Recent rate cuts by the ECB and the Bank of Canada signal a shift in central banking priorities.

Central banks globally are known for their cautious approach towards monetary policy, with a primary mandate to maintain price stability. However, recent developments have seen the European Central Bank (ECB) and the Bank of Canada taking an unexpected move by cutting benchmark interest rates despite inflation not aligning with their targets.

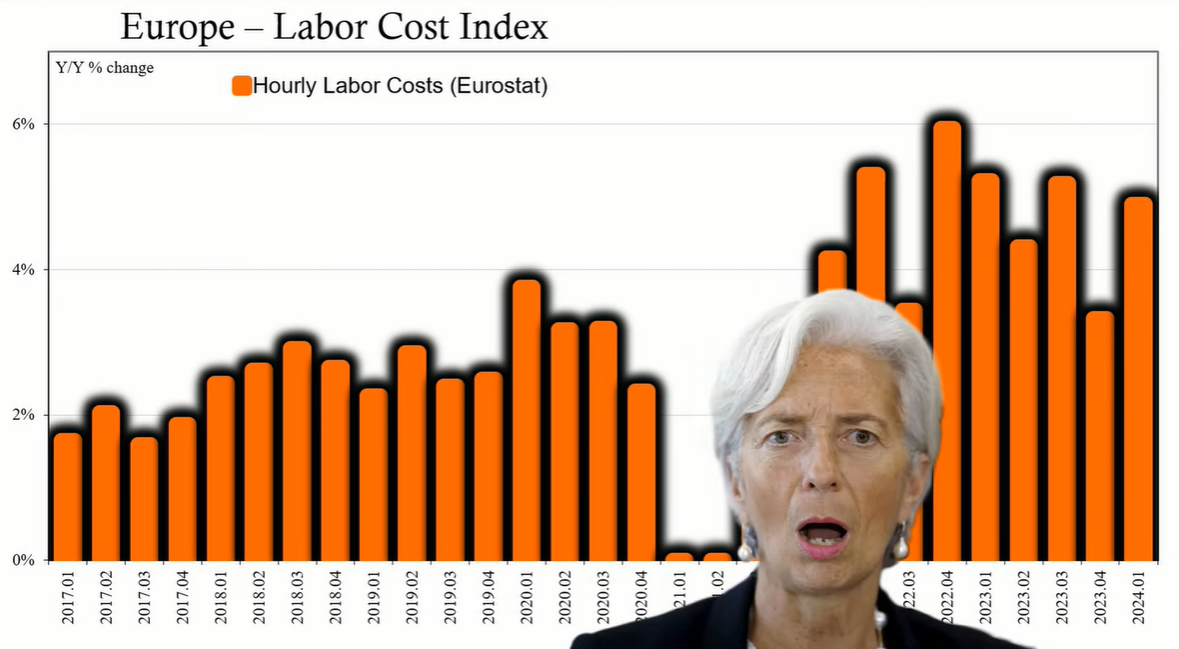

The ECB cut its benchmark interest rate for the first time even though consumer prices have not reached the desired target. The recent Eurostat data on hourly labor costs indicates a sharp increase in the first quarter of 2024, rising to 4.9% year-over-year, from 3.3% in the previous quarter. Similarly, wage growth accelerated to 5% from 3.1%. This surge contradicts the ECB’s previous focus on wage data as inflationary indicators.

