As uncertainty looms over the global economy, the Federal Reserve faces a daunting challenge with its $8 trillion balance sheet, a repository of assets that could potentially strangle credit, skyrocket mortgage rates, and hasten an economic recession.

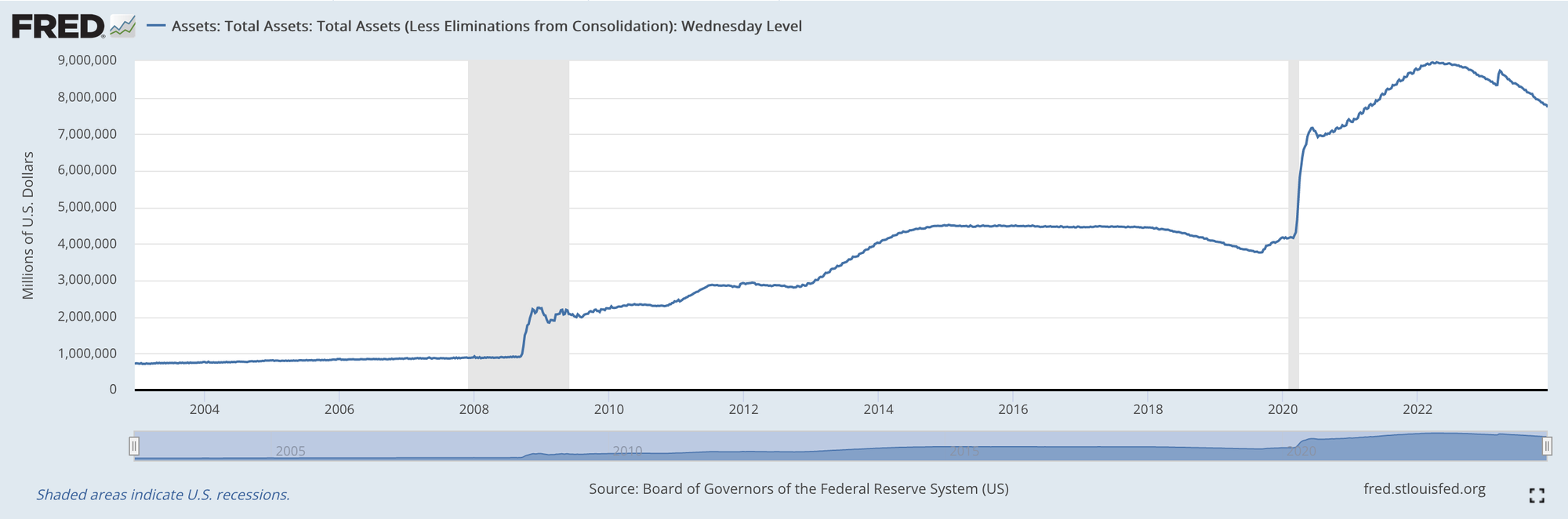

As uncertainty looms over the global economy, the Federal Reserve faces a daunting challenge with its $8 trillion balance sheet, a repository of assets that could potentially strangle credit, skyrocket mortgage rates, and hasten an economic recession. Unlike the traditional focus on interest rates, the Fed's balance sheet has emerged as a second destabilizer since its significant expansion in response to the 2008 financial crisis and the recent COVID-19 pandemic.

Utilizing a process akin to conjuring money by adding zeros in a spreadsheet, the Fed has amassed a vast collection of government bonds and mortgage-backed securities. This expansion, from a pre-2008 hundreds of billions to nearly $9 trillion at the height of the pandemic, was intended as a measure to stabilize markets under extraordinary circumstances. However, the current balance of about $8 trillion remains staggeringly high, representing nearly half of all bank accounts in the United States.

The pressing issue at hand is the Fed's strategy to unwind these assets without exacerbating inflation, which has been driven in part by this very expansion. The money supply has already diluted the value of existing dollars, with only a portion of the inflationary impact realized, as much of this new money resides in savings. Reducing the balance sheet by selling assets and negating the associated zeros is necessary to curb inflation, but doing so risks a decline in asset prices due to basic supply and demand dynamics.

The dilemma is compounded by a $10 trillion wave of government debt roll overs that is approaching the markets, with little appetite from traditional buyers such as banks, China, and Saudi Arabia. With these entities diversifying away from the dollar and dealing with their own economic priorities, the Fed's potential sale of assets could collide with Treasury Secretary Janet Yellen's efforts to finance government debt, creating a buyer's market with potentially dire consequences.

An alternative could be to sell the $2.5 trillion in mortgage-backed securities, but this move could have dire effects on the housing market. The Fed has long subsidized housing, a significant factor in the surge of house prices. A shift to selling these securities could drive mortgage rates even higher, further freezing the housing market and jeopardizing the net worth of countless Americans whose equity in their homes represents their financial bedrock.

In conclusion, the Federal Reserve, having inflated its balance sheet to unprecedented levels, now confronts a scenario with no straightforward resolution. As the Fed grapples with the task of reducing its holdings without triggering financial upheaval, the economic world watches with bated breath. The path forward remains fraught with risk, and the consequences of missteps could be felt across the entire economy.

The Fed is sitting on an $8 trillion mountain of stolen goods that it needs to get rid of. Selling it could strangle credit, hike mortgages, and crash treasury markets.

— Peter St Onge, Ph.D. (@profstonge) December 11, 2023

By writing a blank check to Washington, the Fed stuffed an $8 trillion elephant onto a canoe. There is no… pic.twitter.com/fGePQkQeTT