Does bitcoin face a similar fate as gold?

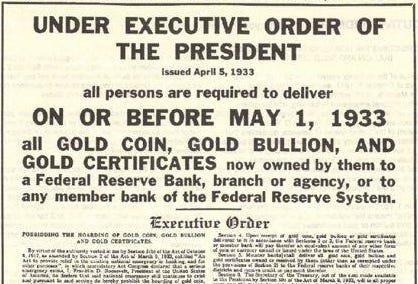

Ninety-one years ago - on April 5, 1933, President Franklin Delano Roosevelt (FDR) issued Executive Order 6102 during the Great Depression.

“All persons are required to deliver on or before May 1, 1933 all gold coin, gold bullion, and gold certificates now owned by them to a Federal Reserve Bank, branch or agency, or to any member bank of the Federal Reserve." Should anyone be found with gold in their custody, the penalty was a $10,000 fine or ten years' imprisonment or both.

US citizens were ordered to turn in their gold to a bank or face a $10,000 fine ($1MM equivalent based on spot gold prices) and/or 10 years in prison.

The following year, the US passed the Gold Reserve Act of 1934, which devalued the dollar by increasing the price of gold from $20.67/oz to $35/oz.

To be clear, the US Government aimed to confiscate each individual’s gold savings, giving them paper money in return, which was then devalued in the following months - an outright robbery.

There’s been a longstanding concern among bitcoin owners that the US Government could issue a similar order to ban private ownership of bitcoin.

Bitcoin, often called ‘digital gold,’ is a money that cannot be controlled by the government or any institution. Governments tend to not like things that cannot be controlled, and since we have a historical precedent, it’s worth considering this attack vector on private bitcoin ownership.

While it’s a valid concern, I believe that bitcoin is more resilient to a 6102-like event than gold, and it’s a low-probability risk. Here's why:

Information can be transmitted instantly anywhere in the world via the Internet. This free flow of information allows individuals to exchange ideas rapidly and sound the alarm bells on potential threats such as Executive Order 6102. Without the Internet, I would not have known about the history of Executive Order 6102, and I would not have been able to easily distribute my thoughts globally with my Substack.

In the 1930s, information was disseminated via newspapers and radios, which were centralizing forces on the exchange of ideas.

Despite all of the fake news today, abundant sources of credible and independent information are still available.

Gold’s biggest drawback in a 6102 scenario is its physical nature. It’s much easier to seize than bitcoin.

The most accessible gold to confiscate in the 1930s was held within bank vaults. If someone trusted a single institution to manage their gold, that counterparty risk resulted in them having their gold stolen by the government.

Additionally, there were people who held gold at home who complied; however, self-custody of the asset increased the friction for the government to seize the asset.

You may be pleased to know that most gold avoided confiscation. Roughly 75% of gold held privately was not turned in to the government. When the government wants to explicitly steal your savings, do not comply. That is the benefit of self-custody, which can be done with both gold and bitcoin.

Nonetheless, the physical nature does limit one’s options to shield their assets from the government. It’s harder to transport a physical asset than a digital asset. For example, a bitcoin seed phrase (private key), often twelve or twenty-four words, can be memorized and taken with you anywhere in the world.

Additionally, bitcoin can be sent globally nearly instantly, allowing for the asset to cross borders and escape hostile jurisdictions.

Multi-signature (multi-sig) is native to the bitcoin protocol. A multi-sig bitcoin wallet requires two or more signatures (private keys) to be signed before accessing the bitcoin. Multi-sig uses an m of n scheme, where m of n keys are needed to access a bitcoin wallet; 2 of 3 is the most popular.

Multi-sig fundamentally is about eliminating single points of failure. By having multiple private keys associated with one wallet, one private key could be lost, hacked, or seized, but it does not result in a loss of bitcoin funds.

