This comprehensive guide introduces beginners to managing Bitcoin UTXOs (Unspent Transaction Outputs) for minimizing transaction fees.

Welcome to this detailed guide on managing your Bitcoin UTXOs (Unspent Transaction Outputs) to minimize transaction fees. If you've been acquiring Bitcoin and taking self-custody, you may be unaware of the potential for high transaction fees when you decide to move your Bitcoin later. These fees could amount to tens or hundreds of dollars in the future, depending on the size and number of your UTXOs. A detailed video by BTC Sessions explores how to prevent this shock by using UTXO management techniques.

Bitcoin transaction fees depend on two main factors:

When you send a Bitcoin transaction, you can choose your fee. However, lower fees may delay transaction confirmation or, in extreme cases, prevent it from being picked up by miners altogether. It's crucial to balance the urgency of your transaction with the fee you're willing to pay.

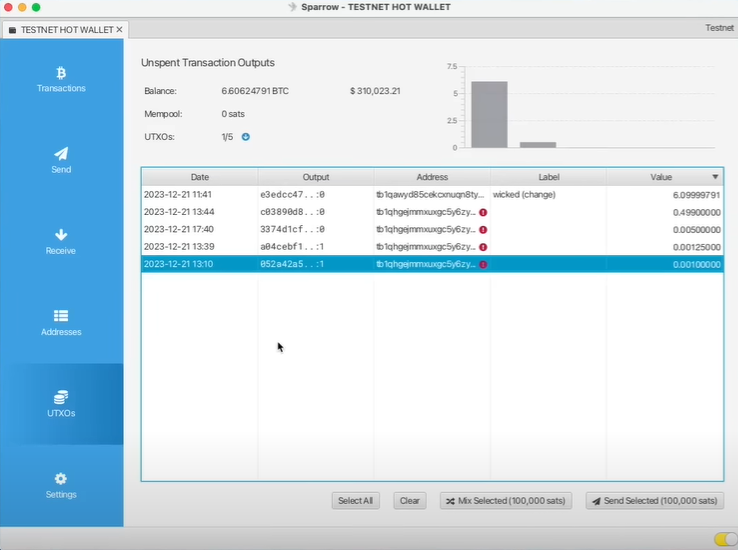

A UTXO represents a chunk of Bitcoin you've received and have not yet spent. Each UTXO is unique, and when you check your wallet, you'll see a collection of UTXOs rather than just a balance. A wallet with good functionality will allow you to view individual UTXOs and their values.

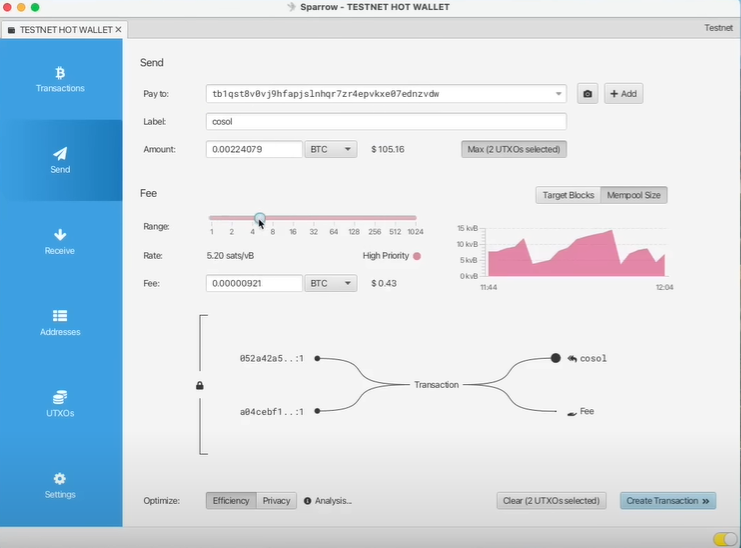

When you spend Bitcoin, the individual UTXOs are combined and then split into the amount sent to the recipient and the change returned to you. A fee is also paid to miners, which is taken from the total UTXOs used in the transaction.

