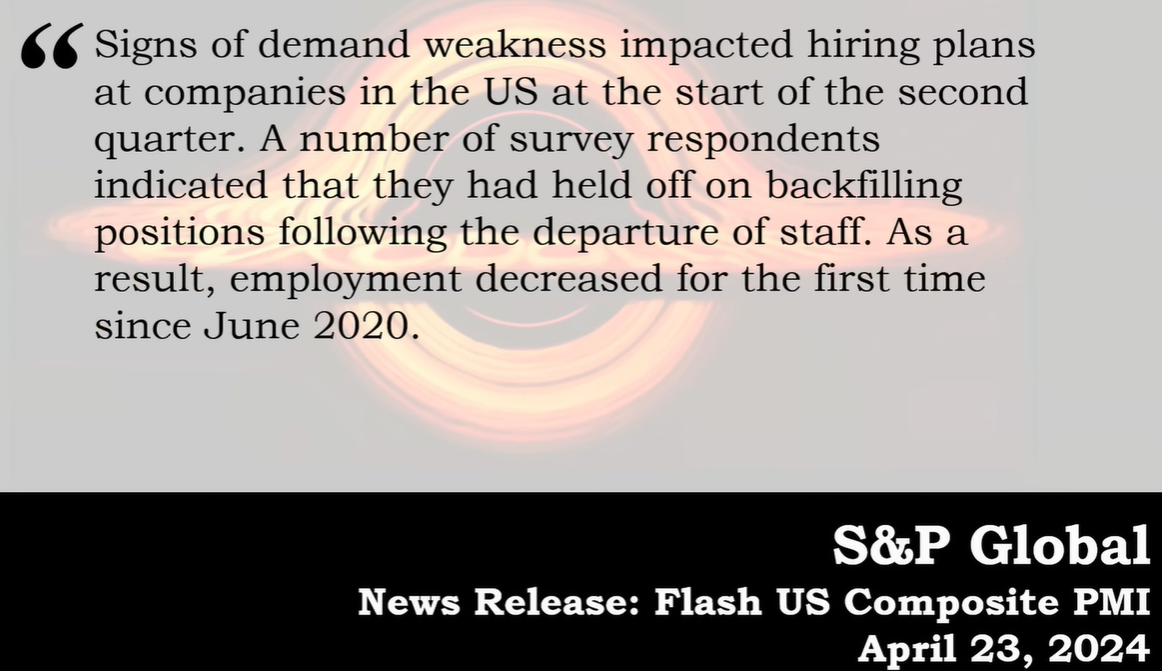

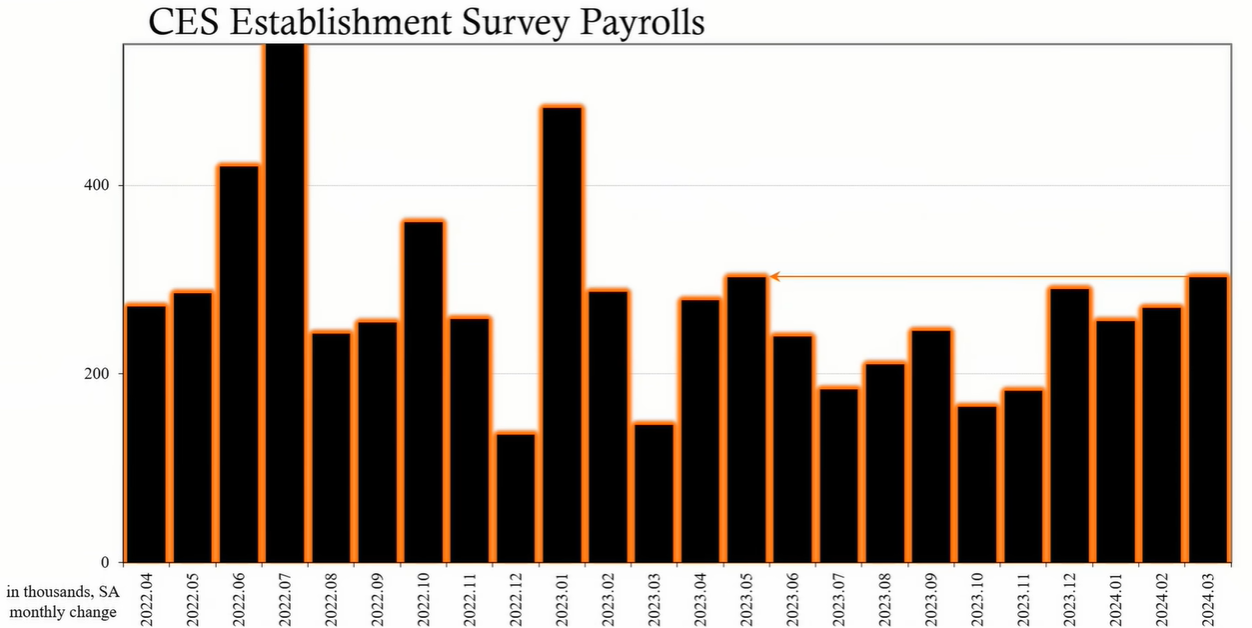

Data from Purchasing Managers' Indexes (PMIs), inventory levels, manufacturing statistics, and labor market indicators suggest a different picture than what the GDP figures initially conveyed. For instance, PMIs and labor data indicate that firms are under considerable pressure, which is inconsistent with the high GDP growth rates previously reported.

