CrowdHealth may be the solution you've been searching for as an entrepreneur in Austin, Texas. Unlike traditional insurance plans, CrowdHealth operates on a crowdfunding model that can significantly reduce your monthly costs.

With this alternative, you're not just another policyholder; you become part of a community that supports each other's medical expenses.

One key feature is the absence of the high premiums and deductibles that often come with health insurance plans from the Healthcare Marketplace.

Instead, CrowdHealth leverages monthly membership fees to pool resources directly for healthcare costs. This streamlined approach means fewer administrative fees, ultimately saving you money and providing a more efficient way to handle medical bills.

We are done crowdfunding for the year.

— CrowdHealth (@JoinCrowdHealth) December 28, 2023

3,506 submitted to the community for crowdfunding

3,506 funded by the community

We had some doozies. Brain surgery, cancer cases, motor vehicle accidents, NICU babies, a whole bunch of MSK surgeries, and a host of other large events.… pic.twitter.com/isPNN9ue9O

In addition to cost savings, CrowdHealth offers tools such as Care Advocates to help you navigate and negotiate medical bills.

Through these services, CrowdHealth aims to empower you to manage your healthcare expenses without the complexity and overhead traditionally associated with insurance companies.

Learn more about how this innovative model works and why it might be the right choice for your healthcare needs here.

CrowdHealth offers a different way for entrepreneurs to handle healthcare costs by crowdfunding medical expenses through a community-based model, rather than traditional insurance, making it a potentially cheaper option.

CrowdHealth was founded in 2021 in Austin, Texas. It is a platform where members contribute monthly payments into a collective pool.

This pool is used to pay for medical expenses, which means you share healthcare costs with others in the network.

Unlike traditional insurance, where premiums are paid to an insurance company, CrowdHealth uses a crowdfunding model. Members are uninsured but rely on the community to cover their healthcare needs.

This approach cuts out insurance companies and allows members to support each other directly in medical need.

The platform includes digital tools, like an app, that help you track contributions and expenses, making the process transparent.

Care Advocates assist with medical bill negotiations, aiming to lower costs and ensuring that funds are used efficiently for genuine medical needs.

For entrepreneurs in Austin, CrowdHealth offers several benefits.

Lower monthly contributions can result in significant savings compared to traditional health insurance premiums. This model can be more cost-effective, helping you save money that can be invested into your business.

CrowdHealth's community-based approach also provides flexibility. You aren't locked into specific provider networks, allowing you to choose your healthcare providers based on your needs.

This flexibility can be crucial for entrepreneurs with unique or varying healthcare requirements.

The digital tools and Care Advocates can save you time by handling bill negotiations and providing a clear overview of your medical expenses.

Knocked this one out of the park…if we do say so ourselves. pic.twitter.com/9EDMlHt8P6

— CrowdHealth (@JoinCrowdHealth) February 12, 2023

This support structure can benefit busy entrepreneurs who must focus on their business rather than managing complex healthcare costs.

You can explore CrowdHealth's funding details and how it plans to reinvest in its community.

Navigating the health insurance landscape in Austin, Texas, involves understanding the available options in the healthcare marketplace and evaluating traditional insurance plans tailored for entrepreneurs. This helps compare costs and select the most beneficial insurance.

The healthcare marketplace, also known as the exchange, offers a variety of plans categorized by metal tiers: Bronze, Silver, Gold, and Platinum. Each tier provides different levels of coverage and premiums.

Bronze plans generally have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite.

Numerous insurance providers participate in the Austin marketplace, including Blue Cross Blue Shield of Texas and Ambetter. Subsidies based on income are available, which can significantly reduce the cost.

