Central bankers often use "pro-social lying" to manipulate forecasts and influence economic stability.

The reliability and honesty of economists and central bankers have been subjects of debate and scrutiny. Allegations that these individuals often misrepresent economic conditions and forecasts have been longstanding, and the rationale behind such deception is rooted in the belief that their statements can significantly influence economic outcomes.

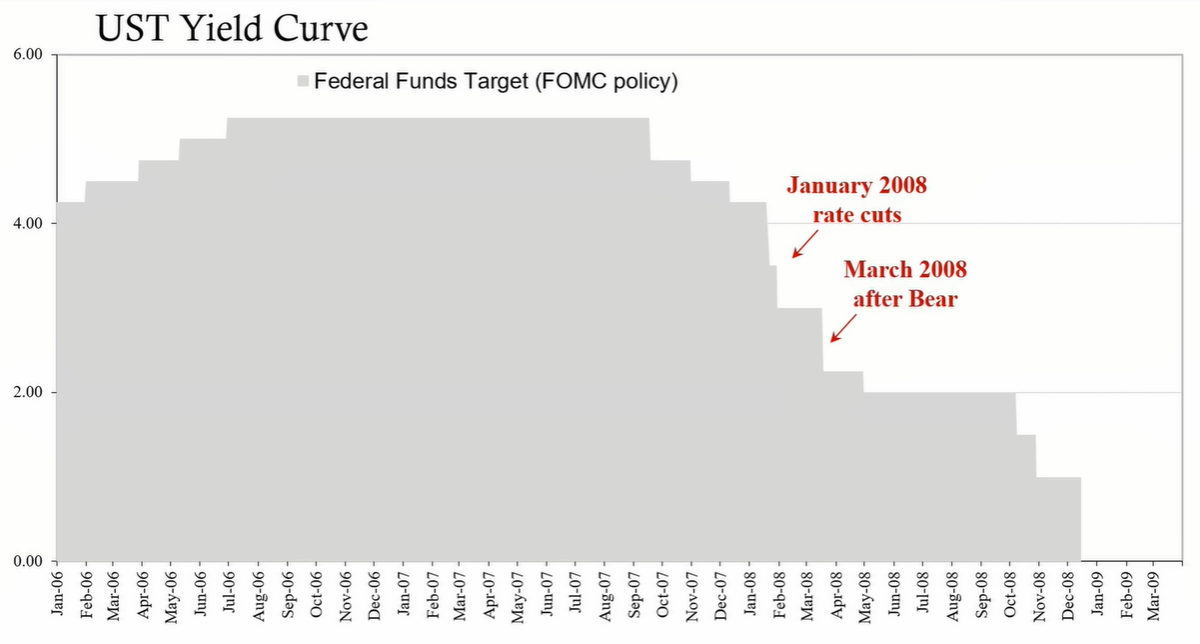

Central figures in the financial world, such as former Federal Reserve Chairman Ben Bernanke, have been criticized for offering overly optimistic assessments, potentially to avoid market panic. For instance, had Bernanke admitted the severity of the subprime mortgage crisis in March 2007, a financial panic might have ensued earlier than it did. This strategy underlines a broader tendency among economists and policymakers to engage in what they perceive as "pro-social lying" or deception for the greater good, based on the assumption that positive sentiment can stave off economic downturns.

Recent instances, such as the denial of an impending recession by German Chancellor Olaf Scholz, illustrate the ongoing discrepancy between official economic statements and reality. This raises questions about the intent and accuracy of government-affiliated economists' predictions. The gap between public perception and official narratives suggests that psychological manipulation is a key tool employed to maintain economic stability, or at least the illusion of it.

A paper from the University of Massachusetts Political Economy Research Institute by George DeMartino, titled "Should Economists Deceive? Pro-social Lying, Paternalism, and the Ben Bernanke Problem," provides insight into the internal perspectives among economists. It highlights historical skepticism towards the honesty of economists, including a quote from Joan Robinson in 1978 emphasizing the importance of not being deceived by economists. DeMartino's paper underscores that economists often do not trust each other's findings and are pressured to produce favorable economic interpretations.

The belief in avoiding recessions at all costs can be traced back to Keynesian economic theory. Economists Brad DeLong and Larry Summers argued in their 1988 paper, "How Does Macroeconomic Policy Affect Output?" that recessions are unnecessary deviations from economic trends and should be prevented through policy measures. This belief system underpins the notion that positive reinforcement through economic forecasts can "fill in the troughs" of economic cycles, thereby avoiding downturns.

The financial crisis of 2008 challenged the effectiveness of Keynesian policies and revealed the limitations of a purely psychological approach to economic stability. It became evident that monetary and financial issues require substantial attention beyond optimistic forecasts. In the years following the crisis, leading economists like DeLong and Summers acknowledged a "lesser depression" or "secular stagnation," recognizing a significant change in macroeconomic performance.