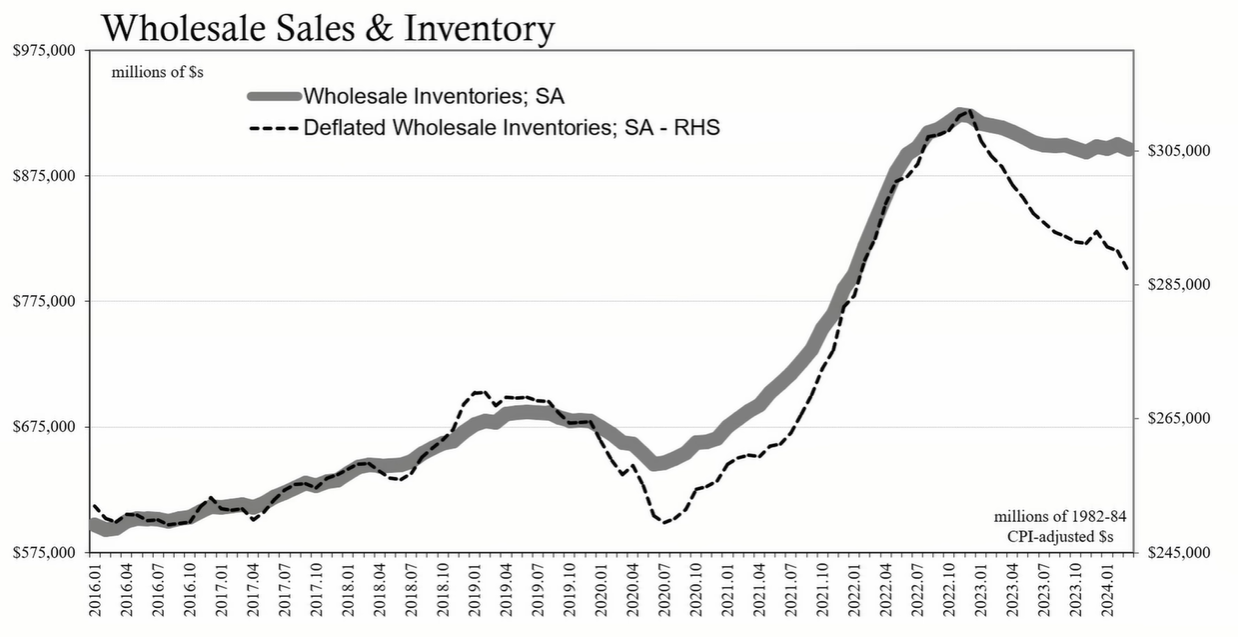

Inventory levels have displayed a mixed narrative, with some data suggesting an accumulation of inventory, ostensibly anticipating a consumption boom that failed to materialize. This mismatch between inventory and consumption is further evidence that the GDP figures may have been misleading.

