In the world of Cryptocurrency, "cold storage" refers to keeping a reserve of bitcoin offline.

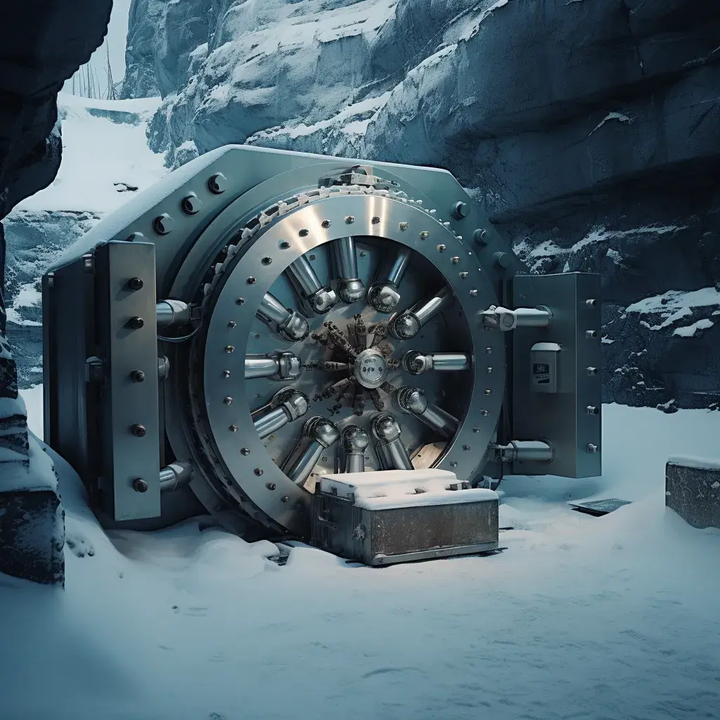

In the world of Cryptocurrency, "cold storage" refers to keeping a reserve of bitcoin offline. This method is often used to reduce the risk of cyber thefts and hacks. Unlike "hot wallets" (bitcoin wallets that run on internet-connected devices), cold storage wallets are not susceptible to online attacks. This feature makes them an appealing choice for long-term investors or those holding large amounts of bitcoin.

Understanding Bitcoin and Wallets

To appreciate the importance of cold storage, one must understand how bitcoin works. Bitcoin is a decentralized digital currency, operating without a central authority. Transactions are recorded on a public ledger called the blockchain.

A bitcoin wallet doesn't store physical coins. Instead, it holds the cryptographic information needed to access bitcoin addresses and send transactions. This information includes private keys, essentially unique strings of numbers and letters that allow bitcoins to be spent.

Types of Bitcoin Wallets

What is Cold Storage for Cryptocurrency?

Cold storage refers to any method used to hold bitcoin and other cryptocurrencies offline. By keeping private keys in an environment disconnected from the internet, cold storage reduces the risk of unauthorized access. The main types of cold storage are paper wallets, hardware wallets, and multi-signature wallets.

1. Paper Wallets

A paper wallet is a physical document containing a Bitcoin address for receiving Bitcoins and the private key for spending or transferring Bitcoin stored in that address. Paper wallets are often printed in the form of QR codes, allowing quick scanning and adding the keys to a software wallet to make a transaction. While novel, paper wallets are not recommended.

Advantages: Inexpensive, immune to online hacks.

Disadvantages: Susceptible to physical damages like water or fire, risk of losing the paper.

2. Hardware Wallets

Hardware wallets are physical devices (similar to USB drives) designed to securely create and store bitcoin keys offline. They can connect to a computer and interact with bitcoin software without exposing the private keys to an internet-connected device. While hardware wallets improve on the physical shortcomings of paper wallets, they are still single points of failure.

Advantages: Secure, portable, can create private keys offline, can easily back up private keys generated using the device.

Disadvantages: More expensive than paper wallets, risk of hardware failure, recognizable.

We recommend: Coinkite's ColdCard

Multi-signature wallets leverage bitcoin’s unique native properties to create a cold storage custody solution that reduces the risks that come with storing your bitcoin a single signature paper or hardware wallet significantly. Bitcoin multi-signature wallets require multiple private keys to authorize a transaction, enhancing security by distributing control among several wallets that can be controlled by an individual or multiple parties. This setup is ideal for scenarios requiring consensus, such as shared accounts or enhanced security measures for individual users.

Advantages: Secure, geographically distributed, can create private keys offline, can easily back up private keys generated using the devices involved.

Disadvantages: Harder to move the bitcoin, more data needs to be backed up and saved.

Security Practices for Cold Storage

Risks and Considerations for Cold Storage

Conclusion

Cold storage is an essential method for anyone looking to secure their bitcoin from online threats. While it offers higher security, it also requires careful handling and planning. Users must balance the security benefits against the risks and inconveniences of handling and maintaining physical devices and private key material. With the right practices, cold storage can effectively safeguard bitcoin, providing peace of mind for long-term holders and serious investors in the cryptocurrency space.