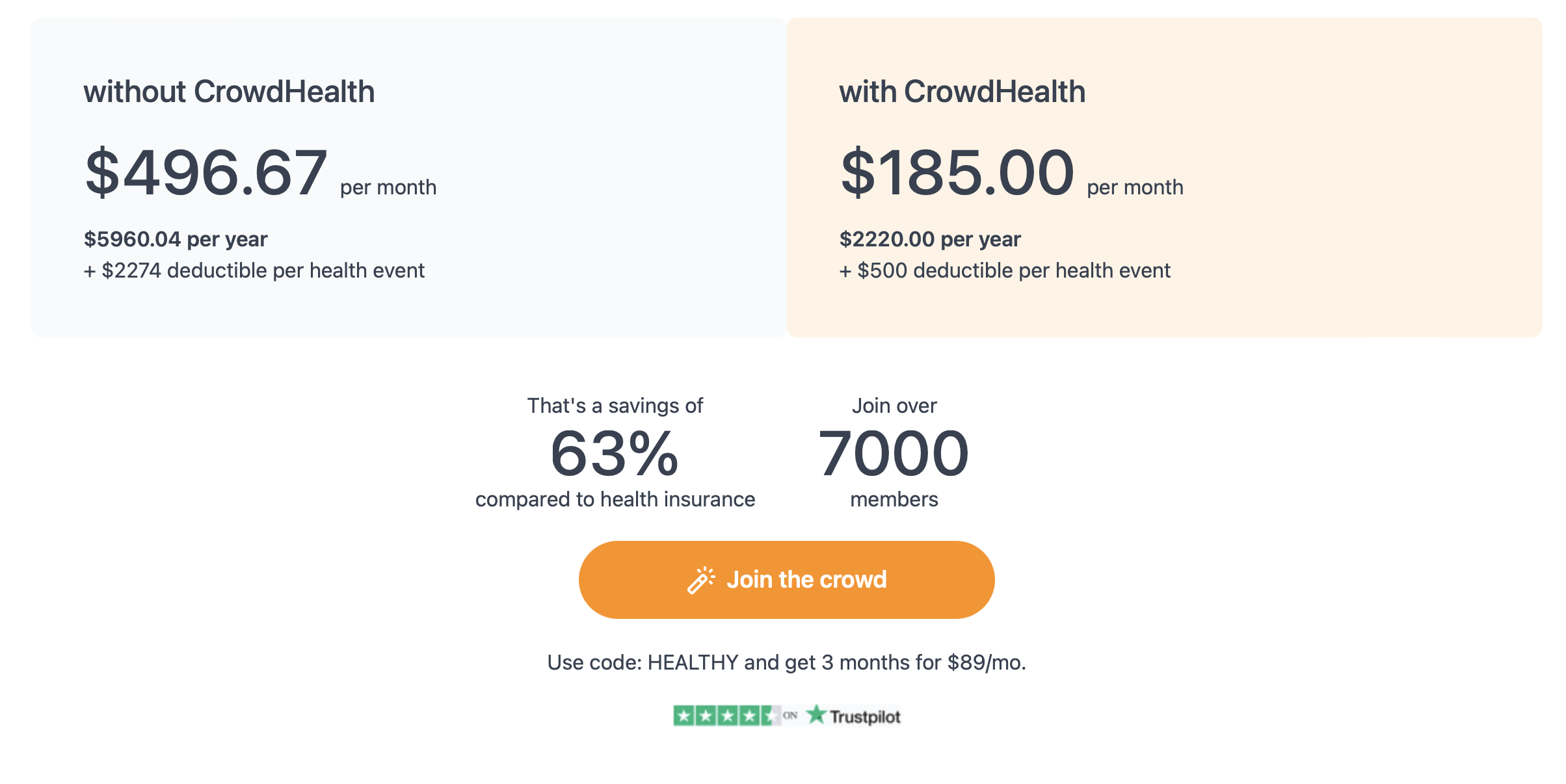

Assessing the benefits and coverage of each plan is essential to making an informed choice. Here are the costs of traditional health insurance vs. CrowdHealth.

For entrepreneurs in Austin, traditional insurance options include group health plans, health maintenance organizations (HMOs), and preferred provider organizations (PPOs).

Group health plans may be accessible through professional associations, offering an affordable way to get coverage.

HMOs typically require members to choose a primary care physician and get referrals for specialist care, often with lower premiums and limited provider networks. PPOs offer more flexibility with a broader network but come with higher premiums.