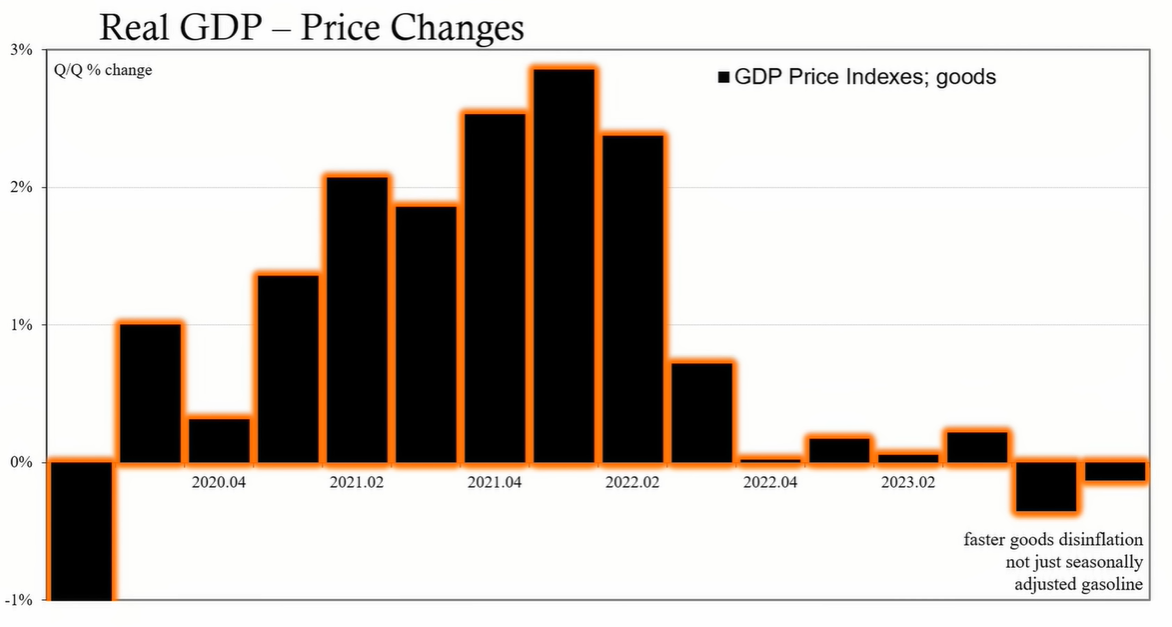

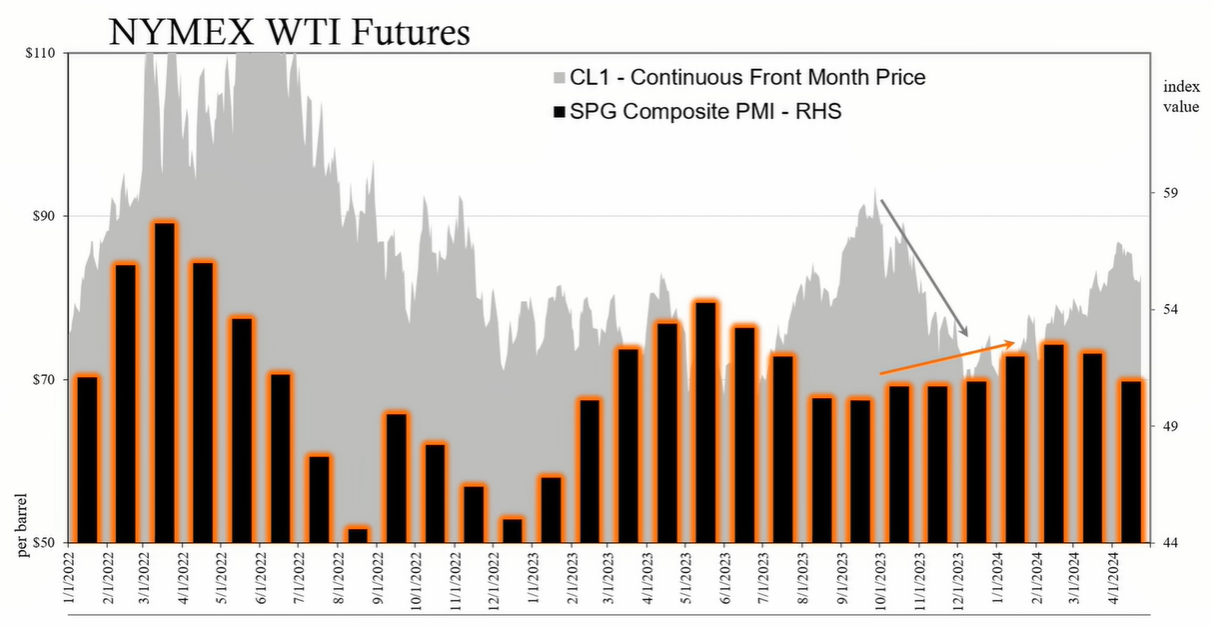

The increase in oil prices and insurance costs has been a significant factor affecting consumer spending and the overall economy. The rise in oil prices, which seemed negligible during the third quarter of the previous year, now appears to have a more profound impact on the economy, as suggested by recent PMI reports.