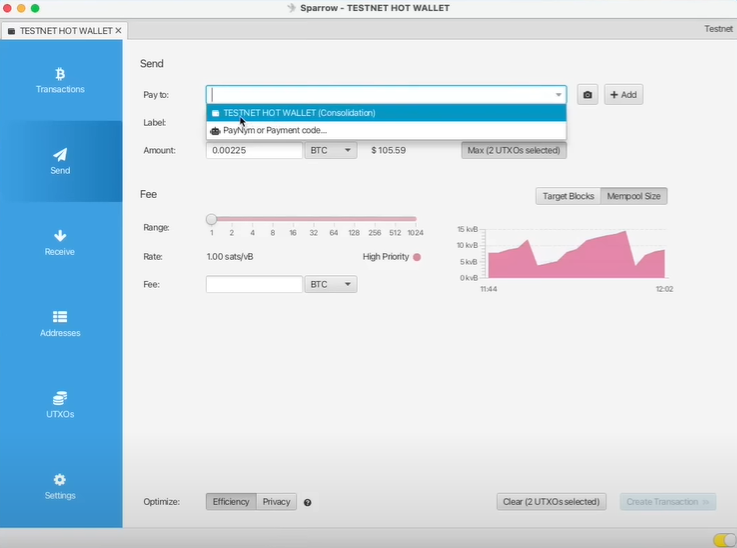

UTXO consolidation is most effective when fees are low, and you don't need to make immediate transactions. This process involves sending multiple small UTXOs to one of your own addresses, effectively "melting" them into one large UTXO.

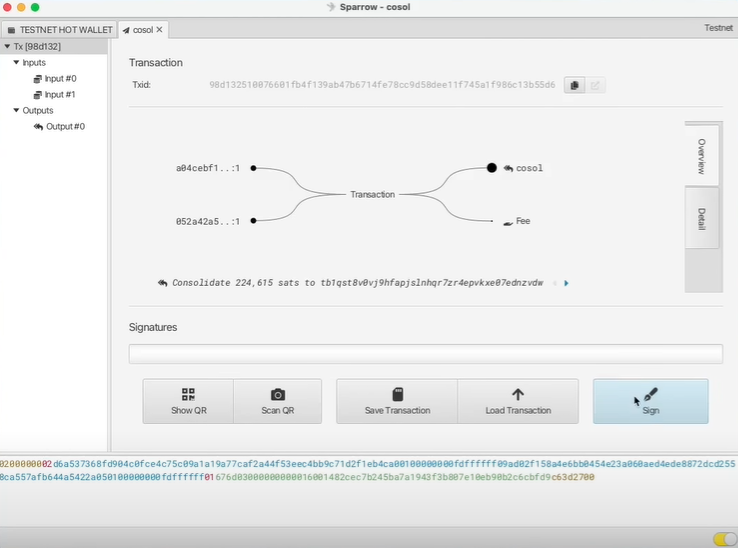

6: Review the transaction details, sign, and broadcast it to the network.

When you consolidate UTXOs, you link them together, which can have privacy implications. It's essential to consider the tradeoff between fee savings and privacy before consolidating.

The ideal UTXO size depends on the current fee environment and your expected future transactions. Generally, UTXOs should be large enough to remain economically viable for future spending, but not so large that they reveal significant wealth when spent. As a rule of thumb, aim for UTXOs of at least 1 million sats (0.01 BTC).

Use tools like mempool.space to assess the current fee environment and adjust your UTXO sizes and consolidation strategy accordingly.

As Bitcoin evolves, so will the tools and strategies for managing UTXOs and transaction fees. Stay nimble and educated on the latest developments, balancing the need for transaction efficiency with privacy and security.

Remember to consider using off-chain solutions like the Lightning Network for smaller, frequent transactions to avoid high on-chain fees. The key is to find the right balance for your individual needs.

UTXO management is an essential skill for any self-custodial Bitcoin user. By following the steps and considerations outlined in this guide, you can minimize fees and maximize your control over your Bitcoin holdings. As always, continue to learn and adapt as the Bitcoin ecosystem grows and changes.