Evaluating these options involves comparing plan details, such as deductibles, co-pays, and coverage networks, to find a plan that fits your needs.

Assessing CrowdHealth involves comparing costs, coverage, and flexibility with traditional healthcare marketplace options. This will help you understand how each choice might fit your needs as an entrepreneur in Austin, Texas.

CrowdHealth aims to be a cheaper alternative by crowdfunding medical expenses. Rather than pay traditional insurance premiums, you make fixed monthly contributions to a community pool.

For 2023, CrowdHealth covered 100% of its members' health events. Compared to conventional insurance, there are typically fewer out-of-pocket costs.

In contrast, the Healthcare Marketplace often involves high premiums, deductibles, and co-pays. Plans can become costly, especially if you have a low income or an unpredictable medical condition.

Additionally, network restrictions could lead to higher costs if you need out-of-network care.

CrowdHealth offers coverage through a community-based sharing model, which funds are pooled to pay for medical events. It includes Care Advocates who help navigate the healthcare system and negotiate bills.

However, CrowdHealth is not traditional insurance, so there can be limitations on covered services and procedures.

Marketplace insurance often provides comprehensive coverage, including preventive care, doctor visits, hospital stays, and prescriptions. These plans must comply with the Affordable Care Act (ACA) requirements, ensuring a standard level of coverage.

Yet, the broad coverage typically comes at a higher cost, and you may need to deal with more paperwork and complexities.

CrowdHealth supports flexibility by offering alternative methods to control your healthcare.

For example, you may have the option to invest community funds in Bitcoin, potentially reducing costs further. The platform is designed to be simple and user-friendly, ideal for those who prefer fewer administrative tasks and more control over their plans.

On the other hand, the Healthcare Marketplace offers a variety of plans from different insurers, which provides choice but can also make the selection process overwhelming.

While multiple options are available, each plan has specific network restrictions and may involve more bureaucratic hurdles to access care.

Understanding the financial impacts of using CrowdHealth over traditional health insurance is crucial. Key areas to explore include the potential tax benefits for entrepreneurs and how this alternative approach ensures more predictable healthcare costs.

Choosing CrowdHealth can bring certain tax advantages for you as an entrepreneur.

Traditional health insurance premiums are often deductible as a business expense, but with CrowdHealth, you may need to structure your payments differently to maximize tax benefits.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): While traditional insurance plans often qualify for FSAs and HSAs, CrowdHealth does not. This might impact your ability to save on pre-tax dollars for healthcare costs.

Business Deductions: You may still deduct medical expenses from your taxable income if they exceed a certain percentage of your earnings.

It's essential to consult a tax professional to understand how using CrowdHealth affects your specific situation.

CrowdHealth aims to offer more predictable healthcare expenses compared to the healthcare marketplace. Traditional insurance often comes with high premiums, unpredictable co-pays, and deductibles.

Monthly Membership Fees: With CrowdHealth, you pay a fixed monthly fee, making budgeting easier. There are no network restrictions, and costs are typically shared among members, reducing the element of surprise in medical bills.

Crowdfunding Approach: When you have a medical event, CrowdHealth helps you crowdfund the cost. This can make expenses more predictable as you won’t face unexpected bills not covered by insurance.

This model can be especially beneficial if you're tired of fluctuating costs and need a more stable way to manage healthcare expenses.

CrowdHealth leverages a community-powered approach to healthcare by utilizing crowdfunding for medical expenses and a unique process for sharing costs among members, making it an efficient alternative to traditional insurance.

CrowdHealth operates under a monthly membership model. Members contribute a set amount each month.

These contributions are pooled together to cover medical expenses for members needing help. This method avoids many of the high costs and complexities of traditional insurance.

When members incur a medical bill, they submit the expense, which is vetted by the CrowdHealth team. Once approved, the community funds the cost using the pooled contributions.

This setup provides a predictable and transparent method of managing healthcare costs, reducing uncertainty for entrepreneurs.

The platform also features Care Advocates, who assist members in finding the best medical care at reasonable prices, further optimizing the use of the pooled funds.

When you join CrowdHealth, you can access a system that shares medical expenses.

