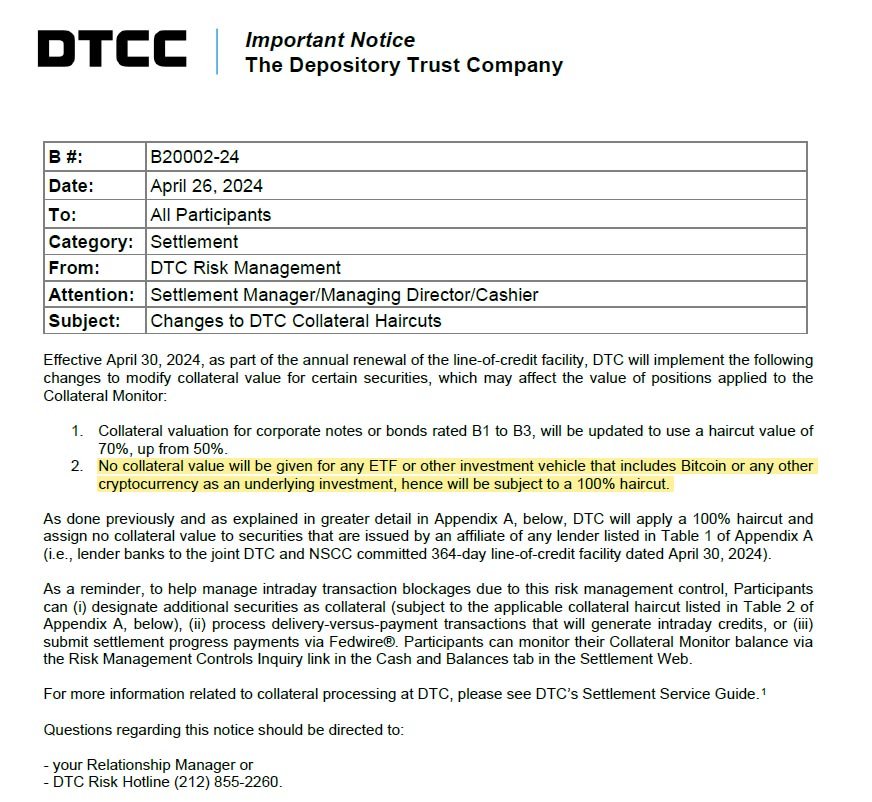

The DTCC's new rule, effective April 30, 2024, disallows Bitcoin and other digital asset ETFs from being used as collateral.

The Depository Trust and Clearing Corporation (DTCC), a central player in the financial services sector responsible for clearing and settlement services, declared that it would not assign any collateral value to Exchange-Traded Funds (ETFs) with exposure to Bitcoin, a policy set to take effect on April 30, 2024. This decision limits the use of Bitcoin ETFs in certain financial operations, particularly within the DTCC's system.

The DTCC's role as a clearinghouse and central securities depository encompasses a variety of financial transactions, including those involving stocks, bonds, and derivatives. Its recent announcement targets ETFs and similar investment vehicles that hold Bitcoin as an underlying asset, stating these will face a 100% reduction in collateral value.

Caitlin Long, CEO of Custodia Bank, supported the DTCC's move, stating on platform X, "I have no problem with this because it reduces the leverage-based financialization games that WallSt could have played (& upon which TPTB would have blamed Bitcoin for the inevitable problems even tho they’d have had nothing to do with Bitcoin itself)."

I have no problem with this bc it reduces the leverage-based financialization games that #WallSt could have played (& upon which TPTB would have blamed #Bitcoin for the inevitable problems even tho they’d have had nothing to do with Bitcoin itself). This is a healthy decision…

— Caitlin Long 🔑⚡️🟠 (@CaitlinLong_) April 26, 2024

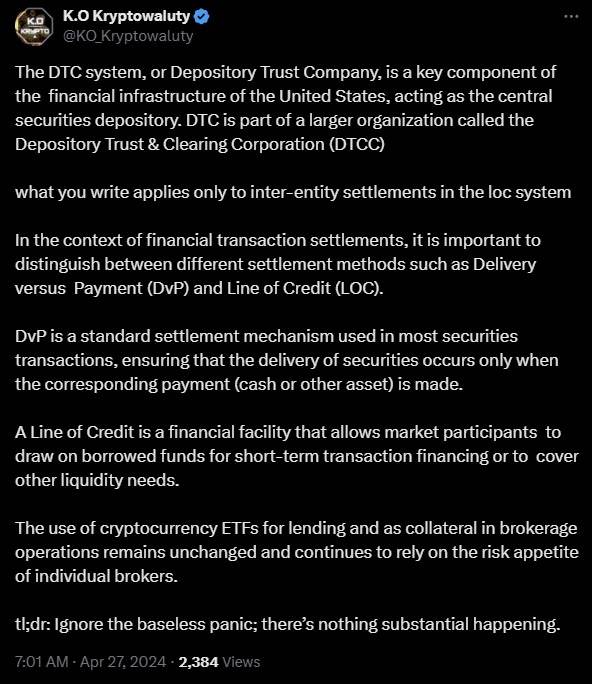

While the DTCC has restricted the use of Bitcoin ETFs as collateral within its system, it does not prohibit their use in all financial transactions. K.O. Kryptowaluty clarified that individual brokerage firms might still accept Bitcoin ETFs as collateral, depending on their risk management strategies. Kryptowaluty added that the use of Bitcoin ETFs for lending and as collateral in brokerage activities is likely to continue, subject to the risk tolerance of each broker.

The introduction of spot Bitcoin ETFs in the United States has been met with significant interest from institutional investors. In the three months following their launch, these ETFs attracted over $12.5 billion in funds, showcasing the traditional market's growing acceptance of Bitcoin. However, the total assets under management (AUM) for all Bitcoin ETFs currently exceed $53 billion, despite a recent slowdown in net inflows and reports of significant outflows from multiple ETF issuers.

Analysts have expressed concerns about potential liquidity issues in the wake of the DTCC's decision, with some anticipating that banks may reduce their exposure to Bitcoin ETFs, leading to asset sell-offs or decreased involvement in corporate bonds.