As a small business owner in Dallas, Texas, finding affordable and effective healthcare options is crucial. Traditional insurance is often costly, but CrowdHealth offers a cheaper alternative for single-payer LLCs or businesses with fewer than ten employees. This platform uses a community-based approach to fund healthcare expenses, which can significantly reduce your costs.

CrowdHealth operates by pooling funds from members to cover medical expenses. Instead of paying high premiums to insurance companies, you contribute to a community fund. This method has been shown to cover 100% of members' healthcare needs in 2023, making it a reliable choice.

We are done crowdfunding for the year.

— CrowdHealth (@JoinCrowdHealth) December 28, 2023

3,506 submitted to the community for crowdfunding

3,506 funded by the community

We had some doozies. Brain surgery, cancer cases, motor vehicle accidents, NICU babies, a whole bunch of MSK surgeries, and a host of other large events.… pic.twitter.com/isPNN9ue9O

Additionally, CrowdHealth's tech-enabled tools provide transparency and ease of use, helping you save money without sacrificing quality care.

For more details, you can explore their offerings on the CrowdHealth website.

By choosing CrowdHealth, you empower yourself and your employees with a cost-effective healthcare solution that aligns with your business needs.

CrowdHealth offers small business owners in Dallas an alternative to traditional health insurance. This section explains how CrowdHealth works and its benefits for single-payer LLCs and small businesses with less than 10 employees.

CrowdHealth is a health-sharing program where members pool funds to cover medical expenses.

Unlike traditional insurance, there are no middlemen or complex policies. When you need healthcare, you pay for services directly using cash prices, and larger expenses can be funded by the community. This model provides more transparency and control over healthcare costs.

Single-payer LLC owners often find traditional health insurance expensive and complicated.

CrowdHealth simplifies this by allowing you to pay for small medical expenses out-of-pocket. For costs over $500, you can submit a funding request to the CrowdHealth community. This approach reduces monthly costs and eliminates insurance premiums, making it a cheaper option for small business owners.

For businesses in Dallas with less than 10 employees, CrowdHealth can be a cost-effective solution.

There are no costly premiums or deductibles. Instead, each member contributes a set amount, making budgeting easier. With CrowdHealth, employees can access affordable healthcare, and your business can save money while providing essential health benefits.

By using an innovative health-sharing approach, CrowdHealth helps small businesses manage healthcare costs efficiently.

CrowdHealth can offer small business owners in Dallas, Texas, a more cost-effective and flexible alternative to traditional health insurance, especially for single-member LLCs or businesses with fewer than 10 employees.

