While building products and services in the growing bitcoin ecosystem will not ensure success, a company’s proclivity for success is inevitably correlated to bitcoin’s upside.

Most companies do not hold enough bitcoin

There is a saying you often hear in bitcoin circles that “you can never have enough bitcoin.” This is typically expressed by those who have spent the time to both understand bitcoin’s unique and superior monetary properties and also to appreciate why those properties are protected from any attempted malicious interference. Bitcoin’s finite supply, protected by cryptography, game theory, and a decentralized computing network rooted in proof-of-work, was the 0 to 1 innovation.

Once one develops conviction in the long term prospects of bitcoin, regardless of what near term volatility may ensue due to resistance from regulatory bodies, political parties, or interest groups elsewhere (these are simply blips on the road to long-term global adoption), one also realizes that most people still do not yet understand or appreciate the value of bitcoin. Fifteen years in, there is still tremendous informational asymmetry in bitcoin, and that is why one often hears many repeat “we are still so early.”

The path to understanding bitcoin is long and arduous, requires humility, persistence, and an open mind, and the journey truly never ends. Most have simply not put in the work to go through this process, and therefore the knowledge of bitcoin has not yet been widely distributed. For that reason there is still tremendous economic upside in the purchasing power of bitcoin to be gained by those who hold it now as the understanding and appreciation of bitcoin spreads more widely over time. Therefore, for believers in bitcoin, no matter how much bitcoin they manage to accumulate, there is always a desire to acquire more. The opportunity is just too great, and the outcome is obvious.

Despite this belief, many of the same bitcoiners who cannot get enough personally often do not apply that strategy to their corporate balance sheets. With rare exception, most bitcoin companies (those who should clearly understand bitcoin more than others) do not hold much bitcoin. Their holdings are too conservative and incongruent with their personal beliefs about bitcoin and their companies’ positive operating leverage to the long-term success and adoption of bitcoin. It is not that they do not want to hold more bitcoin on their corporate balance sheets (they do), but they have deliberately (or implicitly) decided not to do so. I would encourage and challenge companies to consider holding more.

The conventional wisdom (or instinctual pushback) is that holding more bitcoin (relative to cash) in reserves is too risky and/or irresponsible for a company and that they cannot afford to stomach the volatility of bitcoin when their reserves are limited and precious (especially for early stage companies). I will not dwell on the fact that this sounds a lot like the argument of many bitcoin detractors, and instead I will acknowledge this is a tricky topic, and undoubtedly the consequences are significant. Making a strategic misstep with the company’s coffers could strike a fatal blow to a young company if adequate downside contingencies have not been planned for; but on the flip side, I would argue not being positioned to capture equity value appreciation from bitcoin on the balance sheet is actually taking on increased corporate risk of leaving value on the table as well in the form of foregone upside, the opportunity cost of being overly conservative. It is therefore every company’s fiduciary duty to consider a meaningful bitcoin position for their corporate balance sheet.

The fiduciary case for a meaningful bitcoin position

Most think of fiduciary duty primarily as managing risk and protecting the downside, but fiduciary duty goes both ways, encompassing both protecting against downside risks and pursuing opportunities for growth in equity value. In the context of a company, fiduciary duty includes both the executive leadership team and the company’s board of directors. The board of directors is responsible for overseeing the company’s management, setting its strategic direction, and ensuring the company is run in the best interests of shareholders, which includes corporate governance, appointing and incentivizing the management team, setting the strategic priorities of the business, and executing major financial transactions. The executive leadership team are responsible for day-to-day operations, executing the strategic plan set by the board, making operational decisions that impact the company’s financial health and performance, and managing the company’s assets, resources, and operations in a manner that maximizes shareholder value. Based on my descriptions above, I would assert evaluating the bitcoin treasury position is a responsibility of both the board and the executive team.

If bitcoin companies are building products and services for holders of bitcoin based on expected secular growth in bitcoin users globally, then they have already come to the view that the benefits to pursuing their business plan both justify the resource commitments (time and capital) required to achieve their objectives and outweigh the downside risks of bitcoin actually not being adopted at the pace or to the extent expected. From a fiduciary perspective, if the companies have already gotten comfortable with this “bitcoin risk”, why are they not as comfortable with that same risk on their balance sheet?

If it turns out there is some critical flaw discovered in bitcoin software or some catastrophic exogenous factor that suddenly makes bitcoin irrelevant, then it’s probably a safe bet there will be no need for the companies building products and services for the bitcoin ecosystem. As such, a bitcoin company’s fate is already inevitably linked to the lack of bitcoin adoption on the downside. On the other hand, if the adoption of bitcoin continues in the coming decades (as believers in bitcoin have conviction it will), then bitcoin companies are positively skewed to benefit from this growth operationally. While building products and services in the growing bitcoin ecosystem will not ensure success (this will depend on achieving product-market fit, developing a sustainable business model, and successful execution), a company’s proclivity for success is inevitably correlated to bitcoin’s upside.

Considering a company’s balance sheet, if bitcoin turns out to be a failure, the amount of bitcoin a company decides to hold in its treasury will not be the deciding factor in the trajectory of its equity value… the company will be destined to fail alongside bitcoin. On the other hand, if bitcoin adoption continues and the value (and purchasing power) of bitcoin rises consequently, then the benefit and equity value appreciation to come from a company’s decision to hold bitcoin on its balance sheet will be directly proportional to the bitcoin position they accumulated and held in their treasury over time.

