Rising consumer price disparities, credit market stress, and cautious banking behaviors challenge the narrative of a 'soft landing' in the current economy.

The concept of a 'soft landing' in economics refers to the scenario where an economy experiences a slowdown that avoids a recession, leading to a stabilization and modest growth without significant disruption. Despite mainstream narratives, the current economic landscape is experiencing significant turmoil, contradicting the claim that a soft landing is ahead.

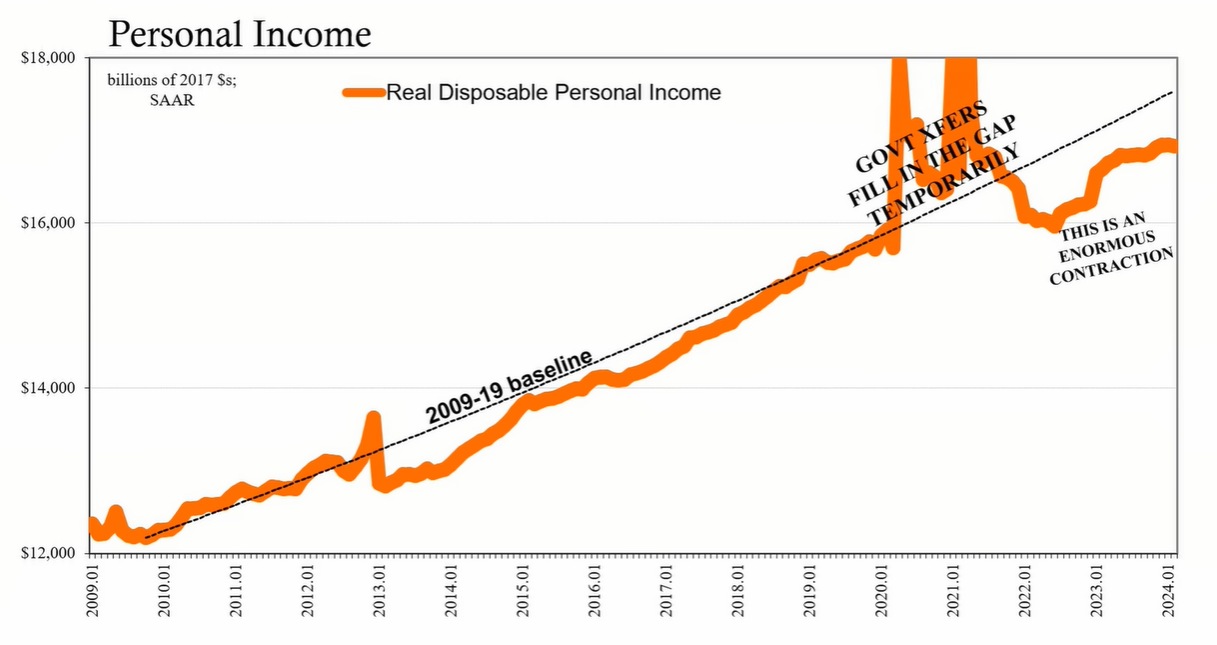

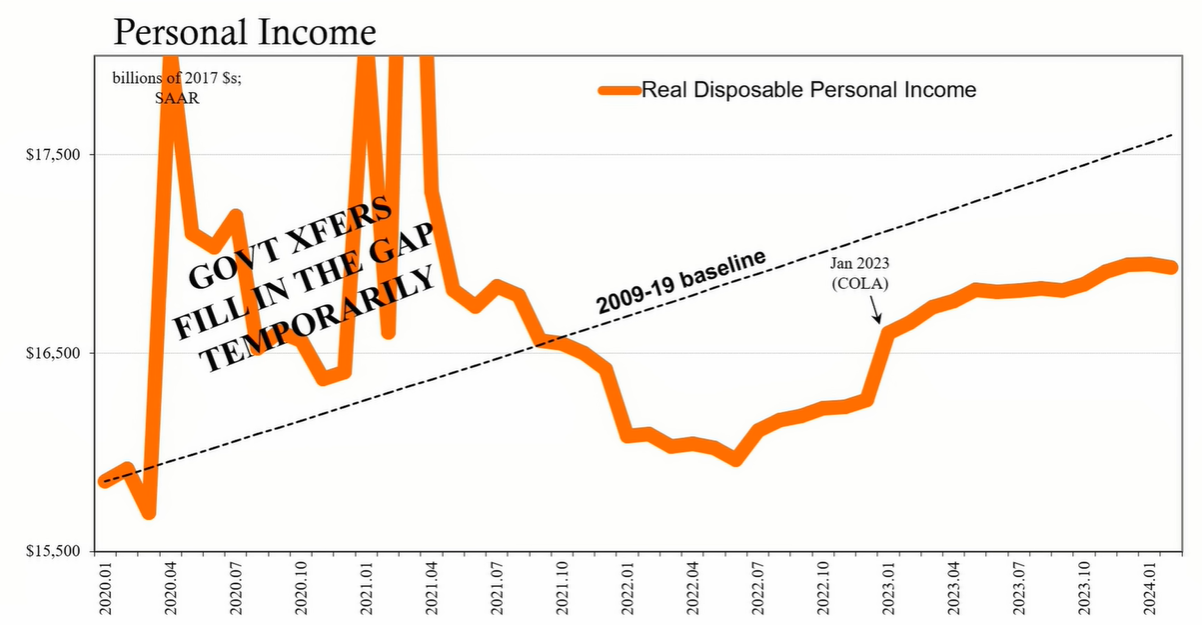

One of the most salient issues is the disparity between consumer price inflation and wage growth. Consumer prices have been escalating at a pace that outstrips wage increases, leaving many families