This analysis delves into the subtle yet significant changes in European banking behavior, highlighting a marked contraction in credit issuance across the board, except for non-bank financial corporations.

The European financial system is adopting a defensive stance, mirroring similar patterns observed in the American banking sector. A review of lending activities indicates a broad-based contraction in credit issuance, with a notable exception being a specific class of borrowers. This trend is not isolated to the European context but serves as a potential indicator of broader systemic tightness within the global eurodollar system.

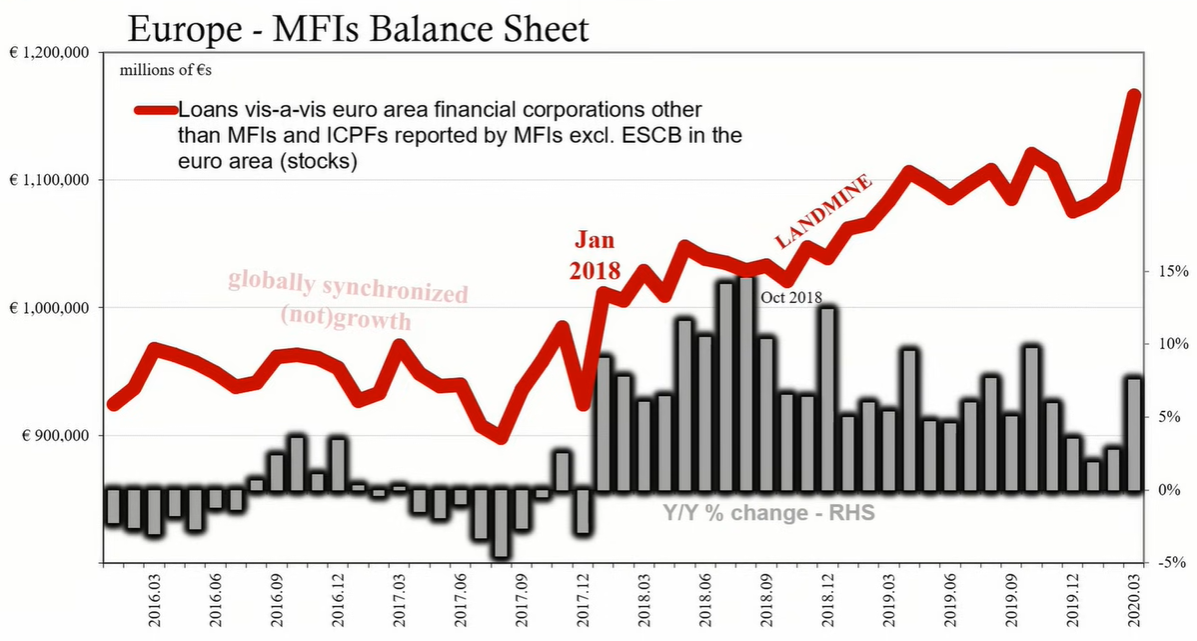

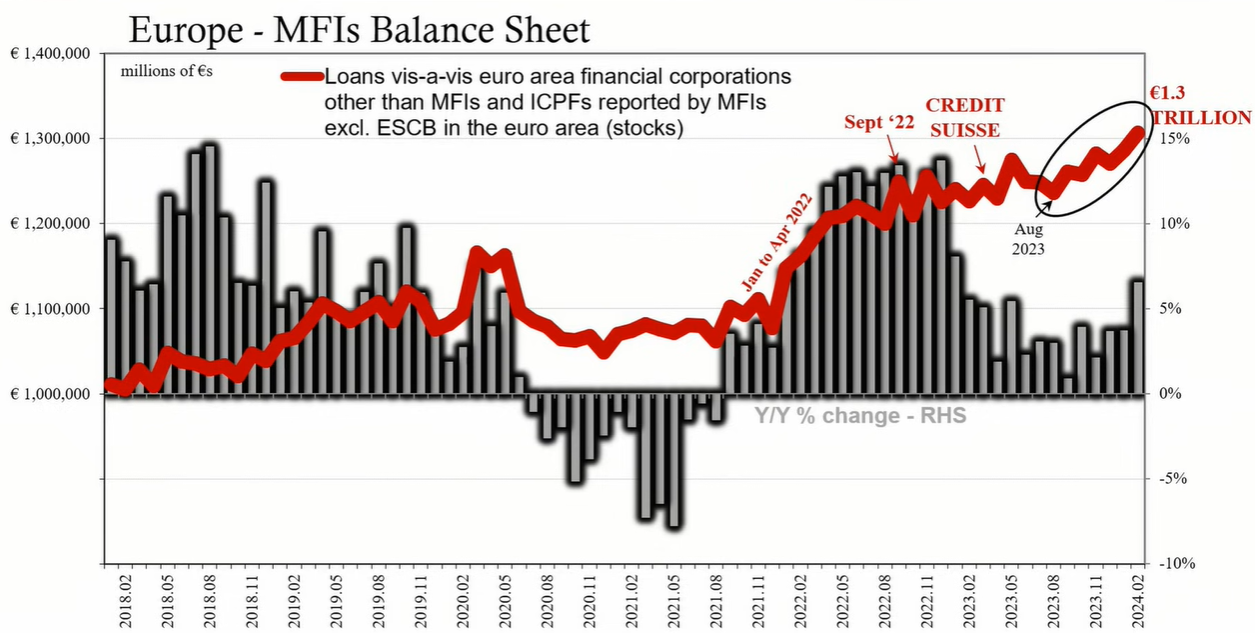