The keys in a multi-sig wallet can exist anywhere in the world, meaning these keys can be geographically distributed to hedge against political risk and a potential government crackdown in a single jurisdiction.

Decentralized storage of keys prevents a centralized threat such as 6102.

Finally, I’d say that the likelihood of 6102 has declined substantially this year as Wall Street now has an entrenched interest in bitcoin adoption increasing.

The bitcoin ETFs have been the most successful ETF launches in history, and the CEO of the world’s largest asset manager, BlackRock, is singing bitcoin’s praises on CNBC.

An outright ban on private bitcoin ownership was a much higher probability threat five or ten years ago when most of the world thought that bitcoin was for purchasing drugs or financing terrorism.

Still, there are preventive actions that can be taken to reduce your exposure to this potential threat to your bitcoin wealth. 6102 is a non-zero chance, so it’s best to be prepared and hedge the risk if possible.

There is low-hanging fruit when it comes to the seizure of bitcoin. Thinking back to the 1930s, the first gold to be seized was the gold already in bank vaults. Those who had physical possession, i.e. self-custody of the gold, were much better protected against the executive order.

Leaving bitcoin on Coinbase is the equivalent of leaving gold in the bank in the 1930s. As of Q4 2023, Coinbase had nearly $200 billion of digital assets in custody, including over $100 billion in institutional assets. Coinbase currently serves as the custodian for approximately 90% of the assets held in the bitcoin ETFs.

Again, this is a low probability risk, but the point here is that trusting a single third party to custody your bitcoin is generally a bad idea, not only because it can easily be turned over to the government but for many reasons.

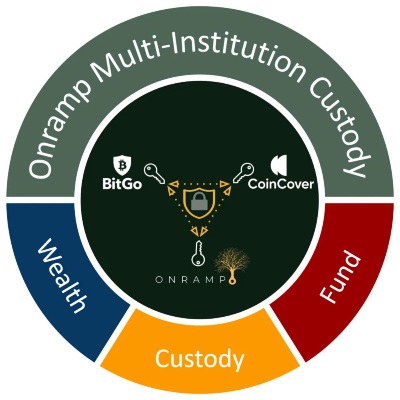

To properly hedge against the low likelihood of a government seizure of bitcoin, it's best to self-custody or work with a company that provides multi-institution custody. I would encourage a mix between the two. Diversification of custody is prudent, especially as bitcoin becomes a more material portion of one’s net worth.

A lot has been written on self-custody, so I’ll overlook that, but reach out if I can answer any questions or be a resource.

Multi-institution is a newer concept, but it utilizes battle-tested multi-sig, which is used to secure hundreds of billions of dollars of bitcoin. The largest firms in the industry, such as Coinbase and BitGo, use multi-sig for their client assets.

The difference is that multi-institution vaults are typically constructed with three keys distributed between independent institutions, and 2 of 3 signatures are required to access the bitcoin (sign a transaction). No single keyholder can unilaterally control the vault.

You can think of multi-institution custody as a digital vault, where keys are distributed among three reputable institutions utilizing industry best practices. This eliminates a single point of failure and increases the security of client assets.

No one of these institutions could turn bitcoin over to the government. Similarly, if one of these institutions went out of business or went rogue, it would not impact the client’s bitcoin.

This solution becomes an even more compelling hedge against 6102 if the keys are held in different jurisdictions. In the above illustration, two US firms hold keys, BitGo (CA) and Onramp (TX), and one UK firm, CoinCover.

To conclude, a 6102 event targeting bitcoin is a low-probability risk, but it’s always best to be prepared. To best protect your wealth against that potential attack vector, I recommend a mix of self-custody and multi-institution custody; that’s what I do personally.

If I can be helpful in anyway to think through this or ask questions, feel free to respond to this email or reach out on Twitter (@macrojack21).

If you want to discuss your situation and learn more about multi-institution custody, you can book a time to discuss with me directly or check out Onramp.

Originally published on The Fiat Cave