China's banking challenges and slowing loan growth raise serious concerns about the country's economic stability and its potential impact on global growth.

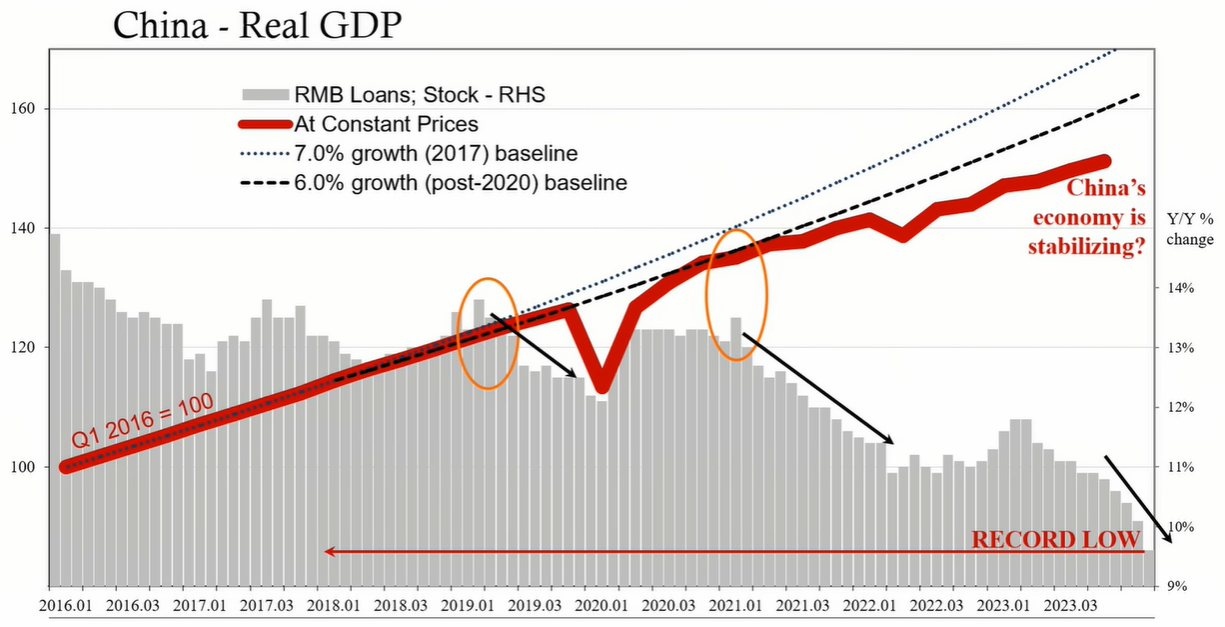

Recent data indicates significant economic challenges in China, with a substantial drop in Chinese prices and banking difficulties. A record low growth rate in the outstanding stock of Chinese loans has been observed, raising concerns about the nation's economic recovery and its impact on the global economy. The International Monetary Fund (IMF) had projected that China would contribute to a quarter of global growth in the next five years, but these expectations are threatened by the current downturn.

The growth rate of the outstanding stock of Chinese loans has hit a record low, signaling a slowdown in financial activity. This decrease in loan growth raises red flags about the overall health of the economy. Fitch Ratings has expressed skepticism about the effectiveness of China's fiscal policy in reigniting GDP growth due to the rising debt levels and challenges in managing high leverage across the economy.

The Chinese government has been implementing stimulus measures to stabilize the economy. However, there are doubts about their effectiveness as the economy continues to struggle and debt levels rise. The cycle of increasing stimulus without tangible economic growth exacerbates the debt situation, reminiscent of the strategies used during the 2008-2009 financial crisis.