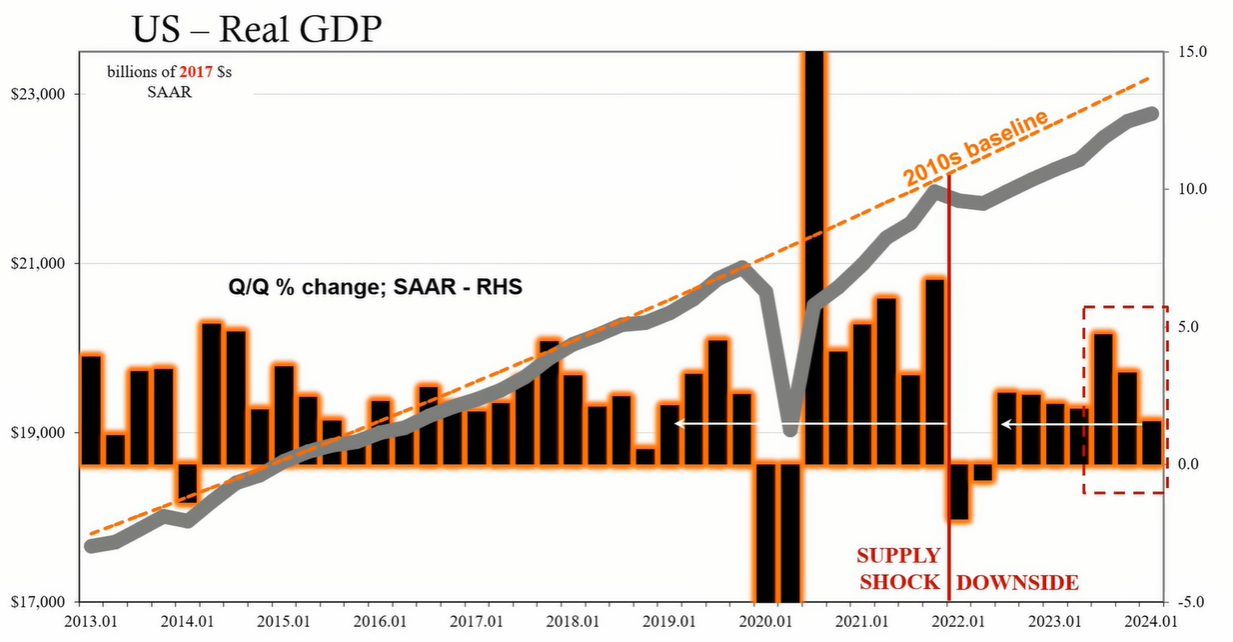

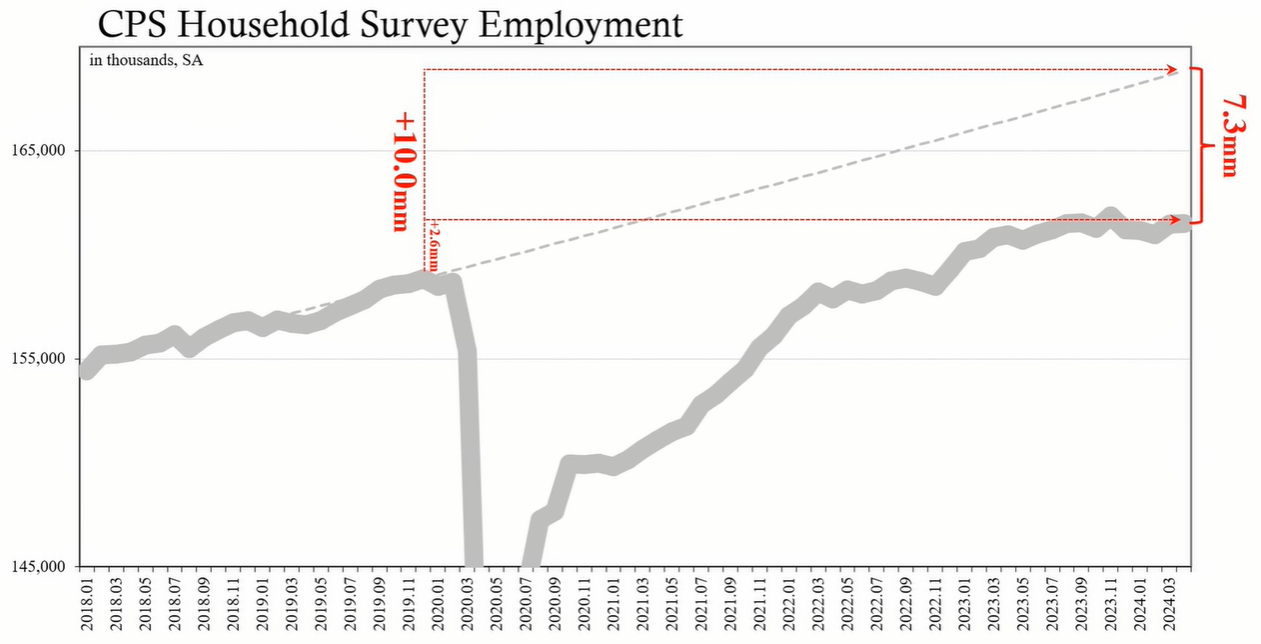

Economic indicators such as GDP growth and unemployment rates are often presented in isolation, without the necessary context to evaluate their true significance. For instance, a GDP growth rate that falls short of what is required for economic recovery, or a low unemployment rate that ignores labor force participation issues, can paint a misleading picture of economic health.

The practice of economists and policymakers presenting overly positive economic forecasts is well-documented and rationalized as being in the public's best interest. However, the effectiveness of such an approach is questionable, as it can lead to misinformation and misplaced trust in authorities. The discrepancy between economic reality and official statements underscores the importance of independent evaluation and skepticism towards authoritative economic predictions. It is essential for the public to scrutinize the data and draw informed conclusions, rather than relying solely on the perceived expertise of central bankers and economists.