A policy pivot, defined as the transition from raising interest rates to lower them, coupled with the injection of liquidity into the economy through quantitative easing, has sparked a debate on its implications for the job market and individual retirement accounts.

During December's FOMC meeting the Federal Reserve appeared to be shift gears from its stance of "higher for longer" to a more dovish 2024. Expecting multiple rate cuts throughout the year. This move has many asking why the Fed changed its tune so quickly. A policy pivot, defined as the transition from raising interest rates to lower them, coupled with the injection of liquidity into the economy through quantitative easing, has sparked a debate on its implications for the job market and individual retirement accounts.

The Federal Reserve's pivot, typically a response to fears of recession, is particularly surprising given the current context of soaring inflation rates. This strategy, which historically leads to an economic boost by making borrowing cheaper, is at odds with the Fed's recent efforts to combat inflation by keeping money tight. The shift, which some speculate is politically motivated to aid President Biden's reelection prospects, has been met with skepticism and concern.

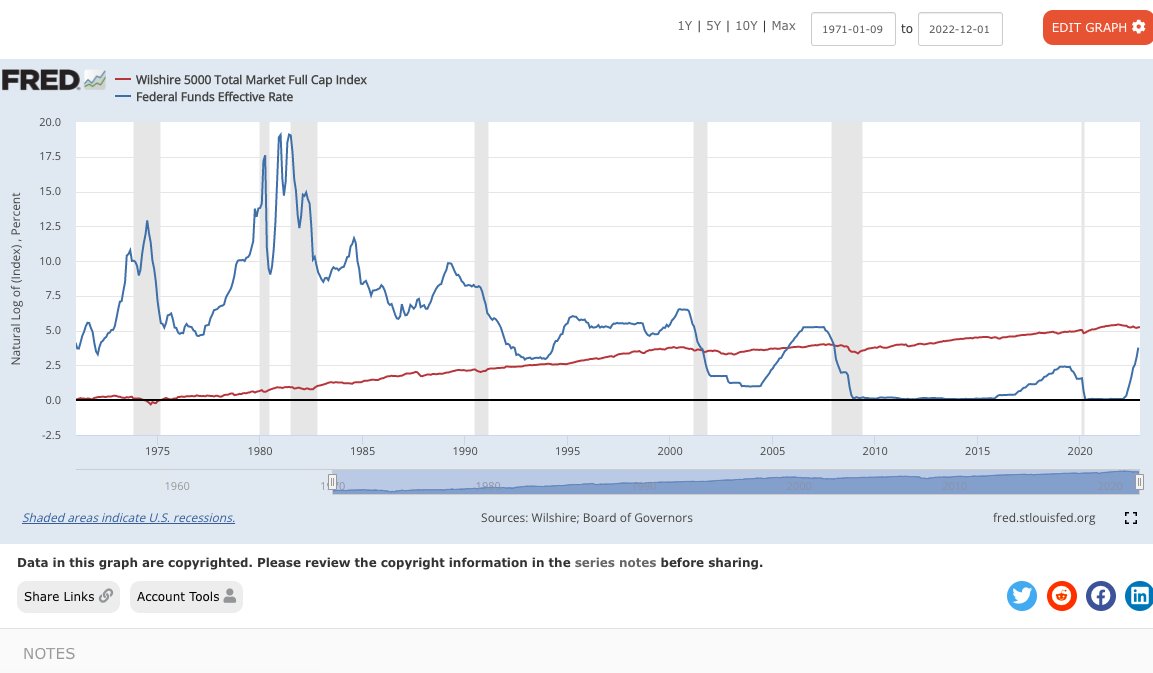

Historical data suggest that a Fed pivot often precedes a recession. Traditionally, within 12 to 18 months following such a shift, the economy experiences a downturn and unemployment rates climb, although the latter usually peaks after the onset of a recession. The stock market, known for its predictive capabilities, often reacts ahead of these economic indicators, signaling trouble for investors.

For those with equities in their retirement portfolios, the outlook is grim. Historically, in the last four recessions, stocks have plunged by an average of 32% following a Fed pivot. The timeline for these declines varies, with some taking as long as two years, as was the case before the infamous Black Monday crash of 1987, when the market dropped 23% in just one day.

The looming question is what the future holds. While the Federal Reserve's pivot might suggest an attempt to preempt a recession, the concurrent high inflation rates paint a picture of either a strategic misstep or potential political interference. With the past fifty years of business cycles as a guide, the trajectory seems pointed towards recession and a bearish stock market, though the unpredictable nature of the market leaves room for different outcomes.

Investors and traders should exercise caution in this uncertain climate, as the potential risks of entering the stock market could outweigh the benefits. As the situation unfolds, the financial community will be watching closely to assess the full impact of the Federal Reserve's pivot on the economy and individual investment strategies.