Freelancers in North Carolina face higher health insurance costs due to a combination of state mandates and limited options available through the healthcare marketplace. These mandates often require consumers to pay for coverage that includes conditions, procedures, and tests they might not need, driving up costs.

The Affordable Care Act (ACA) offers various plans, but the average cost for a silver plan can still be relatively high. A 30-year-old might pay around $453 a month, while a 40-year-old could spend approximately $509 monthly. These premiums put a financial strain on many freelancers who don't have the benefit of employer-subsidized insurance.

Bronze, Silver, and Gold plans offer different coverage levels, with Bronze plans being the least expensive but offering only 60% coverage. The healthcare marketplace in North Carolina is designed to provide options, but the high costs remain a significant challenge for self-employed individuals.

Freelancers in North Carolina have several health insurance options to consider. They need to assess their health care needs, explore the available marketplaces, and understand their eligibility for Medicaid and Medicare.

Each freelancer's healthcare needs are unique. Some might need comprehensive coverage due to existing health conditions, while others may only require basic services.

Choosing the right plan often depends on age, health status, and budget.

Gold and Platinum plans offer higher coverage at higher premiums, while Bronze and Silver plans tend to have lower premiums but higher out-of-pocket costs. Balancing these elements can help you select a suitable plan.

The Health Insurance Marketplace offers various plans under the Affordable Care Act (ACA). Based on their budget and coverage needs, freelancers can choose among Bronze, Silver, Gold, and Platinum plans.

Silver plans are popular because they balance premium costs and coverage well.

Understanding health insurance's cost and financial benefits is crucial for self-employed individuals. This includes knowing about premiums, deductibles, out-of-pocket costs, and tax considerations.

Self-employed workers often face high insurance premiums. For instance, a 40-year-old might pay around $509 per month for a Silver ACA plan. Premiums can increase with age and plan type.

Deductibles and out-of-pocket costs also significantly impact expenses. Deductibles must be met before insurance starts paying, and these can vary greatly.

Out-of-pocket costs, including copays and coinsurance, add to the total expense until reaching the out-of-pocket maximum. Plans like Bronze or Silver from UnitedHealthcare might offer different cost-sharing structures.

| Plan Type | Monthly Premium (Age 40) | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Bronze | ~$400 | High | High |

| Silver | ~$509 | Moderate | Moderate |

| Gold | ~$650 | Low | Low |

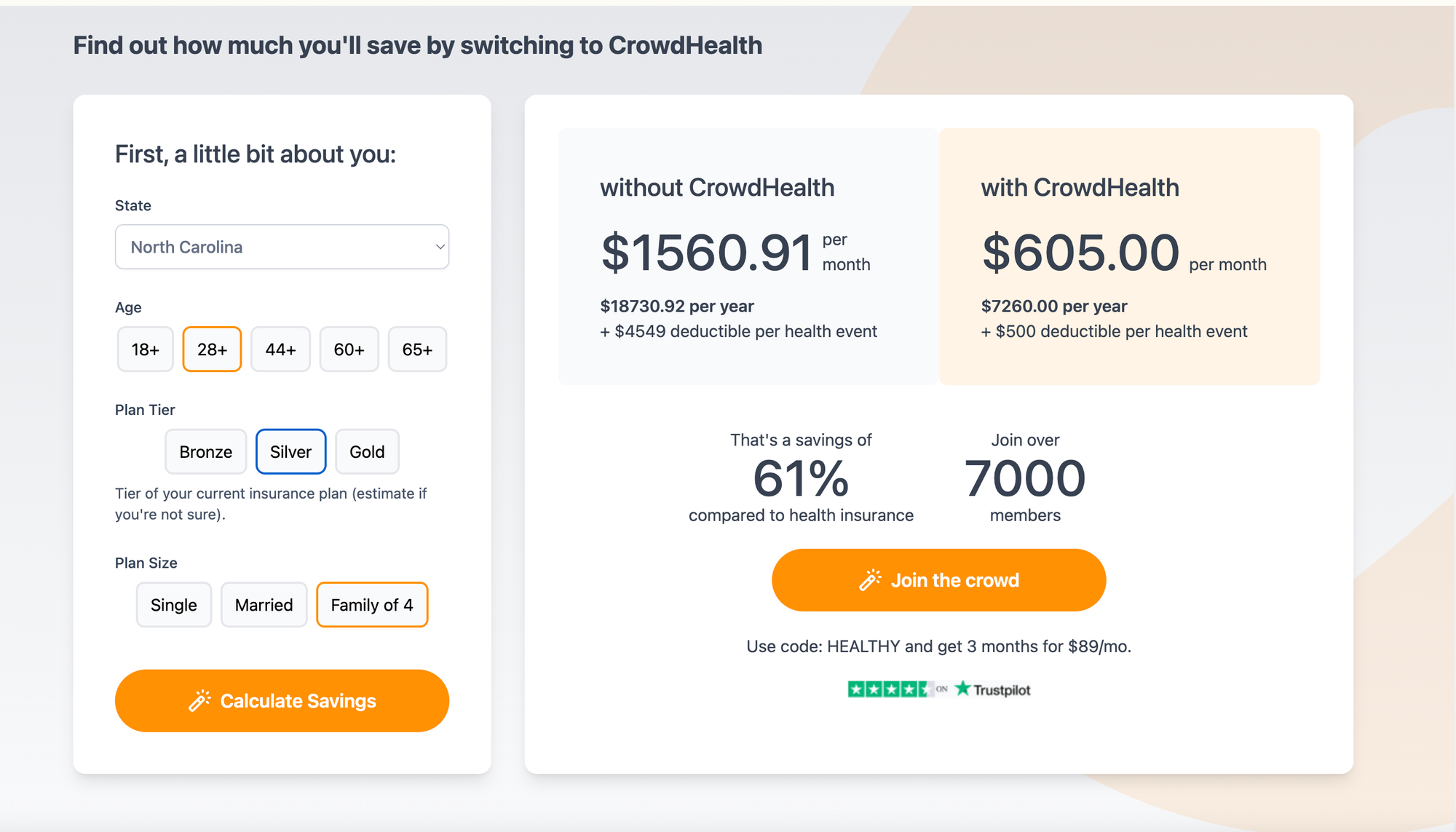

Crowdhealth can save you anywhere from 40-70% percent on your healthcare premiums in North Carolina. Don't believe us? Check out the calculator here and set up a call to learn more today!

Use promo code "healthy" for an exclusive deal. The first 3 months for just 89 dollars!

They funded 100% of their health events in 2023 with 7,000 members and growing; Crowdhealth is an excellent option for any freelancer.

Several factors affect the cost of health insurance for freelancers in North Carolina. The state has limited competition among insurers, which drives up prices. Also, individual plans often lack the economies of scale seen in group plans. Health care costs in the region, local regulations, and the specific needs of freelancers add to the expenses.

Monthly premiums for self-employed health insurance in North Carolina vary. On average, a Bronze plan may cost around $400 per month, while a Silver plan might be about $500. Gold plans can cost $600 monthly, depending on the insurer and coverage specifics.

In North Carolina, the state's healthcare market influences health insurance costs for LLC owners. Premiums are higher than in other states due to less competition and higher healthcare costs. Some states with more insurers and larger populations might offer lower premiums for similar coverage.

Affordable family health insurance options include Bronze or Silver plans from the marketplace. Discounts based on income may also reduce costs.

Individual plans in the healthcare marketplace are often pricier due to large companies' lack of buying power.

Employer-sponsored plans benefit from group pricing, which lowers individual costs. Additionally, individual plans have different administrative costs and risk pools, making them more expensive.