In 2010, $100,000 could theoretically purchase 24.39 million bitcoins, despite only approximately 2.9 million bitcoins being issued at that time, and well before the total cap of 21 million bitcoins is reached, projected to occur around 2140.

In a recent video, marking the 15th anniversary of Bitcoin's code release by its pseudonymous creator Satoshi Nakamoto, a comprehensive evaluation was presented by Matthew Mežinskis from Porkopolis Economics, showcasing the fluctuating purchasing power of various global currencies in Bitcoin terms. The exactly 15 years after Nakamoto introduced the code to the public and six days post the launch of Bitcoin's Genesis block.

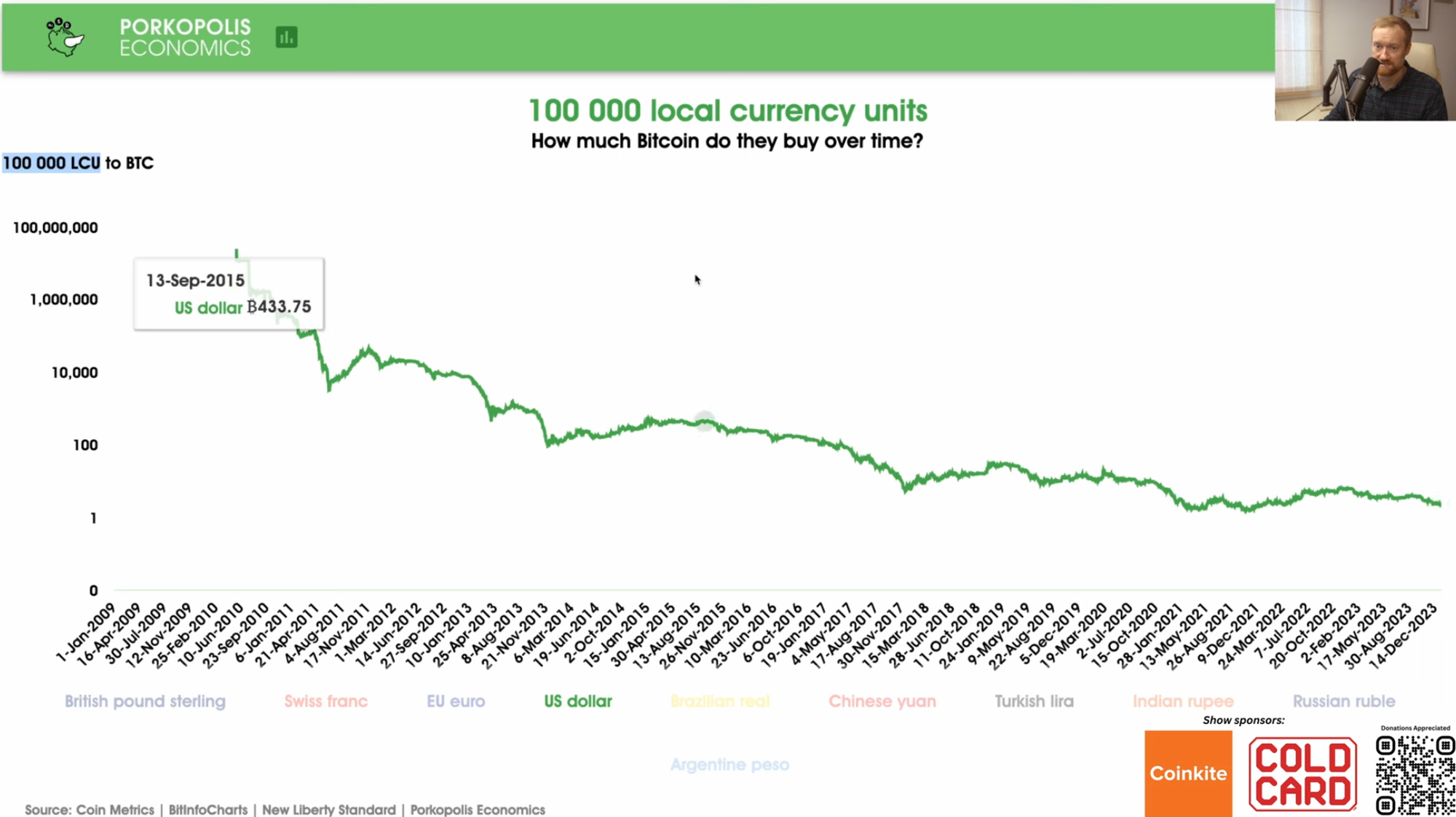

Mežinskis delves into the capacity of $100,000 in different currencies to purchase Bitcoin from its inception to the present day. The analysis offered a stark depiction of Bitcoin's scarcity and exponential growth, juxtaposed with the devaluation of fiat currencies.

