Since bitcoin’s inception fifteen years ago, it’s been demonized and subject to heavy scrutiny. Over this time, central banks, governments, and their media cronies have made an earnest effort to discredit bitcoin to no avail.

November 30, 2022 - $17,163.29 per bitcoin

“Bitcoin’s last stand” published on the European Central Bank’s blog.

"The value of bitcoin peaked at USD 69,000 in November 2021 before falling to USD 17,000 by mid-June 2022. Since then, the value has fluctuated around USD 20,000. For bitcoin proponents, the seeming stabilization signals a breather on the way to new heights. More likely, however, it is an artificially induced last gasp before the road to irrelevance – and this was already foreseeable before FTX went bust and sent the bitcoin price to well below USD16,000."

Then tell me central bankers, did you foresee bitcoin’s price rallying over 150% in 2023 — is that part of the “road to irrelevance?”

Since bitcoin’s inception fifteen years ago, it’s been demonized and subject to heavy scrutiny. Over this time, central banks, governments, and their media cronies have made an earnest effort to discredit bitcoin to no avail.

The collapse of several exchanges, funds, and crypto platforms in 2022, most notably FTX, seriously dampened the credibility and enthusiasm of bitcoin and crypto in the public sphere. The events of 2022 sent bitcoin’s price below the prior cycle’s high of nearly $20,000 (2017) for the first time in its history.

Sentiment was extraordinarily bearish, and it was a seemingly perfect time for the central banks to declare that the war on bitcoin was won — that it was finally dead… right?

The parasitic elites have long proclaimed the death of bitcoin. After all, those who benefit from a theft-based monetary system will hate freedom money.

However, this holds a special place in my heart - a hit piece on bitcoin published on the ECB’s blog after bitcoin suffered a massive blow earlier in the month.

Of course, though, their blog was almost perfectly timed with the bottom of the cycle, and since being published, the price of bitcoin has risen ~140%.

What the central bankers don’t understand — well, actually, there’s a lot…

They don’t understand that bitcoin’s price experiences four-year cycles due to the halving, when new bitcoin issuance (supply) is cut in half every four years, and the investor behavior surrounding the halving (FOMO).

This past cycle was no exception. And despite their attempt to discredit bitcoin at a time when morale was at its lowest, the fundamentals of the network have only improved.

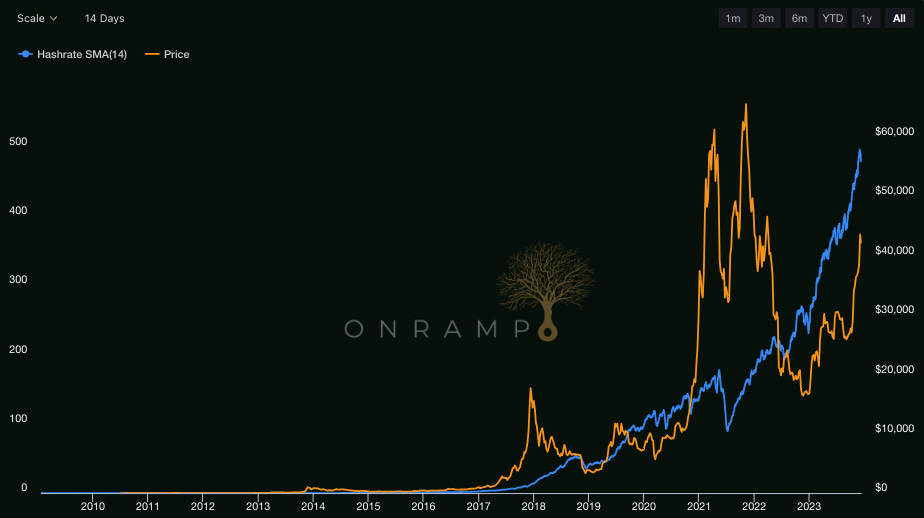

Hash rate, the measure of the computational power directed toward the bitcoin network, continues to set all-time highs - increasing hash rate indicates more miners competing on the bitcoin network and illustrates the robustness of the underlying network despite market fluctuations.

In defiance of naysayers, bitcoin’s price rallied considerably in 2023, even with tighter financial conditions (higher rates) imposed by the Fed and global central banks to ‘fight’ a problem that they create… inflation.

Once dismissed as a speculative asset that could only thrive in easy money conditions, bitcoin’s further proven itself resilient. And more likely than not, bitcoin’s price signals the reversal point of monetary policy on the horizon. After all, the US Government is insolvent and requires massive deficits financed by the Fed, preferably at 0% interest.

Now, central bankers won’t like to hear this, but looking forward to next year, there are several positive catalysts for bitcoin’s fundamentals and price.

The central bankers are about to be trampled by the bulls. As bitcoin’s price surges to new all-time highs, they’ll be left grappling with their dwindling relevance.

As central banks scramble to lower rates and stimulate the economy as things break next year, bitcoin will be more widely adopted, secure, and valuable than ever before. The central banks’ last stand is here.

This article was first published on MacroJack's newsletter, "The Fiat Cave."