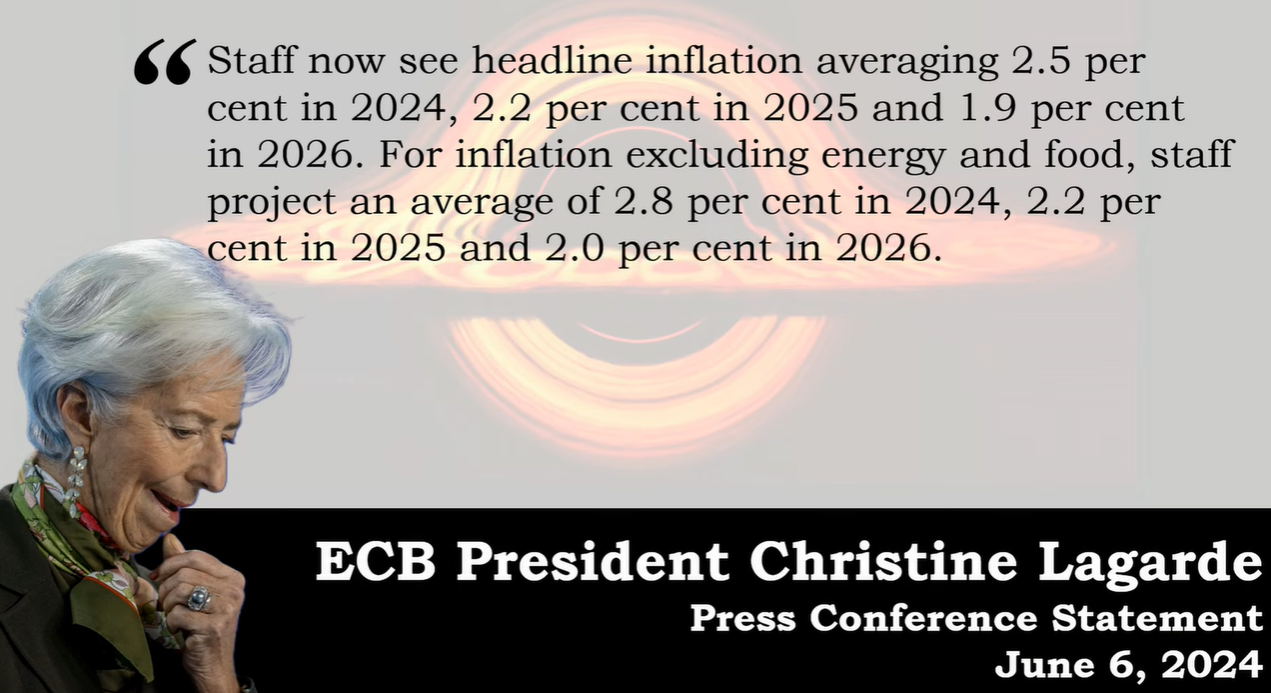

ECB President Christine Lagarde acknowledged the revision of the consumer price outlook for the coming years, citing projections for headline inflation at 2.5% in 2024, significantly above the 2% target. The core inflation rate is also expected to exceed the target, averaging 2.8% in 2024. Despite these projections, the ECB opted for a rate cut, suggesting a sudden shift in policy priorities.

Similarly, the Bank of Canada reduced rates while consumer prices remained above their target. The bank’s decision appears to be driven by the same underlying concerns as the ECB, even though the economic situations in Canada and Europe differ.

Central banks traditionally rely on models like the Phillips curve, which posits a relationship between unemployment rates and inflation, and the theory of expectations, suggesting that inflation expectations can fuel actual inflation. However, the recent pivot by central banks seems to indicate a de-emphasis on these models.

The ECB's justification for the rate cut hinges on the purported increased reliability of their projections, a claim that has not been substantiated with changes to their modeling approach. This raises questions about the real motivations behind the rate cut, especially when compared to the Federal Reserve’s stance, which has expressed uncertainty over similar inflation projections.

The ECB may be increasingly worried about the economy’s trajectory. Despite a 0.3% growth in the first quarter of 2024, there is concern that this could be another false dawn, similar to the previous year's short-lived recovery. Retail sales in Europe have declined, and consumer spending remains suppressed due to ongoing high prices and recessionary pressures.

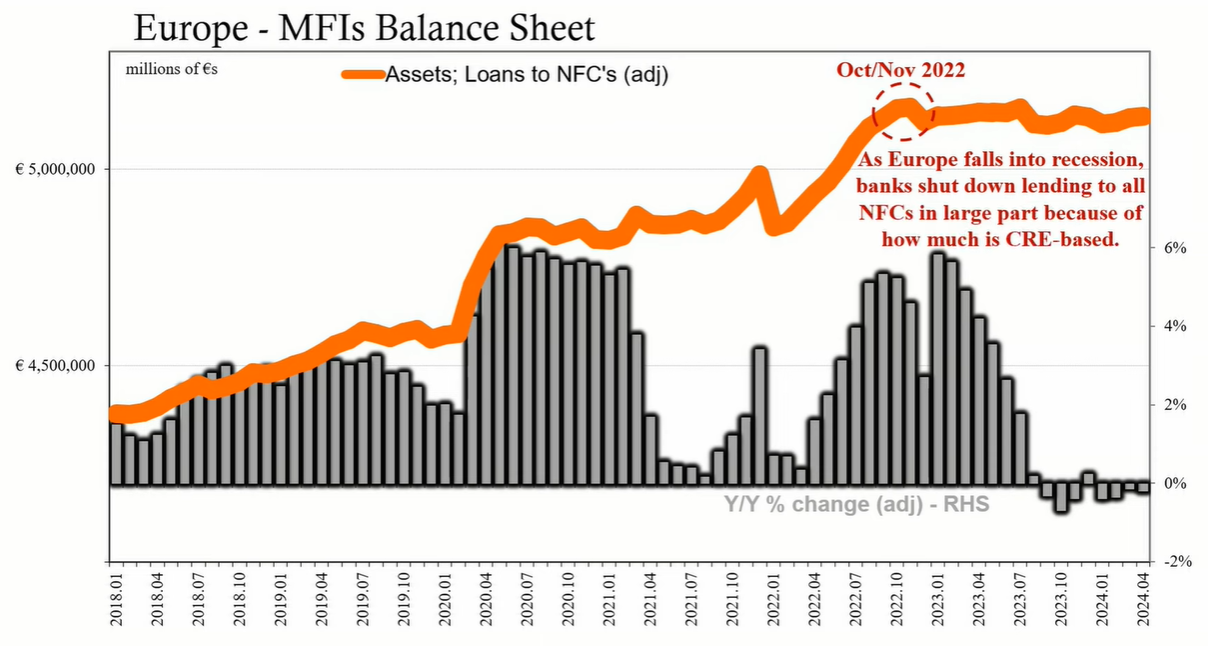

Another critical factor is bank lending, which has been contracting since late 2022 in Europe. Without an uptick in bank credit, economic recovery prospects dim, leading the ECB to consider rate cuts as a stimulus measure.

Central banks worldwide are under pressure to adjust rates in response to economic signals that suggest 2024 might not be as robust as anticipated. The ECB's decision could influence other central banks, including the Federal Reserve, to consider rate cuts to prevent further economic downturns.

The recent rate cuts by the ECB and the Bank of Canada, despite inflationary pressures, reflect a shift in central banking policy priorities from inflation control to economic stimulus. These decisions, driven by concerns over economic stagnation and declining consumer confidence, may lead to a wider trend of rate cuts globally as central banks attempt to preempt further economic slowdowns.