Millennials and Gen Z in Canada face dwindling homeownership prospects due to high costs and severe housing shortages.

Recent reports indicate a significant decline in homeownership among millennials and Gen Z in Canada. According to a new report from Moody’s Analytics, homeownership rates have been steadily falling since their peak in 2011, particularly affecting younger Canadians.

Sebastian Mintah, author of the report, stated, "Once a key milestone on the journey to adulthood, homeownership has become increasingly elusive, particularly for millennials and gen z." The challenges facing these generations are multifaceted, including higher interest rates, inflation, and a competitive housing market.

The Royal Bank of Canada has found that higher borrowing costs have reduced potential homeowners' budgets by 22 per cent since the first quarter of 2022. Home prices, however, have only seen a marginal decrease of 1.8 per cent. RBC assistant chief economist Robert Hogue commented on the situation, saying, "The ability of many Canadians to get into the housing market has greatly diminished."

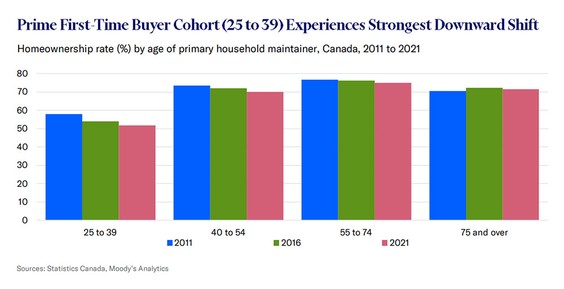

Census data from 2021 highlighted a surprising trend: people aged 25 to 39, who are typically first-time homebuyers, not only had the lowest homeownership rate but also experienced the most significant decline of all age groups since 2011. Factors contributing to this decline include higher education costs, tougher job requirements, and stagnant wage growth relative to housing prices.

Furthermore, Canada's population growth has not been matched by new housing developments, resulting in a severe housing supply deficit. National Bank of Canada economist Stéfane Marion pointed out that with one housing start for every 4.9 people entering the working-age population, "there is no precedent for a housing supply deficit of this magnitude."

The federal government has introduced "Canada’s housing plan," which aims to spur home construction, but the plan’s goal to build an additional two million homes by 2031 is considered "highly ambitious" by Toronto Dominion Bank economist Rishi Sondhi.

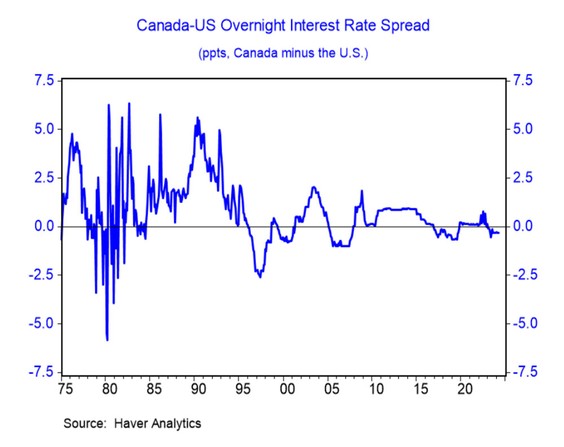

Economists also note potential divergences between the Bank of Canada and the United States Federal Reserve regarding interest rate policies. Bank of Montreal chief economist Douglas Porter suggests that the Bank of Canada could cut interest rates twice ahead of the Fed before experiencing substantial effects on the Canadian dollar.

As the situation unfolds, the decline in homeownership among younger Canadians raises questions about the long-term implications for the country's housing market and the ability of future generations to obtain what has long been considered a core element of financial stability and success in Canada.