In 2010, $100,000 could theoretically purchase 24.39 million bitcoin, despite only approximately 2.9 million bitcoin being issued at that time, and well before the total cap of 21 million bitcoin is reached, projected to occur around 2140. Today, that same sum can only secure 2.15 bitcoin, signifying a dramatic decrease in purchasing power due to Bitcoin's increasing value.

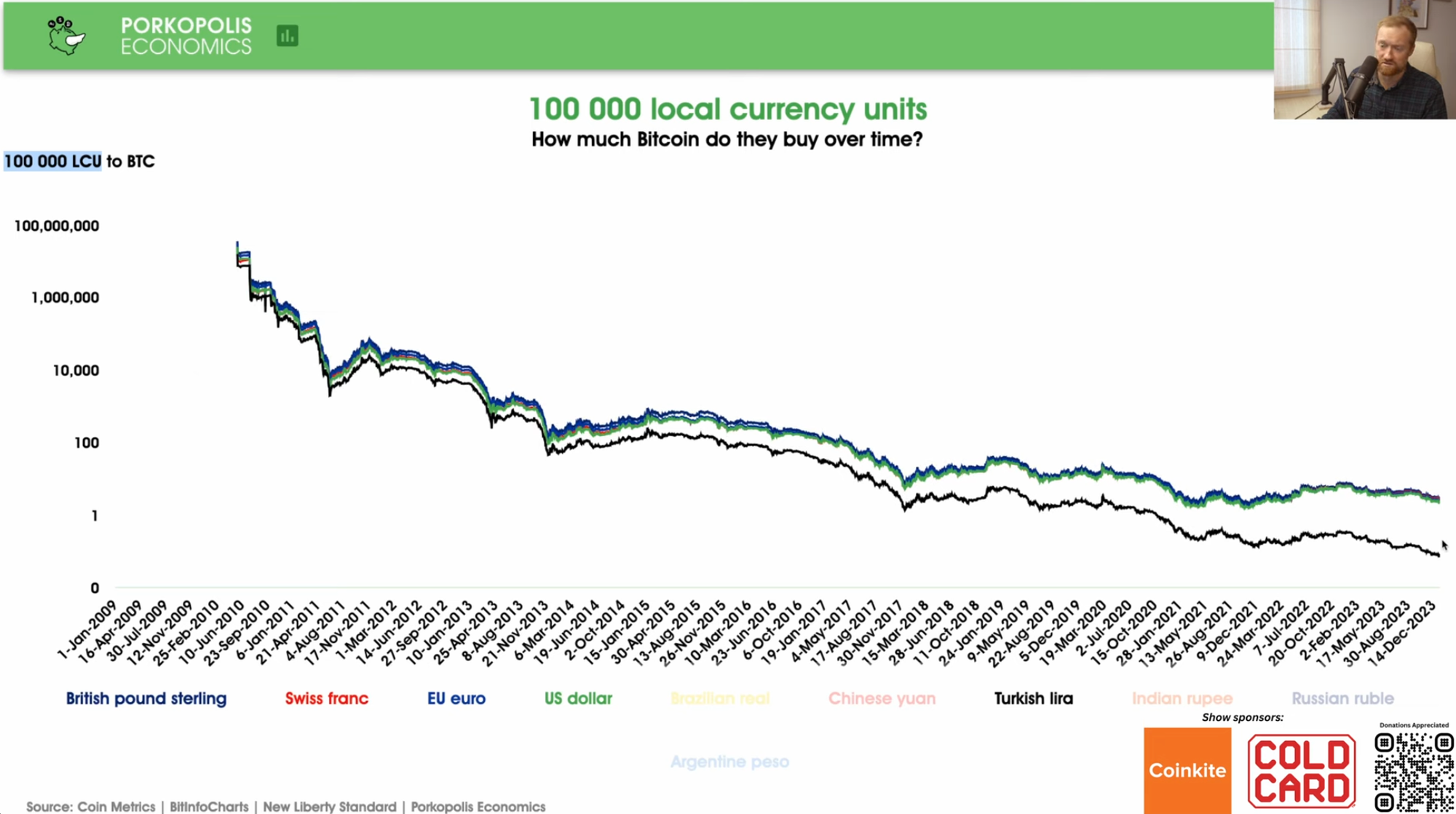

Mežinskis also compared major world currencies like the Euro, Pound Sterling, and Swiss Franc, all of which displayed a similar depreciation against Bitcoin. The Euro and Swiss Franc could fetch 2.35 and 2.52 bitcoin respectively, while the stronger Pound Sterling could buy 2.73 bitcoin.

