The 10yr US Treasury yield has climbed from 0.66% in April 2020 to 4.7% this week.

Fixed Income is getting destroyed. When will the Fed monetize the bond market?

Bond indexes everywhere are getting destroyed, entering their second year of pain as the Federal Reserve hikes interest rates at the fastest rate in history and inflation remains above 3%. Long thought to be the “safe” asset, something is spooking the market- and the implications still aren’t fully grasped.

Could the collapse in fixed income be an omen of what is to come?

In March 2020, with the rapidly increasing spread of the novel COVID-19 coronavirus, the world entered a shutdown. Financial markets entered a freefall, lasting for days and forcing multiple circuit breaker trading halts. The world appeared to be entering a new Great Depression- with debt to GDP at multiple decade highs, corporate bonds and public equities reaching extreme overvaluations, and repo markets in disarray, the Fed responded.

Terrified of a repeat of 2008, Powell undertook dramatic action. The Federal Reserve reduced its target for the federal funds rate, the interest rate at which banks lend to each other overnight, by a cumulative 1.5 percentage points during its meetings on March 3 and March 15, 2020. This brought the funds rate within the range of 0% to 0.25%. Given that the federal funds rate serves as a reference for various short-term and long-term interest rates, this measure was supposedly implemented to encourage spending by decreasing borrowing costs for households and businesses.

The Fed also resumed QE to an extent never before seen. In response to the severe disruptions in the Treasury and mortgage-backed securities (MBS) markets triggered by the onset of COVID-19, the Fed tried to restore stability. On March 15, 2020, the Fed announced plans to purchase a minimum of $500 billion in Treasury securities and $200 billion in government-guaranteed mortgage-backed securities over the upcoming months. Not even a week later, on March 23, 2020, the Fed made these purchases open-ended, stating its intention to buy securities "in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions."

Bonds subsequently paused their freefall and began rallying, along with equities. The early doomsayers who had proclaimed COVID as the end of the 40 year bond bull market were proven wrong.

The trillions in new liquidity flooded into the financial system and began finding its way into every asset class. Congress, terrified of appearing unsupportive of the broader economy, passed stimulus checks and expansions to food stamps and other programs. Inflation slowly began to rise. As inflation accelerated throughout 2021, it was first met with derision and dismissal, and then annoyance and panic. To combat the rising prices, the Fed embarked on the most aggressive hiking cycle ever seen.

The speed of the move has been staggering- consider the abrupt increase in both nominal and real interest rates that is currently unfolding. The 10yr US Treasury yield has climbed from 0.66% in April 2020 to 4.7% this week. The last instance of such a significant movement in the 10-year yield within a three-year span was seen during 1979-1982. This period coincided with Fed Chairman Paul Volcker's efforts to combat the inflationary challenges of the 1970s, a time marked by not one but two recessions.

