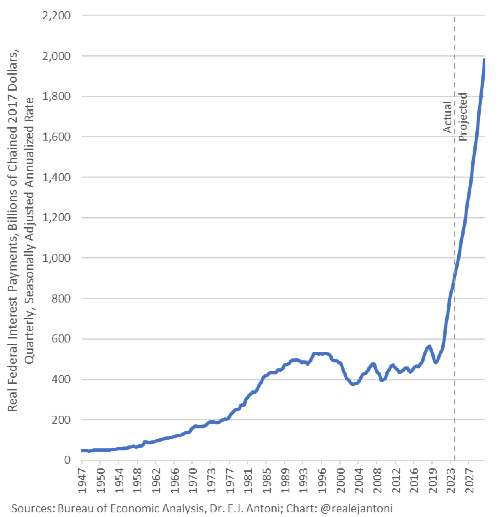

For the first time in American history, interest on the national debt has crossed $1 trillion, with projections indicating it could reach $3 trillion in just five years.

For the first time in American history, interest on the national debt just crossed the one trillion dollar line.

In fact, it's projected to hit 3 trillion in just 5 years.

As Wall Street Silver asks, do you think we have a spending problem.

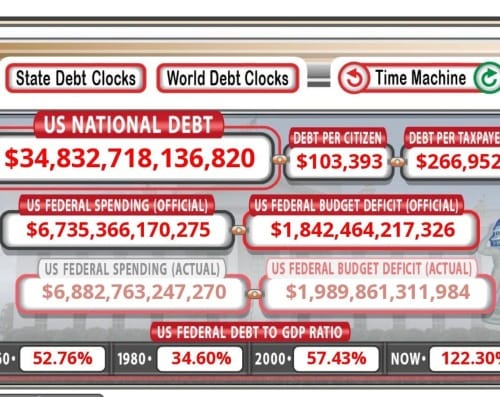

First the numbers. Treasury reported that last month the federal government collected $324 billion from the hard working yet defenseless Americans who earned it.

And they spent nearly one-third of it -- $103 billion -- just to service the debt. That not guns or butter, it's just interest.

Meanwhile, the feds actually spent 671 billion on the month.

Meaning roughly $347 billion in fresh debt. In one month.

For perspective, on an annualized basis that's $4 trillion collected, $1.2 trillion in interest, then $8 trillion spent.

So, yes, we might just have a spending problem.

The problem is not only are these numbers approaching goofytown, the debt itself is getting expensive fast.

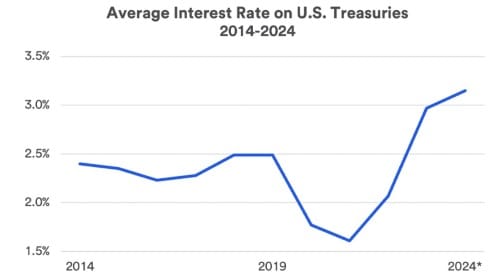

Four years ago the average federal debt was paying 1.6%. Now it's 3.2%. So double.

Take a larger debt and double the interest rate and you're on a treadmill off a cliff.

In fact, debt interest is basically on auto-pilot towards 2 trillion, as old 1.6 debt is replaced by new debt that, thanks to the Fed, actually now costs around 4 and a half percent.

Keep in mind that’s not even counting new debt. Treasury borrowed almost a trillion in the first 6 months of this year, and plans to borrow another 850 billion in the next 3 months.

This kind of borrowing is unprecedented in peacetime and, of course, will jump when the recession hits – they typically add a few trillion in deficit between crashing tax revenue and soaring benefits.

So far it's pretty dire. But it gets worse. Because that escalator of doom assumes an orderly Treasury market.

In other words, it assumes there's enough buyers to absorb not just the 35 trillion in federal debt floating around but also the 2 trillion in new debt we're pumping out every year.

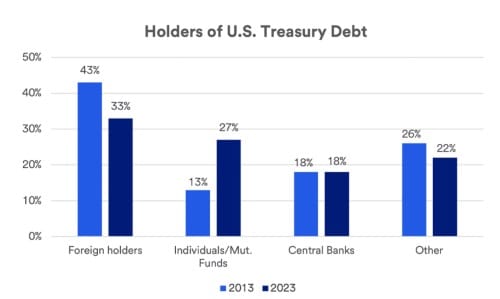

In fact, our 3 biggest foreign buyers -- China, Japan, and Saudi Arabia and Gulf regimes -- are either actively reducing treasuries (China), already struggling to fund their own mammoth debt (Japan), or being bribed or cajoled by by China and Russia to ditch dollars -- hence to ditch Treasuries.

In fact, foreign buyers now own just a third of US debt — down from 43% a decade ago.

That leaves the last man standing: individual Americans.

Since 2008 and especially as rates rose in Bidenflation, individuals have ramped up their buying, going from 13% to 27% of publicly held debt.

The problem is this leaves individuals exposed not just to rising inflation -- which hikes rates and guts bonds -- but to any treasury disruptions.

Because anything that hikes rates slams bond prices -- that's what crashed banks last year.

So if Treasury markets do go wonky for lack of buyers or sheer scale of debt, next time it will hit banks, sure, but it will also hit the roughy $7 trillion of treasury bonds now held in retirement accounts.

The federal debt tsunami is hitting unsustainable levels, with very little interest in Washington in fixing it.

Increasingly it’s individual Americans who are holding it all together, dumping their life savings directly into the firing line.

For 50 years Washington's solution to every crisis it creates has been more spending -- more debt.

If the debt itself is the crisis -- if the calls are coming from inside the house -- Washington is out of ammo just when the big one hits.

Sign up for free weekly articles to skip the mainstream media filter and get straight to what the bastards are trying to do to you.

Originally Published on Profstonge Weekly