To understand current trends, a historical perspective is necessary. The European Central Bank (ECB) classifies a significant portion of the financial system under the umbrella of monetary financial institutions (MFIs). The focus here is on loans made by these MFIs to euro area financial corporations excluding other MFIs, insurance companies, pension funds (ICPFs), and the European System of Central Banks (ESCB). This essentially covers lending to non-bank financial entities such as investment funds and securitization structures.

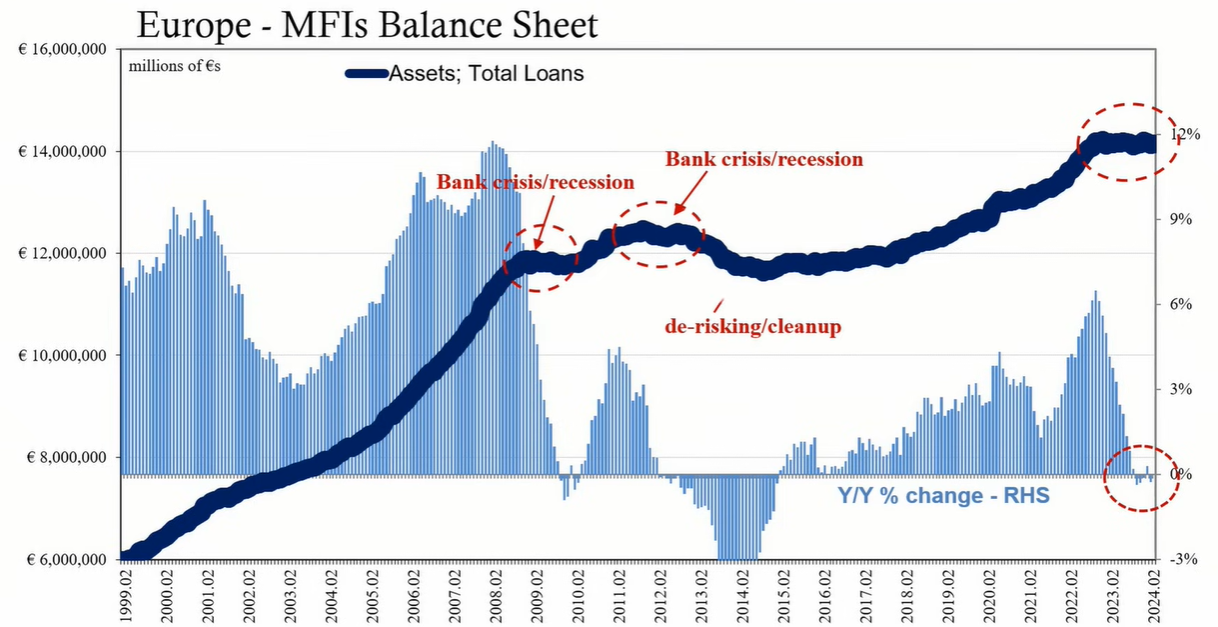

An examination of lending data reveals a contraction in credit to most sectors except the aforementioned non-bank financial corporations. Historically, increases in lending to this group have coincided with periods of liquidity stress and economic turmoil, as evidenced during the 2007 subprime crisis, the subsequent eurodollar events, and the 2020 pandemic-induced financial shakeup.

