The Federal Reserve reports an historic operating loss of $114 billion, the third largest bankruptcy event in U.S. history.

The Federal Reserve just reported its largest loss in history. By far.

But don't worry – you'll be covering it.

A few days ago the Fed announced its preliminary 2023 financial statements. Note these aren't audited results – we have to take the Fed at its word.

You may recall Ron Paul's decades-long campaign to audit the Fed, which failed since the Fed is an unconstitutional racket who answers to nobody. As Murray Rothbard noted, the Fed has less oversight than the CIA.

At any rate, even with the Fed grading its own work, last year it reported an operating loss of one hundred and fourteen billion dollars.

To put that in perspective, it would be the third largest bankruptcy in American history – just behind Lehman Brothers and Washington Mutual in 2008.

In a single year. With much more to come.

So how did the Fed lose so much money?

Some of it comes from their paying Wall Street to park money at the Fed, which it does to hide inflation and because it likes handing money to Wall Street.

But the bulk of the Fed's losses are because they printed trillions to finance Covid lockdowns, used those trillions to buy bonds – mainly government debt. Then when they panic-hiked rates to try and choke off inflation, bond prices collapsed.

Meaning the Fed's pile of $9 trillion worth of bonds started losing money hand over fist. In fact, estimates of unrealized losses -- meaning money the Fed has lost but hasn't yet fessed up to -- could be well over a trillion dollars at this point.

Of course, those unrealized losses don't come clean until the Fed sells the bonds.

Which they do either because the bond matured -- bonds have a fixed time, like 90 days or 5 years. Or because the Fed pawned them off to try and soak up inflationary dollars -- called quantitative tightening.

Last year's hundred and fourteen was a bit of both, with another trillion-odd to come. So far.

So what does it mean? In the near-term, nothing: the Fed ignores losses because in a pickle it can just print money -- converting it into inflation.

Longer term, though, every last penny the Fed loses is going on the taxpayer tab.

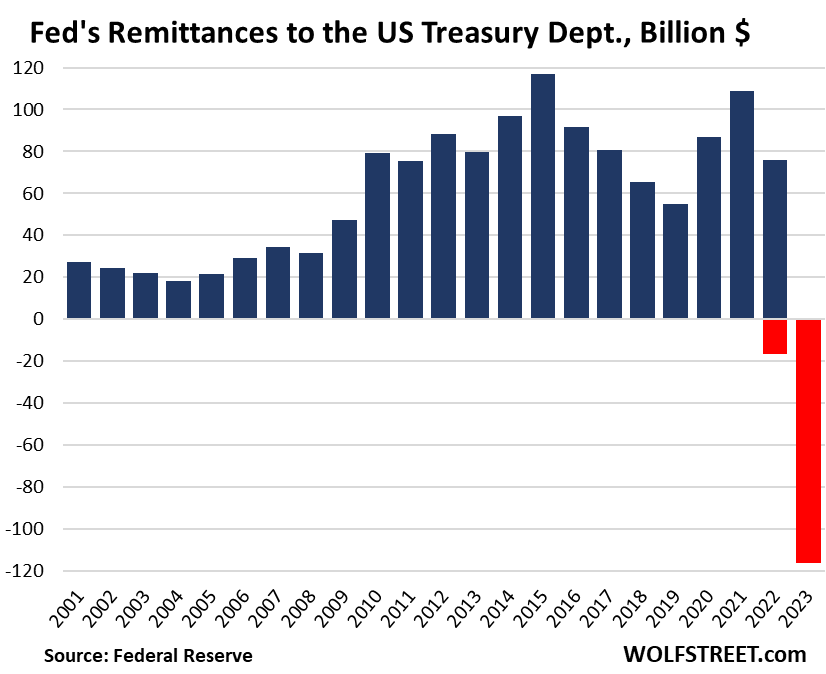

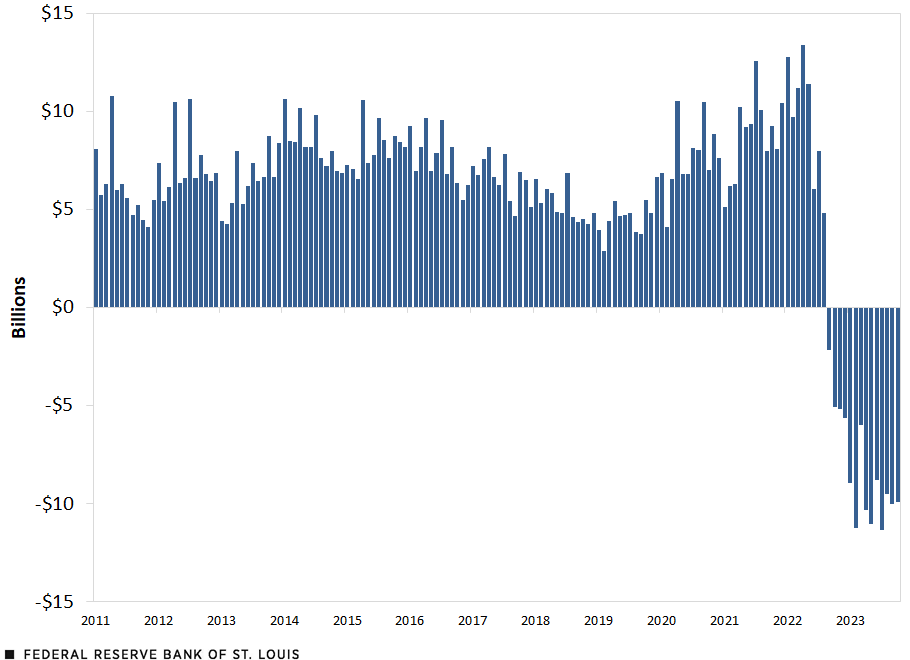

Because all those losses cancel the money the Fed is supposed to pay treasury every year. These are called Fed remittances, and they're the profits from printing money and lending it out -- essentially a licensing fee for counterfeiting.

Those Fed remittances had been running about 80 billion a year. But now they'll be underwater for potentially decades.

It's worth noting this is fresh territory – the Fed never before turned in a loss until 2022. Now it will be losing money until our kids are grown.

The Fed's losses are just beginning -- 114 down, a trillion plus to go.

In fact, they'll continue getting even bigger until interest rates come down hard. Which will only happen with a hard recession – meaning yet more trillion in debt.

Either way, we're looking at trillions more on a federal debt that's already hit $275,000 per American household, growing at almost $30,000 per household per year.

Originally published on Profstonge Weekly