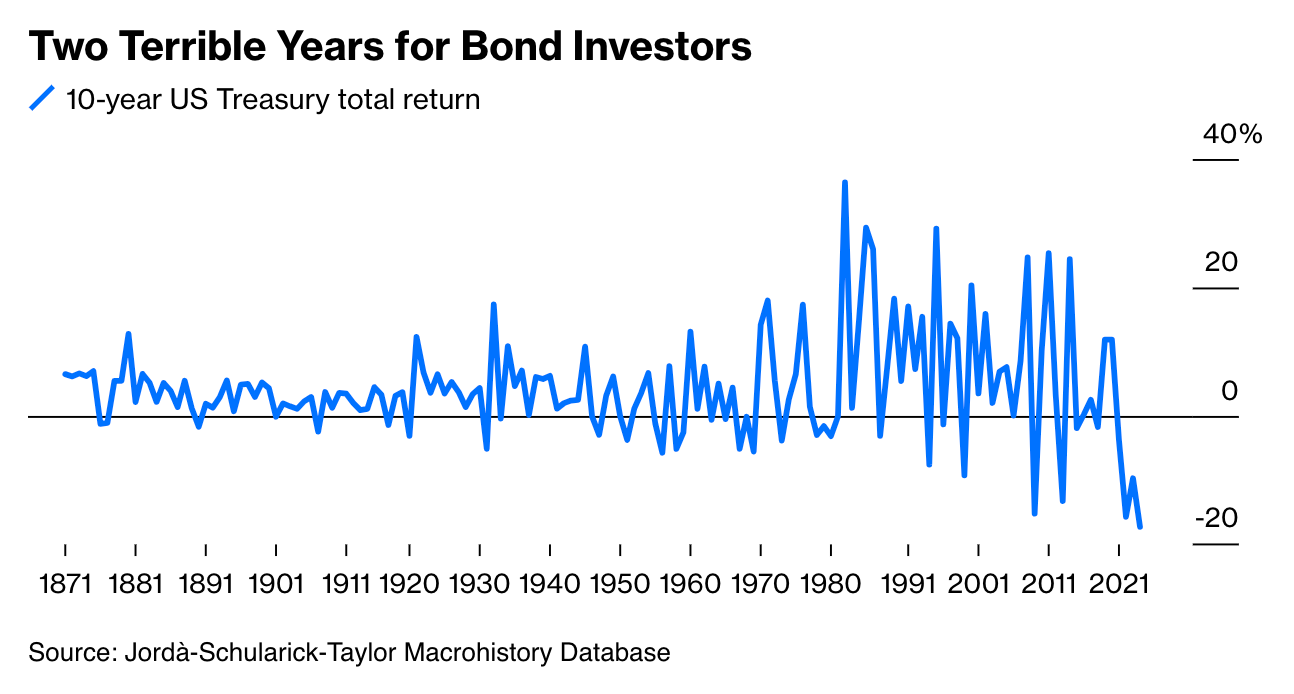

As Bloomberg notes, in terms of overall returns, the current downturn in the bond market is the most significant in 150 years. Last year marked the toughest period for U.S. bond investors since 1871, resulting in a total return of minus 15.7%—an even more adverse outcome than the tumultuous year of 2009. As of the year-to-date performance for 2023, the return has reached nearly minus 10%, and on an annualized basis, it stands at minus 17.3%—a figure even worse than 2022. The past two years have been the worst for bond investors in the past century and a half.

Although many may not know this, bonds are essentially a form of money in our financial system. Bonds are an IOU, a derivative of money that exists as a future claim on the underlying currency. Treasuries in particular are crucial since they are the primary source of collateral in the repo and shadow banking markets, and also serve as benchmarks on which other bond prices *should* trade.

Deposits and cash obviously make up base money, but on top of these instruments exist layers of complexity that exist as forms of money. The damage in bonds is thus a destruction of money- and is particularly dangerous to banks or pension funds that hold a lot of duration.

$TLT, the largest long duration bond ETF, has seen a more than 48% loss from its 2020 peak. Jack Farley of Blockworks noted that $EDV, another ultra long duration bond Treasury ETF, has seen a peak-to-trough collapse greater than that of the S&P 500 during the 2008 Financial Crisis.

Duration risk refers to the sensitivity of a bond to fluctuations in interest rates, considering factors like yield, coupon rate, and maturity. Given the inverse relationship between bond prices and interest rates—where rising rates lead to falling bond prices and vice versa—the duration of a bond, measured in years, indicates its sensitivity to interest rate movements. The longer the duration, the more pronounced the impact of interest rate changes o

n the bond's price. The chart below reveals a consistent increase in duration (represented by the shaded area) since the mid-1990s, with an acceleration following the global financial crisis.

Many bonds on bank balance sheets are marked HTM- Hold To Maturity. Accounting regulations state that these bonds do not have to be accounted for losses, and also do not have to be hedged- a fact that came into the public eye during the collapse of Silicon Valley Bank and First Republic this spring.

It’s only a loss if you sell. So it doesn’t matter.

Right?