struggling to keep up with their daily expenses. The burden is more pronounced at the lower end of the economic spectrum, while those at the top, especially those with stock investments, have realized substantial financial gains.

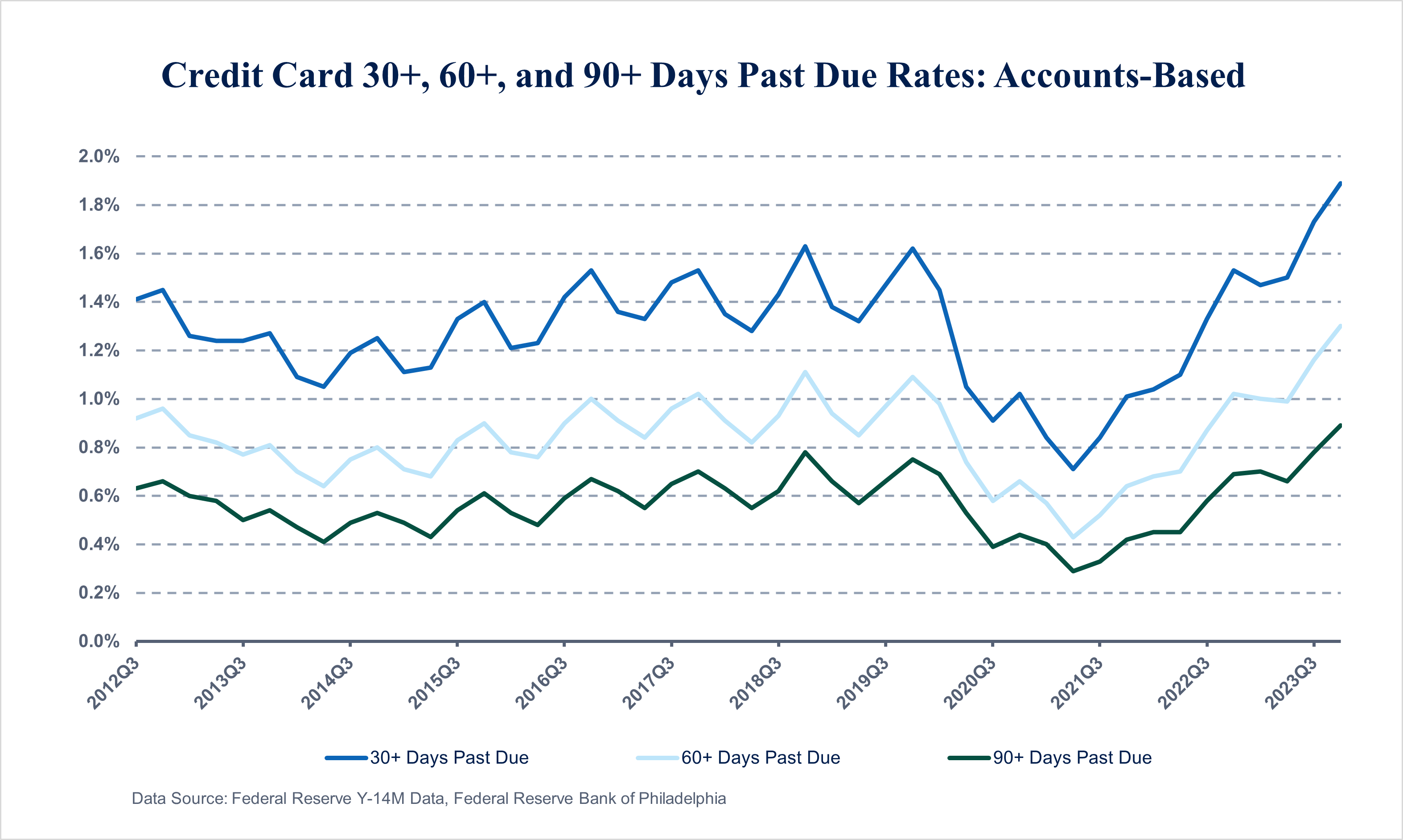

Recent reports from the Federal Reserve Bank of Philadelphia indicate emerging stress in the credit markets. The fourth quarter of 2023 showed a marked deterioration in credit card performance, with delinquency rates for 30, 60, and 90 days past due reaching the highest levels recorded since the data series began in 2012. Moreover, the proportion of accounts making only minimum payments increased, signifying heightened financial strain among cardholders. Typically, such behavior is an early indicator of an economic setback.

