Q1 2024 13F Analysis & Reasons to be Bullish.

In January 2024, the SEC approved 11 spot bitcoin ETFs. I’ve shared my thoughts about the significance of this milestone as far back as July 2023, referring to it as the Digital Gold Rush, and then again in March 2024 to revisit the first two months of spot bitcoin trading.

But now, as of May 15th, we have Q1 2024 13F data for spot bitcoin ETFs, so we can analyze the current ownership of these financial products and speculate on what’s in store for upcoming quarters.

Before doing so, it’s probably smart to ensure we all are on the same page when it comes to 13Fs — A 13F filing is a quarterly report submitted by institutional investment managers to the SEC.

These managers have over $100M in assets under management and either buy and sell securities for their own accounts and/or invest on behalf of another client. Examples include:

The filings are due 45 days after the end of each quarter and offer a snapshot of the holdings of these institutions. Ok, now for the interesting stuff.

At March 31, 2024, the spot bitcoin ETFs held approximately 840,000 BTC, valued at $56 billion. It’s worth noting that the Grayscale Bitcoin Trust (GBTC) held ~ 600,000 BTC valued at $26bn in AUM prior to ETF approval.

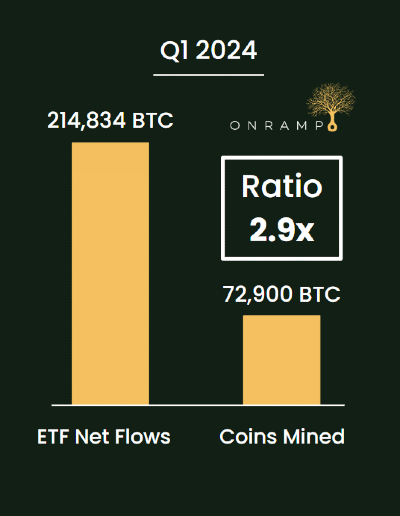

When we consider the net new buying over the quarter, we observe a significant disparity between supply and demand. Roughly 220,000 BTC have been purchased by the ETFs, compared to ~73,000 BTC mined. This means that there was 2.9 times more demand than supply from the ETFs alone.

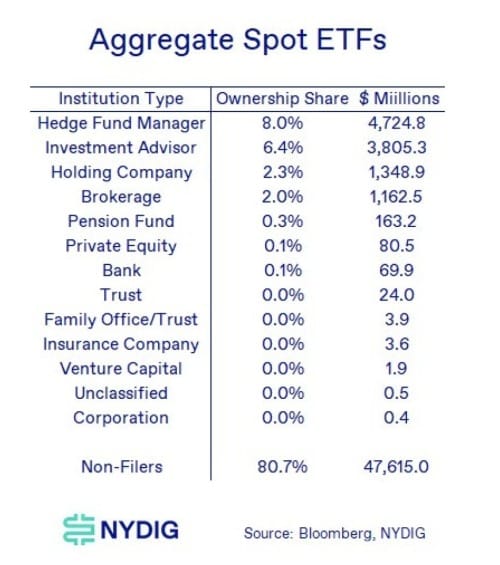

Below you can find a breakdown of who owned the 13Fs at the end of the quarter. The data reveals a substantial retail adoption of spot bitcoin ETFs — approximately 80% of Bitcoin ETF owners are non-filers, holding around $47 billion.

This trend challenges the narrative that institutional adoption is the primary driver of bitcoin's growth. For at least two cycles now, industry participants have said, "The institutions are coming," and well, for the most part, they haven't.

But, here's the good news, the institutions have started allocating.

The key word is "started," as institutional investors, advisors, and financial services companies have a longer due diligence process. Typically, these cohorts start with a smaller allocation and grow their position as their conviction deepens.

I find this to be extremely bullish because it means that over the coming quarters, the non-filer ownership of the ETFs will almost certainly decline from the high of 80%. As larger firms with big pockets increase their understanding of this digital bearer asset, allocations will grow.

