This unconventional tax strategy extends beyond California’s borders, as it includes a provision to tax part-time residents pro rata for the days spent within the state.

In a move that is stirring both concern and controversy, California's legislature is considering implementing a wealth tax targeting the state's most affluent residents. According to the proposed legislation, individuals with assets over $50 million would be taxed at an annual rate of 1%, while billionaires would face a 1.5% tax. The tax for billionaires could take effect as early as next year, while millionaires would have a one-year reprieve.

This unconventional tax strategy extends beyond California’s borders, as it includes a provision to tax part-time residents pro rata for the days spent within the state. Moreover, California plans to pursue those who leave the state, seeking to collect taxes on wealth generated during their residency.

The proposed wealth tax also enlists private attorneys to pursue affluent Californians for underreporting assets, with financial incentives in the form of a share of the recovered taxes. This raises the specter of legal battles over asset valuation, including mundane matters like the cost basis of home renovations.

Behind this legislative push lies California's daunting $68 billion budget deficit, further exacerbated by generous social welfare programs, such as the recent introduction of free healthcare for all illegal migrants—a policy that includes coverage for gender reassignment surgeries.

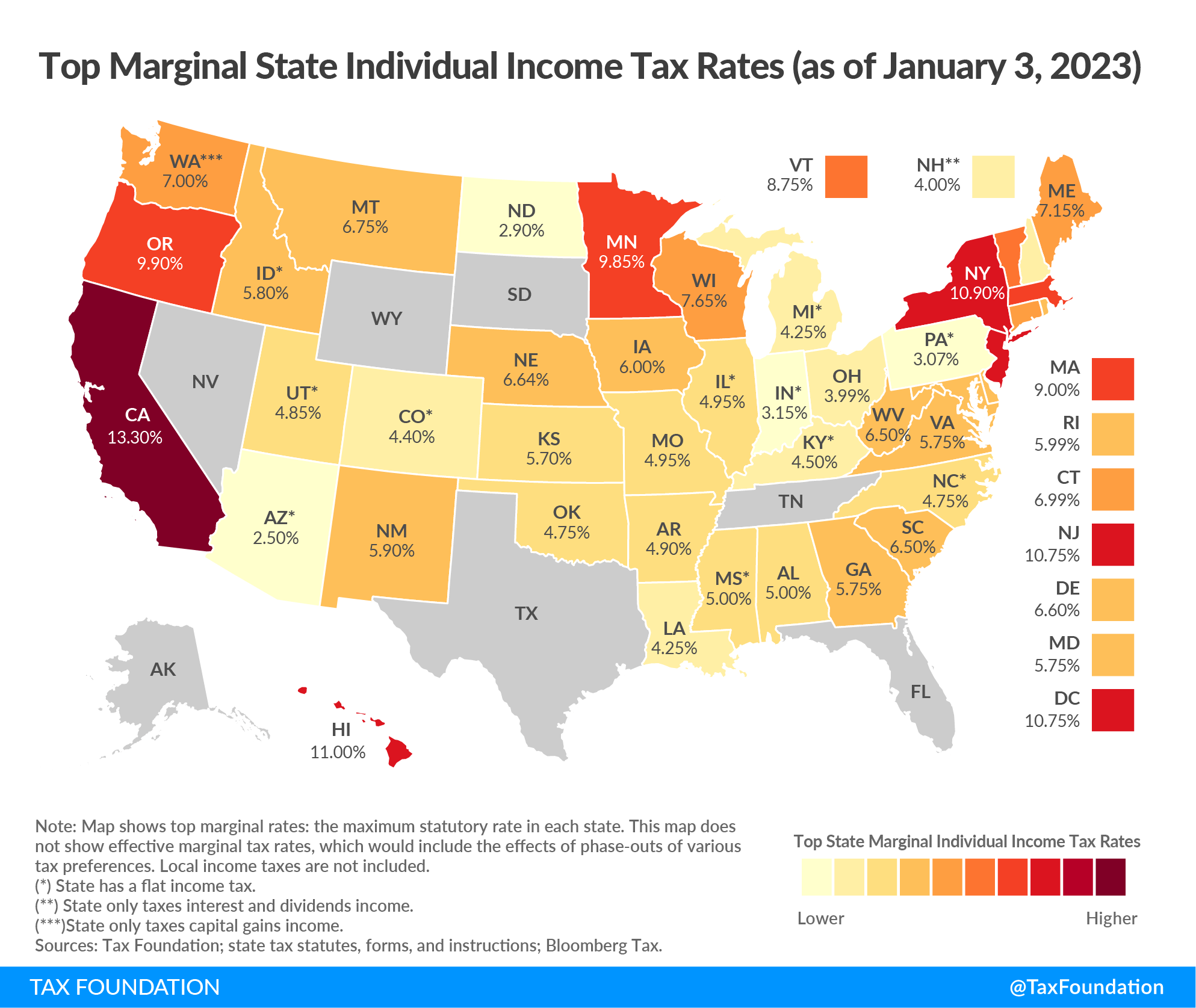

Critics argue that the proposed tax, though seemingly modest as a percentage, would have a significant impact on the wealthy, potentially confiscating nearly a third of their annual returns. With California's existing top income tax rate of 14%, the wealth tax could see the affluent contributing a substantial portion of their earnings to state coffers.

The wealth tax is not yet a certainty; it must still pass legislative hurdles and would likely face legal challenges. However, given California's history of taxing property through property taxes, proponents believe it could withstand scrutiny.

The broader implication of this tax could be a mass exodus of wealthy Californians to more tax-friendly states such as Florida or Texas, potentially eroding California's tax base. Additionally, there is concern that this policy could set a precedent for other progressive states.

California's wealth tax proposal is a critical development that could reshape the state's fiscal landscape and influence tax policy nationwide. As the story unfolds, we will provide updates on this potentially disastrous legislation.