The recent SEC approval of 11 Bitcoin ETFs marks a monumental shift in the investment landscape, igniting what could be termed a modern 'Digital Gold Rush.'

In June 2023, several asset managers representing over $20 trillion in AUM filed for bitcoin ETFs with the SEC. Six months later, the SEC approved 11 bitcoin ETFs, which started trading on January 11, 2024.

Eight months ago, I published “The International Digital Gold (Bitcoin) Rush.” In that piece, I wrote about the California Gold Rush of the 1800s and drew parallels to the digital gold rush I had expected should Wall Street’s ETFs be approved.

Well, it’s clear that after two months of ETF trading, I was too bearish. Of course, I was bullish enough to refer to the launch of the ETFs as the “digital gold rush,” yet I did not expect the extent of the volume we’ve seen thus far.

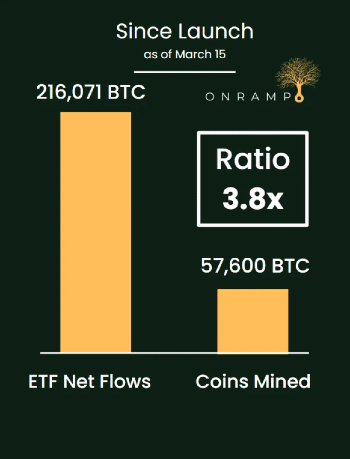

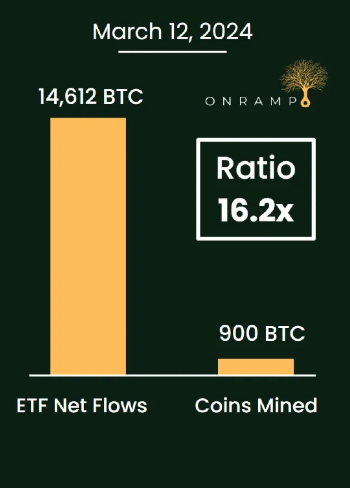

Since the ETFs went live, they’ve purchased over 216,000 BTC, 3.8x the new issuance of 57,600. There have been several days where the iShares Bitcoin Trust has purchased more than 10 times the daily bitcoin issuance (900 BTC).

In fact, earlier this week, a record high for ETF inflows was set. On Tuesday, March 12th, the ETFs purchased 16.2x more than the daily issuance. This was the first time over $1 billion of BTC was purchased in a single day by the ETFs.

When I published the article in July, the price was ~ $30,000, and when the ETFs started trading, the price was ~$46,000, followed by a swift selloff. At that time, all the "sell the news" bears had declared victory as they claimed that the ETFs were priced in….

Yet here we are two months later, and bitcoin is trading for $68,000, near its previous all-time high of $69,000. Earlier this week, bitcoin made a new all-time high of $73,794, the first time a new all-time high was set before the halving. That's a big deal.

I totally underestimated the magnitude of this—we're in a new market structure now being led by the US Managed Wealth industry, which is approximately a $50 trillion industry between broker-dealers, banks, and Registered Investment Advisors (RIAs).

These firms are at the early stages of adopting bitcoin in client portfolios, and some leading firms, such as Vanguard, have failed their clients by prohibiting the purchase of bitcoin ETFs.

Nonetheless, this is only starting; wealth management firms do not yet realize that they'll need to get smart on bitcoin and fast. Advisors are beginning to get peppered by their clients about bitcoin. Everyone wants a piece of the best-performing asset of the 2010s and what's looking to be the 2020s as well.

We're witnessing the rise of a new asset class on Wall Street. Bitcoin now has established credibility among equities, fixed income, real estate, and other alternative investments. The investment strategy teams at Wealth Management shops will soon begin to advise strategic (long-term) asset allocations to bitcoin, maybe somewhere in the ballpark of 1-10%, depending on client risk tolerances.

Beyond the ETFs, we’re also seeing major players like BlackRock update filings for funds such as “Global Allocation Fund” ($18bn in AUM) and “Strategic Income Opportunities” ($36bn in AUM). This trend is only getting started.

The birth of a new digitally scarce form of property, commodity, money, or whatever you want to call it is a once-in-a-species event. There's no perfect historical precedent for this. As traditional assets, particularly fixed income, fail to protect investors against the fiscal and monetary madness post-2020, bitcoin will increasingly play a significant role in portfolios.

As sovereigns continue to rack up debt at alarming rates and fiat currencies inflate more rapidly, bitcoin's prominence on Wall Street will grow.

There's simply not enough coin out there. Bitcoin is absolutely scarce—only 21 million bitcoin will ever be mined. Unlike the California Gold Rush, where eventually all the new supply mined ended the mania, bitcoin is due for its scarcity to increase in about a month.

Right now, 900 bitcoin are mined each day, but the halving is scheduled for mid-late April. At that point, only 450 bitcoin will be mined each day.

Remember from earlier, 16.2x more bitcoin was purchased in a single day by ETFs than was mined? Well, a month from now that's a 32x. We've never seen anything like this. It's a commodity that's absolutely scarce and that scarcity programmatically increases every four years; meanwhile the digital gold rush is in very early days.

There’s one other interesting dynamic at play here. Most manias tend to end when supply just overwhelms the demand … The interesting thing about bitcoin is there’s no new supply that can come online for bitcoin. In fact, the current rip is reducing the bitcoin supply. As bitcoin’s price goes up, advisors who have allocated to bitcoin outperform, letting them poach clients from advisors who haven’t and creating pressure on other advisors to open some allocation to bitcoin. In the short term, that’s a perpetual motion machine.

- Andrew Walker, Portfolio Manager at Rangeley Capital and self-described bitcoin skeptic, Yet Another Value Blog, March 4, 2024 (H/T Zack Morris)

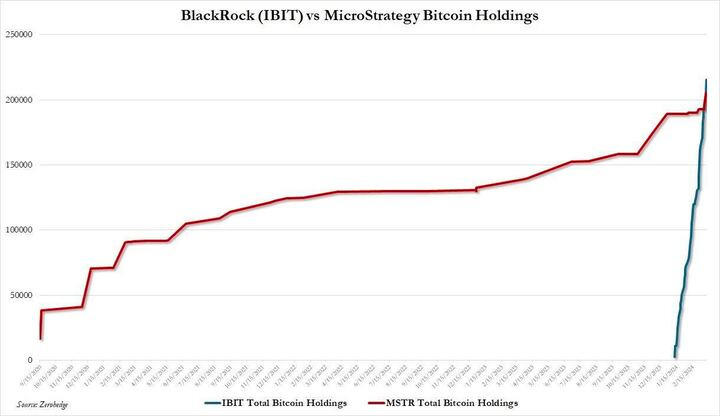

This is madness. I was not bulled up enough eight months ago. If one chart can encapsulate the magnitude of the digital gold rush, it's this one. Michael Saylor will go down in history for his treasury strategy - an absolute legend, yet even he looks like a shrimp compared to the flows we’ve seen in IBIT. Of course, it’s one man vs. a $10T asset manager with tens of thousands (I’m guessing) buyers of the financial products, but nonetheless, the growth of these ETFs is unfathomable.

And remember, the ETFs represent mainly one cohort of buyers, predominantly US managed wealth and retail investors. The digital gold rush is a global phenomenon, with the largest public and private entities only starting to get their picks and shovels. I’m convinced that this year some large global players will announce their bitcoin strategy…

The Digital Gold Rush is only getting started.

Originally published on The Fiat Cave