As of the latest ECB estimates, loans between European banks and non-MFI financial corporations exceed €1.3 trillion, marking a significant year-over-year increase. This growth in lending occurs against the backdrop of a general lending slowdown, suggesting that European banks are selectively extending credit to non-banks possibly in need of liquidity.

One potential driver of this trend could be the challenges in the European commercial real estate market. The ECB's financial stability report highlights vulnerabilities and declining prices within this sector, exacerbated by tightening financial conditions. This suggests that European banks could be providing liquidity to non-banks exposed to commercial real estate risks.

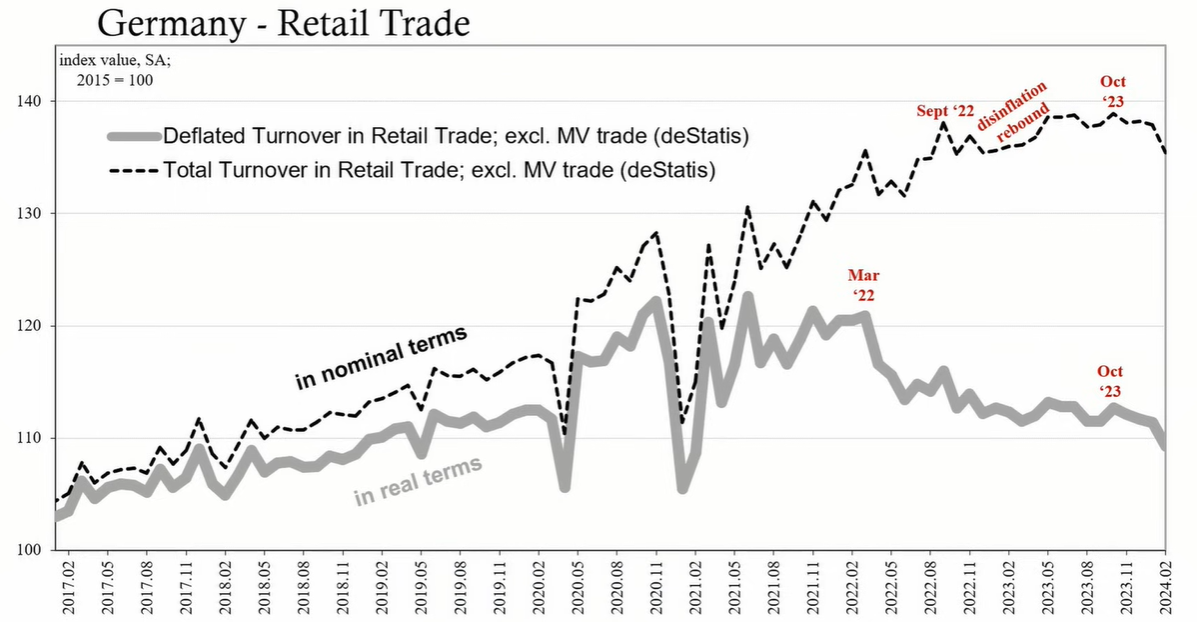

Recent statistics, particularly from Germany, indicate a slump in retail sales, hinting at a broader economic deceleration. This may partially explain the ECB's urgency to consider interest rate cuts, as the central bank grapples with the dual threats of a worsening economy and potential financial irregularities.

The data reveals that European banks are exercising caution, but remain open to lending to a particular class of borrowers, typically during periods of financial stress. This trend warrants closer scrutiny as it may signal underlying issues within the wider financial and monetary systems. While not an immediate cause for alarm, the increased lending to non-bank financial institutions is a potential indicator of systemic tightness that requires vigilant monitoring.