In an era marked by economic uncertainty, the American consumer has increasingly turned to an alternative payment method that is raising concerns among financial experts: Buy Now, Pay Later (BNPL) services.

In an era marked by economic uncertainty, the American consumer has increasingly turned to an alternative payment method that is raising concerns among financial experts: Buy Now, Pay Later (BNPL) services. Recent data reveals a startling 14% year-over-year increase in the use of BNPL, a trend that has not gone unnoticed as pandemic savings evaporate and real incomes dwindle.

As reported by LexisNexis, an estimated one in four Americans have engaged with BNPL loans, a significant statistic that underscores the popularity of such services. This was particularly evident during the past Black Friday sales, where BNPL transactions constituted 7.22% of all online purchases—a 25% rise from the previous year. The Bank of International Settlements has noted an approximate tenfold escalation in BNPL usage since the pandemic began, with app usage alone reaching 2.5 million people, a figure highlighted by a New York Fed study.

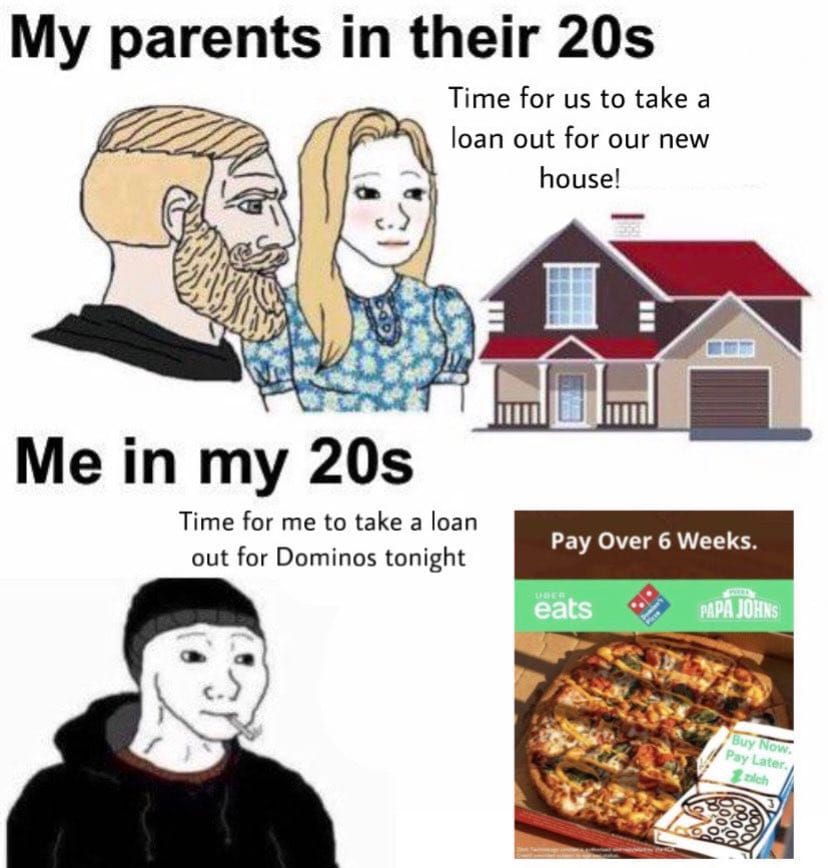

The demographic most drawn to BNPL includes individuals with lower incomes and less formal education. But what drives this surge in BNPL's appeal? One factor is its invisibility to credit bureaus—transactions through BNPL are not typically reported, allowing consumers to bypass traditional credit checks. Retail giants like Walmart have capitalized on this, offering BNPL loans directly at self-checkout stations without the need for credit review.

However, this convenience comes with a dark lining. Initial 0% interest rates can skyrocket to 36% following a missed payment, a punitive measure that could lead to a financial disaster for the unwary consumer. Despite this, some users remain undeterred, as highlighted in a Wall Street Journal profile: unlike credit cards, BNPL lenders may sever ties instead of pursuing wage garnishment—but what happens when this mindset is multiplied across 80 million users?

Millennials, in particular, represent the majority of BNPL users, many of whom have not only relinquished the dream of homeownership or starting a family but now seem indifferent to their future creditworthiness. With one study indicating that a third of millennials are teetering on the brink of bankruptcy, the future appears bleak.

This surge in "phantom debt" can be traced back to the Federal Reserve's monetary policies post-COVID. The initial distribution of "free money" has birthed an era of aggressive lending practices by companies that are less concerned with repayment than with sustaining the cash flow until they can profitably exit. Compounded by the Fed's recent rate hikes, countless Americans find themselves ensnared in a financial "woodchipper," seeking loans at any rate to combat inflation and the erosion of real wages.

As the economy teeters on the brink, powered by the fumes of unsustainable debt, the question that looms large is what will break next—and at what cost to the taxpayer who may ultimately foot the bill for a potential trillion-dollar bailout.

In a climate where "the supposed adults in the room" are hastening the pace of economic disintegration, it is imperative to keep a watchful eye on the developments of this burgeoning debt crisis.