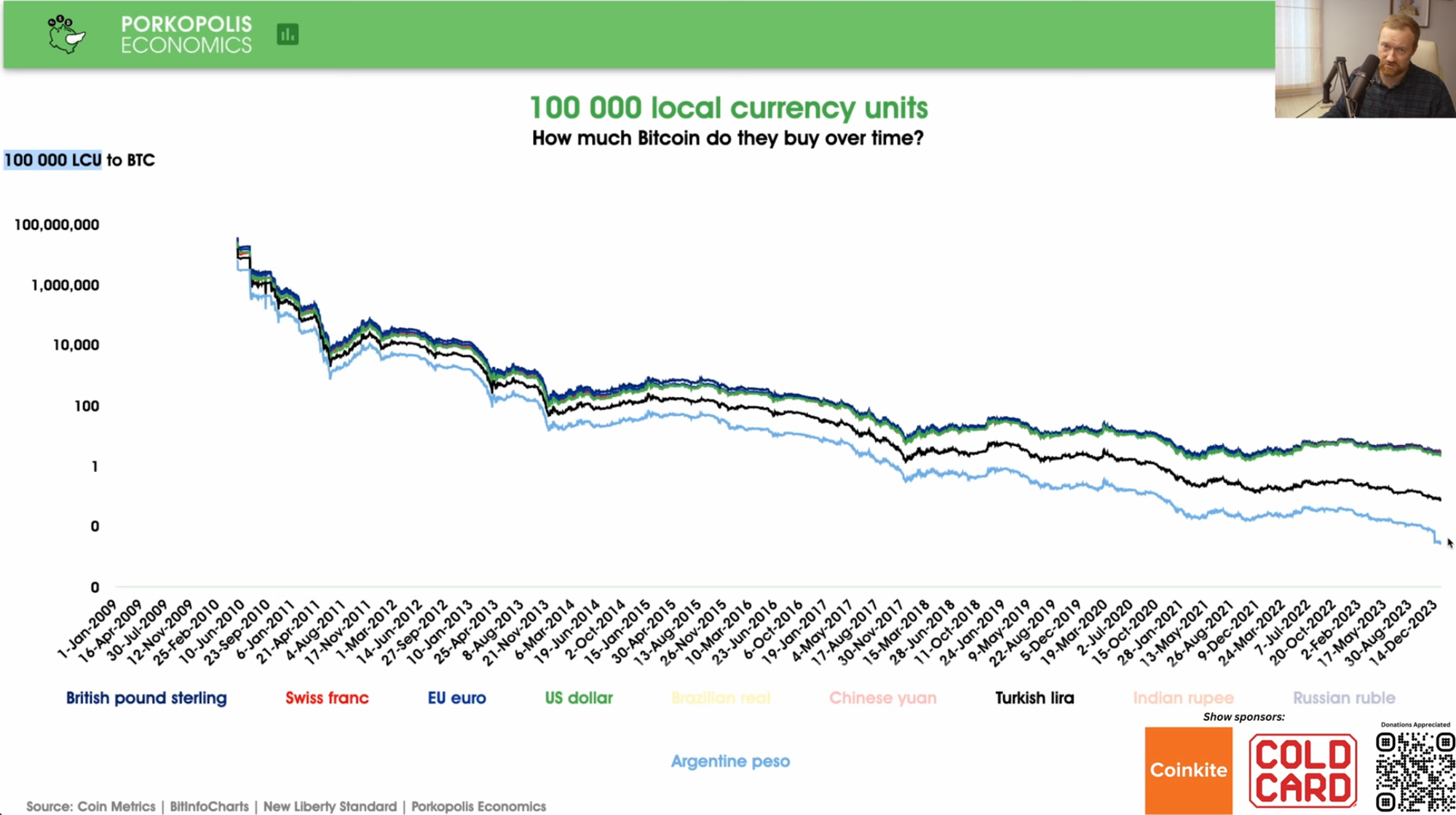

In contrast, the Turkish Lira and Argentine Peso were highlighted as currencies severely impacted by inflation. The Turkish Lira's purchasing power plunged from potentially buying the entire Bitcoin network to a mere 0.07 bitcoin today. The Argentine Peso fared even worse, with 100,000 pesos currently equating to less than 0.1 bitcoin, also emphasizing the discrepancy between official and black market exchange rates.

Other currencies like the Brazilian Real, Chinese Yuan, Indian Rupee, and Russian Ruble were also analyzed, with all demonstrating a decline in buying power relative to Bitcoin over time.

This reflection on Bitcoin's growth and fiat currency devaluation serves as a poignant reminder of the revolutionary impact of Bitcoin on the global financial landscape. As Mežinskis notes, Bitcoin has emerged as perhaps one of the most significant sovereign wealth and monetary inventions, challenging traditional notions of currency value and stability.

As we move into 2024, the message is clear: the dynamics of Bitcoin's value proposition continue to intrigue and shape discussions around wealth, monetary policy, and the future of global finance.