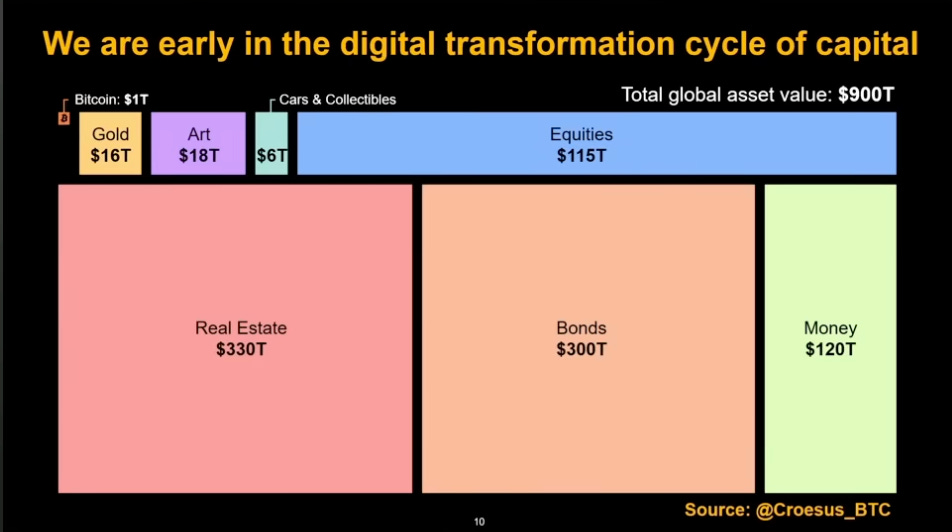

These large pools of capital represent tens of trillions of dollars and there's approximately $900 TRILLION of wealth globally. Bitcoin is only $1.5 trillion global asset and the US ETFs are approximately $60 billion.

Bitcoin has existed for 15 years. Over those 15 years, we've seen exponential adoption of the asset class and proliferation of the ecosystem.

Each four-year cycle, there are more bitcoin businesses that allow for more people to buy, secure, and spend bitcoin.

However, the high adoption rate of ETFs among individuals shows that there's still a bias toward convenience and familiarity. Many people hesitate to open an exchange account like Coinbase (I don't recommend Coinbase) to purchase bitcoin. Even more people are uncomfortable with self-custody, especially for material amounts of bitcoin.

