US Treasury yield stability challenges mainstream views of surging interest rates, suggesting a more cautious economic outlook.

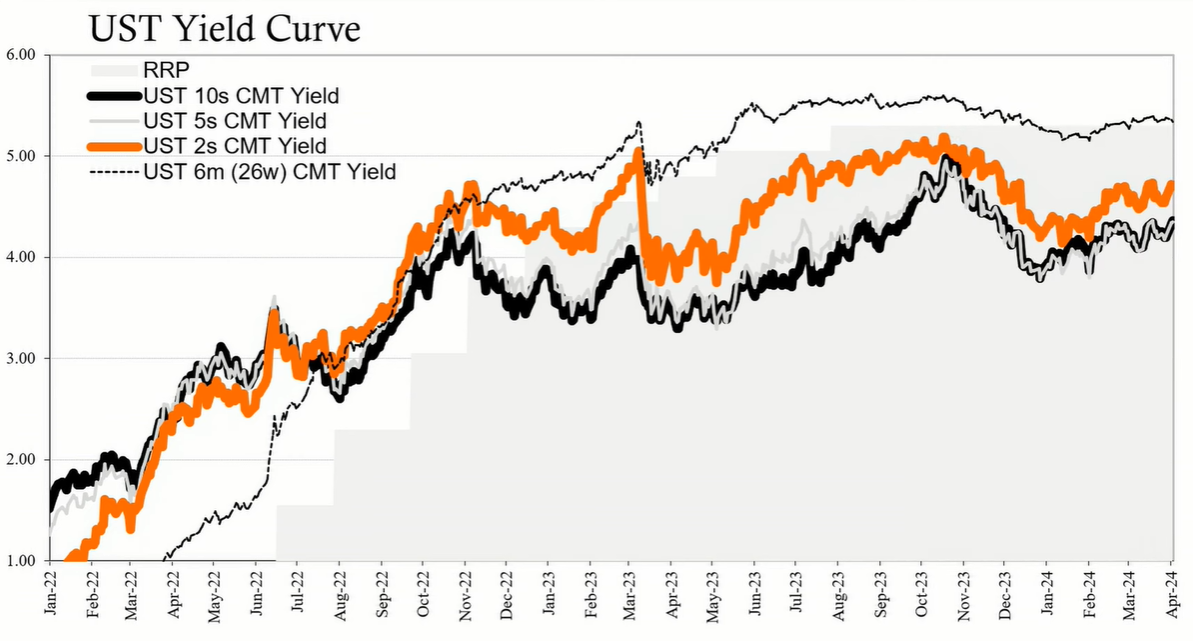

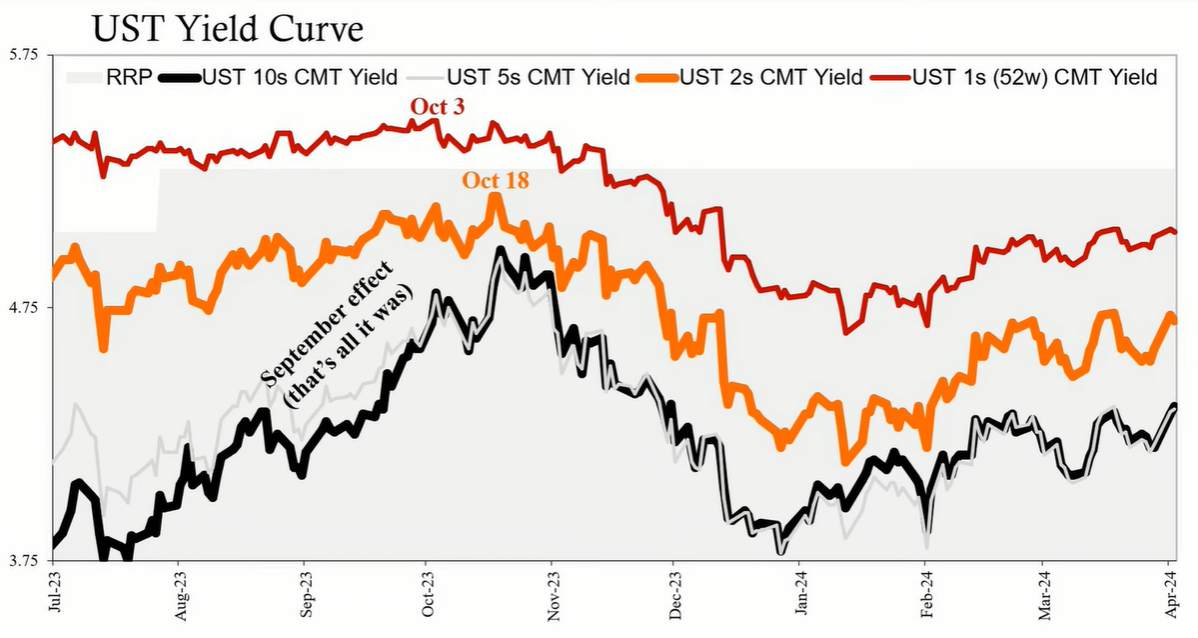

The bond market has been a topic of significant discussion in financial circles, particularly with respect to the ongoing debate about the direction of interest rates and the health of the economy. Contrary to the dominant narrative of surging interest rates and consequent losses on bonds, the data reveals a more nuanced picture. In reality, bond yields have shown minimal movement over the past two months, aligning with the traditional patterns observed post-rally last year. These patterns contradict the mainstream narrative of a re-pricing in the market due to a strong resilient economy and inflation fears.

An analysis of the US Treasury yields over the past seven weeks indicates a largely static trend. For instance, the ten-year Treasury yield has increased by mere basis points, from 4.31% to 4.36%, which cannot be characterized as significant losses in the bond market. Similarly, the two-year Treasury yield has shown a comparable pattern of stability. This suggests that the market is not signaling an urgent need for rate adjustments, neither in anticipation of rate cuts nor due to inflationary pressures.

Despite fluctuations, the stability in interest rates aligns with the market's expectation that conditions will remain conducive to lower rates over the intermediate term. Financial institutions, including the Federal Reserve, do not exhibit immediate urgency to alter rates, which mirrors the market's sentiment.

