A Lendingtree study reveals that 78% of Americans now view fast food as a luxury due to soaring prices.

As the cost of living continues to soar, fast food, once the emblem of affordable convenience, has become a luxury for many Americans. In a revealing study by Lendingtree, a staggering 78% of participants now classify fast food as a luxury item. The report, which surveyed 2,000 Americans on their financial habits, indicates a significant shift in consumer behavior, particularly in the wake of rising prices post-COVID.

Before the pandemic, a Big Mac was priced at $3.99, but today it stands at $8.29. Similarly, a Chipotle chicken burrito that cost $6.50 has jumped to $10.70. More staple items like chicken nuggets and cheeseburgers have seen price increases of up to 200% or more, placing additional financial strain on families. The result is a typical family meal at fast-food chains like McDonald's, which would have cost between $35 to $40, now hitting the $60 mark.

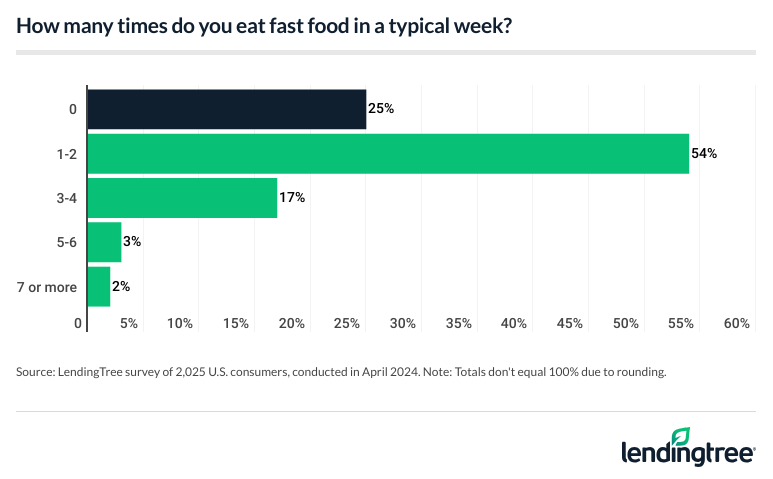

The Lendingtree study reveals that 74% of Americans used to indulge in fast food at least once a week. However, due to the spike in prices, 62% are now reducing their consumption, with 65% expressing shock at the current costs. Those scaling back most significantly include parents with young children, Generation Z individuals under 30, and women. Surprisingly, even among high-income groups, more than half report eating less fast food, potentially opting to cut down on full-service dining as well.

The implications of these changes are vast, considering the restaurant and food service industry employs approximately 14 million people in the United States. Lendingtree's analysis suggests that the era of relying on fast food as a budget-friendly option is over, with McDonald's transitioning from a modest budget aid to a noticeable dent in consumers' wallets.

This seismic shift in food affordability can be attributed to a combination of aggressive monetary policies, including $6 trillion printed by the Federal Reserve and $8 trillion in federal government deficits, all exacerbated by regulations and societal disruptions. The Federal Reserve's own data puts the fast food price increase at 41%, but a glance at actual menus shows a rise closer to 55%.

The Big Mac, long considered a more reliable indicator of inflation than government statistics, points to an inflation rate not at the 20 to 30% reported by officials, but closer to the 40% to 50% reflected by fast food prices. This suggests that the economic hardship is disproportionately affecting lower-middle and working-class Americans who lack the asset buffers to protect against such inflationary pressures.

Indicators such as life expectancy, housing size, car ownership, and dining habits are stalling or even reversing. While the upper echelons of society may remain insulated, it is the everyday American facing the harsh reality of tightened belts and fewer Happy Meals.