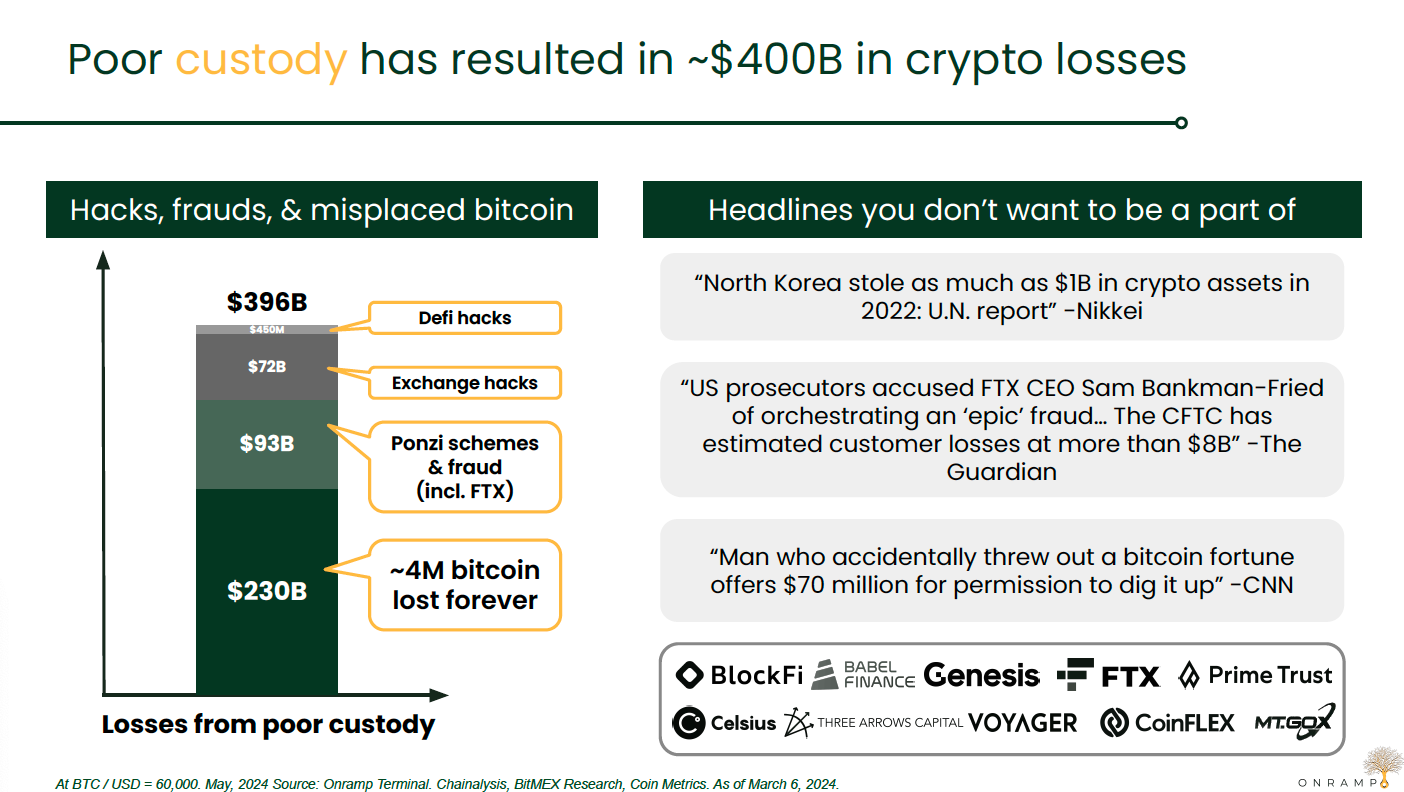

It's not hard to imagine that for an asset class that has seen $400 billion in losses in a little over a decade, there's some hesitation for people to participate. When people read about FTX or someone diving through a landfill to find their hard drive with millions of dollars in bitcoin, it's no wonder people waited for ETFs.

So if we want to see more people own bitcoin rather than a financial product, more solutions need to exist to meet people where they are at.

My firm Onramp is one example of making it easy to purchase and hold bitcoin in deep cold storage without subjecting yourself to potential risks of losing keys or being hacked. It's also great to see the launch of other platforms like Theya that allow for true ownership and security of one's bitcoin.

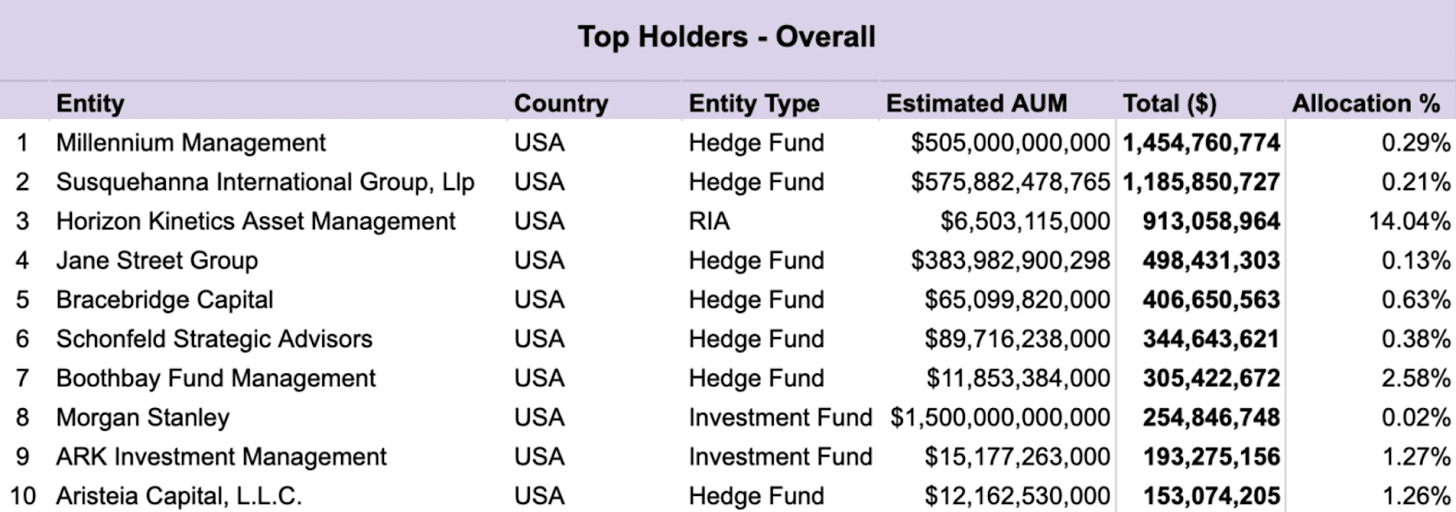

Hedge funds represented 8% and $5 billion of ETF ownership and 7 out of 10 top holders.