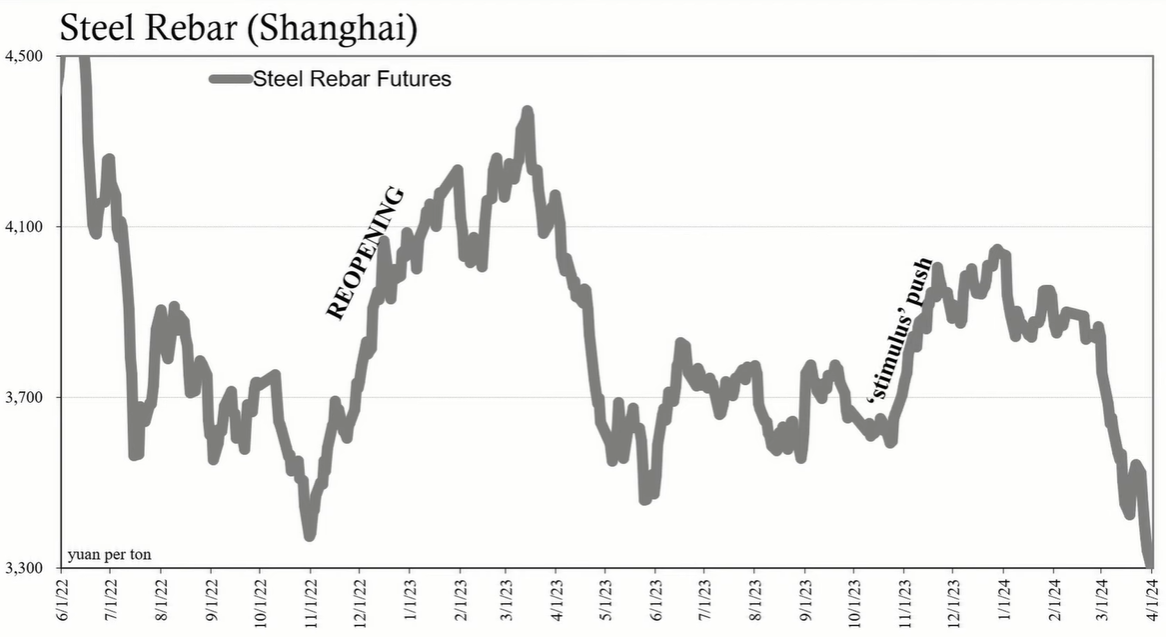

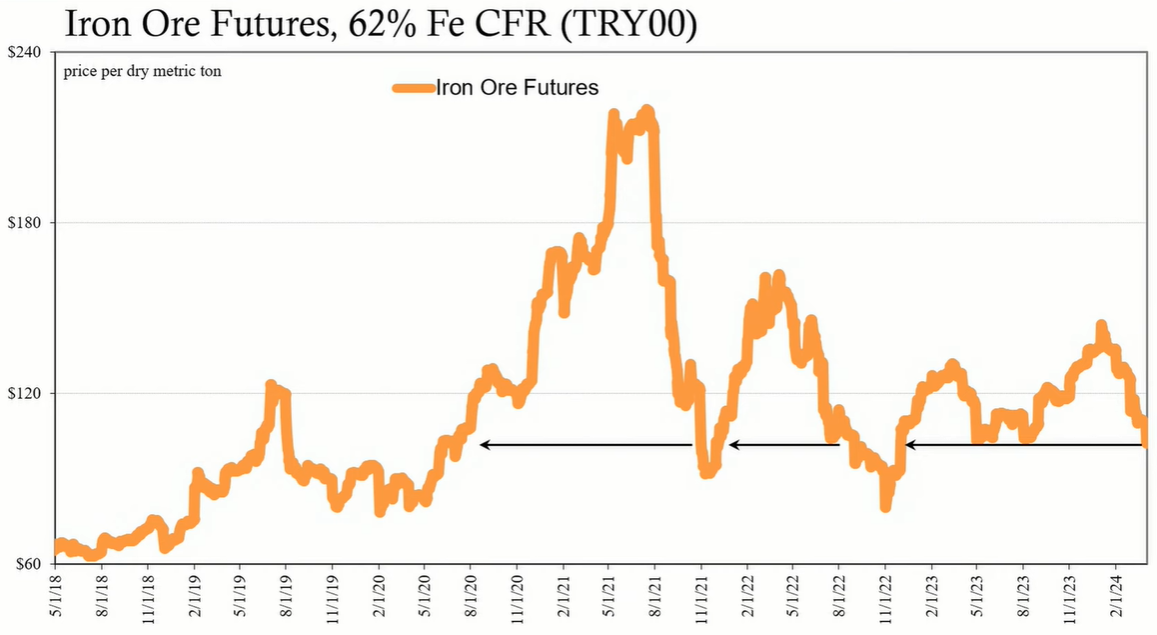

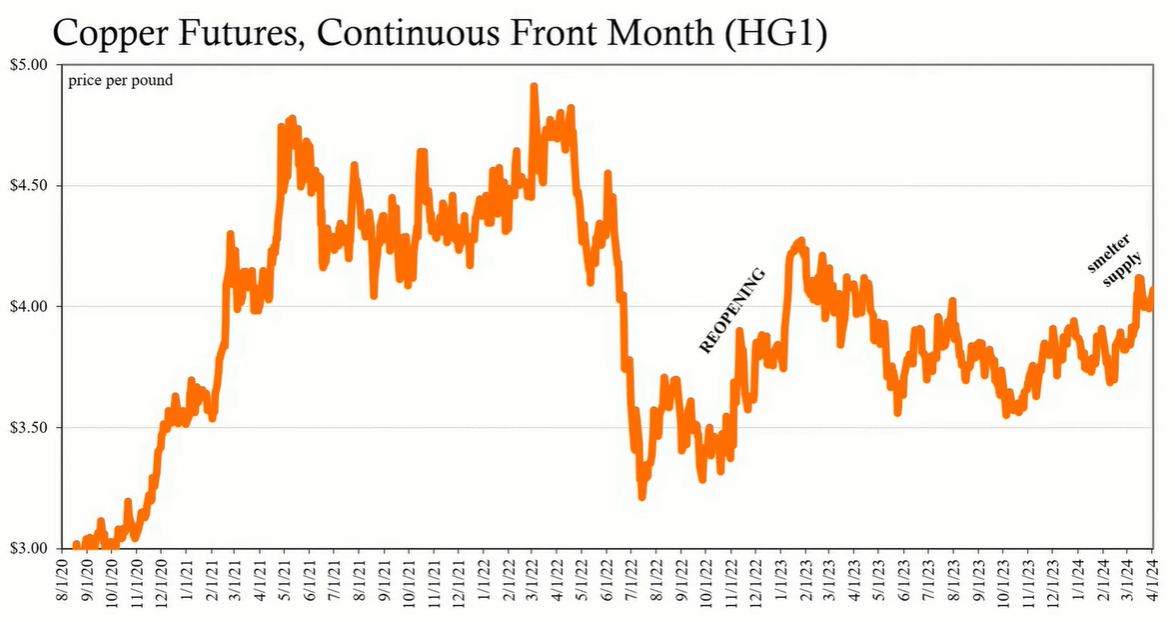

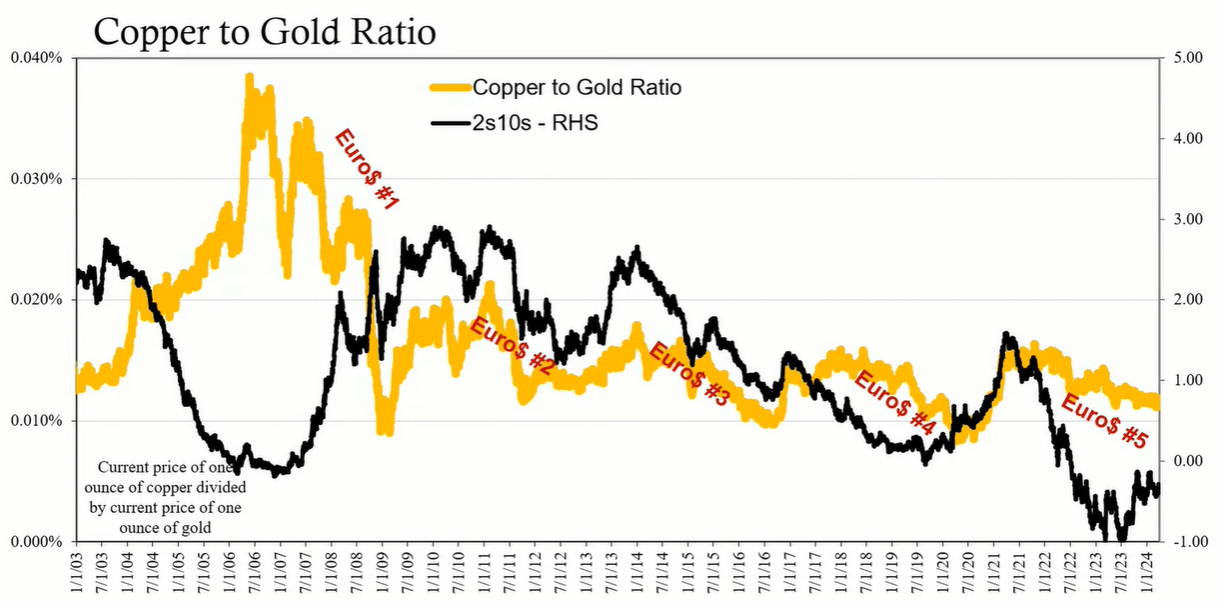

The commodity market provides further insight into the economic and financial landscape. Prices of industrial metals like steel and iron have declined, particularly in China, reflecting a lack of demand and ongoing real estate issues. Copper prices have remained stagnant despite supply constraints, which indicates tepid demand in the real economy. The copper-to-gold ratio, a measure correlated with financial market movements, has approached multi-year lows, reinforcing the message from bond yields about economic concerns.