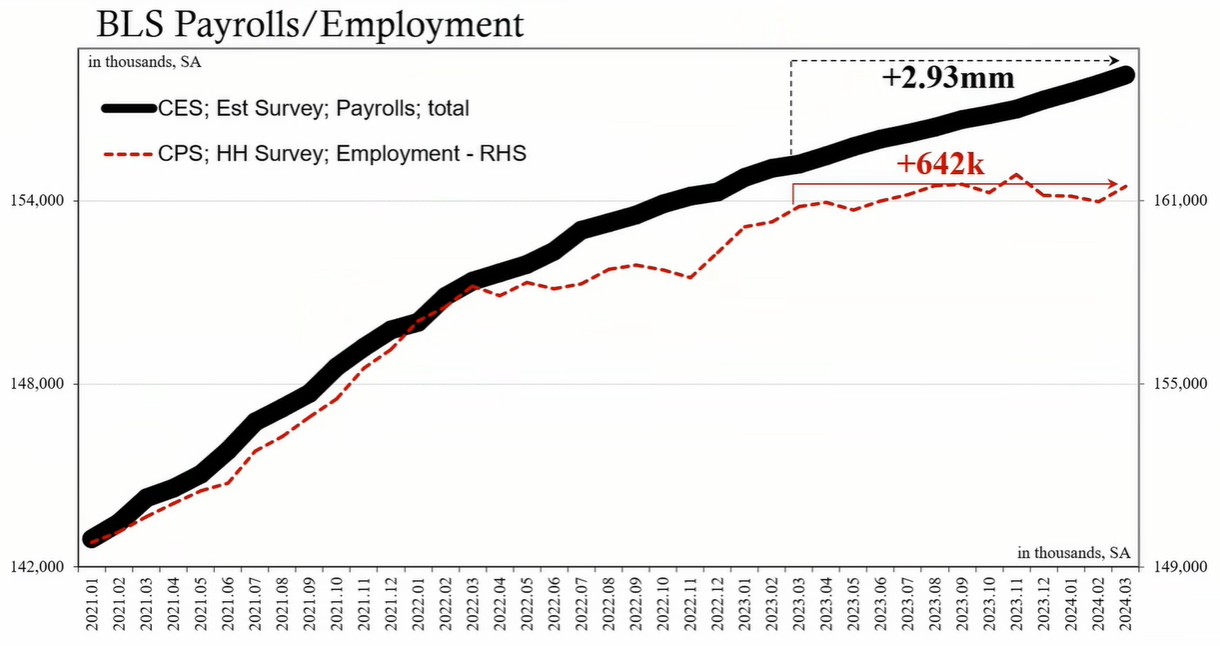

Despite these warning signs, traditional economic indicators like GDP and payroll numbers have not yet reflected the underlying weaknesses. This discrepancy has led some analysts to prematurely declare that the economy has successfully navigated through the soft patch. However, the persistence of price imbalances and the long-term impact of the pandemic lockdowns suggest that a robust recovery may be illusory.

The Philadelphia Fed report also pointed out a significant decline in mortgage originations, the lowest since 2012, hinting at a more cautious approach by lending institutions. Banks' risk aversion is rising in response to elevated debt-to-income and loan-to-value ratios, which could further dampen economic activity.

Banks play a critical role in the economy, not just through extending credit but also as barometers of financial health. Reports from banks have indicated a decline in loan demand, with consumers and businesses focusing on repaying existing debts rather than seeking new credit. This trend suggests tightening financial conditions and a potential contraction in spending.

The data and trends emerging from the credit markets and banking sector point to a scenario where the United States is not on the cusp of a soft landing followed by a robust economy. Instead, there is a mounting body of evidence suggesting that the challenges of income disparity, credit delinquencies, and cautious lending practices are early innings of a more prolonged and complex economic adjustment period.

The economy is not yet in a position to achieve a soft landing, given the existing imbalances and the hardships faced by a significant portion of the population. The notion of a soft landing and subsequent economic boom is increasingly at odds with the reality of persistent financial strain among consumers and a cautious banking sector. The path ahead may require a more comprehensive reckoning of these imbalances before a genuine and sustained recovery can take place.