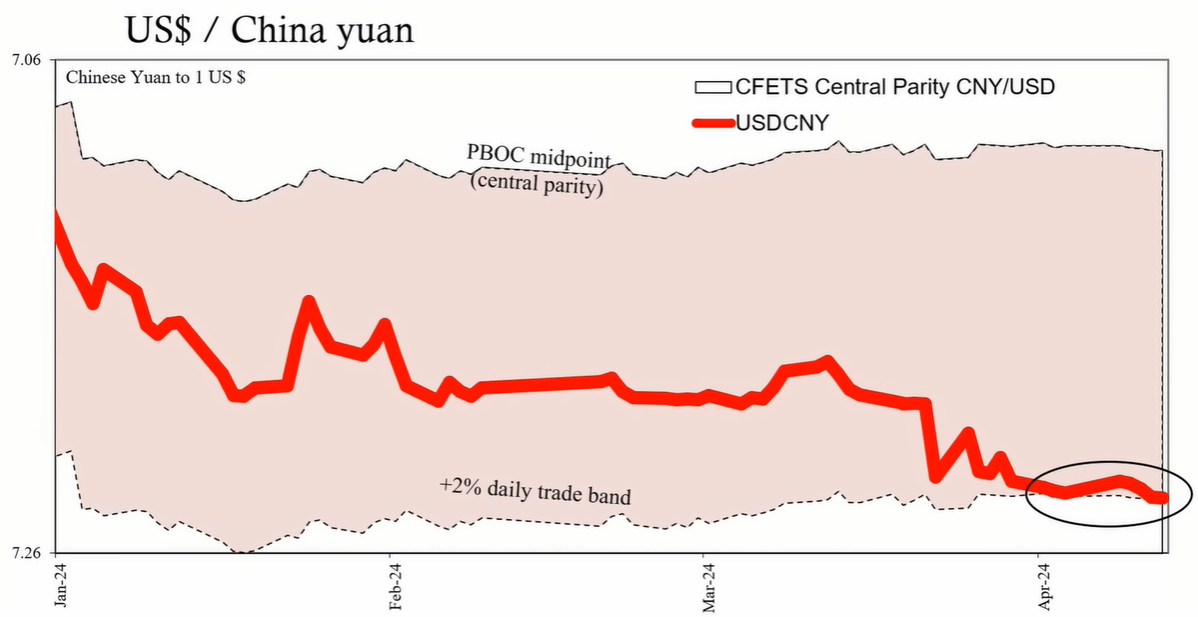

The Chinese currency (CNY) has shown tendencies to devalue, while bond yields have been falling since November, reflecting diminished growth and inflation expectations. This trend in financial markets underscores the lack of confidence in China's economic prospects.

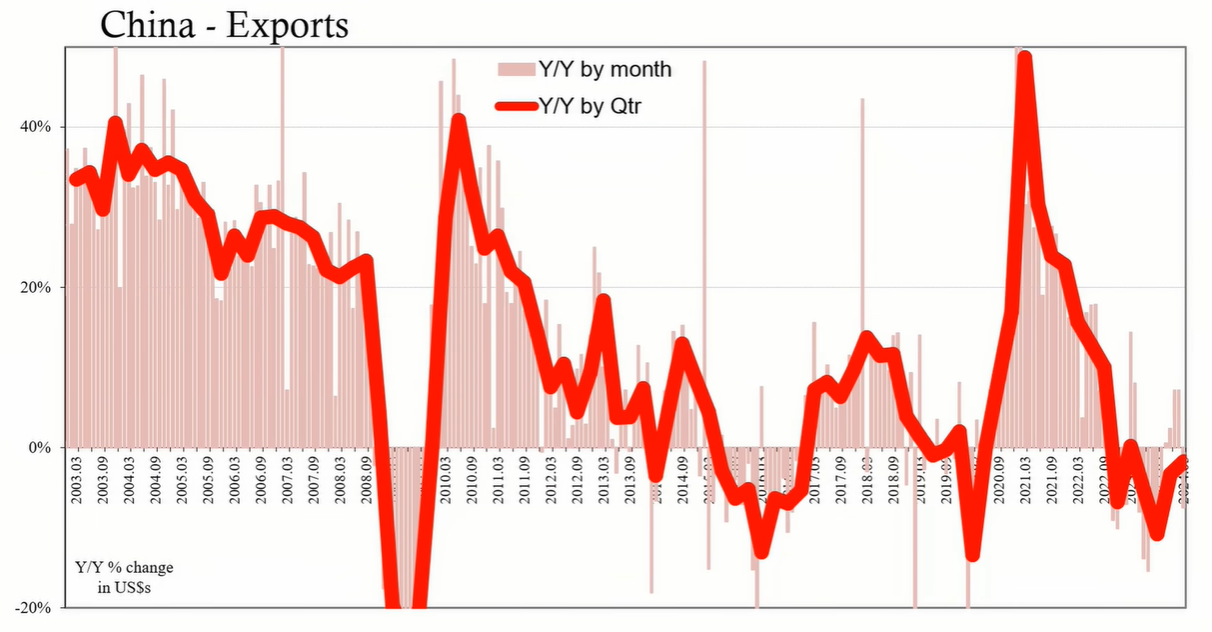

Trade data from China indicates a decline in both exports and imports. A nearly 8% year-over-year drop in exports in US dollar terms highlights weak global demand, and declining imports suggest a contraction in domestic consumption, further evidencing economic difficulties.

Despite liquidity injections and modest rate cuts from the People's Bank of China (PBoC), the banking sector's reluctance to lend reflects a lack of confidence in the economy's ability to recover. The latest financial statistics from the PBoC show a continued deceleration in the growth of yuan loans.

The weakening of China's economy has near-term implications for global growth, particularly in emerging markets that are expected to rely on China's recovery. Disinflation or deflationary pressures emanating from China could impact inflation rates elsewhere.

The persistent economic weakness in China suggests a grim long-term outlook for global economic stability. A continued decline in China's growth could lead to more significant global consequences, including increased migration, uncertainty, and instability.

China's economic challenges, characterized by deflationary pressures, a reluctant banking sector, and a falling currency, paint a concerning picture for both its domestic economy and the global economic landscape. These issues raise doubts about the anticipated recovery and growth, with potential ramifications that could extend well beyond 2024. The global economy may face significant hurdles if China fails to stabilize and initiate a recovery.