After a medical service, you submit the bill to CrowdHealth. The team negotiates with healthcare providers to lower the costs before the next steps.

Following negotiation, the reduced bill amount is shared among the members. Each member contributes a portion of their monthly contributions to cover the expense.

This collaborative approach helps keep individual costs low.

The process ensures transparency and efficiency, as members are keenly aware of where their contributions are going and how they are being used. This transparency fosters community and shared responsibility, distinguishing CrowdHealth from traditional healthcare marketplaces.

When considering CrowdHealth as an alternative for health insurance in Austin, Texas, it's essential to understand the legal and regulatory environment. You need to be aware of compliance with health insurance regulations and implications related to the Patient Protection and Affordable Care Act.

CrowdHealth operates under a different model than traditional health insurance. It relies on crowdfunding to pay for medical bills rather than using insurance premiums.

Therefore, it is not classified as traditional health insurance and doesn't need to follow the same regulations.

However, it must still ensure transparency and fairness in its operations to protect its members.

You should verify that CrowdHealth meets state-specific health regulations in Texas. The Texas Department of Insurance oversees this, and any health care alternative must comply with state laws to avoid legal complications.

The Patient Protection and Affordable Care Act (ACA) mandates that all individuals have health insurance or pay a penalty.

Since CrowdHealth is not traditional insurance, using it alone might expose you to penalties under the ACA.

You should check if any exemptions apply in your case. Some individuals may qualify for hardship exemptions or other waivers that make using CrowdHealth more viable.

Additionally, understand how using CrowdHealth impacts your eligibility for subsidies through the Healthcare Marketplace.

Being aware of these implications can help you decide whether CrowdHealth is a suitable and compliant alternative. Stay updated on changes to ACA laws that might affect this choice.

Choosing CrowdHealth as an alternative to traditional health insurance can be a smart move for entrepreneurs in Austin, Texas.

CrowdHealth leverages a community-powered model. Members pool resources to cover medical expenses, which can lead to lower costs than the healthcare marketplace.

Because it’s not traditional insurance, you avoid the complexities and potentially high premiums.

In addition to cost savings, you get personalized support through Care Advocates. They help navigate the healthcare system, giving you peace of mind when dealing with medical bills.

CrowdHealth also offers the unique option to invest in Bitcoin, adding a tech-forward approach to healthcare financing.

In summary, CrowdHealth offers an innovative and cost-effective option for handling medical expenses, making it a valuable choice for entrepreneurs.

Explore more about how CrowdHealth works and its benefits here,.

Austin, Texas entrepreneurs are turning to CrowdHealth for their healthcare needs because it offers a blend of affordability and tailored services not found in traditional health insurance plans. Here, we address some common questions to help you understand the benefits and workings of CrowdHealth.

CrowdHealth caters specifically to freelancers, independent contractors, and small business owners. By joining, you enjoy tailored plans that suit your needs better than standard health insurance.

It's designed to fill gaps often left by traditional plans, offering peace of mind for big and small medical expenses.

CrowdHealth reduces costs by pooling funds from members to cover medical expenses.

You assist others with their health events each month, making it a community-driven model. This approach lowers administrative costs and avoids the high premiums of traditional insurance.

LLC owners in Texas can choose from various options, including traditional insurance plans and health-sharing programs like CrowdHealth.

These alternatives offer flexibility and often lower costs, making them attractive for small business owners seeking affordable healthcare solutions.

Single-member LLCs in Texas can deduct health insurance premiums from their taxes.

This can lower overall taxable income, providing significant financial relief. Section 162(l) of the IRS code allows for these deductions, which can benefit sole proprietors who pay for their health coverage.

Group insurance often provides better rates and more comprehensive coverage than individual plans.

Small business owners can offer these benefits to employees, enhancing their overall compensation package and aiding in employee retention and satisfaction.

Some users express concerns about the variability in monthly contributions. They also express concerns about paying out-of-pocket for minor expenses before reimbursement.

Understanding how the funding requests work can help manage these concerns. It can also ensure that you are prepared for any financial commitments under the program but it's only $500 dollars per health event compared to costly deductibles.