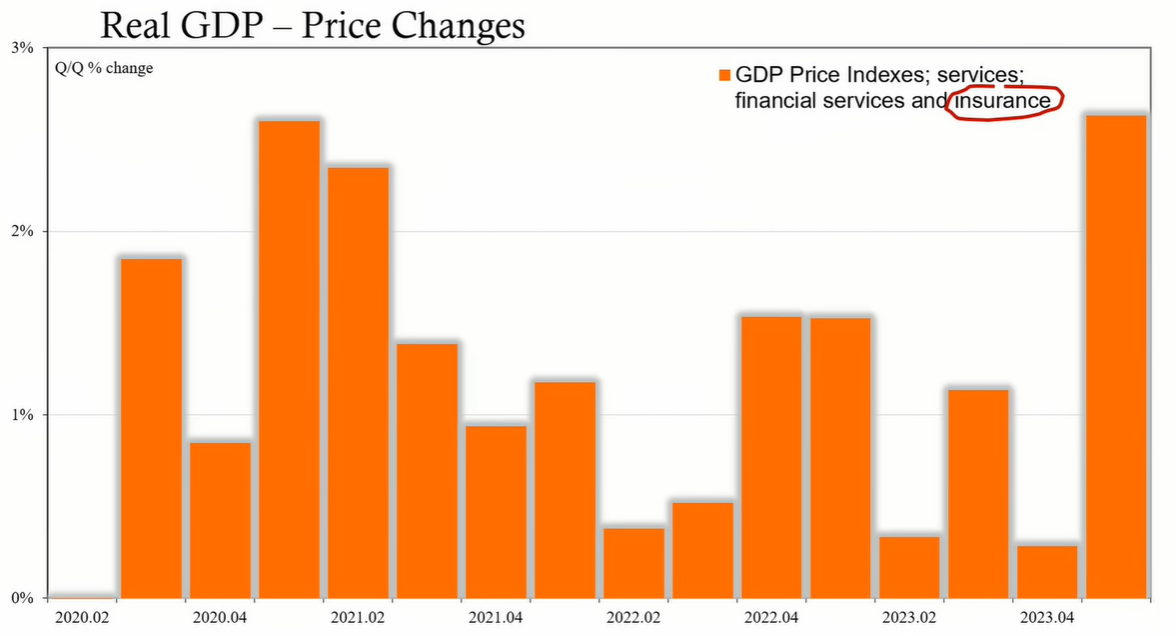

Additionally, a sharp increase in insurance expenses has imposed an additional burden on consumers and businesses, leading to a reduction in discretionary spending. This trend is not conducive to economic growth and may point towards a decelerating economy.

The services sector, often seen as a leading economic indicator, has shown signs of distress, with PMIs indicating declining employment levels. This trend contradicts the expectation of a resilient services sector and could signal broader economic challenges.

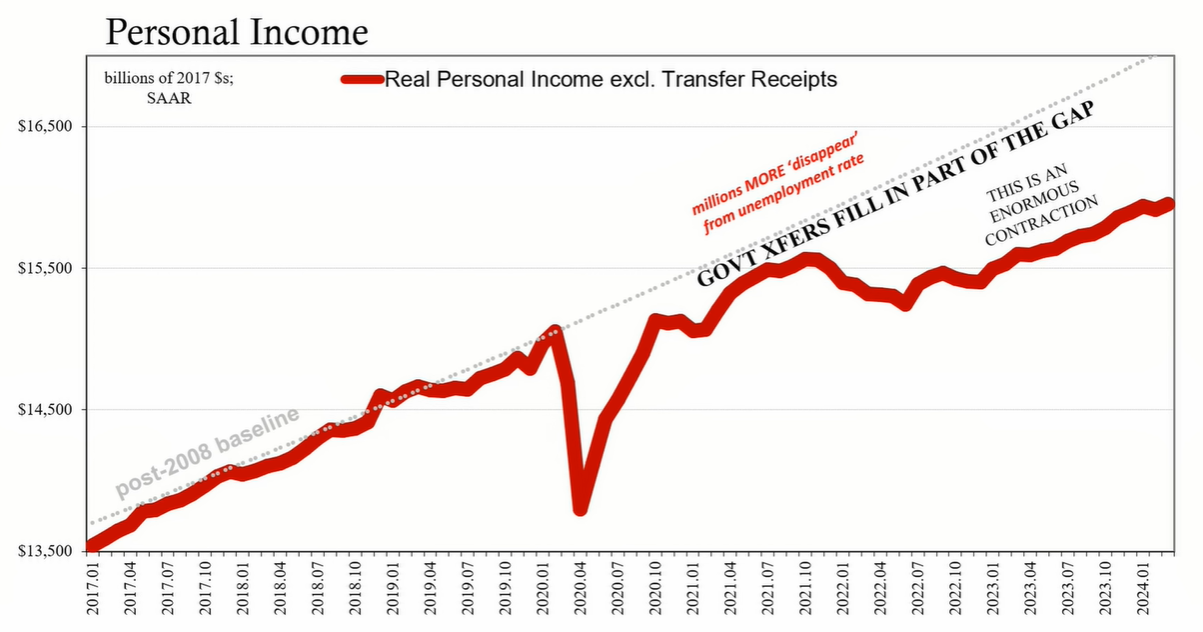

Government financial support has been a stabilizing factor for the economy, but recent data suggest that such transfers are diminishing. Alongside a declining savings rate, this trend may indicate that consumers are reaching a threshold beyond which spending cuts become inevitable, potentially pushing the economy closer to a downturn.

The inconsistencies between the GDP reports and other economic data have raised questions about the true state of the US economy. While payroll reports continue to show strong employment numbers, alternative indicators suggest that the economy might be heading towards a more significant slowdown.