Many people like to compare bitcoin to PayPal, but the two networks couldn't be more different.

The digital payment landscape has undergone significant changes with the rise of cryptocurrencies and digital cash systems. This shift began with the cryptographic revolution, which introduced concepts like digital cash and privacy-enhanced currency through blind signatures, as proposed by David Chaum. However, not all digital payment systems sought to emphasize privacy; PayPal, for example, focused on streamlining traditional financial transactions without the privacy features that Chaum envisioned.

David Chaum's concept of digicache was a pivotal moment in the history of digital currency. His idea centered around enhanced privacy through the use of blind signatures, which allowed for anonymous transactions akin to physical cash exchanges. This innovation aimed to provide a level of privacy and security not previously seen in digital transactions.

On the other hand, PayPal's entry into the digital payment space was not initially driven by a desire to revolutionize the protocol of financial transactions. Founded in December 1998 and going public in February 2002, PayPal's approach was to facilitate online money transfers as a form of a virtual bank. Unlike cryptographic digital cash, PayPal's system was fully regulated and reliant on traditional currency, primarily the US dollar.

A critical metric for understanding the scale of any payment system is the total payment volume processed. As of 2024, both the PayPal network and the Bitcoin network reported an annual transaction payment volume of $1.5 trillion, signifying a significant milestone for Bitcoin as it matches a longstanding financial service in transaction throughput. This is particularly notable considering Bitcoin's transaction value first surpassed $1 trillion in 2018, while PayPal's volume at the time was $578 billion.

PayPal experienced a high-profile initial public offering (IPO) in 2002, valuing the company at $1.5 billion, which was later acquired by eBay within the same year. Over time, PayPal served a crucial role in online transactions, particularly through its synergy with eBay. However, the company's protocol was not seen as particularly innovative within the context of digital currency and privacy.

In contrast, Bitcoin's decentralized nature and its status as a form of base money place it in a different category. It stands outside the established financial system, akin to gold and silver, which have been recognized as basic money for millennia.

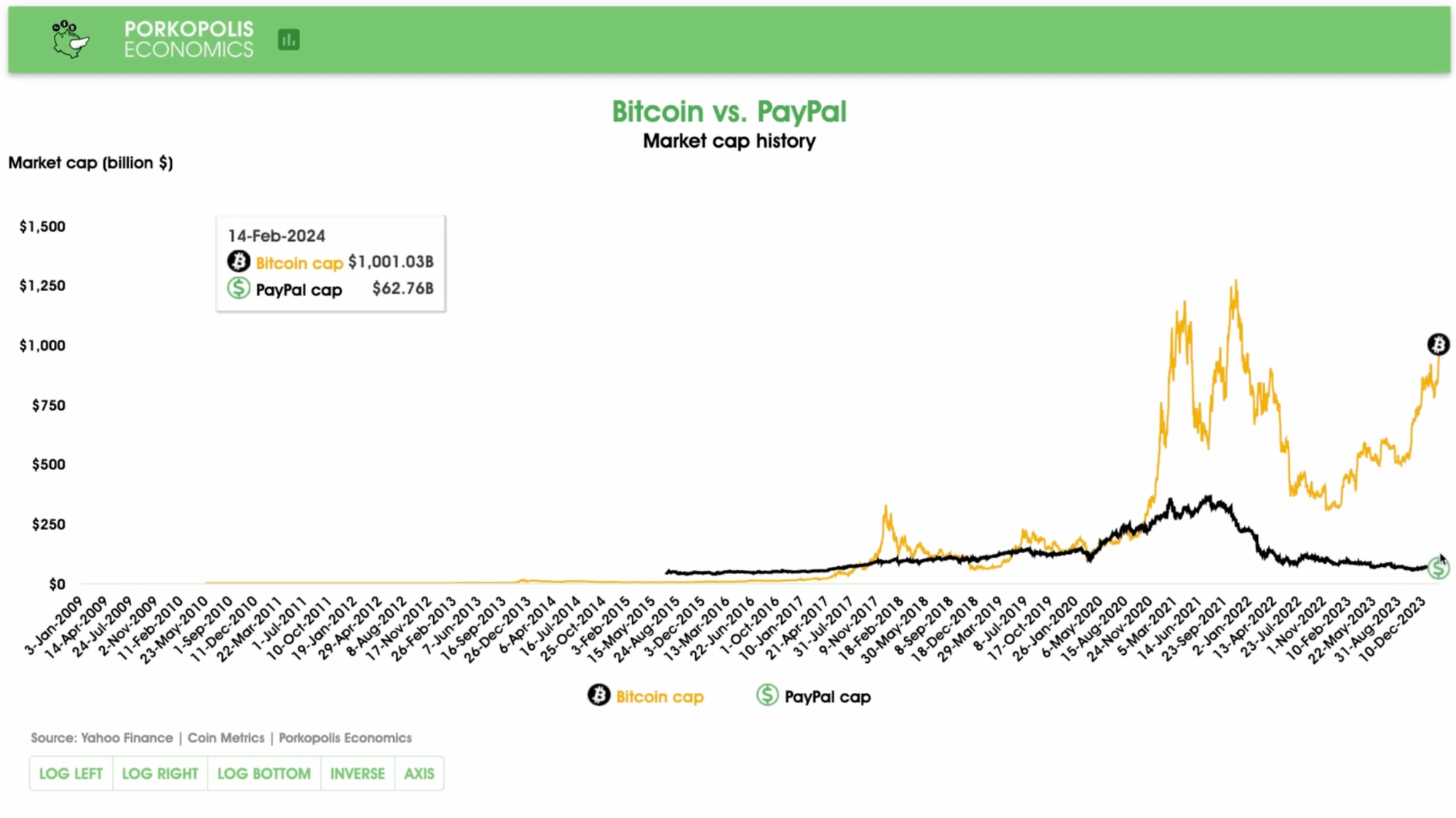

Assessing the market capitalization offers another perspective on the growth and acceptance of these payment platforms. By 2024, Bitcoin's market capitalization had once again reached over $1 trillion, showcasing its resilience and growing acceptance as a store of value and medium of exchange. PayPal, in contrast, had a market capitalization of approximately $63 billion, reflecting its stable but comparatively less explosive growth trajectory.

The development of digital payment systems has dramatically shifted consumer and business transaction methods. Bitcoin, with its decentralized protocol, stands in stark contrast to PayPal's company-centric, regulated approach. Bitcoin's rise in transaction volume and market capitalization indicates a growing market recognition of its value proposition as a secure, global, and neutral monetary system.

Despite the similar transaction volumes processed by both networks as of 2024, the fundamental differences in their design, purpose, and regulatory environment underscore the unique position Bitcoin occupies in the digital payment space. As the digital economy continues to evolve, the principles of decentralization, security, and privacy championed by the early cypherpunks remain at the forefront of discussions about the future of money and financial sovereignty.