Navigating health insurance can be challenging for freelancers in Texas. The costs can vary widely, depending on the type of plan.

For a 30-year-old, a silver ACA health plan costs about $453 a month, while a 40-year-old might pay around $509 a month.

Freelancers must also consider deductibles and out-of-pocket maximums.

For example, the Trailblazer plan available in Texas has a monthly premium of $390, a $4,500 deductible, and a $7,150 out-of-pocket max.

Shopping around and comparing different plans is crucial.

Being self-employed means no employer is there to cover part of the insurance premium. Texas, with its dynamic economy, sees many freelancers and independent contractors seeking affordable health insurance options. This makes finding the right plan essential.

Freelancers in Texas need to consider various factors when choosing health insurance. Without an employer to help cover costs, they must pay the full premium themselves. This makes it crucial to choose an affordable plan.

Premiums are the monthly payments made to keep the insurance active.

For instance, a plan like Decent's Trailblazer costs about $390 monthly.

Deductibles are the amounts paid out-of-pocket before the insurance starts covering medical costs.

Some plans, like the one mentioned, have deductibles of around $4,500.

Freelancers can explore several plan types:

Exploring organizations like the Freelancers Union can also be beneficial. They often offer tailored health insurance options for members. UnitedHealthcare provides suitable freelancer plans, including bronze and silver options.

The cost of health insurance for freelancers in Texas varies widely. These costs depend on age, gender, location, insurance provider, type of health plan, and government subsidies or tax credits.

Age and gender significantly influence health insurance premiums.

Younger adults generally pay lower premiums. For instance, a 30-year-old might pay around $390 monthly, while a 60-year-old could pay much more.

Gender also plays a role. Although the Affordable Care Act limits gender-based pricing, women of childbearing age may face slightly higher premiums due to coverage for maternity services.

Where a freelancer lives in Texas can impact health insurance costs.

Urban areas like Houston, Dallas, and Austin usually have higher premiums than rural regions. This is due to the higher cost of medical services and greater demand for healthcare in cities.

For example, premiums in Dallas might range from $300 to $750 per month for a 40-year-old individual.

Different insurance providers offer varying premiums for similar health plans.

Premiums can differ based on the insurer’s pricing strategy, network of healthcare providers, and administrative costs.

Freelancers should compare plans from multiple providers. A plan from Decent's Trailblazer might have a premium of $390, while another insurer could offer a similar plan at a different rate.

The type of health plan chosen affects costs.

High-deductible health Plans (HDHPs) typically have lower monthly premiums but higher out-of-pocket costs. Preferred Provider Organizations (PPOs) offer more flexibility in choosing doctors but come with higher premiums.

With deductibles varying from $0 to $8,700, freelancers must assess their healthcare needs and budget.

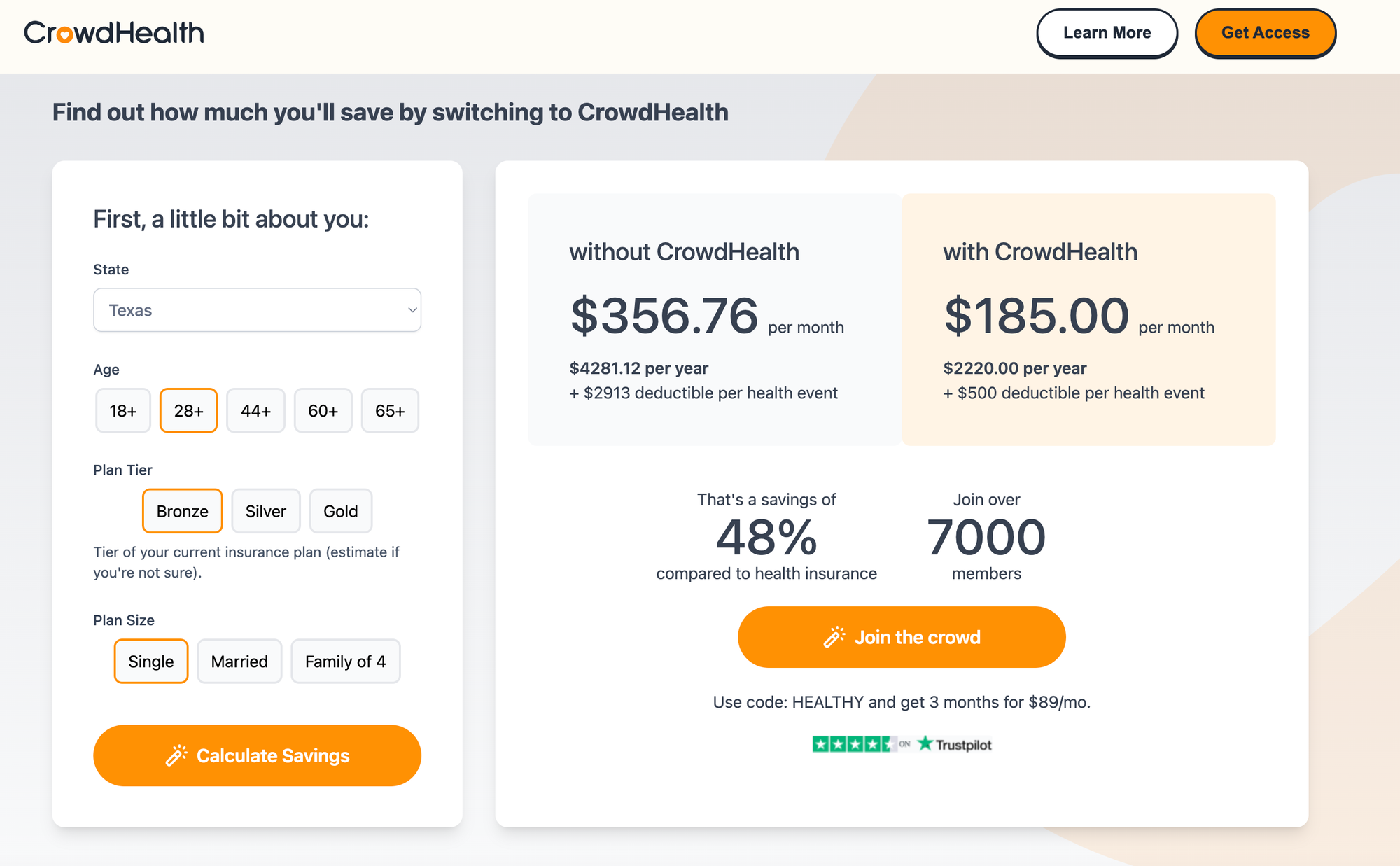

Crowdhealth can save you anywhere from 40-70% percent of your Texas healthcare premiums. Don't believe us? Check out the calculator here and set up a call to learn more today!

Use promo code "healthy" for an exclusive deal. First 3 months for just $89 dollars!