I’ve already touched on the Peruvian Bull Debt Paradox on this substack and elsewhere, but as a quick review, what is going to occur on the macro stage in the next few years is the exact inverse of what Keynesian economic theory and the statistical models predict. Instead of interest rates slowly and gradually bringing down inflation, as consumer spending cools and loan demand dries up, it will accelerate.

As the Treasury is the most indebted entity in the system, with every hike the Fed ratchets onto the market it is doing more so onto Treasury, who must respond with more bond sales at higher and higher rates. This pushes us into an exponential debt spiral, like I laid out here.

The Treasury will refinance the massive debt at high rates, thus requiring more borrowing in the future. Bank reserves, traditionally isolated to the financial system, will flow in greater and greater quantities into the TGA (Treasury General Account) and be spent in the real economy, driving up inflation.

With every rate hike the Fed dooms the U.S. to greater inflation in the future.

This paradigm is already playing out- but what about a similar paradox with their current BTFP program? Hiking rates means lower and lower bond prices, which puts pressure on commercial bank portfolios, which means increased usage of the Bank Term Funding Facility as banks seek a mechanism for liquidity at par on bonds that are deeply underwater. Basically every week this year the amount outstanding at the facility has increased. Just this last week, it went up another $1.2 billion.

The Fed ostensibly is supposed to end the program next March. But we all know it will be extended.

With every rate hike, the hole blown in the banking sector grows larger. Today, on October 17th, Bank of America reported unrealized losses of $131.6B. Much of this is held in their HTM portfolio, so it will be held to maturity and therefore not suffer any actual impairment, but this is dangerous nonetheless.

On the balance sheet, investment securities are classified into two categories: "held to maturity" (HTM) and "available for sale" (AFS). HTM securities are those that the bank intends to retain until they mature and are reported at their amortized cost. Changes in their market value do not impact total assets or book equity; instead, the reported value of HTM securities changes gradually as their initial discount or premium amortizes over time. (AKA, they don’t report losses officially and do not have to hedge interest or duration risk).

However, Available for Sale (AFS) securities may be sold before maturity and are reported at their market value. Any fluctuations in the market value of AFS securities, whether gains or losses, are reflected in book equity within the accumulated other comprehensive income (AOCI) account on a bank’s financial, like I laid out in this thread back in March for Silicon Valley Bank. Consequently, as the market value of AFS securities increases or decreases, both assets and book equity follow suit, rising or falling accordingly.

Banks are increasingly shifting their portfolios to HTM to avoid reporting the massive losses being incurred on their balance sheets.

Bonds exist not only obviously as an income stream but also as an asset. The liquidity and value of that asset matters, as we have seen in March and April of this year. Thus, if any new crisis strikes the banking sector, these financial institutions will not be able to sell their assets for par but either be forced to sell at significant loss or tap the Fed for more liquidity. Which essentially is the thesis of Dollar Endgame anyway.

Bonds have been fortunate enough to experience a four decade bull market, as the Fed has consistently and slowly lowered rates. However, once you get to the zero bound, there’s not much more return potential for owning them.

They only pay out par at maturity, after all.

The U.S. Treasury is functionally insolvent, and the real question is when does the market finally wake up? Inflation is going to be the driving macro theme moving forward- and federal debt is going to drive it.

This month, the debt spiral has accelerated, even faster than the models had predicted. The Congressional Budget Office estimated a -5.8% federal deficit as a percent of GDP, and net interest of 2.5% of GDP- with GDP at $25.8T, this equates to $0.645T net interest for the fiscal year. (Fiscal year for the Federal Government runs from October 1st- Sept 30th). However, already interest expense as of Q2 2023 is already at $909B, or 3.6% of GDP, per FRED data. We are easily going to hit $1T of interest expense this calendar year and more beyond that next year.

The Fed supposedly has a mandate to protect the real economy- to maintain low inflation and low unemployment. However, at every juncture when forced to choose between the real and financial economies, it has chosen the latter. Once the market wakes up to this fact, everything changes.

This means eventual money printing to stave off losses in any market the Fed deems critical, even if the real economy suffers.

Why would it be any different for bonds?

Originally written on Dollar End Game