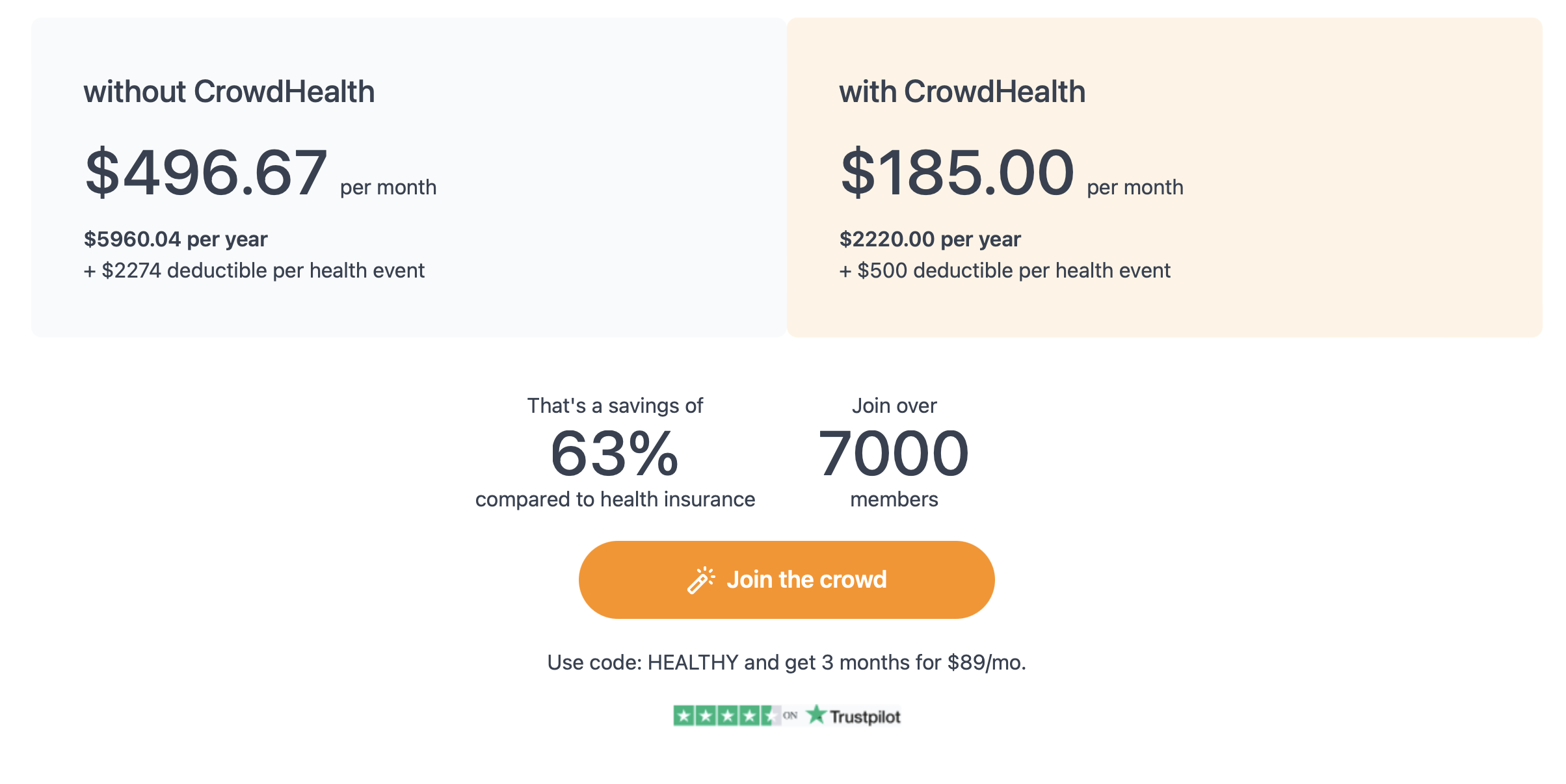

Traditional health insurance plans often come with high premiums, deductibles, and out-of-pocket expenses. These costs can be particularly burdensome for small businesses. On the other hand, CrowdHealth operates on a community-based model where members contribute to each other’s medical expenses, which can lead to significant savings.

In essence, you typically avoid the overhead costs associated with insurance companies, such as administrative fees.

For example, while a traditional plan might cost upwards of $800 per month per employee, CrowdHealth could potentially reduce this cost by half or more due to its shared expense model.

Traditional insurance offers predictable coverage, but it may not always meet the unique needs of small businesses. Policies can be rigid, and adding or removing employees may require complex paperwork and adjustments to the premium.

CrowdHealth provides a more adaptable solution. You can customize your contributions based on your current workforce, allowing for easier scaling.

For instance, whereas traditional plans might have blanket coverage that isn't always relevant, CrowdHealth lets you allocate funds toward your employees' needs.

Managing traditional insurance policies can be a hassle. The paperwork, renewals, and dealing with claims can take up much of your time. Traditional insurance plans often have strict rules and long-term commitments, limiting your ability to make quick changes.

With CrowdHealth, the management process is streamlined and less bureaucratic. You can easily make changes as your business evolves without getting bogged down in red tape. This flexibility is particularly beneficial for small, agile companies that need to adapt quickly to market changes.

For example, if you need to add a new employee or decide to shift some funds towards a different area of healthcare, CrowdHealth's platform allows you to do this swiftly.

Knocked this one out of the park…if we do say so ourselves. pic.twitter.com/9EDMlHt8P6

— CrowdHealth (@JoinCrowdHealth) February 12, 2023

CrowdHealth offers unique benefits for single-member LLCs and small businesses in Dallas. Learn how it compares to traditional insurance and what advantages it provides.

CrowdHealth allows you to manage health costs more predictably. You pay a fixed monthly amount and only fund the first $500 of any health event over $500. This can simplify budgeting.

CrowdHealth isn't traditional insurance. It operates on a crowdfunding model where members share expenses. This often results in lower costs because you're not paying for comprehensive coverage but specific health events.

Dallas business owners benefit from lower monthly costs. For example, members contribute up to $135 per month for individuals aged 0-54. This can be more affordable than traditional plans.

CrowdHealth reduces costs by avoiding the high administrative expenses of traditional insurance. It focuses on direct payments and community sharing Crowdhealth, which can lead to significant savings.

Consider the structure of payments and the type of coverage. With CrowdHealth, you fund initial costs of up to $500 per event and rely on community funding afterward.

CrowdHealth covers health events over $500 but requires upfront payment.

Traditional insurance often includes comprehensive coverage but can be more expensive.

Evaluate which method aligns better with your budget and needs.

Use the promo code "healthy" to get the first 3 months for $89 dollars.