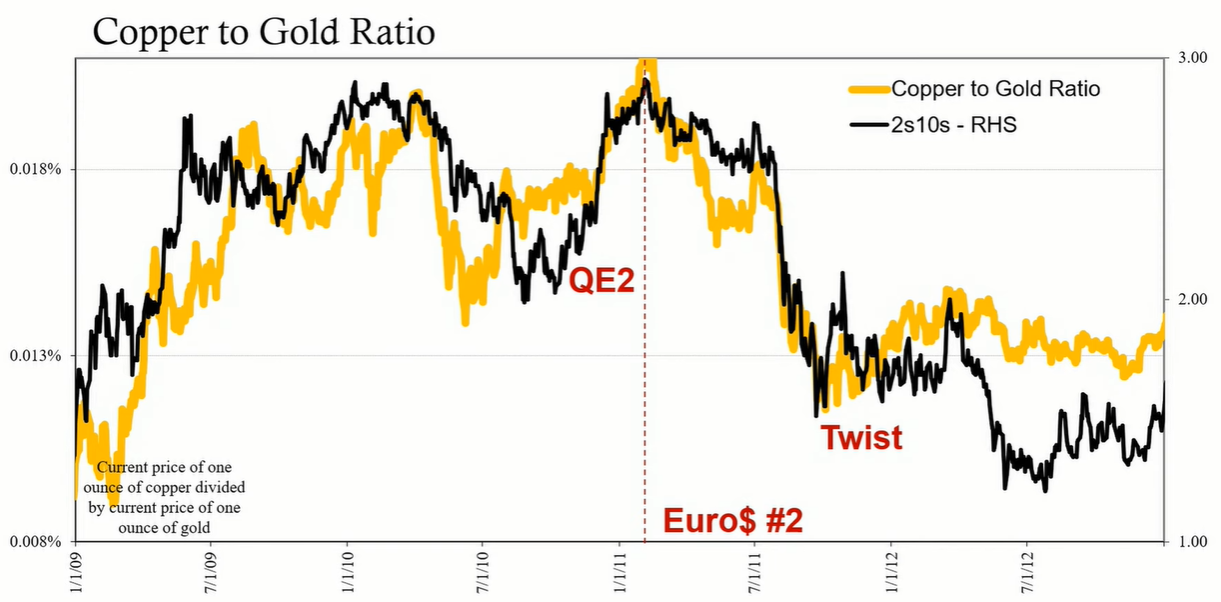

Historically, the copper-to-gold ratio has exhibited a close relationship with the yield curve. Periods of economic uncertainty and liquidity pressures have seen a decline in the ratio, alongside flattening or inversion of the yield curve. This trend has been consistent across different economic cycles, including the lead-up to the 2008 financial crisis, the European debt crisis, and the reflation period post-crisis. Currently, the near multi-year low in the copper-to-gold ratio suggests that the economic outlook is not as robust as some narratives suggest.

In conclusion, the bond market and commodity-based measures offer a different perspective from the mainstream narrative. The evidence points toward a bond market that has remained relatively stable and commodity indicators suggesting economic risks. These indicators, together with the copper-to-gold ratio and the behavior of the yield curve, imply that the market is not yet ready to change its stance significantly. Instead, they suggest a cautious approach, with the potential for rate adjustments in the future being contingent upon the direction of the economic signals currently observed.