To be sure, a company’s balance sheet should not become purely a speculation platform for the expected appreciation of bitcoin. However, as described above, to some extent bitcoin companies’ success is already dependent on the expected appreciation given these companies can be thought of as “derivatives” of bitcoin, and therefore it makes sense to consider whether a company’s liquidity is appropriately weighted between cash and bitcoin.

Bitcoin treasury as a lever to equity value growth

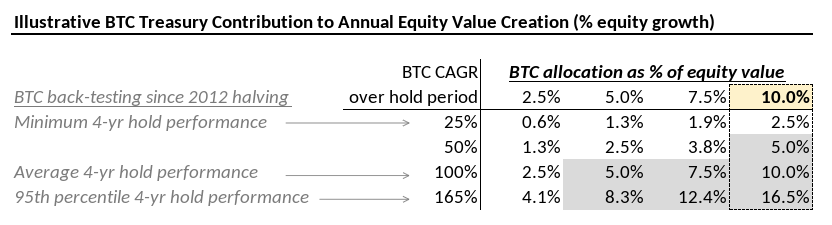

As I have described previously, a company’s equity value appreciation over a defined time period can traditionally be thought of as being driven by three primary factors: (I) company growth over the period (typically revenue or profit growth, multiplied by some constant valuation multiple), (II) cash flow generation (and more importantly going forward, sats flow generation), and (III) any change in valuation multiple of the business relative to financial performance (increase or decrease in valuation multiple, multiplied by current revenue or profits). I believe the incorporation of bitcoin in the corporate treasury allows companies to capitalize on a “fourth lever” of equity growth, simply defined by the appreciation of value in the company’s balance sheet over the same time period (apart from net cash flow), which benefits the earliest adopters of bitcoin most and diminishes over time as bitcoin’s value appreciates.

Based on the above, how should companies think about sizing bitcoin as a treasury asset and a lever for equity growth, given their business prospects are already tied to bitcoin’s long-term success as an asset? As one might expect, there is not a one-size-fits-all answer to prescribe for each company; however, I do think there is a framework each company can use for thinking through the near-, medium-, and long-term factors at play in their own financial planning decisions to find a sweet spot that can not only offer some protection against potential downside risks and unknowns but also offer a sufficient level of balance sheet upside through bitcoin’s long-term appreciation (thereby appropriately fulfilling their fiduciary duties of managing risks while pursuing equity value growth).

At Ten31 we have had a front row seat partnering with and advising more bitcoin companies than any other group, and our thinking on bitcoin treasury has evolved over time, particularly over the last twelve months. Our latest advice can be summarized as follows, with three big buckets I believe are important for including in a company’s treasury policy and goals:

A few notes to the idea above: first, this assumes a company has sufficient provisions to hold long-term reserves as just that, i.e. is willing and able to hold for at least 4 years (beyond assumed fundraising cycles which may be required if not yet cash flow positive). Second, I am aware there may be corporate finance rebuttals to the above, arguing a company holding excess assets in bitcoin may imply they have no better use of capital to achieve outsized returns in their own business and that this liquidity should instead be distributed to shareholders who can decide how to invest that capital at their discretion (including deciding whether to hold bitcoin themselves). Third, I acknowledge a 10% bitcoin target relative to equity value may be ambitious, especially given most early stage companies typically raise equity representing 10-20% dilution in each fundraising round just to provide them enough capital to hopefully successfully make it to the next capital injection (i.e. establishing a sizable long-term treasury position may not be feasible or practical in the context of just one fundraising cycle). As such, perhaps the 10% position becomes a stretch target to be achieved over time, either over multiple fundraisings, or by generating profits / sats flows which can accumulate as bitcoin on the balance sheet, or by allowing a smaller bitcoin position to grow into that level over time as it appreciates. For further context, I have shown balance sheet positions of several selected public companies below. A 10% target may be challenging, but I believe it is a worthwhile and achievable goal, particularly with the appreciation potential of bitcoin relative to traditional cash and marketable securities.

Conclusion

Successful implementation of the above strategy can extend a company’s runway as bitcoin appreciates (thereby minimizing potential future dilution), deliver a strengthened balance sheet over time, and even potentially position a company for the proverbial “last raise ever”. Further, accumulating a meaningful bitcoin position early enough can allow challenger companies to establish a solid foundation relative to incumbent legacy companies who may not decide to begin accumulating bitcoin until much later after the value has appreciated demonstrably (at which point their fiat cash flows will earn them considerably less bitcoin than would be available to them today).

Finally, as a thought exercise, imagine the scenario where a company has raised equity over a series of fundraising rounds, has accumulated a large bitcoin position over that time which has appreciated in value, and by the time it seeks its next round of fundraising the then-current value of its balance sheet has exceeded the cumulative amount of equity raised up to that point (including potentially reaching profitability and positive sats flow generation by that time). This would be the holy grail of building a sustainable bitcoin business to endure generations, and would likely require new ways of thinking about valuing businesses going forward.

I believe the end result is a return to a focus on profitability and sats flows. It is my hope and expectation that more companies in the space will begin thinking about these topics in a similar way and begin to accumulate a larger amount of bitcoin in their treasury. Those that do will be best positioned to survive and drive equity value creation over the long-term.

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.