It’s hard to read into this because many funds actively trade their positions. Many of the large funds that own the ETFs are quantitatively driven, so they do not necessarily purchase the ETFs because of the fundamentals of bitcoin but rather because their algorithm has identified some trend.

Also, the 13F does not capture short positions, so a significant amount of this long exposure is likely hedged with short positions.

This is the least interesting part of the data to me.

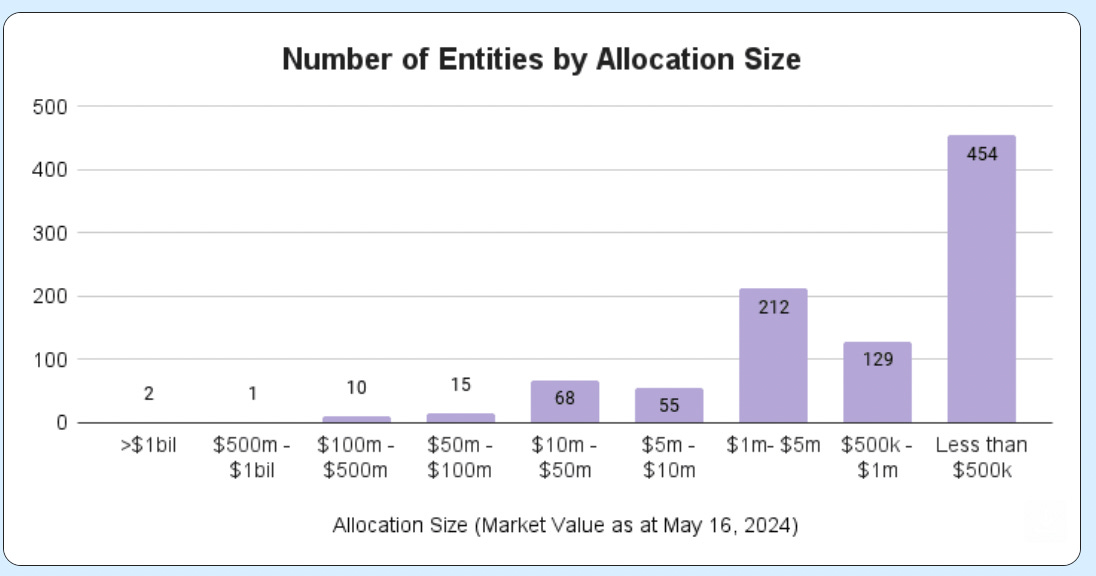

Nearly 800 investment advisory firms reported holding almost $4 billion in bitcoin. For context, there are around 15,000 such firms in the US, representing tens of trillions of dollars. So yes, we are early.

454 out of 948 firms have allocated less than $500k, and remember to file 13F, a firm must manage over $100MM, so these are tiny exposures.

It’s also worth noting that some of the largest wealth management firms in the country are still not offering their advisors and underlying clients any bitcoin ETFs. Other firms have the products available but do not allow advisors to bring them up to clients; the clients must explicitly ask. There’s still a lot of sidelined firms.

The most notable allocation in Q1 2024 was the State of Wisconsin Investment Board (SWIB), which allocated $160 million to Bitcoin—about 0.10% of its $156 billion portfolio.

SWIB manages the Wisconsin Retirement System (WRS), the ninth-largest public pension fund in the United States. The WRS provides retirement benefits to over 677,000 current and former employees of Wisconsin state agencies, school districts, the university system, and most local governments.

Again, this reinforces the idea of how early institutional adoption is and the fact that these larger pools of capital start with small allocations and grow over time.

Retail investors are leading the charge with substantial holdings in bitcoin ETFs, while institutional adoption is very early — only 60 out of the 948 filers have allocated more than 1% of their portfolios to bitcoin.

This is bullish for bitcoin, as I expect we will see broader institutional adoption and growing position sizes of existing allocations over the coming quarters.

Full disclosure: I am an employee of Onramp, but for good reason. We have the best Private Client solution in the industry and are helping people secure their bitcoin legacy.

Interesting in learning more about Onramp and how we can help you secure your bitcoin legacy?

Originally Published on The Fiat Cave